Will water trump methane for hydrogen production?

The International Renewable Energy Agency (IRENA) recently issued a slick report on the future of renewable energy and hydrogen. The report, titled Geopolitics of the Energy Transformation: The Hydrogen Factor, includes an assertion that “accelerating deployment of renewables” will soon make carbon-free production of hydrogen by electrolysis of water, or green hydrogen, cheaper than low-carbon hydrogen production from methane with carbon capture, or blue hydrogen. Consequently, companies that invest in blue hydrogen production risk finding themselves holding stranded investments that will never pay off, it states. The hydrogen they produce will not be competitive with green hydrogen.

But a review of the report shows there is some flawed reasoning at play here.

A shaky tripod

The case for green hydrogen becoming cheaper than blue rests on a tripod of three premises. On examination, all three premises turn out to be shaky:

- Accelerating deployment of renewables will soon create an abundance of nearly free surplus energy that will be available for production of green hydrogen.

- As the hydrogen revolution takes hold, market expansion will see electrolysis systems plunge in cost, to the point that it will be economically feasible to operate them at low capacity factors in periods when nearly free electricity is available.

- The recent spikes in the price of natural gas in Europe are harbingers of the onset of a “new normal” in which gas will average two to four times what was previously held to be normal.

I will explain why I say these are shaky premises as we go on. But first I should mention another point. It is not so much a “premise” as it is an unconscious assumption that biases the IRENA authors’ analysis of the issue. It is the assumption that, when the cost of carbon emissions rises to the point that hydrogen producers are motivated to reduce carbon emissions, they will do so by tacking CCS onto the steam methane reforming (SMR) process trains that currently produce grey hydrogen.

It apparently did not occur to the authors of the IRENA report that in the face of a growing market for low-carbon hydrogen, process engineers might find it advantageous to replace existing SMR process trains with alternatives designed from the start for carbon capture. Arguably, IRENA’s projections for the cost and performance of blue hydrogen production are as overly pessimistic as their projections for green hydrogen are overly optimistic.

A tall order

To a large extent, the relative cost issue for blue versus green hydrogen boils down to theoretical minimum energy. This comes to 237 kilojoules/mole for hydrogen by electrolysis of water and by steam, and 32.5 kj/m for auto thermal reforming of methane at standard temperatures. The former is almost eight times larger than the latter.

As a rule of thumb, the monetary cost to produce a commodity tends to be directly proportional to the energy cost. This is not always nor exactly the case, but it is the tendency. Hence, SMR starts out with anearly 8:1 advantage that electrolysis must somehow overcome to be price-competitive. That is a tall order.

The one big advantage that electrolysis does enjoy over SMR is that its feedstock – deionised water – is essentially free. Natural gas, the feedstock for SMR, is not. But how far will the difference in feedstock go in compensating for a nearly 8:1 difference in energy cost? To get a handle on that question, we need to get quantitative.

The capex hurdle

The thermodynamic minimum energy for standard temperature electrolysis of water, 237 kJ/m, translates to 39 kWh/kg of H2. For reasons rooted in physical chemistry, the maximum efficiency we can expect from electrolysers is about 80%. That boosts the energy required to 49 kWh/kg of H2. Add a conservative 2% for power conversion losses between AC input from the power grid and DC current to the electrolyser cells, and we arrive at 50 kWh/kg of H2. That’s a nice round number – a tad lower than typically required, but close enough and easy to remember.

