EU, Iran Seek Sanctions Loophole

Donald Trump kept another of his election promises in May, pulling the US out of the six-way alliance that signed the deal lifting trade sanctions on Iran just over a year ago. Now the investors must see what can be salvaged, and what must be written off.

Despite the US withdrawal from the nuclear deal with Iran – the so-called Joint Comprehensive Plan of Action (JCPOA) – that was struck in 2015 and its threats to impose the harshest sanctions ever on Iran and any companies that support it, Iran is for now committed to the deal, hoping to keep the benefits that trade with the other five signatories – France, UK, Germany, Russia and China – will bring.

But the shadow of US sanctions makes this difficult. Iran’s foreign minister Mohammad Javad Zarif started a tour of participant countries May 13 to get “actual and real guarantees” from them even though Germany and UK have already said that saving companies from the effect of US sanctions is a very complicated issue and that they would struggle to provide the guarantees Tehran seeks. US sanctions are serious, especially for EU. However, tens of billions in deals and trade between Europe and Iran is not to be lightly dismissed.

A glance at Iran, EU trade and deals

EU exported nearly $13bn in goods to Iran last year, of which 94% was industrial products, which is vital for Iran because of the quality of European-made products, comparing to Asia or Russia. On the other hand, EU imported $12.1bn in goods from Iran, of which about 83% was crude oil and gas condensate, the EU’s official statistics show. Iran’s exports to the EU rose 31.5% on year and its imports from the EU grew 83.9%.

There are no new official statistics about service exports, but EU exported about $1.5bn of services to Iran in 2016 and NGW learnt from Iran’s Chamber of Commerce that the value for last Iranian fiscal year, ended to March 20, was around $7bn.

The EU has also not reported investments statistics for last year, but in 2016, its direct investment into Iran was $4.97bn and it attracted $2.59bn from Iran that year.

Iran’s overall share in the EU’s total trade turnover is about 0.6%; but considering the low GDP growth of the EU, its reliance on oil imports and the multi-billion-dollar deals between Iran and European companies, the EU needs to salvage the JCPOA.

Major deals

Beside French Airbus’s $17bn and Franco-Italian ATR’s up to half of a billion dollar aircraft purchase deal, there are other major contracts between Iran and European companies at risk, in the transport, automobile, petrochemical and energy sectors.

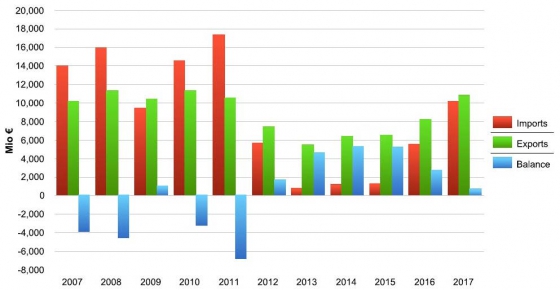

Total goods: EU trade flows and balances, annual data 2007-2017

Credit: Eurostat Comext

Immediately after the implementation of the JCPOA in January 2016, Iran’s president Hassan Rouhani went on a tour of Italy and France, where Iranian companies signed contracts worth $51bn and memoranda of understandings (MoUs), of which $33bn was signed with French companies, especially in auto, transportation and aviation sectors.

After that tens of billions in deals have been signed between European companies and Iran.

Nathalie Goulet, the vice-chair of the French senate’s foreign affairs committee, told NGW that the European companies will hesitate to work in and with Iran in case they are barred from the US market.

Mehrdad Emadi, an Iranian economist and head of energy risk analysis at the Betamatrix consultancy in London, told NGW that excepting the Airbus option, of which about a tenth of its components are made in the US, the remaining contracts with Iran are salvageable only if EU members guarantee them directly, though it is a very hard and complicated issue.

Hamburg-based Iranian-European Bank, which is wholly owned by Tehran, can partly cover financial transactions through euro or other non-dollar currencies, he said. German and Austrian banks have also contracts to finance deals and trade with Iran.

Fereydoun Barkeshli, a member of a team that has designed Iran’s new oil and gas contract model, called Iran Petroleum Contact (IPC) also told NGW that keeping some service and cargo deals between Iran and EU in sanctions regime was also possible.

Barkeshli who is the president of Vienna Energy Research Group in Austria and has served as National Iranian Oil Company's (NIOC) general manager for Opec and international affairs, agrees with Emadi that implementing sanctions on engineering and service companies is very complicated.

Major energy-related deals

1. French Total-led consortium’s $4.8bn contract (excluding taxes) to develop Iran’s South Pars gas field phase 11 is the biggest energy-related contract. The consortium has spent $90mn as of now to prepare grounds for development of project. Total announced that it cannot continue to work on the project without a US waiver. According to the contract, it can deliver its 50.1% share to one of the partners: CNPC, which now holds 30% stake or Iran’s PetroPars company. Recently, Reuters cited several industrial sources saying that CNPC is willing to take Total’s shares. Total can regain its €40mn invested funds once the project starts up, but it will not make any profit from it.

