Low-carbon investments to rise by $60bn in 2023: Rystad

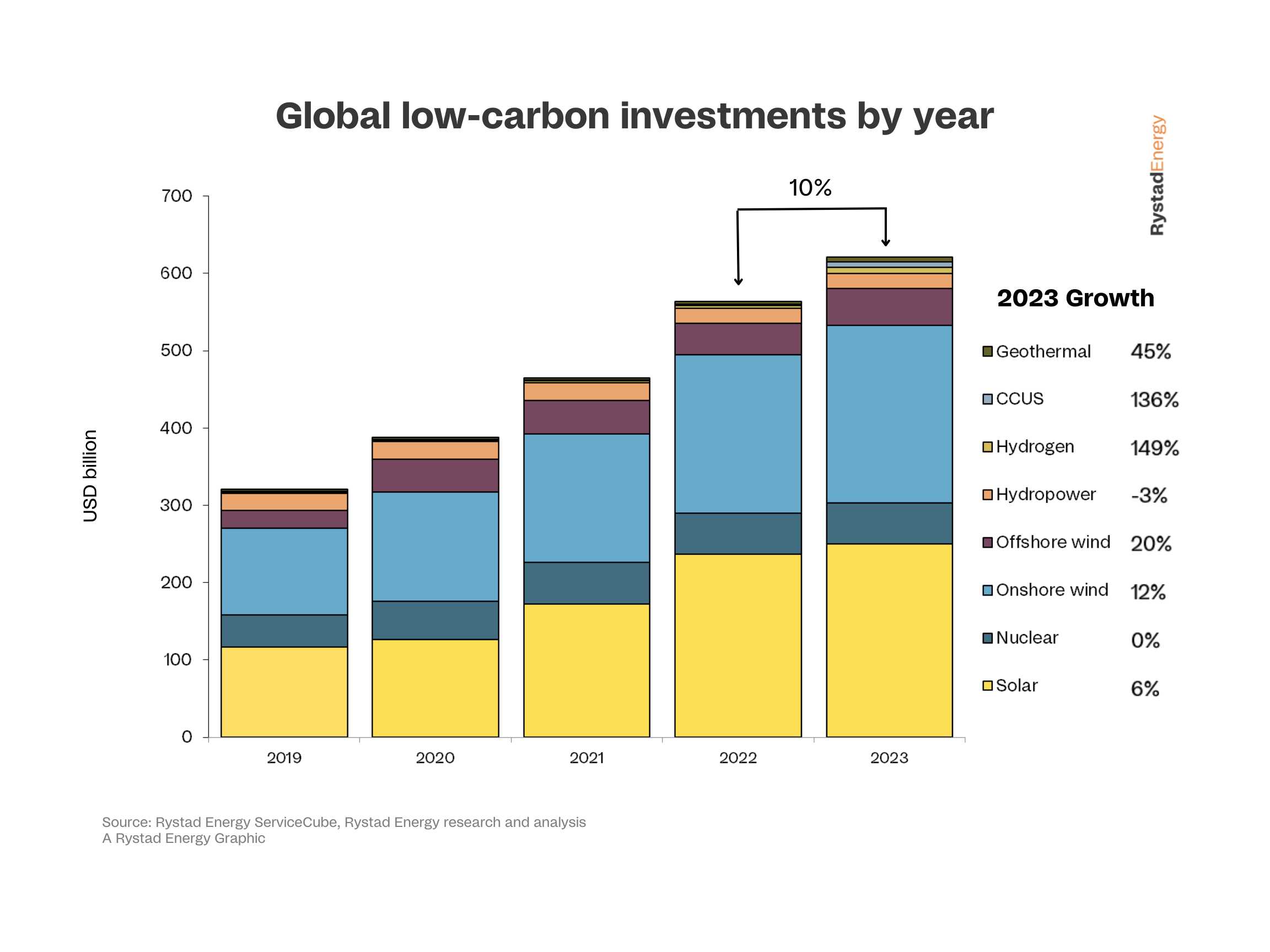

Spending on low-carbon projects will increase by $60bn this year, 10% higher than 2022, led by wind developments but helped by a significant rise in funding for hydrogen and carbon capture, utilisation and storage (CCUS) infrastructure, Rystad Energy said on January 13 in a report.