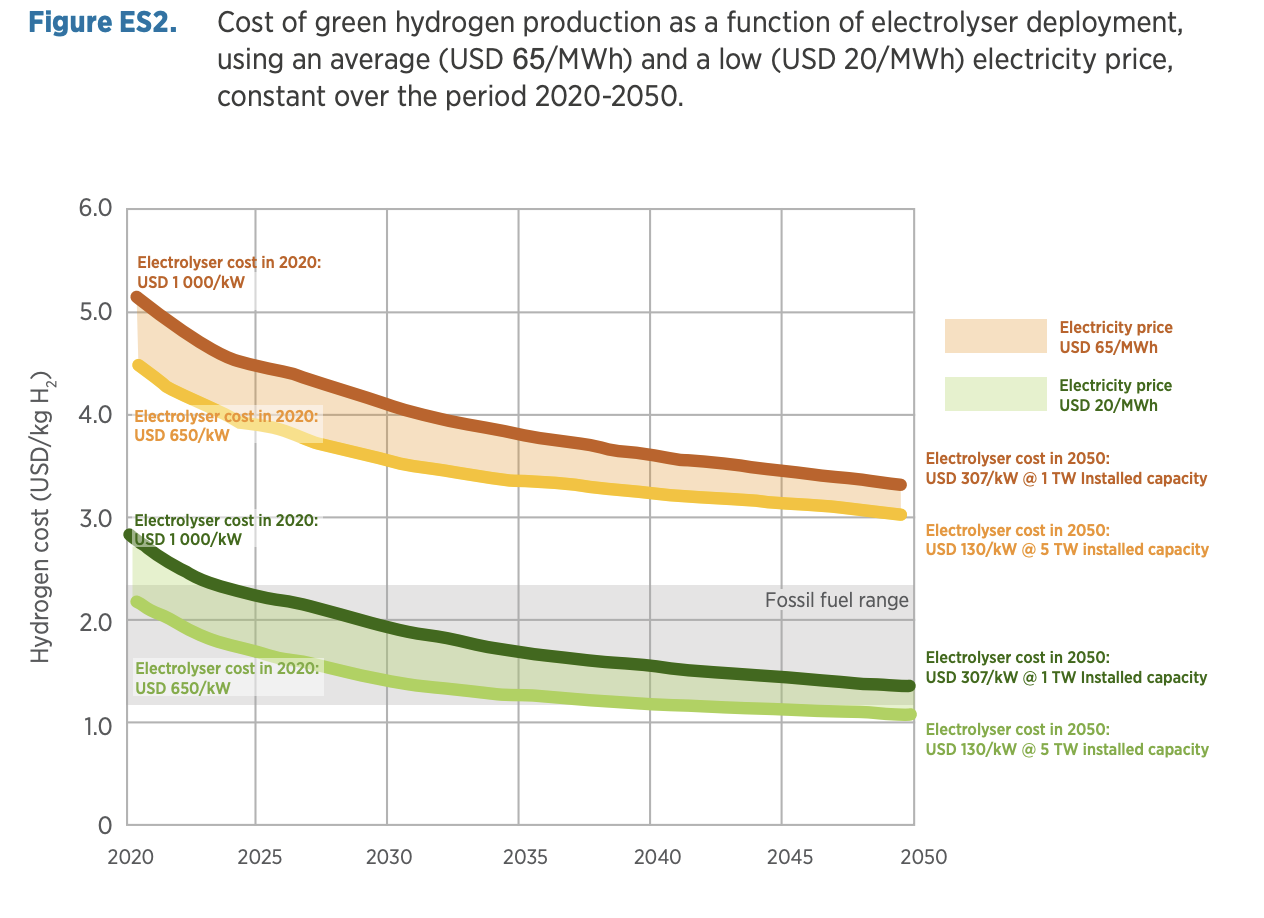

Let us temporarily ignore amortisation of capital expenditure (capex). We will also ignore all operation and maintenance expenses (O&M) other than power to the electrolysis cells, and all business and plant overheads. Then for parity with the estimated $2.40/kg taken as the future cost of blue hydrogen, the absolute maximum price one could pay for electricity is $0.048/kWh. That is significantly below what retail power customers typically have to pay, but not unreasonable on the wholesale market – if one is flexible about when the power is taken. It is easily within the realm of possibility for dedicated wind turbines or solar farms in good locations. But it is not low enough to make cheap green hydrogen a realistic possibility, given all the costs we have ignored. Rather, it’s a crude first cut on the upper bound on the acceptable cost of electricity (CoE).

Now let us get just slightly more realistic. We will still ignore all O&M costs other than power, and likewise all plant and business overheads. But we will include amortisation of capex. The overall cost of large-scale PEM electrolysis systems is currently estimated to be around $1000/kW. If we figure the cost of capital at 6% and a system lifetime of 20 years, amortisation of capex adds at least $0.50/kg to the cost of electrolytic H2. That figure is for plant utilisation at a 100% capacity factor. If the capacity factor is only 25% (e.g., a dedicated solar array in a good sunny location), then amortisation of capex adds $1.97 to the specific cost of hydrogen. Now our upper bound on the acceptable CoE has dropped to $0.0086/kWh. That is roughly a quarter of the average price that favourably located wind or solar farms require in order to cover their own O&M costs and to amortise their capex. Yet we are still talking only about a toy model that ignores a raft of real expenses.

