Why CO2-based EOR is a triple win

Enhanced oil recovery (EOR) based on injection of supercritical CO2 into mature oilfields yields wins for the environment, the producers, and the economy. That runs counter to the views of many climate activists. They see it as a win only for producers, while being a loss for climate and the environment. As to the economy, well, that’s not something such activists are typically much concerned about. That view is unfortunate. This article examines why.

How EOR works

Background: conventional vs. non-conventional reservoirs

Oil and gas reservoirs are by no means all the same. There are a few things they all have in common, beginning with the fact that they all started out millions of years ago as deposits of sediments and dead organic material laid down in shallow seas. Over time, the deposits were buried ever more deeply under layers deposited on top of them. Heat from the earth below, pressure from the accumulating deposits above, and chemical interactions with particles and water trapped in the sediments along with the organic matter slowly transformed the latter into petroleum.

That’s the key thing all petroleum reservoirs have in common. From there, they diverge. There are more ways in which they may differ than it’s worth trying to enumerate. The most important, however, is the permeability of the sedimentary rock hosting the reservoir. That parameter defines two broad classes of reservoir,conventional and non-conventional.

Conventional petroleum reservoirs are hosted in sandstone or limestone deposits. The particles aggregated in the deposit are grains of sand or the packed shells of calcareous microplankton. The porosity – a measure of how readily fluids can seep through the rock – is typically in the range of 200-500 millidarcies (md). Non-conventional reservoirs are hosted in shale or so-called tight sand deposits. The sediments in which the original organic matter was laid down were silts or clays with microscopic grain sizes. The processes by which the organic matter was transformed into petroleum are the same as for conventional petroleum reservoirs, but the permeability of the aggregated reservoir rock is much lower. Permeability in tight sands (derived mainly from silt) is typically 0.1 md or less; in shales, it’s 0.001 md or less.

Within North America, non-conventional reservoirs are thought to hold more oil and gas than conventional reservoirs. Until recently, however, their extremely low permeability rendered them non-viable for commercial exploitation. That changed in 2009, when advances in horizontal drilling technology and reservoir rock fracturing proved successful. They started to reverse the decline of oil and gas production in the U.S., and the fracking revolution was born.

Methods for enhanced recovery from conventional reservoirs are well known, and have been long been practised. The same cannot be said for non-conventional reservoirs. In the following subsections, we will first look at EOR methods for conventional reservoirs, and then look briefly at methods for non-conventional reservoirs.

EOR in conventional reservoirs

Oil and gas production can include up to three phases: primary, secondary, and tertiary recovery. Primary recovery is straightforward: it’s what can be produced simply by individual production wells tapping into a petroleum reservoir. Primary recovery is typically limited to about 10% of the reservoir’s original oil in place (OOIP). The oil (and gas, if present) resides within the pore space of the sedimentary rock formation hosting the reservoir. As fluid is withdrawn, the internal pressure in the pore space drops. With nothing to replace the fluid withdrawn, the pressure drops rather quickly. It soon gets to the point that no more fluid can be recovered – even if 90% of the OOIP is still present in the reservoir.

For both secondary and tertiary recovery, there are additional wells drilled at selected locations among the original wells tapping the field. The additional wells are not production wells; rather, they’re injection wells for pumping a “drive” fluid into the reservoir. The aim is to maintain pressure within the pore space of the reservoir and drive migration of reservoir contents away from the injection well (or wells) toward the production wells.

The difference between secondary and tertiary recovery (EOR) is in the drive fluid(s) pumped into the reservoir via the injection wells. For secondary recovery, the drive fluid is cheap and passive. It does not alter the characteristics of the crude oil present in the reservoir. It’s usually just water, or a combination of water and pressurised gas. In some cases, the gas is natural gas co-produced with the oil. That’s done as an alternative to flaring when laying gathering pipelines to a gas processing and distribution facility would be too expensive.