The growth in total spending is a slowdown from recent years – which averaged 20% annual increases – as cost-conscious developers tighten their purse strings after two years of soaring prices.

According to Rystad, investments in green sectors surged 21% in 2022 to overtake related oil and gas spending for the first time, but inflation-spooked developers seem set to rein in spending growth this year. However, as inflationary pressure weakens, Rystad expects spending to rebound.

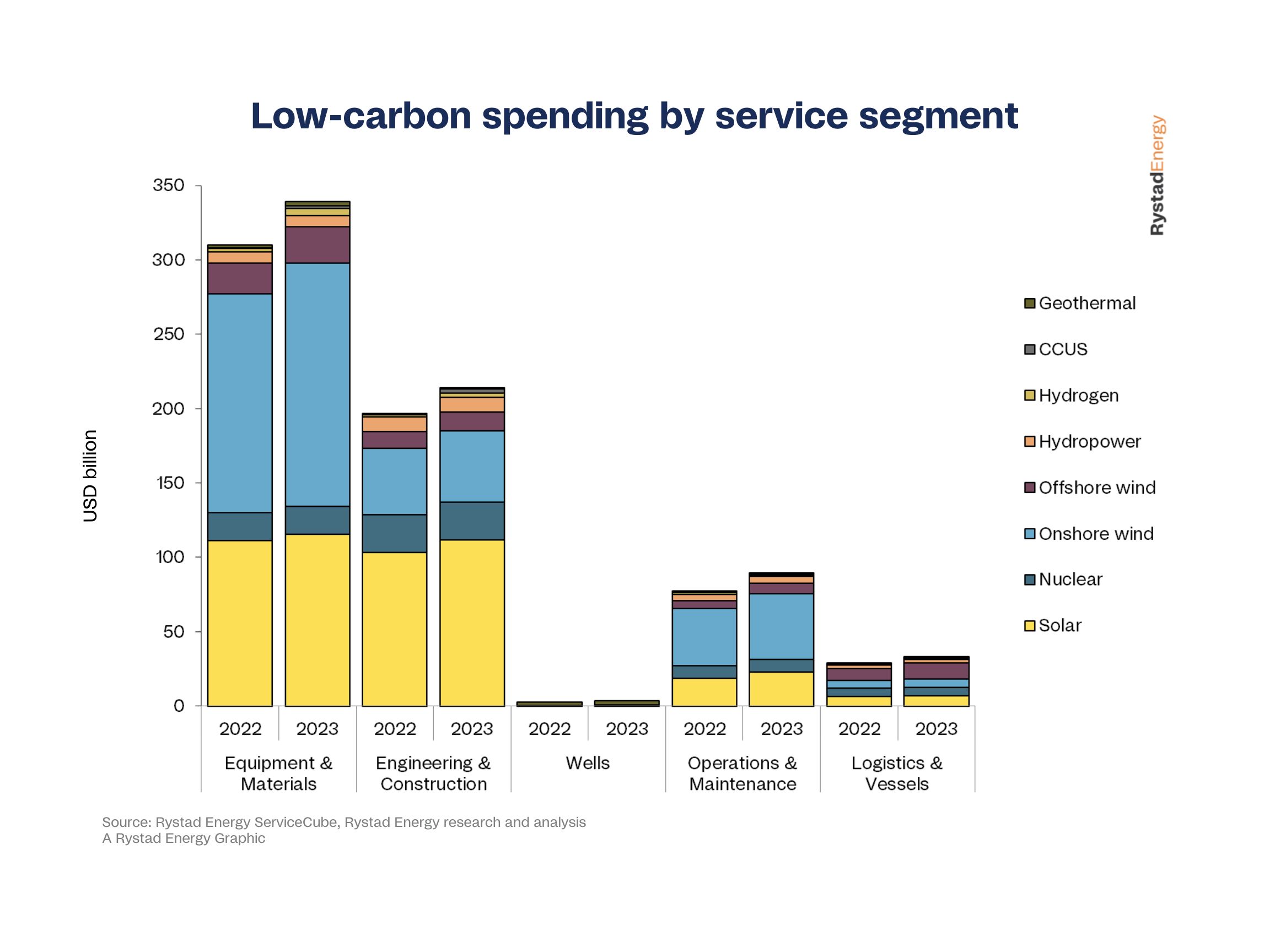

Investments in the geothermal, CCUS, hydrogen, hydropower, offshore and onshore wind, nuclear and solar industries are set to hit $620bn in 2023, up from about $560bn last year. Service segments included in Rystad's calculations include project equipment and materials, engineering and construction, wells, operations and maintenance, and logistics and vessels.

Solar and onshore wind will contribute the most by a sizable margin. Spending on solar investments will total $250bn this year, rising only 6% over 2022. However, thanks to the falling cost of polysilicon, the primary cost driver of solar PV cells, capacity growth will be more substantial than dollar investments suggest. Despite a relatively insignificant rise in investment value, installed capacity is expected to swell by roughly 25% to 1,250 GW.

Rystad believes spending growth will vary widely across industries. Hydrogen and CCUS are expected to see the most significant annual increase, growing 149% and 136%, respectively. Total hydrogen spending will approach $7.8bn in 2023, while CCUS investments will total about $7.4bn.

In contrast, the hydropower market is expected to shrink over 2022, while nuclear investments are forecast to stay relatively flat. Onshore wind investments are projected to increase by 12% to about $230bn, while offshore wind spending is expected to jump 20% to $48bn. Expenditure in geothermal is expected to jump significantly – about 45% – albeit from a relatively low starting position.

“The weaker-than-expected growth is not a reason to panic for those in the low-carbon sector. Rampant inflation typically triggers fiscal restraint across industries, and spending will likely bounce back in the coming years. The outlook for hydrogen and CCUS is especially rosy as technology advances, and the large-scale feasibility of these solutions improves,” said Audun Martinsen, Rystad Energy's head of supply chain research.

