Spare Gas Production Capacity to Shrink 2021

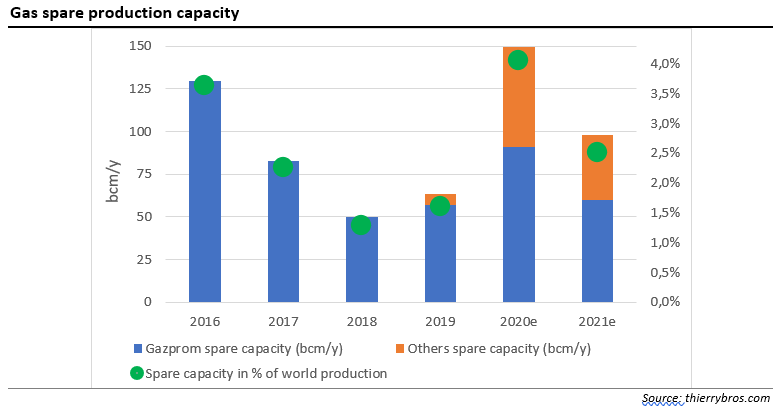

As mentioned back in March and April, in front of the pandemic, Gazprom reduced its exports to Europe but did not make room for unlimited LNG. Hence other suppliers had also to cut, either proactively or following a market signal (ie lower prices). We can estimate Gazprom 2020 spare capacity up by 34bn m³ vs 2019 owing to a drop in sales in Europe (-19 bn m³) and in Russia & FSU (-15bn m³). After having already reduced production by 6.4bn m³ in 2019 vs 2018, Norway cut again proactively this year (increasing its spare capacity to about 8bn m³). But most importantly LNG producers had, for the first time, to shut in plants:

- Some for an extended maintenance[1]

- Some in the US (accounting for c.50% of the LNG spare capacity) for around 6 months

- One (Prelude FLNG) has been offline since February.

After trending down in 2016-2018, spare production capacity[2] has grown in 2019/2020 with Gazprom not being the only producer swinging supply any longer. This growing spare capacity negatively impacted prices.

In 2020 when coronavirus caused havoc, both oil and gas producers had to stop production to rebalance markets. But the flexibility of gas producers (proactive for Russian and Norwegian pipeline and forced for LNG) helped the market to rebalance faster than the less flexible oil one. We can therefore expect 2021 spare capacity to be materially lower with higher prices already visible in all major markets. The speed of the demand recovery will ultimately set 2021 spare capacity above or below the 2.5%[3] threshold between a relaxed or a tight market…

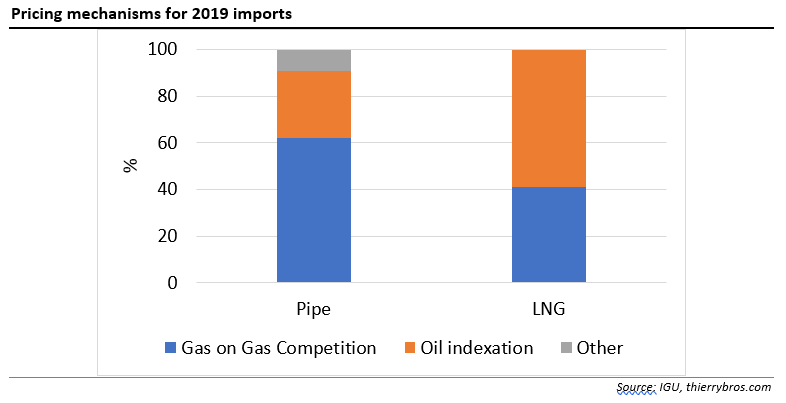

As we expect this sharing of the spare capacity between Gazprom and others to stay the new norm, LNG production will need to become much more flexible. Hence the pricing mechanism needs to adapt as oil indexation does not provide the price signal to turn on/off an LNG plant on a seasonal basis.

2021 could be an interesting year with historical long-term oil-indexed LNG prices in the money, while the share of spot LNG needs to increase! Producers selling on hub basis could have to shut in again in summer 2021 but hopefully high spot prices in Q1 & Q4 21 would make those plants profitable on a full year basis.

Thierry Bros

5 December 2020

Advisory Board Member Natural Gas World

[1] Shell the biggest listed LNG player, downgraded its LNG production each quarter by 12% yoy https://www.shell.com/investors/financial-reporting/quarterly-results/2020/q3-2020/_jcr_content/par/toptasks_1119141760_.stream/1603912380339/269db2f66fc2d5a9859e36daa847eee9212b0679/q3-2020-quarterly-press-release.pdf

[2] Landlocked fields serving only domestic customers are not taken into account in this analysis focusing on international trade

[3] Gas spare capacity numbers are similar to the oil market: https://www.eia.gov/finance/markets/crudeoil/supply-opec.php