2. The other major project is a 600 km corrosion-resistant alloy (CRA) pipeline purchase, worth $615mn, between Iran and Spanish Tubacex. Iran says 50 km of that has been already delivered to Iran for use in the South Pars sour gas field. According to the agreement, the Spanish company has to deliver the technology needed to produce CRA pipelines in two years, but this technology is very sensitive as it can also be used to make uranium enrichment machines, called centrifuges. Iran’s oil minister has said that during the sanctions era, purchasing even a metre of CRA pipeline was very hard. Tubacex told NGW that after the Trump announced his decision to leave the nuclear deal, it would be premature to give an opinion, especially considering the international reactions.

3. German engineers Siemens has contracts in place worth $1.6bn to deliver F-class turbines, used in power plants as well as supplying locomotives for railroad projects. The company told NGW that it has already delivered three turbines to Iran, adding that “we are currently assessing the impact of the decision taken by the US administration. Needless to say, we have always been compliant with the sanctions and will always be in the future.” A source at its Iranian partner Mapna told NGW that based on their agreement, after delivering the sixth turbine, the next six should have been partly made inside Iran jointly by Mapna and Siemens; and thereafter all should be made in Iran. “This option at the contract was the major interest of our company,” Mapna said.

4. The other major contract belongs to Norwegian Saga company to build 2-GW solar power plants worth $2.9bn, but no progress has yet been made since the October signing. Other companies in the renewables sector, such as UK Quercus, Germany’s Solarwatt, Italy’s Finergy and Norway’s Scatec were in talks to build 3-GW renewables capacity in Iran and some MoUs were signed last year.

5. German BASF also has various deals with Iran worth between $4-6.8bn in all, mostly in petrochemicals. The company told NGW that it will review the new situation. “BASF will comply with all applicable international laws and regulations. BASF's business in Iran has developed positively since sanctions were lifted in 2016. Sales last year were in the high double digit million euro range. In Iran, BASF only produces or sells those products that are not subject to trade restrictions,” it said.

What was wrong with JCPOA?

The international Atomic Energy Agency (IAEA) has confirmed constantly during the last three years that Iran was fully committed to the deal and fulfilling its obligations.

Senator Goulet told NGW that re-imposing sanctions on Iran was “highly political” and warned that it will help the most conservative part of Iranian politicians and weaken the moderate Rouhani administration. All of the countries involved in the nuclear deal with Iran have criticised Trump for pulling out of JCPOA.

However, the former deputy director general of IAEA Olli Heinonen, during the sanctions era, told NGW that the question is whether the IAEA is certifying that Iran is in full compliance with its obligations under the nuclear deal.

“To this end we have seen a bit of a cryptic statement from the IAEA saying in its latest February 22 report that since the implementation day, the agency has been verifying and monitoring the implementation by Iran of its nuclear related commitments under the JCPOA, without saying explicitly whether Iran is, according to the agency assessment, in full compliance with its undertakings.”

He added that such a clear statement is essential, since the Iranian authorities have repeatedly said that the IAEA would not be allowed to access military sites, which contradicts the provisions of the safeguards agreement concluded between the IAEA and Iran. “What is worth noting, is that before the JCPOA the IAEA had more clear language in its reports when it came to express conclusions.”

Heinonen added that it has not been able make Iran to give fully up its nuclear weapons aspirations. “As evidence to that is the maintenance of the extensive set of nuclear weapons archives together with developing uranium enrichment when there is no market or true domestic need for that. There is global overproduction of uranium enrichment services. We need also to remember that there has not been anywhere a reactor, which was not able to operate due to lack of fuel. The deal, which blesses technically and economically unjustified uranium enrichment, is not the way to proceed in the Middle East. The deal, which allowed Iran to maintain nuclear weapons related documentation needs fixing”.

He added that Iran faces now important decisions. Any activities that contradict the restrictions set in the JCPOA, will reduce the support of the EU.

“In my view, the maintenance of the extensive documentation on nuclear weapon design, and not addressing properly the questions raised by the IAEA, increases the concerns about Iran’s compliance not only with the JCPOA, but also with the Nuclear Non-Proliferation Treaty. The best way for Iran is now to address those questions properly, destroy the documents and equipment associated with them, and finally close this part of Iran’s nuclear history in an irreversible and verifiable manner.”

It appears that the EU-3 (France, Germany, UK) and the US are still looking at whether the JCPOA can be fixed by an amendment. That process will probably take a couple of months, which would mean that Iran will be hesitant to boost any of its enrichment capabilities during that period.

Dalga Khatinoglu