Potential Effects of Australia LNG Supply Disruption [GGP]

LNG plant workers in Australia have taken a vote on whether they may to strike at several key LNG facilities, and with Australia being one of the largest LNG exporters in the world, this could have big consequences for the global LNG market. The LNG plants that these workers may strike at, Northwest Shelf, Gorgon, and Wheatstone, account for 10% of the global supply.1

Woodside Energy and Chevron are in discussions with various trade unions in Australia to avoid a strike, but so far, the two sides have not reached an agreement.2

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

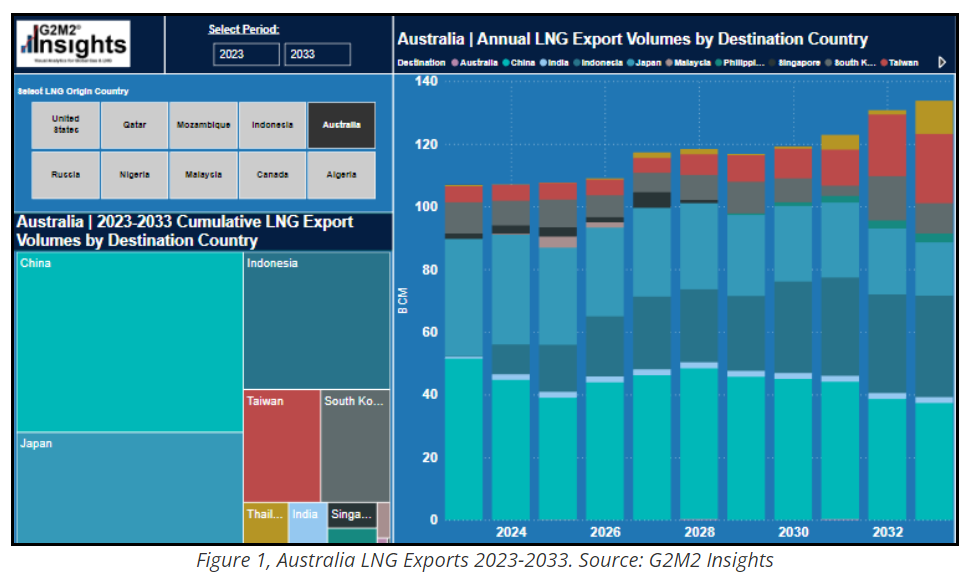

As the world awaits the results of these negotiations, players want to know, “Who relies on Australian LNG?” and, “What would the effects of a supply disruption likely be?” We know that Australia primarily exports to countries in East and Southeast Asia, as shown in figure 1, however these are not the only markets that would be affected by a potential worker’s strike or similar disruption.

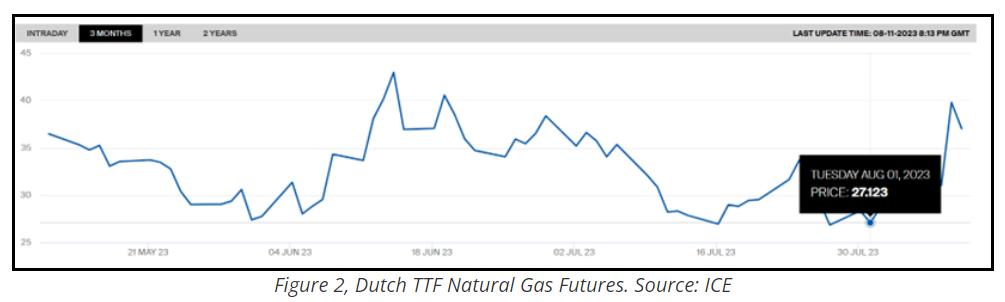

Natural gas prices in Europe 3 and in Asia 4 have already seen price increases in possible anticipation with Dutch TTF prices up by around 40% and 10-15% in Asia.

The effects of these price increases won’t be felt immediately as there is ample gas in storage within Asia thanks to prudent efforts stemming from the energy crisis of the previous year. 5 And Europe’s gas storage levels are over 90% capacity across the EU, which is equivalent to 93 bcm. 6

However, if the dispute (or a similar disruption) were to carry on into the winter months as demand begins to peak, what would likely happen? Things could get dicey. If the strike were to go through, then 10% of the global supply would be affected. This would send those who relied on that supply to the spot market. The price increases we are seeing today are in response to the potential for a strike. If these plants were actually shut down, then prices may climb even higher.

However, if the dispute (or a similar disruption) were to carry on into the winter months as demand begins to peak, what would likely happen? Things could get dicey. If the strike were to go through, then 10% of the global supply would be affected. This would send those who relied on that supply to the spot market. The price increases we are seeing today are in response to the potential for a strike. If these plants were actually shut down, then prices may climb even higher.

