The rise of FLNG - NGW Magazine

This article is featured in NGW Magazine Volume 2, Issue 14

Floating LNG has scored some notable successes this year and gas and LNG are gaining traction as the world is gradually but firmly moving towards clean energy.

Something like 60% of global natural gas supplies lie offshore, sometimes in difficult and remote locations. FLNG can be a game changer for their development, much the same way as FPSOs enabled oil and gas production from deep-water fields. But after initial optimism following Shell’s decision to proceed with Prelude, the collapse in prices in 2014 dampened enthusiasm. And the Qatari government’s snap decision to boost LNG output from the North Field will doubtless force agonising reappraisals of borderline projects.

But although the FLNG market has not developed as quickly as once hoped, the attainment of a number of successful milestones over the last few months, such as such as PFLNG Satu, Shell’s Prelude, FLNG Hilli and Coral FLNG, are bringing interest back. In fact 2017 is turning out to be a big year for FLNG.

Key FLNG milestones

First, the world’s first FLNG vessel, known as PFLNG Satu, with a total processing capacity of 1.2mn mt/yr and an estimated cost of $1.6bn, positioned off Sarawak is now operational. Petronas’ Satu project came on stream and started producing LNG early December and exported its first LNG early April. Petronas CEO Datuk Wan Zulkiflee Wan Ariffin said: “This accomplishment effectively demonstrates Petronas’ proven technology and capability of adapting a conventionally land-based installation to a floating LNG facility, a game-changer in today’s LNG business landscape.”

Emboldened with this success, Petronas is proceeding with its second FLNG vessel, PFLNG-2, announcing in May that it will be operational by 2020. It will be deployed at the Rotan field, 240 km off Sabah in Malaysia, with a total processing capacity of 1.5mn mt/yr and at a cost for the vessel estimated at $827 per mt/yr of LNG.

But the world’s second FLNG vessel to become operational, with 1.2mn mt/yr capacity, will be for the Kribi gas-field offshore Cameroon, operated by Perenco and Cameroon’s SNH. Golar is supplying the unit, known as FLNG Hilli Episeyo, the first for the company. It is also the first LNG carrier to be converted into an FLNG unit. It took 32 months to complete at an estimated vessel cost of $600/mt/yr of LNG. Golar confirmed in June that conversion of the vessel is nearing completion at the Keppel shipyard in Singapore. All equipment has been installed and testing and pre-commissioning work will continue until departure from the yard, in July. It is aiming to start production in September.

Golar, through its joint venture with Schlumberger, OneLNG, plans to follow this up with the Fortuna FLNG vessel to be installed in Ophir Energy’s block-R. It has 73bn m³ proven gas reserves and it is about 100 km offshore Equatorial Guinea (Figure 1). Fortuna’s capacity will be 2.5mn mt/yr, at an estimated vessel cost of $600/mt/yr and it is scheduled to become operational in 2020. FID is expected in August. Ophir Energy CEO Nick Cooper said that talks with offtakers “remain on-going and are expected to be closed out imminently.”

The next milestone will be Shell’s Prelude FLNG. This left Samsung Heavy Industries’ Geoje shipyard in Korea and is now on its 5,550 km journey to location at the Prelude field in the Browse Basin, 475 km offshore Western Australia in 250 m water depth. It is expected to arrive July 30 and to stay on location for 25 years. At 600,000 mt it is the biggest floating structure ever constructed, measuring 488 m by 74 m, with total costs of about $12.6bn. Shell can also claims credit for the largest object to be towed across the face of the earth: the Troll gas platform, installed off Norway in 1995..png)

Prelude will be producing 3.6mn mt/yr and it is expected to start operating in 2018. It should be noted that this cost includes facilities to produce 5.3mn mt/yr liquids, 1.3mn mt/yr condensate and 0.4mn mt/yr LPG – by-products that make the project more competitive. It is a prototype that the industry is watching with great interest.

Another important milestone is Eni’s FID for Coral FLNG, in Mozambique, taken in June. The importance of this lies in the fact that FID has been taken in a low price environment – a strong indication that the FLNG concept can be viable even at low prices. This achievement comes just three years since the drilling of the final exploration well in a country that is a newcomer to the global gas market.