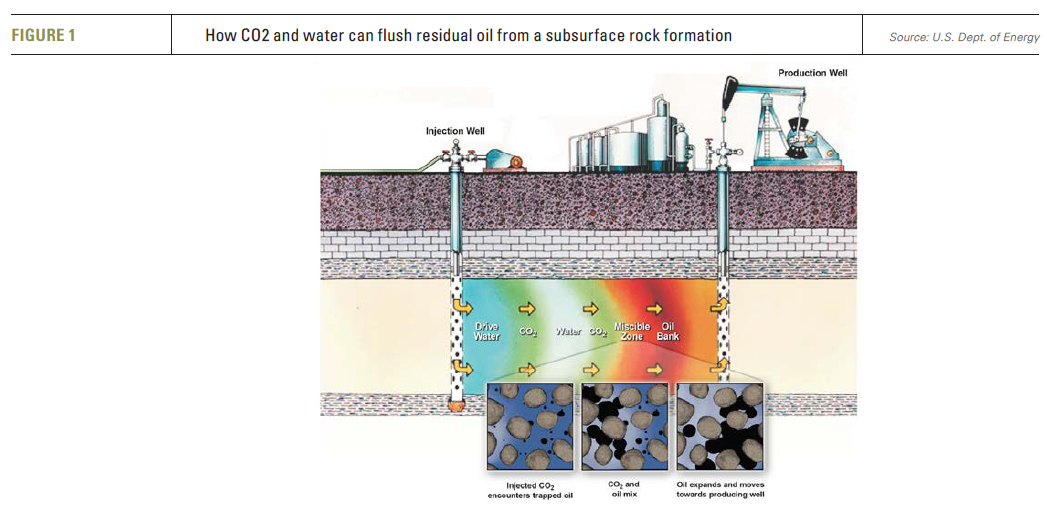

For tertiary recovery, the drive fluid does alter the characteristics of the reservoir oil. It does so in a manner that enables the oil to move more easily through the network of linked pores in the reservoir rock. The fluid can be steam or hot water, both of which heat the oil and lower its viscosity. It can also be water mixed with chemicals that lubricate the flow of oil and water together through the pore space. Or it can be supercritical CO2.

Supercritical CO2, if available, is by far the most effective drive fluid for EOR. Supercritical CO2 and oil are miscible. The mixture has low viscosity and no surface tension; it flows relatively easily through the pore space of the reservoir. The ultimate recovery fraction depends on many factors particular to individual reservoirs, but generally speaking, CO2-based EOR can recover up to 60% of the reservoir’s OOIP. In some cases, it can be even more. CO2-based EOR is illustrated in the figure below.

Whether it is to the advantage of an oil field operator to employ CO2-based EOR hinges on the availability and price of CO2, as well as the price of oil and the state of the particular reservoir for which EOR is being considered. A document from the Proceedings of the National Academy of Science states:

“CO2-EOR operations typically pay an oil-linked price near 40% of the per-barrel oil price for a metric ton of carbon dioxide ($23/mt at the April 2018 oil price of ∼$60/barrel).”

If the price/mt of CO2 is negative – i.e, the operator will be paid for the CO2 sequestered in the reservoir – then use of CO2-based EOR in a conventional reservoir is more or less guaranteed to be advantageous. But that’s getting into economic issues that we will look at further below.

EOR in non-conventional reservoirs

Separate wells for injection of drive fluids won’t work in non-conventional reservoirs. The permeability of reservoir rock is too low. But oil field service companies in partnership with shale field operators are experimenting with methods that can work.

The “huff and puff” approach alternates cycles of production and repressurization from a single well. When primary recovery from a fracked well falls below a designated threshold, production is suspended. The well is repressurized with supercritical CO2 and left to “soak” for a time. During that time, supercritical CO2 will diffuse and penetrate into the tight pores of the shale around the fracture surfaces. There it will mix with the oil and gas remaining in the pores. At the end of the soaking interval, production is resumed. Recovered fluid will be a mix of oil, CO2, and natural gas which will have to be separated. After separation, the CO2 will be stored in tanks to await the next repressurization cycle.