The above explains why dramatic reductions in the capex for electrolysis systems are crucial to hopes for cheap green hydrogen. The capex for electrolysis plants must be cut by at least half – and preferably a lot more – for green hydrogen to have any hope of competing. Promises are being made to deliver on such reductions before 2030, but how confident can we be that those promises will be fulfilled? They are predicated on explosive growth in the market for electrolysis over the next few years. Growth will let manufacturers tap into “economies of scale” to achieve great cost savings. But will that happen?

Market size

Proponents of green hydrogen project a vast expansion in the use of hydrogen in the future. They see it as a clean replacement for fossil fuels and as a means for long-term energy storage. The trouble is, it is not really great for either of those applications. It is hard to transport and store in bulk. As energy storage, it returns only 40% of the energy that was needed to produce it. In any application where batteries or direct electrification are feasible options, they’re generally far more cost-effective.

Michael Barnard, chief strategist at TFIE Strategies, has argued that hydrogen is not a growing market at all, but rather a contracting one. His argument is that the two largest applications for hydrogen, by far, are currently in oil refining and nitrogen fertiliser production. Both of those will be contracting – oil refining for obvious reasons, and nitrogen fertiliser production because it is recognised that excessive use is already harming the oceans and global environment – and because we now have equally effective and more sustainable biological alternatives. The only real growth area that Barnard sees for hydrogen is in reduction of iron ore. It can replace coal for that purpose, but that market will not be enough to offset overall contraction. He discounts prospects for growing use of hydrogen in production of synthetic fuels.

Barnard’s assessment may or may not be on target. If he is correct, it undercuts premise #2 of the tripod supporting the case for green hydrogen. If he is wrong, premise #2 may stand, but it does not automatically establish the case for green hydrogen. A boom in the market for hydrogen could end up being a boom in the market for blue hydrogen. We need to dig deeper.

Cost of blue hydrogen

Let us look at the other side of the green versus blue balance scale: the cost of blue hydrogen. I quoted $2.40/kg of H2 as a figure that has been forecast as a likely future cost for blue hydrogen. It is the approximate average that Bloomberg NEF assumes for 2030 in its modelling for 28 countries around the world and it is in line with what IRENA says green hydrogen can achieve by then to achieve parity. However, there are no commercial plants making blue hydrogen for general markets today. Cost estimates are extrapolated on the basis of grey hydrogen production and assumptions about how blue hydrogen production would differ.

Studies that assume that process stages for carbon capture will simply be tacked onto the back end of process trains for grey hydrogen are bound to be misleading. SMR plants in use today at oil refineries and fertiliser plants were designed to produce specific amounts of hydrogen at minimum net cost. No regard was given for CO2 emissions. But if one knows from the start that full CO2 capture is a requirement, then different design choices will be made.

One approach that is superior to conventional SMR plus CCS is autothermal reforming (ATR). It is widely used in the chemical industry when synthesis gas – a mix of CO and H2 – is the desired output. It can be modified to output pure hydrogen, but if carbon capture is not required, the result is slightly more expensive than conventional CCS. On the other hand, if carbon capture is required, then a modified autothermal reforming process will be more economical than SMR plus CCS. It will also capture a much higher fraction of the CO2.

My own informal research on the cost of blue hydrogen suggests that a fair model for the cost per kilogram of hydrogen from a modified ATR process would be $1.75 plus the cost of 2.5 kg of natural gas. For natural gas at the prevailing Henry Hub price (at the time of writing) of $4.00/mn Btu, 2.5 kg would cost $0.50. That gives a blue hydrogen cost of $2.25/kg. Take that with a grain of salt, as the research that went into it was very informal. But it’s in the same ballpark as the $2.40 estimate that shows up in the Bloomberg NEF studies.

Electric blue

A number of other approaches to efficient production of blue hydrogen have been proposed. Several promising options have been tested in research labs and simulated for commercial deployment. One class of approaches stands out as particularly interesting. And it is interesting for reasons that go beyond cost-efficiency. I term hydrogen produced in this class of approach as electric blue.

In principle, it is possible to produce hydrogen by reforming methane using only two kilograms of methane per kilogram of hydrogen. That is the amount of methane required by the reforming reaction itself. But that reaction is strongly endothermic, meaning that heat must be supplied to drive it forward. The usual way to supply that heat is through combustion of additional methane. But it is also possible to supply it through ohmic heating. That has the advantage that no flue gas is produced, and no CO2 that has to be scrubbed from the flue gas.