The strike scenario could be compared to the shutdown of Freeport LNG after a fire in June 2022. Freeport has a capacity of 15 mtpa and the loss caused prices at TTF to increase by almost 9%. 7 However, Freeport is a much smaller scale than this would be—the potential lost capacity in Australia being slightly more than 2.5 times that of Freeport. 8

South Korea’s Midland Power Co (KOMIPO) has already issued a tender for the delivery of an LNG cargo of 1.6 trillion BTU 9 in October. Toby Copson, the global head of trading at LNG Trident, stated that, “This in itself could prompt other players to start bidding earlier than expected to get ahead of pricing moves to the upside.”

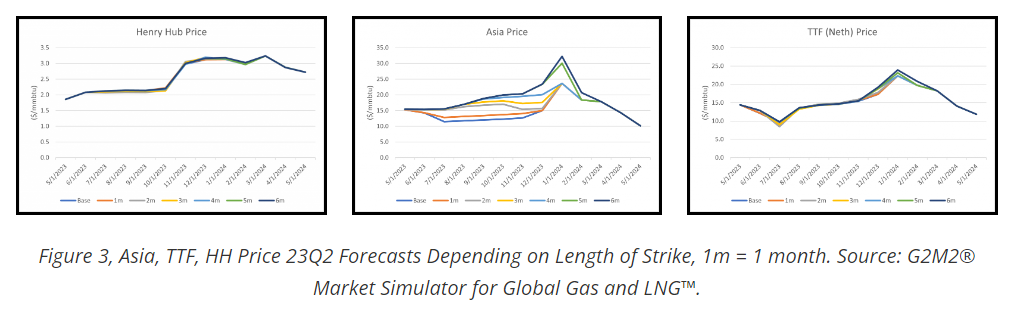

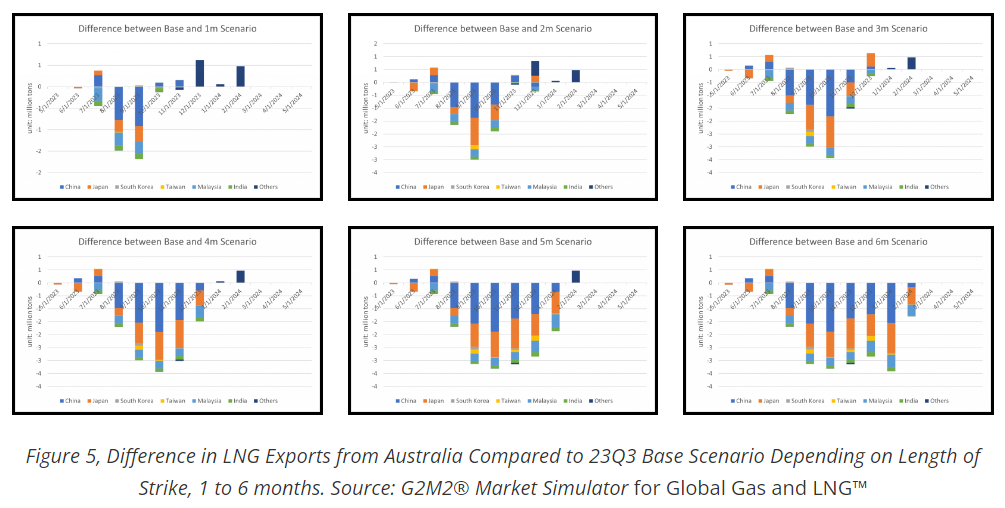

What would be the effects of the strike if it was a full work stoppage that lasted for anywhere between a few months to all the long into the winter? We used the G2M2® Market Simulator for Global Gas and LNG™ to estimate the potential effects of the strike and where the countries who relied on Australian LNG would then potentially seek alternative supply.

.png)

How Gas Prices are Affected

Prices at TTF and HH will likely not be fazed by such a strike, but the markets in Asia are a different story. If everything was business as usual with no threat of impending strike, the price in Asia would hover between $11.70 and $15.00/mmbtu until January 2024 in which it would peak at $23.60/mmbtu (figure 3).

If production was stopped for 1 month due to a strike, the prices would remain relatively the same, only seeing a slight increase between September and November.

If the strikes lasted 2 to 4 months, then prices within that same time frame would be about $5 to 7 /mmbtu higher than if everything was normal.

However, if the strikes were to last 5 or 6 months then there would be a dramatic increase in prices after November. At this point, the prices would rise to between $20.4 /mmbtu and $32.2 /mmbtu.

How LNG Exports are Affected

The primary importers of Australian LNG are currently China and Japan, and they would be the ones most affected by a supply disruption. The graph in figure 4 shows what the expected LNG exports from Australia would be if there were no interruptions.

The graphs in figure 5 show how Australian LNG exports to China, Japan, South Korea and Taiwan would be affected if the strike lasted between 1 to 6 months. China would suffer losses of 1 to 2 million tons of LNG imports per month while Japan would lose 1 million tons worth of imports per month, the overall amount lost being dependent on how long a potential strike would last.

How does China react?