Low-carbon investments are more short-cycled than the fossil fuel industries and are, therefore, more sensitive to inflationary pressures. Project plans, permitting activity and awards from companies and governments indicate this year’s expected investment growth. Based on likely activity, investments for each project were calculated based on specific characteristics and where Rysatd forecast unit prices across 2023.

What sectors will benefit the most?

Looking at the individual segment types, operations and maintenance companies will achieve the most growth this year – 16%. These companies are more exposed to the overall installed operational capacity, which will grow this year at a similar pace to 2022, with last year’s additions entering their first full year of operations. These providers’ costs are also more labor-driven than other sectors, and high consumer inflation is likely to push up wages for skilled labor, inflating segment spending.

According to Rystad, logistics and vessel companies, heavily weighted towards offshore projects and marine trade, are estimated to take in 15% more this year. Spending in the equipment, materials, engineering, and construction sectors, where the bulk of global investment dollars are spent, are expected to rise by about 9% annually. The new and relatively tiny market of suppliers exposed to low-carbon, well-related services is forecast to climb 33% this year, driven by geothermal drilling and CO2 injection. Despite the significant increase, investments in this market will only total about $3.7bn.

Regional considerations

Some suppliers are not targeting the global market, preferring to focus on regional clients and project hubs. The location of confirmed projects this year shows that Africa is set to attract the highest investment growth with a 26% increase, mainly driven by onshore wind projects in Egypt, Rystad said. Australia takes second place with 23% growth with expansion across almost all sectors.

Asian growth of 12% is heavily impacted by China’s ambitions within solar and wind, while the US Inflation Reduction Act and a step-up in renewables and CCUS will help push North American investments up 9% this year. Europe is challenged by high inflation and a regional supply chain in crisis, resulting in a projected investment growth of 7% – much lower than the tempo needed to meet the European Union’s REPowerEU ambitions.