Is Natural Gas the Bridge, the Destination or the Has Been? [GGP]

There is ongoing debate on what the future role of natural gas will be in the energy sector. The industry is seeing a convergence of factors at play including increasing global supply from new exporters like the United States, demand growth from developing economies, policy decisions supporting cleaner energy resources, lowering costs of renewables, and geopolitical shifts impacting traditional supplier-buyer relationships.

There is ongoing debate on what the future role of natural gas will be in the energy sector. The industry is seeing a convergence of factors at play including increasing global supply from new exporters like the United States, demand growth from developing economies, policy decisions supporting cleaner energy resources, lowering costs of renewables, and geopolitical shifts impacting traditional supplier-buyer relationships.

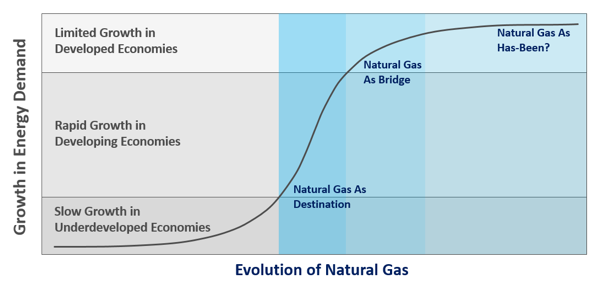

Rather than one universal answer, natural gas’s role will be dynamic and multi-dimensional, morphing with the need of the regional market. In a given market, natural gas can be a bridge fuel to reducing greenhouse gas emissions, a destination fuel that serves traditional sectors, or a “has been” where the need for natural gas is reduced due to public policy goal, renewable technology advancements, and declining energy storage costs. The role that natural gas takes on in each market will depend on several critical factors: economic development and energy demand growth, public policy goals, and natural gas availability and prices.

Economic Growth Influences Demand

Economic development and population growth across the globe drive natural gas demand. It is critical that the industry have a clear understanding of energy demand growth and the threats or opportunities this will bring to the industry.

In developing economies, energy demand growth and the need for natural gas are initially low, with higher dependence on coal and oil as primary energy sources. As their economies grow, however, these countries typically will need a tremendous amount of energy over a relatively short time frame that will require an “all of the above” strategy to procure sufficient energy to keep pace with and facilitate economic development. Urbanization across developing countries creates a significant potential growth trajectory for natural gas that needs to be supported by infrastructure investment and favorable governmental policies. These high energy growth areas will act as destinations for natural gas, as energy demand growth is met with investments in natural gas infrastructure and gas to power projects, subject to availability of natural gas.

In developing economies, energy demand growth and the need for natural gas are initially low, with higher dependence on coal and oil as primary energy sources. As their economies grow, however, these countries typically will need a tremendous amount of energy over a relatively short time frame that will require an “all of the above” strategy to procure sufficient energy to keep pace with and facilitate economic development. Urbanization across developing countries creates a significant potential growth trajectory for natural gas that needs to be supported by infrastructure investment and favorable governmental policies. These high energy growth areas will act as destinations for natural gas, as energy demand growth is met with investments in natural gas infrastructure and gas to power projects, subject to availability of natural gas.

In developed countries, as energy demand growth stabilizes, fuels like coal and oil are phased out of power generation. Renewables are integrated into the overall energy mix and natural gas gradually becomes a bridge as more economic and cleaner burning fuels are introduced . The ultimate goal from a green economy perspective is to increasingly replace fossil fuels with renewable resources, potentially driving natural gas to a “has-been” through a combination of public policy goals facilitating high penetration of renewable resources and technology advancements including energy storage for timely transformation.

Policies Driving Renewable Energy and Natural Gas Use

Providing access to global gas supply will be critical in capitalizing on opportunities in rapidly developing economies, especially in Asia where policies are driving energy development. In combination with advancements in renewables and energy storage becoming more economical, natural gas is seen as a critical and clean partner in achieving development while navigating environmental goals.

China’s limitation on coal-fired generation is being offset by growing adoption of renewable energy resources, increasing liquefied natural gas (LNG) imports and overall development of energy efficiency policies. India is working to reduce its dependency on imported power as it strives for energy independence to support an expanding population. India is quickly driving renewable development to achieve its target to produce 227 gigawatts of renewable energy by 2022, as well as aggressively supporting development of indigenous as well as imported natural gas supply. Asia and Africa account for over 50% of the projected incremental demand for natural gas between now and 2040.

China’s limitation on coal-fired generation is being offset by growing adoption of renewable energy resources, increasing liquefied natural gas (LNG) imports and overall development of energy efficiency policies. India is working to reduce its dependency on imported power as it strives for energy independence to support an expanding population. India is quickly driving renewable development to achieve its target to produce 227 gigawatts of renewable energy by 2022, as well as aggressively supporting development of indigenous as well as imported natural gas supply. Asia and Africa account for over 50% of the projected incremental demand for natural gas between now and 2040.

