Russian Pipeline Flows to Europe Dip in November

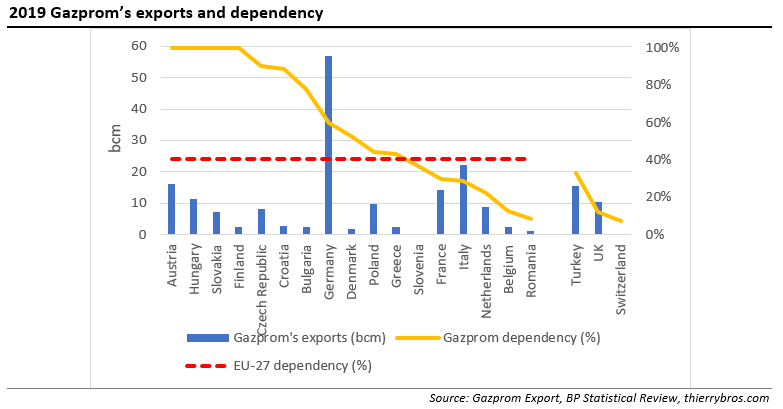

The 878-km Trans-Adriatic Pipeline (TAP) started commercial operations on November 15, by flowing gas from Azerbaijan to southern Europe. At peak capacity it could supply 10bn m³/year of gas. Could this gas from the BP-operated Shah Deniz field displace some Gazprom volumes and allow doubling the TAP capacity to 20bn m³/yr? This monthly analysis would help answering this question even if we doubt Gazprom will surrender some of its 40% market share (2019 EU-27 market share using Gazprom Export data). TAP has received several European Union grants under the 'projects of common interest' heading.

As expected, Gazprom has reached its first deal to sell gas to Turkey via its electronic sales platform, with the 700,000 m³ of gas due to be delivered to Malkoclar on the country's border with Bulgaria in December. As in Europe, this added flexibility tool will help Gazprom regain some market share in Turkey (33% in 2019 vs 40% for EU-27).

The Nord Stream 2 saga continues with industrial certification company DNV GL stopping work on 26 November while the laying of the pipe could be resumed in shallow German waters…

A broad government reshuffle happened in November in Moscow. The energy minister, since May 2012, Alexander Novak was promoted deputy prime minister and was replaced by Nikolay Shulginov, the chairman of state-run hydropower group RusHydro since 2015. This recent appointment is very significant as the major oil and gas exporting country will now be represented by a minister that only worked in electricity dispatch and renewable production.

It could be the first strategic move from Russia to adapt to the EU Green Deal. Russia could position itself in the EU like Norway: using renewable at home and exporting oil and gas today with a will to export hydrogen tomorrow…

