Solving an energy crisis through subsidies is unsustainable [Global Gas Perspectives]

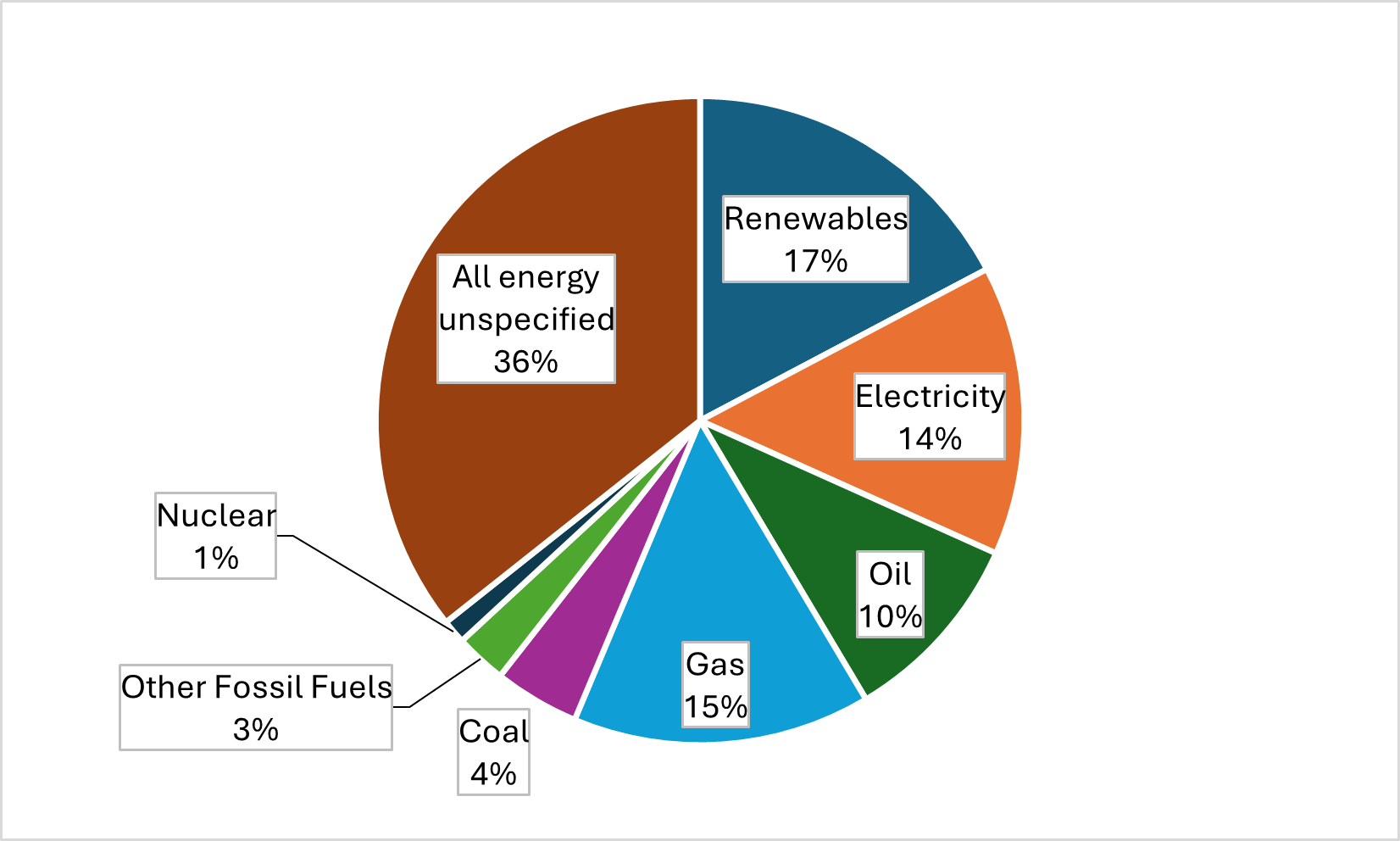

The European Commission has finally published its annual report on energy subsidies. In 2023, another €354bn ($365bn) was spent on energy, down 10.8% from the record €397bn in 2022 but still equal to 2.1% of EU GDP. When splitting this by energy type, subsidies amounted to at least €42/MWh for electricity, €9/barrel for oil and €16/MWh for natural gas. Even with gas spot prices and demand falling in 2023, gas subsidies rose. For gas, European subsidies are more than double US wholesale prices.

