Gazprom exports to Europe in August see first year/year decline in 2024 [Global Gas Perspectives]

Gazprom’s pipeline natural gas exports to Europe were lower year/year in August for the first time in 2024, but volumes over the first eight months of the year remained substantially higher. This is in defiance of the ambition of EU policymakers to eliminate Russian gas imports entirely within a few years.

The Russian gas giant piped 2.5bn m3 of gas to Europe last month, down 3% from the 2.6bn m3 it delivered in August 2023. Increased sales to the EU and China allowed Gazprom to swing back to profit in the first half of this year, booking a net income of $11bn, after suffering a $7bn loss in 2023. For a commodities producer, revenues are what matter as operating and financing expenses are a lot less volatile. As noted in October, Gazprom must earn more than $21bn/quarter in revenues to stay profitable, and it exceeded this amount in the first half, earning $45bn.

Gazprom’s monthly gas pipeline exports to Europe

.png)

Sources: Entsog, thierrybros.com

The question is whether this monthly drop year/year exports represents a shift in strategy by Gazprom, or just a short-term adjustment. Nevertheless, pipeline flow should remain within the expected narrow range of between 0.9 and 3.5bn m3/month.

Split of Gazprom’s monthly pipeline gas exports to Europe by route

.png)

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

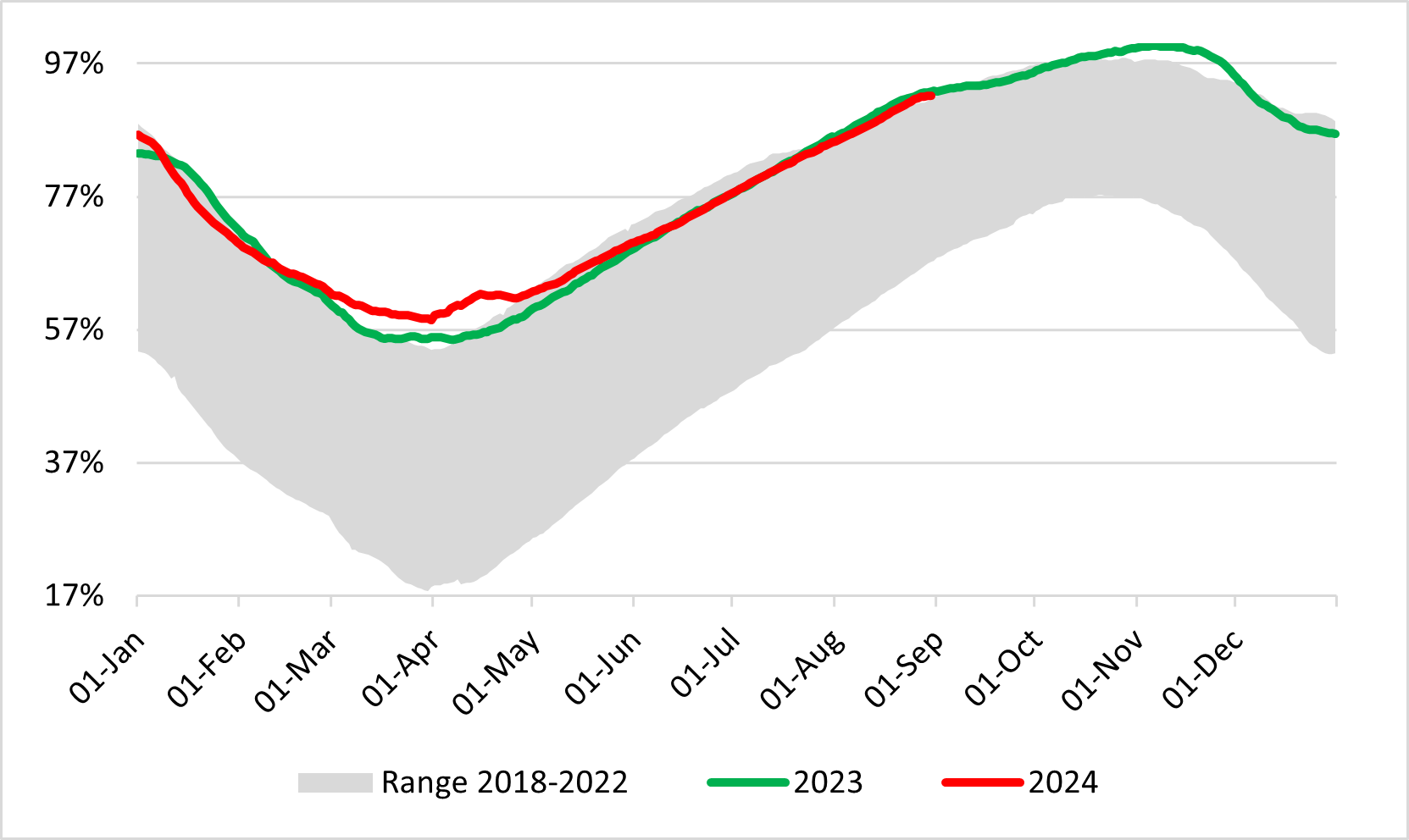

EU storage utilisation reached the 90% target on August 19, more than two months ahead of the deadline set by policymakers. Storage facilities were filled to 92% of capacity at the end of August, towards the higher end of the historical range, and just slightly less than at the same point last year.