New energy policies in growing and emerging economies will greatly affect opportunities for the natural gas industry. Providing leadership and engaging with local governments can position buyers, suppliers and utilities to influence and shape energy policies globally to ensure continued growth and adoption of natural gas.

Developed countries could see natural gas as a bridge solution where their more stable demand is met increasingly by renewable resources with natural gas providing a critical backstop. In the United States, California public policy is aggressively driving fuel choice. The state adopted a mandate for electricity to be sourced 100 percent by renewable energy by 2045. Other developed regions around the globe are not far behind in pledging similar goals and public policies. Europe is aiming to have its power generation be 27 percent renewable by 2030. It should be noted that energy-dependent sectors other than electric generation often continue to be significant consumers of natural gas in these economies. As an example, residential, commercial and industrial uses account for over 60% of natural gas consumption in California. The unique attributes of natural gas for these uses as well as the technical and market challenges that remain in moving to 100 percent renewables generation signal that natural gas is not destined to be a has-been yet.

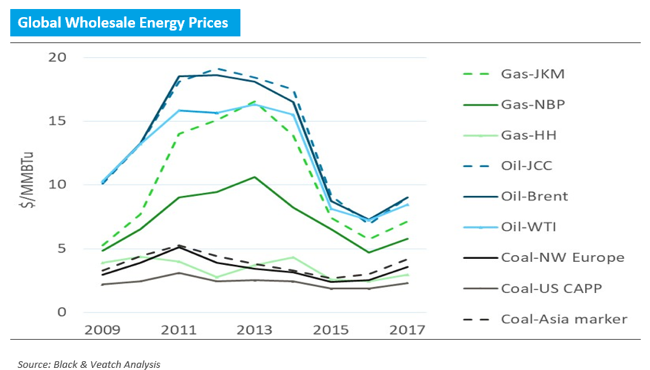

Price Divergence Creates Market Opportunities

Natural gas has the highest divergence in regional pricing when compared to other commodities such as coal and crude oil, which are more closely linked. This divergence in natural gas pricing is driven greatly by the uneven distribution of the resource, coupled with the relatively high cost for transportation, storage and distribution of natural gas. These disparities among regional areas make the cost for natural gas vary widely by market, which in turn has a direct impact on consumption profiles.

Natural gas industry participants will need to focus in the coming decade on growing and enabling access to natural gas to support growing energy needs. In 2017, LNG trade grew to 293.1 MT, a 14 percent year over year increase – the highest of all time. Today there are nearly 40 countries that import natural gas and 19 exporting countries. Qatar continues to be the global export leader, but the U.S. and Australia are quickly catching up. China and India are anticipated to become increasingly active importers of natural gas but how they will impact the global markets remains to be seen. Strategically growing LNG trade, and enabling and supporting new, smaller importers, will represent an impactful opportunity for the industry.

The Future of Natural Gas

Natural gas will continue to play an integral role in meeting growing global energy needs. In the next two decades, natural gas consumption is expected to grow by 30 percent. Regional market dynamics will significantly impact this growth in consumption.

Natural gas will continue to play an integral role in meeting growing global energy needs. In the next two decades, natural gas consumption is expected to grow by 30 percent. Regional market dynamics will significantly impact this growth in consumption.

In the developing economies of Asia and Africa, gas fuels economic growth with offsetting impacts between coal-switching and renewables penetration. More developed economies including the U.S. and Europe embrace natural gas as a bridge. In these countries, natural gas can serve as the immediate solution to comply with government policies and mandates to reduce carbon footprint, deploy more renewable-based energy resources and move away from coal-generated power.

Several factors must be carefully managed by the industry. Access to natural gas resources will continue to keep natural gas economies regional and each market will have to be evaluated on its own merits. Shifts in energy demand and population growth will put demands on local and national governments to develop new public policies. While the complexities and dependencies encompass many variables, natural gas has every opportunity to be the destination resource and avoid the pitfalls that could lead it down the “has been” path.

Deepa Poduval is a Senior Managing Director, leading the Oil & Gas & Mining Practice within Black & Veatch Management Consulting. She has provided strategic, economic, asset management, and fundamental market advisory services to producers, midstream entities with assets including pipeline, storage and liquefied natural gas facilities, utilities, project developers, financial institutions, and sovereigns.

Deepa Poduval is a Senior Managing Director, leading the Oil & Gas & Mining Practice within Black & Veatch Management Consulting. She has provided strategic, economic, asset management, and fundamental market advisory services to producers, midstream entities with assets including pipeline, storage and liquefied natural gas facilities, utilities, project developers, financial institutions, and sovereigns.

Her expertise involves advising clients on strategic responses to key issues impacting their business including growing gas-electric industry interdependencies and related implications for participants in both industries, the evolving role of natural gas in the global energy mix, emerging commercial trends in the global LNG market, and implications of energy price volatility on project viability, risk and future growth.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.