EU 2023 subsidies split by energy type

Sources: 2024 Report on Energy subsidies in the EU, thierrybros.com

This shows that the EU energy crisis is still ongoing and the current way of solving the energy crisis through subsidies is clearly unsustainable. When is the European Commission going to implement a pragmatic energy policy that works for all and not a dogmatic one from civil servants to civil servants? Without a fast answer, some member states could soon be tempted to take back control of energy policy. Cyprus is already looking to establish itself as an alternative supplier of gas in the EU with recent exploratory drilling offshore.

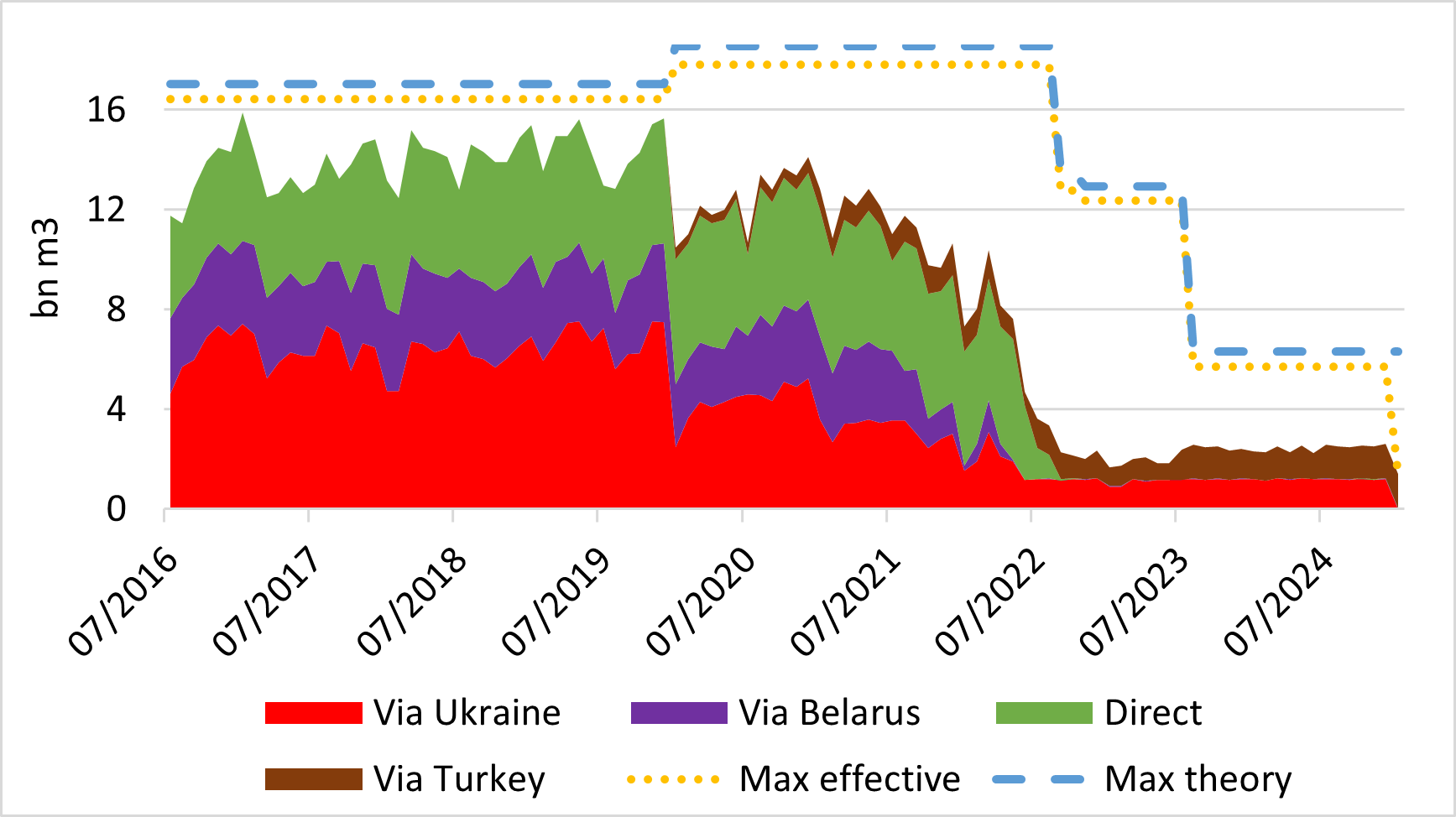

On January 1, Russian transit via Ukraine stopped, as the 2019 transit contract was not renewed or extended. But as there is no embargo or sanction on Russian pipe gas in the EU, in the next few weeks we could witness some tough negotiations between member states not willing to go through yet further deindustrialisation while the US, that is embarking on a massive deregulation pro-business cycle, would be more than happy to see European industries relocating in the US. The new EU Energy Commissioner Dan Jørgensen, whose first mission is to “bring down energy prices for households and companies,” is already starting with a failure.