Coral FLNG will have a capacity of 3.4mn mt/yr. In October 2016, Eni and its Area 4 partners signed an agreement with BP for the sale of the entire volumes of LNG produced by the project for a period of over 20 years, with some flexibility over volumes. These partners will, once cleared, include ExxonMobil, which bought 50% of Eni’s share in March.

Where Coral FLNG is a first, is the water depth. It will operate in 2,000 m of water, making it the first ever ultra-deep-water FLNG. For comparison, Shell’s Prelude FLNG will be in a water depth of about 250 m. Eni’s operations manager Roberto Casula said that Coral FLNG could be developed at an installed cost of $1,300/ mt/yr of LNG. Start-up is expected mid-2022, with about 5 trillion ft³ gas to be produced over 20 years.

In the US, Delfin FLNG is about to break new ground. Not only is this the US’ first FLNG project, but it will use floating liquefaction facilities instead of a land-based plant. Delfin will involve four FLNG vessels, to be provided by Golar, about 80 km off the coast of Louisiana and supplied with gas by pipeline from the grid. The total project liquefaction capacity will be 13mn mt/yr. Being offshore, Delfin benefits from several advantages over land-based facilities, such as more environmentally friendly, faster to permit and build; and cheaper, using converted LNG carriers.

Not many LNG projects have reached FID during the last two years, reflecting the oversupply of LNG in the market. But the two projects sanctioned this year, Coral and Fortuna, are both FLNG projects. According to Wood McKenzie this highlights a positive shift in industry perception toward FLNG. Majors like Eni, ExxonMobil and BP have all now endorsed FLNG in a low LNG price environment. With stranded gas resources suited to FLNG elsewhere in the world, FLNG appears to be regaining support, especially where standardisation lowers construction costs.

Standardisation is key

Similarly to the FPSO concept, FLNG future lies in standardisation and reduction of time to build and costs. In a way this has already started with Golar’s Hilli and Fortuna projects. In both cases the owners of the gas-fields are leasing their FLNG vessels from Golar, which in effect is offering a more industry-standard solution.

In fact Golar, through OneLNG, is now proceeding with conversion of two Moss hulls, with one to be used at Ophir’s Fortuna field. This is a generic conversion of LNG carriers into FLNG vessels that can be easily used for the development of other deep-water gas-fields. They also benefit from reduced construction time and lower project costs in comparison to purposefully build vessels.

Keppel Offshore and Marine shipyard in Singapore, where the conversion of FLNG Hilli is being completed, sees this as the first of many future standardised conversions to come. CEO Chris Ong said: "Compared with new-builds in the market, a converted FLNG solution is not only significantly more cost-effective but also much faster to market, without compromising safety and operating capabilities." He added: "After this project, we are well placed to replicate similar projects and provide end-to-end solutions to meet the growing needs of the LNG industry."

Another standardised design is Exmar’s Caribbean FLNG being constructed at the Wison Offshore & Marine’s yard in Nantong, China, and expected to be delivered in July. Exmar has just secured $200mn bank finance in support of this project. It is a small unit, with 0.5mn mt/yr LNG production capacity and 16,100 m³ storage capacity. It was scheduled for delivery to Pacific Exploration & Production in 2015, offshore Colombia’s Caribbean coast, but the agreement was terminated in March 2016. Exmar is still in talks to secure a customer for the FLNG unit.

In the meanwhile, ExxonMobil is progressing studies for the adoption of a cylindrical FLNG design for the Scarborough gas-field offshore Australia. This is based on Norway’s Sevan Marine standardized FLNG concept, an 80-m high floating cylinder with a diameter of 106 m that can process up to 4.8mn mt/yr of LNG, with 240,000 m³ storage capacity. Sevan Marine’s CEO Reese McNeel said in April the design is cheaper and more stable in rough seas than ship-shaped vessels. He added: “We think it is good for a number of projects in the Australian region and we have been having conversations with a number of venture proponents.” But a final decision on whether the Scarborough field development will be based on an offshore or an onshore LNG facility is still to be made. There were also plans to use a spar platform such as this at Cyprus, before the oil price fall and the reserves downgrade rendered the project uneconomic.

A number of other standardized design concepts are being developed, but they are at early stages. This is indicative of the longer-term interest in the FLNG concept.

These are smaller, low cost and more flexible projects able to respond to the new era of plentiful energy supplies and low prices.

Shell with Prelude and Eni with Coral FLNG are also claiming that these are not one-off, but prototypes. Both aim to use these vessels for the future development of other deep-water offshore gas-fields.