After some number of cycles, the fraction of oil and gas in the recovered fluid will drop off. The drop off can be reduced by extending the soaking cycles. Eventually the soaking cycle is extended indefinitely. The well is capped, leaving the reservoir full of sequestered CO2.

Note that this and other EOR methods for non-conventional reservoirs are recent developments. They are not fully mature technologies, and there is ongoing R&D.

CO2 emissions benefit of EOR

Because CO2 has a positive value in EOR operations, EOR is an attractive way to sequester captured carbon. CO2-based EOR is a tertiary recovery method, so any field where it might be used will already be equipped with the injection wells and seismic monitoring equipment needed to track the movement of injected fluids. Aside from the cost of obtaining CO2, the cost of upgrading from water flooding to CO2-based EOR is minimal.

Responsible debate about the environmental value of CO2-based EOR tends to centre around two questions:

- Whether the amount of CO2 left in the oil reservoir at the end of EOR operations will exceed the amount of CO2 that will be emitted when the recovered oil is burned; and

- How the additional oil recovered will affect net global oil consumption.

The answer to the first question is not simple, but it is straightforward. One can find cases where the additional oil recovered will emit more CO2 when burned than the CO2 that was used to recover the oil. That is because EOR operations are tailored to minimise the dollar ratio of CO2 purchased to oil recovered. When the price of oil is low or the cost of the purchased CO2 is high, operations will be tailored to minimise the amount of CO2 used. When the price of oil is high or the cost of CO2 is low, operations will seek to maximise the amount of oil recovered. In that case, the amount of CO2 used for EOR will substantially exceed the amount of CO2 emitted when the recovered oil is burned.

The answer to the second question renders the answer to the first question somewhat moot. That is because – at least by one line of argument – the additional oil recovered from mature fields through EOR has little or no effect on net global oil consumption. It merely shifts the source of oil supplied to the market. More will be from mature fields, less from new fields that would have to be found and developed if the additional oil recovered were not available. That being the case, then it does not matter whether the CO2 emitted when the additional recovered oil is burned will be greater or less than the amount sequestered through EOR operations. The same total amount of oil will be burned either way. 100% of the CO2 sequestered will count toward global emissions reduction.

The justification for this line of argument is that the market for oil is demand-limited. Aggregate consumption is inelastic – insensitive to price changes – in the short term. Oil consumption is overwhelmingly tied to transportation and heavy equipment. There are also small regional markets for heating oil. None of these applications are elastic in the economic sense. They display no significant short term price sensitivity. High oil prices may cause owners of old homes with fuel oil furnaces to lower their thermostat settings, and families may defer road trips. Those responses are insignificant in terms of the overall market for oil.

In the long term, of course, things are different. Persistently high oil and gas prices accelerate the transition away from fossil fuels to alternatives. That is the point of pricing carbon emissions. But the transition will occur in any case, as electrification of the energy economy proceeds. Oil and gas companies know that. So where it is feasible, they are happy to cut exploration and development (E&D) investment in favour of higher returns from existing assets before they become stranded.

Other environmental benefits

E&D activity is expensive, and accounts for a noticeable fraction of global oil consumption. Being able to cut back on it, in addition to the direct financial benefit to oil and gas companies, delivers indirect environmental benefits:

- access roads not bulldozed through forests or grazing land;

- drilling pads and holding ponds for drilling mud not built;

- gathering pipelines not laid; and

- diesel fuel for all those operations not consumed.

In the end, these indirect environmental benefits enabled by CO2-based EOR may prove as valuable as the emissions benefit from sequestering the CO2.

Economic benefits

Even when oil producers must purchase the CO2 used in EOR operations, the EOR operations will increase oil recovery by enough to justify the expense, so long as the price for CO2 is below a certain threshold. The rule of thumb cited earlier for the threshold is 40% of the per-barrel oil price for a mt of CO2. Below that CO2 purchase price, EOR operations will be profitable; they will increase the producer’s return on investment in the field. That is obviously good for the producer and its shareholders, but what about the environment and the economy as a whole? Is it good for them as well? That’s a more difficult question.