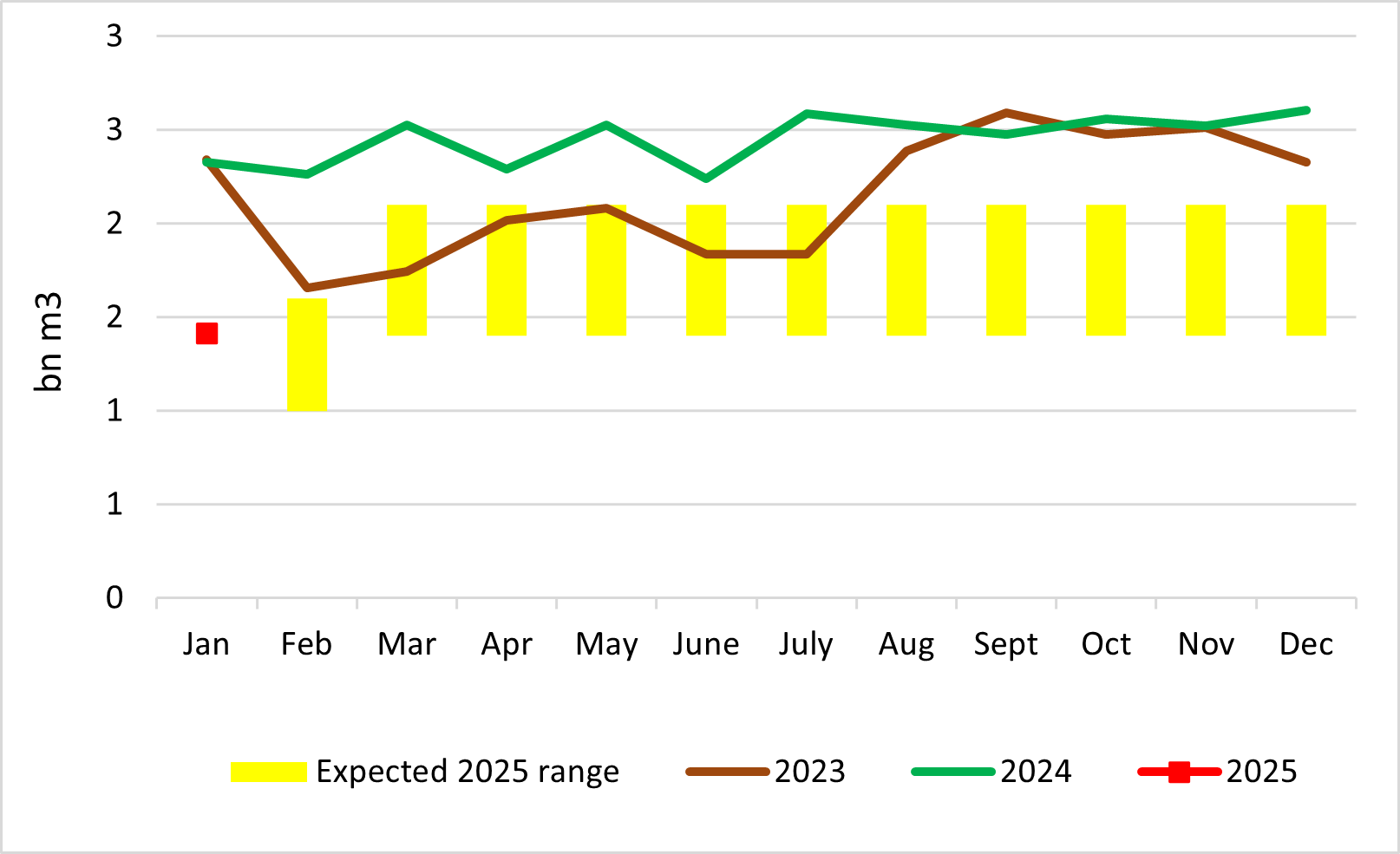

Gazprom’s monthly gas exports to Europe

Sources: Entsog, thierrybros.com

Without Ukraine, the maximum effective Russian gas pipeline export capacity moves down from the prior 5.7bn m3/month to 1.4bn m3/m from 2025. And as expected, January 2025 exports were down 39% versus January 2024.