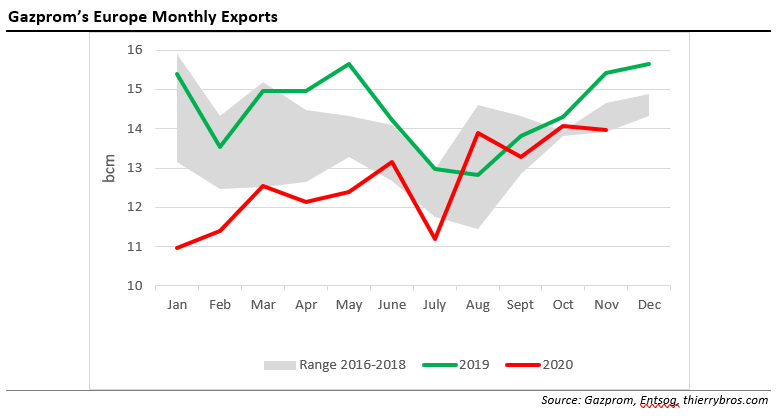

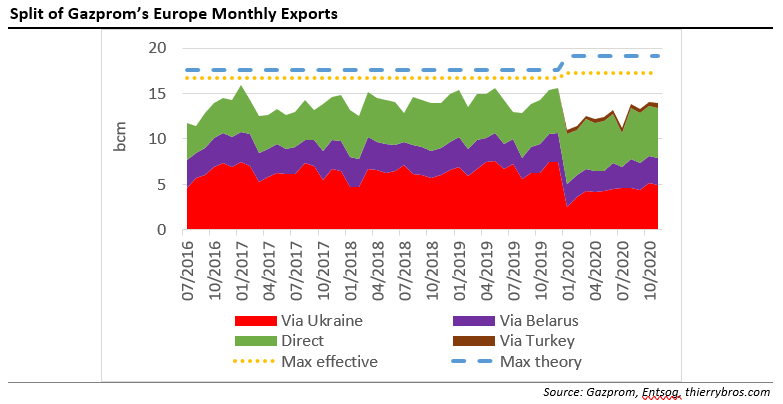

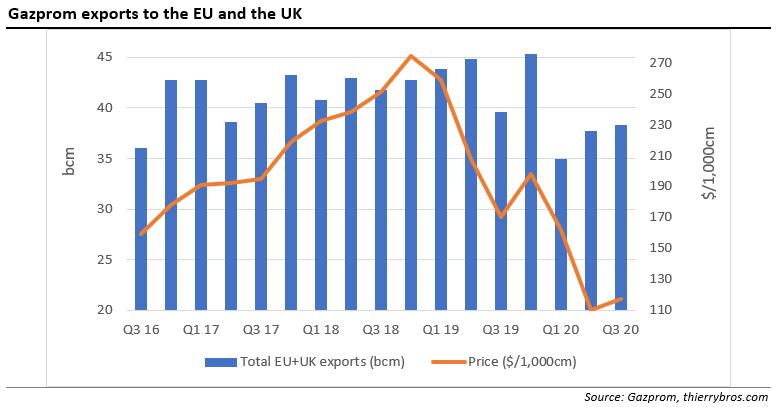

Gazprom used all routes less in November except Turk Stream. The drop was, in total, a massive 9.4% vs last year as then Gazprom had to push as much gas as possible before December 29 and the end of the Ukraine transit deal. Until this date, as the 2020 transit via Ukraine was unknown, the only mitigation strategy was to fill EU storage by maximising all import routes. We are also seeing an unseasonal drop (-0.7%) vs October. This can be explained by the Coronavirus lockdowns that are affecting demand in many European countries even with the weather getting colder.

Belarus is in the news as democratic peaceful protests are requesting a regime change. It is also an important energy country as about a fifth (35bn m³/yr) of Russian pipeline gas for the EU and UK crosses the country. There will always be at least 2.1bn m³/month transiting through the network that has been wholly owned by Gazprom since 2011. The contracts between Gazprom and Gazprom Transgaz Belarus for gas supplies to and gas transportation across Belarus are valid until the end of 2020 (https://www.gazprom.com/press/news/2020/september/article512781/). In the coming months, Belarus could also become an energy country to watch…

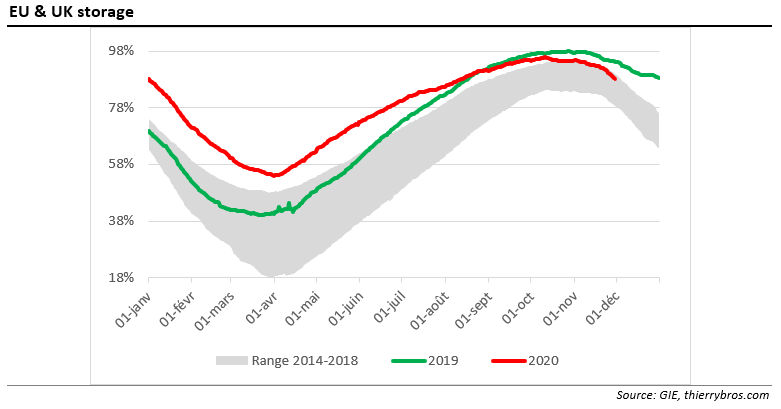

Storage reached its peak on 12 October with 95.7% full, slightly lower than the record high reached last year (97.8% on 28 October). Storage level is, since mid-October, back in the historical 2014-2018 range (at the top).

The Coronavirus-impacted-demand will continue to restrain EU demand and hence imports needs. But as we have been writing since early this year, Gazprom is not the only producer to swing supply any longer. For the first time ever, Gazprom could only hold half of the global spare capacity. All producers are sharing the burden of reducing volumes to the EU. As we explained back in August, Gazprom’s flexible strategy, to reduce severely volumes in Jan-July 2020 (-17.9bn m³ or -17.6%) vs last year and then to increase exports is turning out to be less costly than slower-moving LNG suppliers that are turning down volumes only when price start to recover.

Gazprom did stress this flexibility advantage of its delivery to Europe vs LNG producers during its negative Q3 2020 results on 30 November with since Q2 a rebound in both prices and volumes.

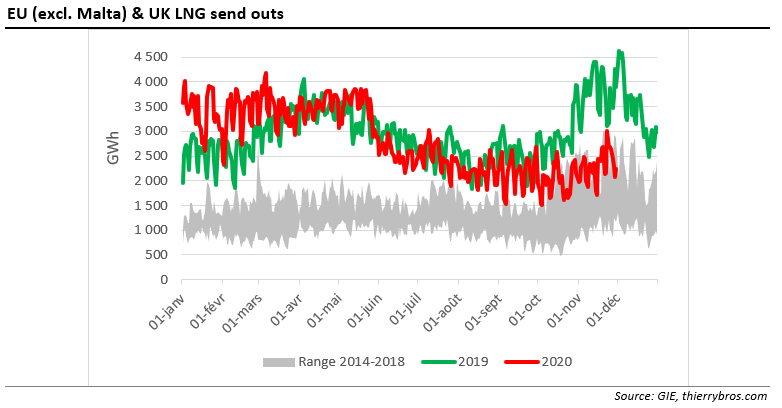

In November, LNG send outs were in Europe down by 40% vs last year and back inside the historical 2014-2018 range. Comparing Gazprom pipe exports to Europe and LNG regas graphs show clearly that if LNG has an optionality value (it can move to where it provides the highest profit) it lacks flexibility (ability to be turned on and off at short notice). In an energy transition, where Europe and Asia are long energy in summer (high solar, low demand) and very short in winter (low solar, high demand & possibly blackouts), LNG production will need to become flexible...

Thierry Bros

December 3, 2020

Advisory Board Member, Natural Gas World