TurkStream to Increase Competition in Balkan Gas Markets

The $20+Billion TurkStream project of Gazprom may have a surprising side effect. If commissioned, the new pipeline can increase competition in the gas markets in Bulgaria, Romania, Greece and Macedonia.

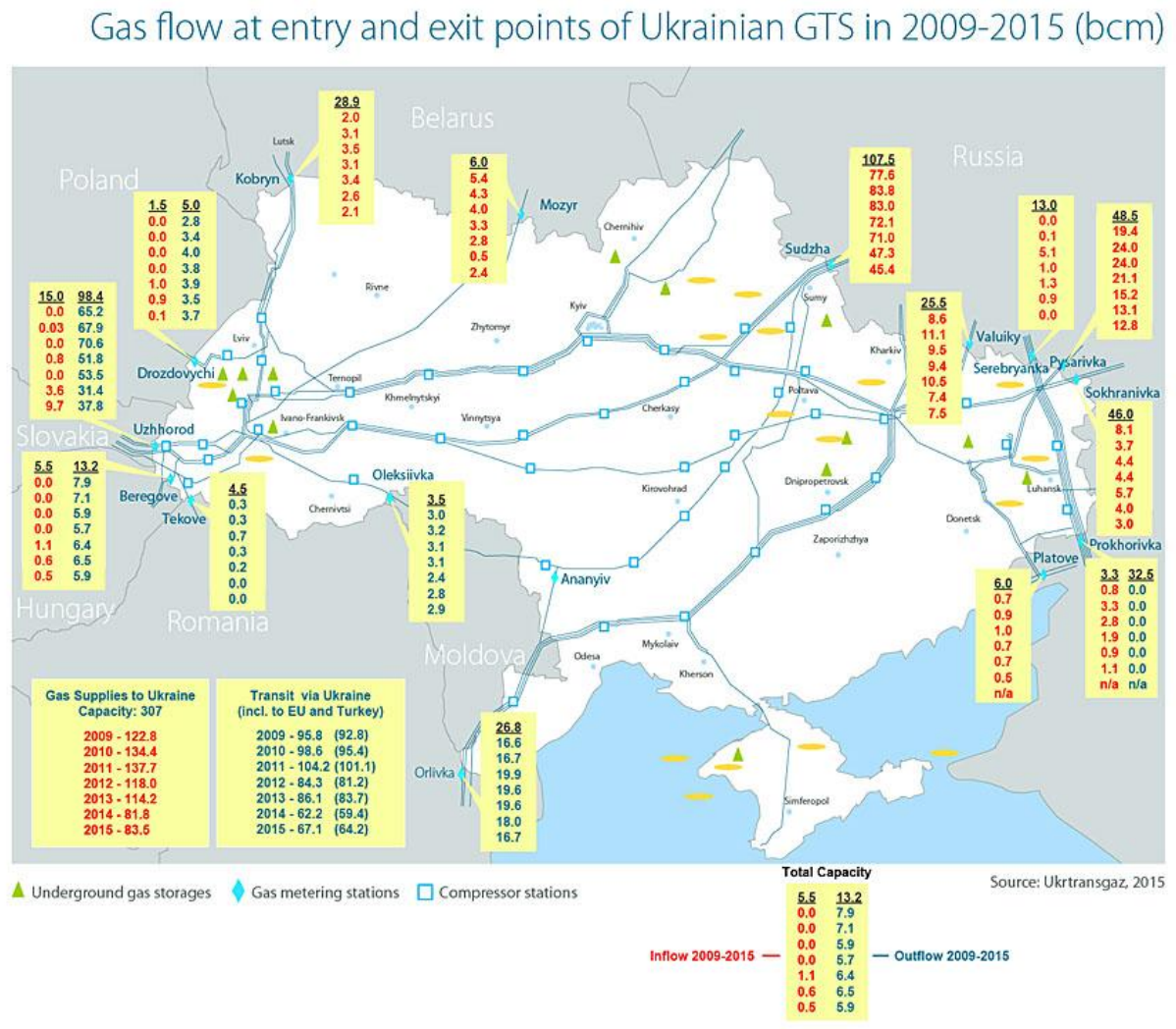

Gazprom has designed the TurkStream project to reduce Russian gas transit through Ukraine. In 2015, Gazprom shipped via Ukraine to Europe 64.2 billion cubic meters (bcm) of gas, including 16.7 bcm through the Trans