Gazprom’s monthly gas exports to Europe via route

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

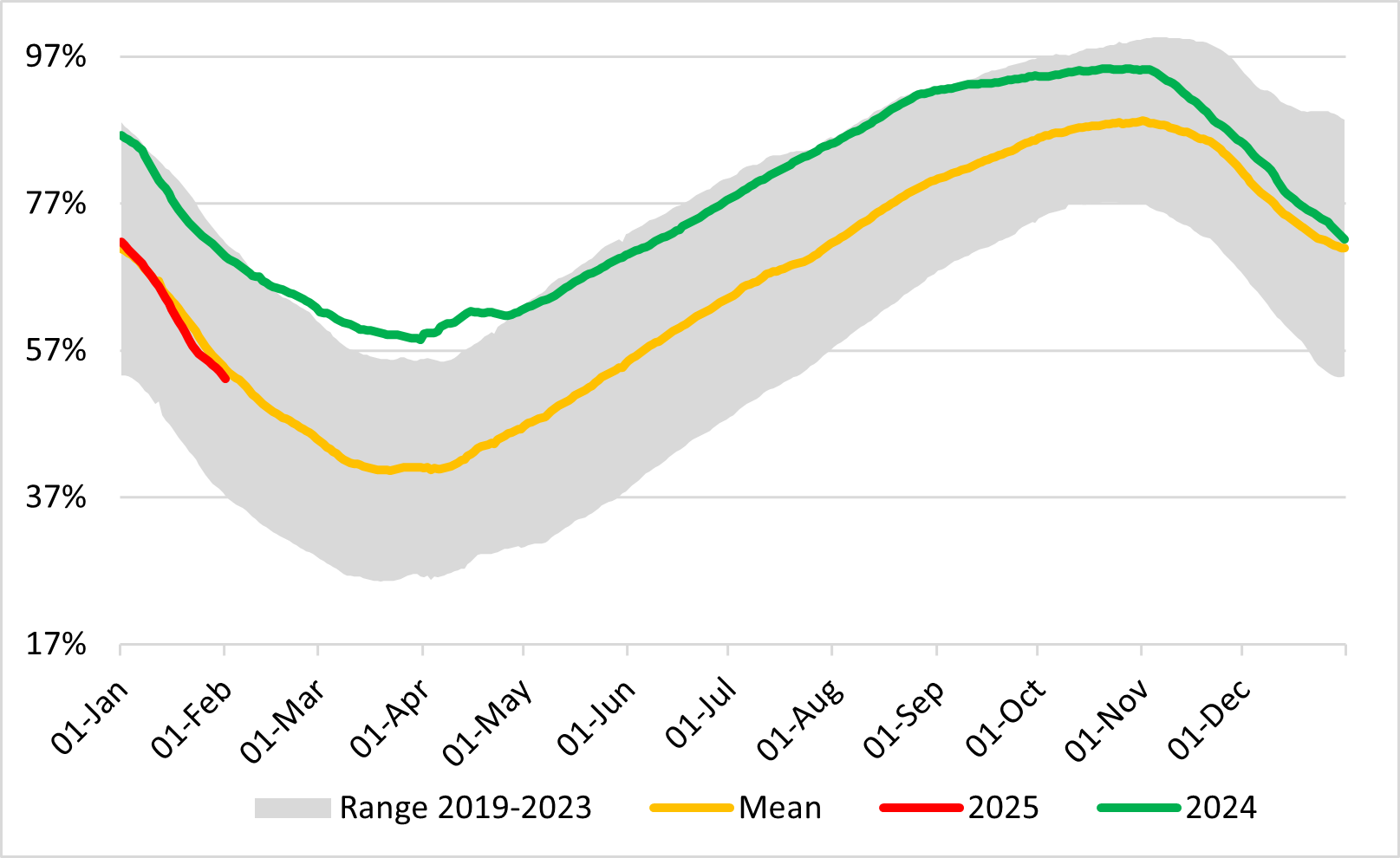

The storage level started in February 2025 at 53% full, slightly below the 2019-2023 mean value of 54%. This is going to further stress the EU supply-demand balance during the summer session as more gas will need to be injected.

EU gas storage utilisation

Source: GIE, thierrybros.com

Spot LNG provides the equilibrium between Asia and Europe. In January 2025, EU send-out was 3% lower than in the same month a year earlier. Europe is paying up to $15/mn Btu for gas but gets less LNG than last year as the global gas market is tighter than the consensus predicted, because of delays in LNG plants start-ups and continued world demand growth.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

The stopping of Russian gas in Ukraine is perhaps the end of an era but not the end of the story. Unsustainable subsidies and economic downturn could push realpolitik to replace political postures, and that flow may yet resume.

Thierry Bros

February 3, 2025