A study of one example of this approach was recently published in the journal Science. Titled Electrified methane reforming: A compact approach to greener industrial hydrogen production, the study reported some dramatic results. From the abstract:

“Electrification of conventionally fired chemical reactors has the potential to reduce CO2 emissions and provide flexible and compact heat generation. Here, we describe a disruptive approach to a fundamental process by integrating an electrically heated catalytic structure directly into a steam-methane–reforming (SMR) reactor for hydrogen production. Intimate contact between the electric heat source and the reaction site drives the reaction close to thermal equilibrium, increases catalyst utilisation, and limits unwanted byproduct formation. The integrated design with small characteristic length scales allows compact reactor designs, potentially 100 times smaller than current reformer platforms.”

When external energy to drive the endothermic reforming reaction is supplied in this manner, the resulting hydrogen actually holds more chemical potential energy than the natural gas used to produce it. When the external energy comes from an intermittent renewable resource, the system functions as a sort of battery, storing intermittent renewable energy in hydrogen for subsequent use on demand. This is the same thing that green hydrogen does, but with the difference that the blue hydrogen system yields ten times more hydrogen per kilowatt.

Boosting the energy transition

Now let us backtrack and examine the premise that accelerating deployment of renewables will create “an abundance of nearly free surplus energy” available for green hydrogen production.

It is an interesting premise. There are opposing reasons why it might or might not be true. It turns out, however, that it is most likely to be true under a scenario in which blue hydrogen dominates over green for the next 20 years of the energy transition. Green hydrogen would slowly phase in to replace blue as depletion set in, but would not become dominant before 2050.

It is not too hard to understand why. Because electrolysis requires so much energy to produce each unit of hydrogen, cheap green hydrogen absolutely requires super-cheap electricity. Why is that a problem? That’s what wind and solar regularly deliver, whenever their output exceeds demand on the grid. A big part of the rationale for green hydrogen is that it would be a way to make use of that surplus energy that would otherwise be curtailed.

The problem is that installed generation capacity of renewables is still far too small to make green hydrogen production from surplus renewable energy practical. There are not enough hours per month when renewable output is exceeding demand. If green hydrogen production uses renewable energy that is not truly surplus, it is forcing some other application to use an equal amount of energy from fossil fuels. Its production is increasing carbon emissions – by a rather large amount – rather than reducing them.

Electric blue hydrogen does not have that problem. Its ratio of hydrogen output to electricity input is so high that it does not much matter if the renewable electricity it is using is truly surplus.

The bottom line

In the long run, there is no question that green hydrogen will overtake blue. Fossil fuels are a finite resource. Even if advanced carbon capture methods enable us to keep on using them with no adverse climate effects, the cost of extracting them from slowly depleting geological reserves will eventually combine with a decreasing cost of clean energy to make electrolytic hydrogen from water unambiguously cheaper. That is inevitable, but it is not the point.

IRENA implies that hydrogen producers should avoid investing in blue hydrogen technology because within just a few years green hydrogen will be cheaper. Money invested in blue hydrogen will be wasted. It would be better spent buying electrolysers and building more wind and solar installations, the agency reasons.

My aim in this article has not been to prove that IRENA’s projections for the relative costs of green versus blue hydrogen in the remaining years of this decade should be disregarded. The point is that the touted “straight to green” strategy is not only unnecessary, but unsound. It fails to account for the enormous difference in energy cost between production of blue and green hydrogen. It effectively dismisses it with a shrug, assuming that the continued deployment of renewables will make energy so cheap that it will no longer matter.

By ignoring the difference in energy cost, the “straight to green” policy holds major progress on carbon mitigation hostage to an orders-of-magnitude increase in the deployment of wind and solar capacity. At the same time, it makes it harder to achieve that increase by eliminating the best business incentive for building new capacity: the prospect for a strong financial return on investment, not dependent on subsidies. Electric blue hydrogen does not require “nearly free” surplus energy for economic viability. It can afford to pay a price that makes building new capacity attractive.

As Nils Rokke of Norway’s SINTEF just recently proclaimed in the title of a Forbes article, Blue Hydrogen Isn’t The Climate Enemy, It’s Part Of The Solution. Let us hope that IRENA heeds that message.