Figure 1. Ukrainian gas transit flow in 2009-2015, bcm

Source: Naftogaz Europe

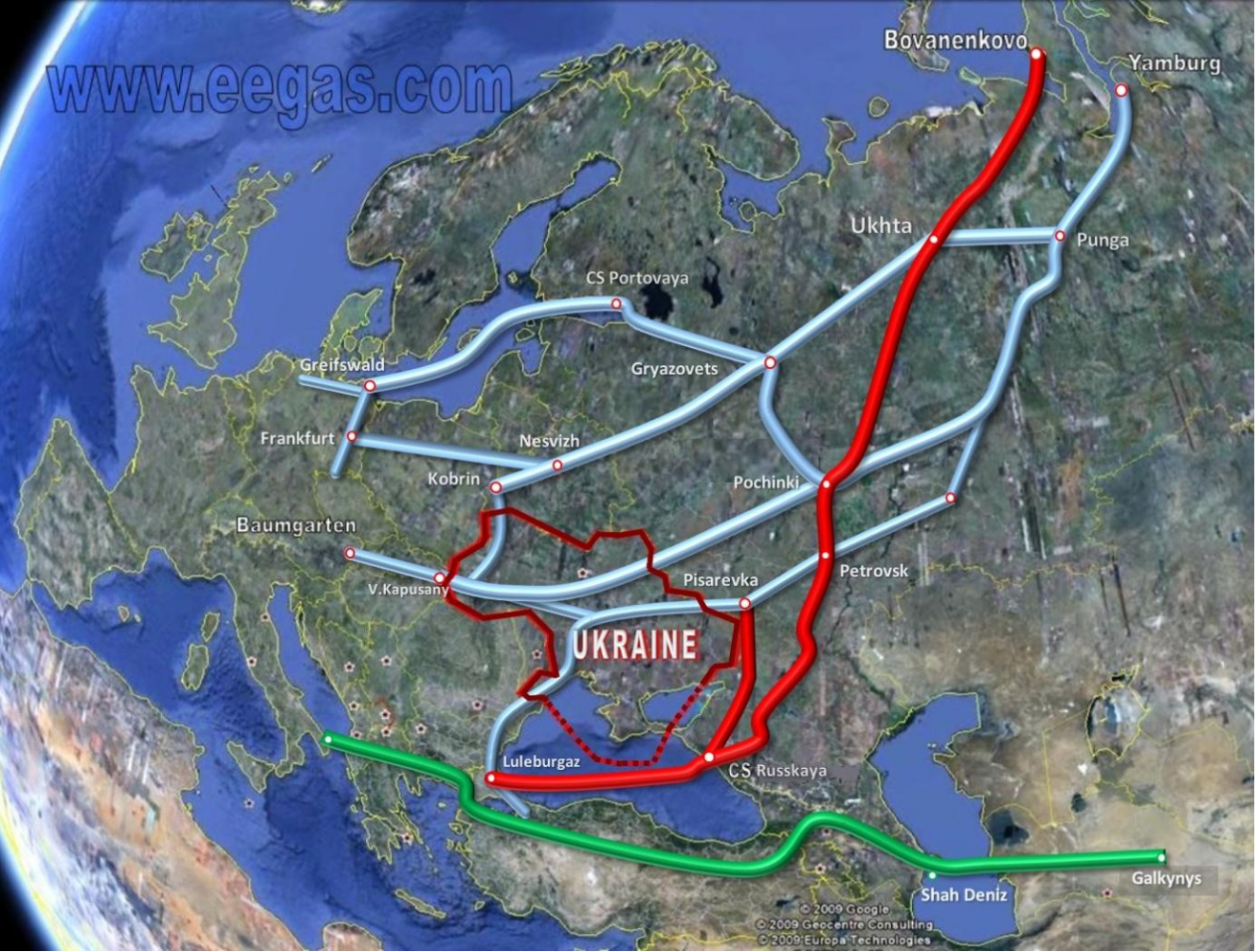

Gazprom plans to build two 15.75 bcma strings, but without new pipelines running from Turkey to Greece and further into Europe, TurkStream can replace only the volumes currently delivered by TBP. One 15.75 bcma string of TurkStream would result in TBP supplying gas only to Romania and the Sofia gas pipeline in Bulgaria leaving the rest of the TBP capacity free for reverse flow from Turkey.

The reversed TBP can be easily connected with TANAP opening the Balkan markets for gas from Azerbaijan, Iran, Iraq and Turkmenistan. According to the EU rules, Gazprom would need to compete for the access to the reversed TBP.

Figure 2. TurkStream and Southern Gas Corridor

Source: eegas.com

It is very unlikely that any European company would build a new link between TurkStream and Italy, and the Trans-Adriatic pipeline (TAP) is exempt from third party access. With TurkStream commissioned, Gazprom may lose a share of the Balkan market.

Mikhail Korchemkin

East European Gas Analysis Malvern, PA 19355

USA

This analysis was originally published by East European Gas Analysis