Nord Stream 2 Provides Cost-Effective Contribution to EU Climate Protection Target

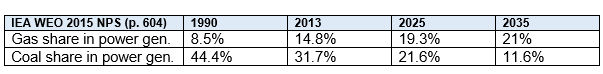

In the EU, gas is expanding its share in the power generation mix, projected to overtake coal in about 10 years.

Current CO2 emissions in the EU stand at around 4611 Mio t. of CO2-equivalents (for 20131) – which is about 19.8% below 1990 levels, likely to reach the 2020 target of a 20% reduction over 1990. However, as for the 2030 targets of 40% reduction, the European Commission contends2 that Europe is not yet on track. According to a PWC study, the EU will need to decarbonise at 3.1% per year (measured in tCO2/GDP) to reach its 40% reduction target by 2030. This is faster than the UK’s ‘dash for gas’ in the 1990s or Germany’s restructuring after reunification. Despite the EU’s existing policies to tackle climate change, it will still need to “find another gear.”

Without more gas for fuel switching, the emissions reduction targets will not be met

|

|---|

Coal use in the EU28 power sector accounted for 927 Million t. of CO2 in 2013, generating a total of 905 TWh of electricity. Producing the same amount of power with gas, the EU could save 500 Mio. tonnes of CO2, already a long way towards the reduction goal. Switching just one percent of the overall EU’s electricity generation from coal to gas cuts CO2 emissions by about 5 million tonnes. The UK for example, increased power consumption between 1990 and 2013 by 11%. Still, emissions from power generation decreased by 29% over the same period, which the UK department of Energy and Climate Change attributes to the fuel switch from coal to gas6.

However, in Germany gas is under pressure from cheap coal – despite an ever growing share of renewables, emissions have even gone up recently from increased coal burning, from 315 Mio. t. of energy related CO2-emissions in 2010 (when gas covered 14% of power generation, coal 43%) to 327 Mio. t. in 2013, reflecting that the share of gas in power generation dropped to 10.5% while coal grew to 45.5%. Germany needs to reach a reduction down to 750 Million tonnes of CO2-emissions by 2020 (from currently 912 Mio. t.) to stay on track with its own emission reduction targets (40% under 1990 by 2020). Currently, this goal is not in sight. Latest expert estimates put the German government’s plan to retire coal plants in reserve at saving only 8 Mio. t.

Using 55 billion cubic metres of gas (nameplate capacity of Nord Stream 2) to replace coal in power generation would by itself save about 160 Mio. t., or 14% of the CO2 from power generation overall.

Energy experts confirm growth in gas demand

Fuel switching from coal to gas, even within the existing power generation capacities in the EU, can move gas demand by as much as 30 bcm in one year.

As such, renowned research institutions like the IEA and IHS CERA predict a growth in gas demand. The IEA sees gas demand, even under new policies, as largely stable (+2 bcm over current levels, EU28 New Policies Scenario for 203512) – if only current policies are accounted for, demand will grow by 98bcm (EU28 Current Policies Scenario for 204013). IHS Energy sees gas demand in the EU moderately grow to about 500 billion cubic metres, driven by the power sector recovery, which will see rising demand.

If this demand for more gas is not met or gas supplies become less competitive, coal will once again replace gas (as it happened in Germany, see above). In a well supplied market, gas can compete with coal, despite the currently record low carbon price. However, this market liquidity requires new gas deliveries in a cost-competitive and secure way, since domestic production is projected to rapidly decrease.

Pipeline gas is preferred supply over LNG

Nord Stream 2 will offer a secure, reliable connection to the world’s biggest gas reserves in Siberia, where investments from Russian and international energy companies over the last decades have ensured that the gas fields are amongst the most cost-effective sources from which to supply Europe. At the same time, Russian gas supplies are available and deliverable at short notice, making Russian piped gas the best option for Europe’s gas supply - economically and ecologically.

LNG, as often suggested, will certainly play a role in supplying the EU, yet its role in realizing a secure, affordable and sustainable gas supply are limited. Higher emissions: Liquefaction and shipping of LNG causes about a third more emissions than piped gas. By comparison, the Nord Stream 2 pipeline will need only one compressor station to propel the gas across the Baltic Sea.

Lack in capacity: 55bcm of gas would require around 600-700 LNG tanker shipments in the Baltic Sea. Currently, in the whole world only 30 tankers are available for spot trading, meaning that the rest of vessels is tied up in long-term shipping contracts, mostly in Asia. LNG follows the markets: Due to the prevailing market dynamics, LNG Imports in the EU dropped from around 80 bcm in 2011 to about 44 bcm in 2013, as suppliers directed their shipments to Asia because of the higher market prices in that region. Despite sufficient upstream facilities and many LNG regasification sites in Europe, which on average are only used at 25%, LNG cannot competitively replace piped gas in the European markets.

Nord Stream 2 also compares favourably to onshore pipelines, which require significant land usage, longer construction times and burn more gas for interim compression. Over the pipeline’s lifetime of at least 50 years, the Nord Stream 2 pipeline system will save 200 Mio.t. of CO217 due to the higher average pressure and the lower number of compressor stations required to transit gas, compared to onshore transport.

Extensive Environmental and Social Monitoring Programmes have demonstrated that construction of the existing Nord Stream lines did not cause any significant environmental impact in the Baltic Sea, confirming the positive trend in environmental recovery after construction. So far, all monitoring results have confirmed that construction-related impacts were minor, locally limited and predominantly shortterm.

Nord Stream 2 will add a new and highly reliable supply route from Russia to the EU internal market, ensuring that gas remains affordable. By making more gas available to replace coal in power generation Nord Stream 2 will provide a cost-effective contribution to emissions reduction.

Romans Baumanis, Regional Advisor for the Baltic States, Nord Stream.

This article originally appeared in the Baltic Course.