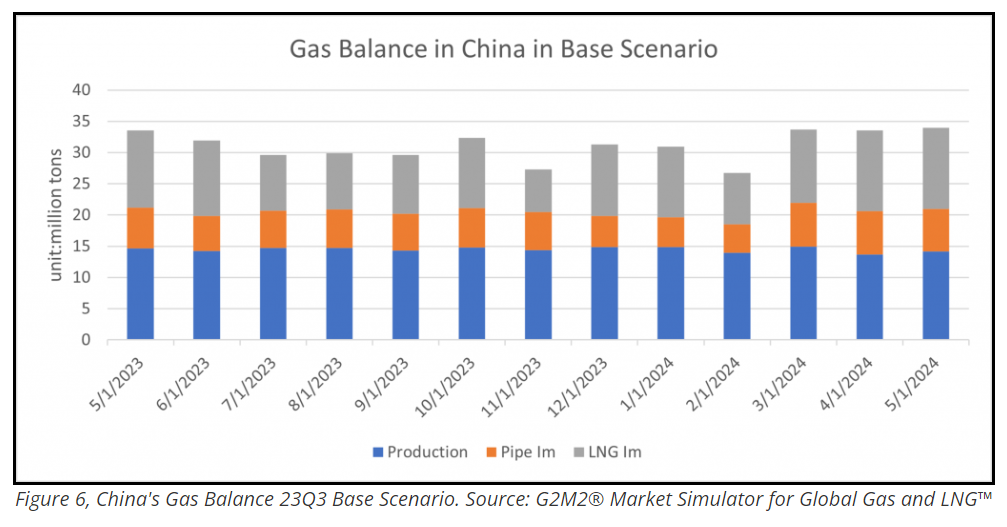

China relies on a mix of domestic gas production, pipeline imports, and LNG imports to make up their gas supply (figure 6).

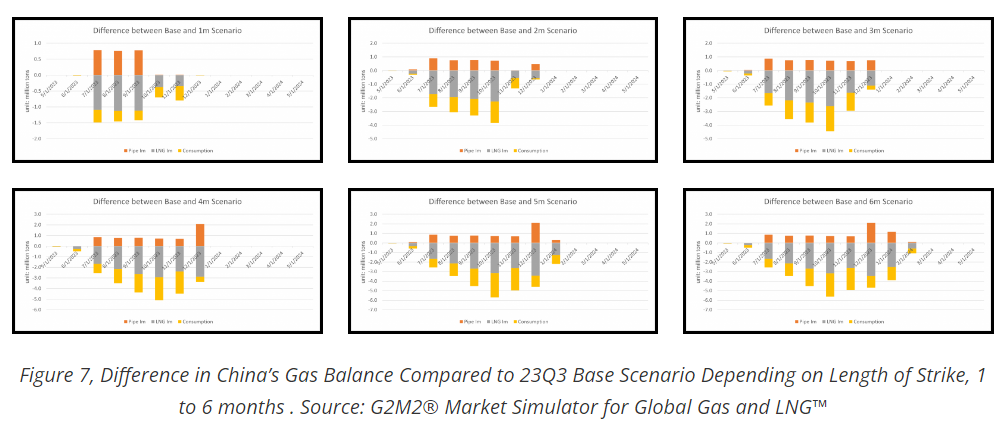

Figure 7 below shows how China would respond in the event Australian LNG is no longer available. A disruption in LNG imports, between 0.3 bcm and 3.5 bcm, from Australia to China would result in China’s domestic consumption to drop and for their pipeline imports from neighboring countries to increase. Domestic consumption would decrease between 0.2 bcm and 2.4 bcm and pipeline imports would increase between 08 bcm and 2.4 bcm, this of course dependent on the length of the disruption.

While it is don’t anticipate this current potential disruption (strike) to last long enough to have a significant effect on prices or LNG flows to importers, it is important to know what the possibilities could be on the outside chance that it could.

With G2M2® Market Simulator for Global Gas and LNG™ it is possible to not only run scenarios such as this one to determine the effects of a supply disruption on prices and LNG exports, but it can also be used to determine the impact of severe weather events, new LNG import/export terminals, new pipelines or expansions on existing ones, and many more types of scenarios.

Originally published at RBAC, Inc.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets. For more information visit RBAC’s website at http://www.rbac.com.

© 2023 RBAC, Inc. All rights reserved. GPCM, GPCM Market Simulator for North American Gas and LNG, G2M2 and G2M2 Market Simulator for Global Gas and LNG are trademarks of RT7K, LLC and are used with its permission.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

[1] Workers Cleared To Vote On Strike At Australia LNG Plants | OilPrice.com

[2] LNG Strikes Could Begin Early September Amid Australia Disputes (energyconnects.com)

[3] European gas prices expected to rise amid Australia LNG supply fears (cnbc.com)

[4] GLOBAL LNG-Asian spot prices inch up as market eyes Australian strikes | Reuters

[5] Wary of 2022 crisis, Asian buyers to build strategic gas reserves | Reuters

[6] LNG supplies: Why Europe is spooked by Australian strike – DW – 08/19/2023

[7] Freeport LNG blast sends natural gas prices in two directions (houstonchronicle.com)

[8] Why We Should Be Worried About Gas Prices Again (yahoo.com)

[9] Explainer: How would a strike at Australian LNG facilities affect gas markets? | Reuters