A bit of economic theory

To anyone who still subscribes to the Reagan-era theory of “trickle-down economics”, the answer for the economy as a whole is a straightforward “yes”. But subsequent history has discredited the theory of trickle-down economics. Trickle-down does exist, but whether its net effect is good for the economy as a whole is nuanced. It depends on the source of the funds intended to trickle down.

In terms of economic stimulus, “tax cuts for the wealthy” are unconditionally negative. They amount to a transfer of wealth from lower and middle income citizens to the wealthy. The transfer takes the form of either higher taxes for lower income citizens, or higher expenses for government services and benefits lost in lieu of government tax revenue. The wealth transfer in that case hurts the economy. It is not a question of social justice or moral issues around progressive versus regressive tax rates. It is a simple matter of the economic “velocity of money”. Funds that find their way into accounts of the wealthy have, statistically speaking, a lower turnover rate than funds going to the not-so-wealthy. A lower money turnover rate, by definition, lowers GDP.

On the other hand, the higher return on oilfield investment that EOR enables does not, in general, constitute a wealth transfer. It constitutes an improvement in productivity of capital. Improved productivity, whether of capital or of labour, is good for the economy. It means getting more output from less input. In this case specifically, funds not spent for E&D will be available for investment in other areas. Hopefully, they will find their way to investment in alternative energy resources that don’t emit carbon.

A small wrinkle

I qualified my statement above regarding EOR not constituting a wealth transfer. I said “in general”. I had to add that qualifier because, under certain conditions, it does involve such a transfer. Under those conditions, the effects on the economy are negative. And unfortunately, we are currently staring at exactly such conditions.

The problem is the Section 45Q tax credit for CO2 sequestration. Specifically, the problem lies in how the tax credits are funded. They should be funded by a price on carbon emissions, either through a direct carbon tax or mandatory purchase of carbon permits. But they’re not. Instead, they’re tax credits allowed for certified carbon sequestration. That means they are funded by taxpayers left on the hook for revenues not collected from those to whom the credits were awarded. That is an indirect wealth transfer from taxpayers to the oilfield operators using EOR. The economic harm from that transfer reduces – and perhaps overwhelms – the economic benefit from the higher productivity that EOR otherwise brings.

The solution is easy to state: implement a national carbon tax, apply some of the revenue to pay for carbon sequestration, and rebate the rest uniformly to all citizens. But that may be politically difficult.

About sources of CO2

If a proper economic solution – a carbon tax and rebate plan – proves politically infeasible, at the least the 45Q credits should be rationalised to exclude sequestration of CO2 sourced from CO2 gas wells. Most of the CO2 now used for EOR in the Permian basin comes from such wells. They are the cheapest large scale sources of CO2. However, there is no climate benefit from using them for EOR. They produce CO2 that was already sequestered. Their CO2 would have remained in the ground if not extracted for use in EOR. Under a proper carbon tax and rebate plan, their output would be taxed as a carbon source. Failing that, it should at least not be allowed as a source for 45Q tax credits.

The most economically and environmentally advantageous source of CO2 for EOR is probably that produced in reforming of natural gas for production of blue hydrogen. There is a large and growing demand for clean hydrogen. When hydrogen is produced by reforming natural gas with carbon capture, its cost can be only marginally higher than so-called grey hydrogen, produced without carbon capture. I.e., the cost of CO2 captured from greenfield blue hydrogen plants is only marginally above zero. That is contingent on the plant employing a modern design specifically developed with capture of CO2 in mind. Appropriate designs have been discussed in the May issue of Gas in Transition. The feature can be read here.

About the author

Roger Arnold is a former physicist, aerospace engineer, and systems architect. He has worked at IBM, Boeing Aerospace, AT&T, and a number of electronics companies and startups in San Diego and Silicon Valley. Now retired, he pursues independent research and writing. His writings focus on climate, clean energy, and sustainability. He is especially interested in exploring how technologies interact and create opportunities for synergistic solutions to critical problems.