EU gas storage utilisation

Sources: GIE, thierrybros.com

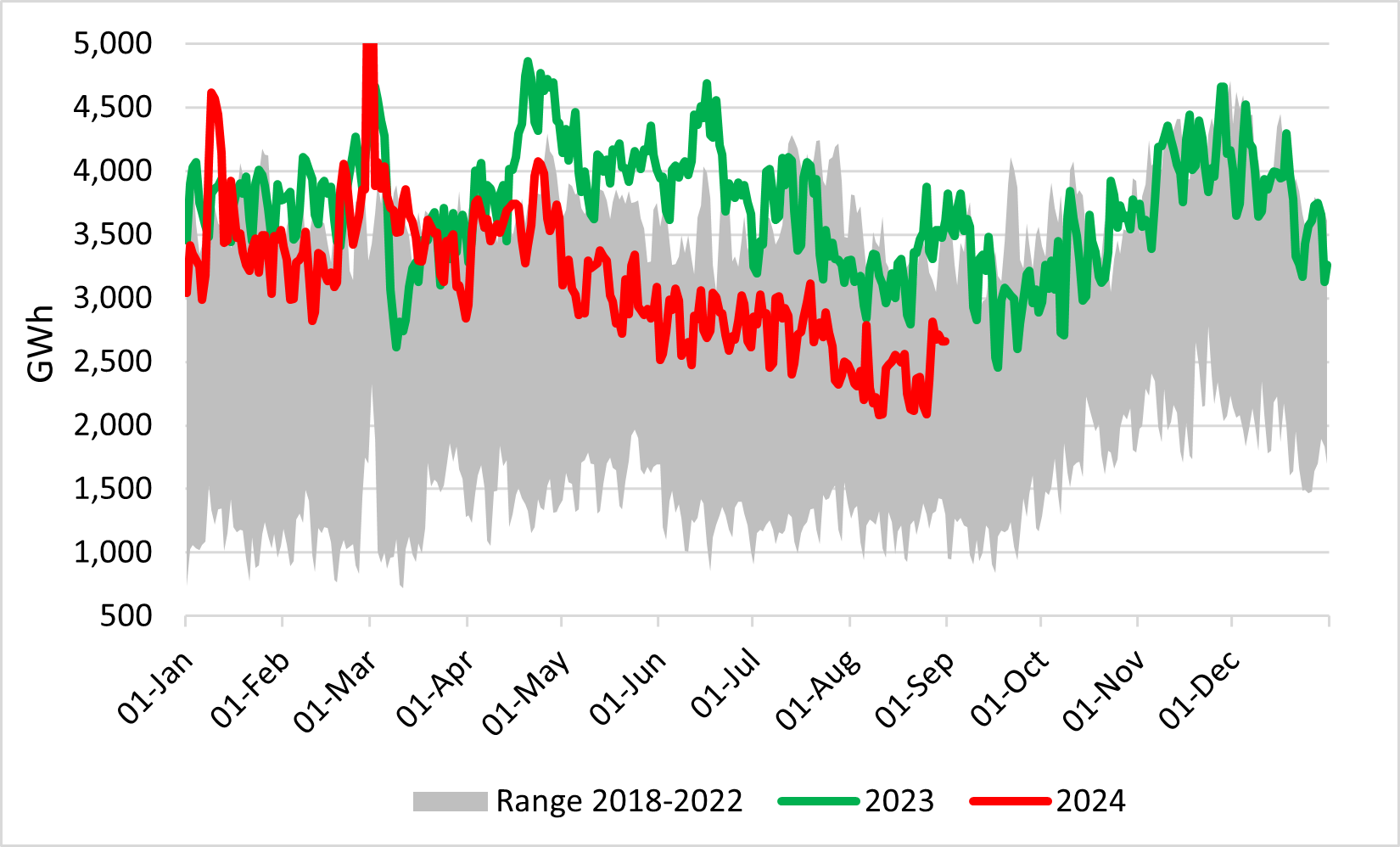

Spot LNG provides the equilibrium between Asia and Europe. EU LNG sent-out data shows that Asia is more willing to attract LNG since the start of this year as the EU is in no need of extra LNG thanks to ample supplies of Russian gas and further demand destruction. For the first eight months of this year, send-out was 17% lower than the same period last year. But even in the middle of summer, and with storage levels at a near record high, Europe is paying over $12/mn Btu for gas, as the global gas market is once more getting tighter.

EU LNG sent-out (excluding Malta)

Sources: GIE, thierrybros.com

Looming four months from now is the expected end of Russian gas transit via Ukraine. Moscow and Kyiv’s long–term transit contract expires at the end of December and is unlikely to be renewed. But with European wholesale gas prices at above $12/mn Btu, replacing the 14bn m3/yr of gas that is delivered through Ukraine’s pipelines is going to be a challenge. Replacing a further 5% of EU gas demand could be very expensive and could contravene the next European Commission’s focus on re-industrialisation.

We might see a double standard emerge, with sanctions on Russia increasing on the one hand and some manoeuvres to find a solution for gas to keep flowing through Ukraine, until the EU is able to implement its 2027 target of no Russian gas, thanks to the arrival of more LNG.

Dr. Thierry Bros

Energy Expert & Professor

September 1, 2024