FLNG will follow the history of FPSOs

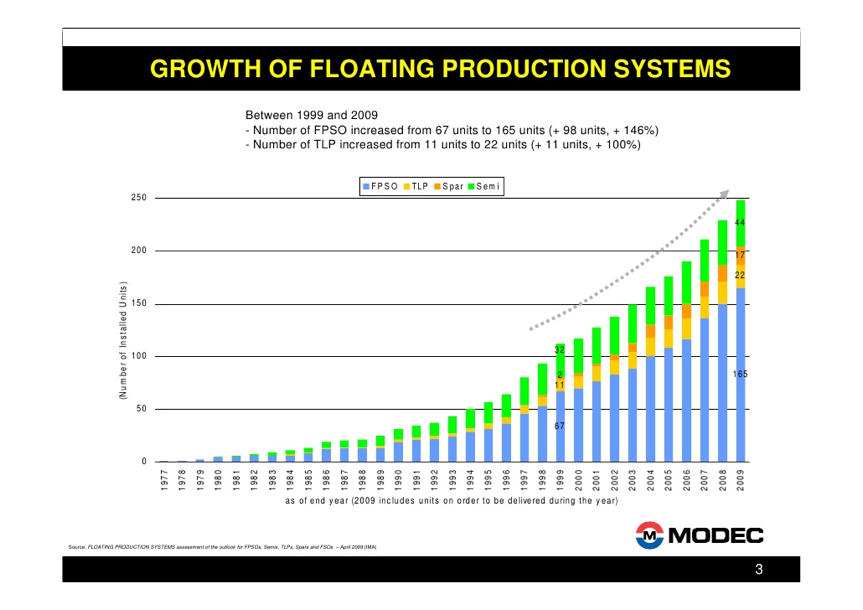

Studies into offshore LNG production started in the early 1970s, but it was only in the mid-1990s that significant research backed by experimental development began. This led to the first FPSO, Shell’s Castellon, built in Spain in 1977. Today, over 270 vessels are deployed worldwide as oil FPSOs. The rapid growth in the number of FPSOs deployed globally during the first 30 years after Castellon in shown in Figure 2.

Similarly, studies into offshore LNG started in the 1970s and by 1997 Mobil proposed the first FLNG concept, with first export from an FLNG vessel achieved this year. Indications are that FLNGs are on the way to follow a similar growth pattern. After all, FLNG is an evolution of the FPSO concept.

FLNG has now become an attractive option to develop offshore and often stranded gas-fields, holding between 2 and 10 trillion ft³ of gas, especially for those located at significant distances from land. In comparison to onshore liquefaction, which requires an offshore production platform, a pipeline to transport the gas and an onshore LNG plant, FLNG in effect combines all of these in a single unit. This brings advantages of shorter project completion times and lower costs.

In comparison with onshore plants, which typically take four or five years to construct and are far more prone to delays influenced by factors such as weather, approvals, lack of infrastructure and cost overruns, the delivery track record for FLNG vessels is generally good. Using FLNG can circumvent the often-lengthy approvals processes facing onshore developments. Key factors driving adoption of FLNG include technological advancement, monetization of stranded gas reserves, rising costs for the development of onshore terminals, shorter lead times, relocation flexibility, and lower space requirements.

Chinese interest

In a strategic push, China is planning to invest about $7bn into FLNG projects in Africa. It has already committed $4bn funding support to three FLNG projects off Africa: in Eni’s Mozambique project and in Cameroon and Equatorial Guinea. China also plans to provide $3bn funding to two other projects planned by NewAge African Global Energy offshore Congo and Cameroon, but in these cases, if they go ahead, Chinese shipyards will also build the FLNG vessels. Sanctioning is expected next year.

Not only China needs the LNG to lower carbon emissions and improve air quality, but the country also appears to be aiming to develop its own FLNG vessel construction market. Steve Lowden, chairman of NewAge, confirmed that its two projects will be wholly financed by Chinese companies and will also be built in Chinese shipyards. He added "They are more than fully able to handle such projects."

One of the first FLNG projects to be constructed in China, under the ‘belt and road initiative’ (BRI) could be for the development of Ethiopia’s Ogaden basin project by the Chinese conglomerates Poly Group and GCL Group (Poly-GCL). They appear to be homing into Sembcomb Marine’s Gravifloat FLNG concept, with initial production estimated at 3mn mt/yr. This uses a box-like unit floated in and connected to a pre-installed bottom frame in shallow water. This would be a first for this technology. In addition, Poly-GCL has already purchased a second-hand LNG carrier to store output processed from the FLNG. FID is expected in September or October, with construction to start before the end of 2017 and scheduled to last 28 months.

As part of its BRI strategic priorities, China sees FLNG as bringing a new technology to benefit its shipyards, but also to expand trade links with Africa.

The smaller and more flexible FLNG projects now being developed in Africa based on standardised, lower cost, designs seem to be the focus. If through their cheaper labour costs, state support and easy access to funds, Chinese shipyards can bring costs further down, they may be able to capture this market.

They are coming at a time when the market is re-emerging from a low. In effect they are investing at the bottom of the market and they are prepared to commit, in comparison with hesitant western banks who are first waiting to see how FLNG turns out. China sees long-term gains from FLNG technology.

The future of FLNG

The future of FLNG is decidedly looking better. With PFLNG Satu, and soon FLNG Hilli and Prelude, valuable operational experience is being gained giving operators, financiers and insurers more confidence in FLNG making future adoption easier.

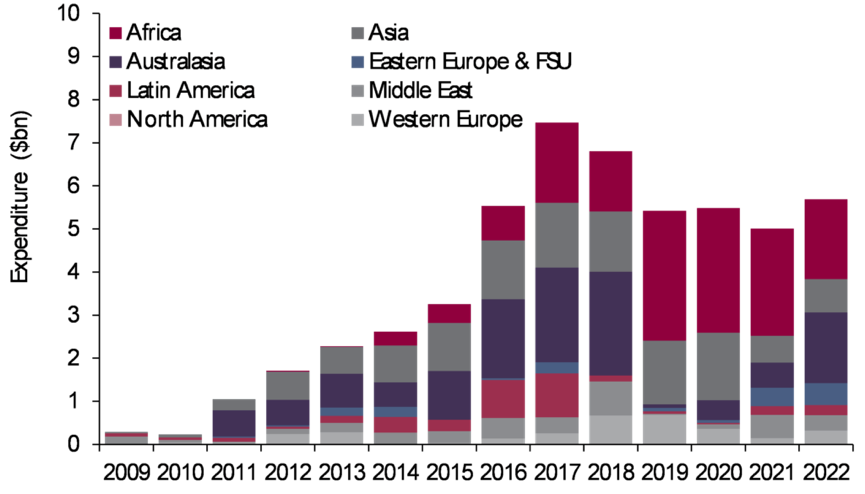

Analysts at Douglas Westwood predict that despite concerns over the fall in LNG spot prices and the slow sanctioning for new FLNGs, global capex on floating liquefaction units will total $41.6bn over the period of 2016-2022, compared with $11.4bn between 2011 to 2015 (Figure 3). FLNGs account for about 60% of this expenditure – the rest is for import and regasification terminals.

About half of this capex is for projects in Africa. In the longer-term, gas discoveries in remote regions offshore Africa will continue to drive adoption of FLNG solutions. It is becoming the next FLNG frontier.

Many current FLNG projects have opted for new-builds. However, the two proposed units in Africa have chosen converted LNG carriers for fields in Cameroon and Equatorial Guinea. Until demand for new LNG projects recovers significantly, the outlook for mega-projects will be slow. However, the outlook for smaller and cheaper conversions is still good. Chinese capital and interest in cornering this market could drive this.

Shell’s former CFO Simon Henry said in 2016 that FLNG is an attractive way to develop remote fields and he still expects Shell's portfolio eventually to include several such projects. "If I look in 10 to 15 years’ time I would hope that we would see multiple FLNG projects in the Shell portfolio because it's a great way of monetising gas in a competitive manner that perhaps only Shell will be able to do." But cheap and quick LNG carrier conversions may steal the lead for now.

Despite shorter-term concerns, the long-term viability of FLNGs in supporting the increasing role natural gas has to play in meeting global energy demand is evident. In addition, the rising cost of onshore LNG terminals and the shorter lead times of FLNGs make them viable even in the current low-price market environment, as the new projects in Africa are demonstrating.

Charles Ellinas

This article is featured in NGW Magazine Volume 2, Issue 14