If Europe doesn’t Join Trump, will it be Beaten by Him? [Gas Transitions]

North American readers of NGW no doubt know about the Appalachian Storage Hub, the mega-petrochemical project being built in the US. In Europe, however, few people will have heard of it.

I was only vaguely aware of it myself, so I was fascinated by an article I came across, entitled Why the World Will be Slow to Abandon Natural Gas – One Word: Plastics, written by Washington DC-based energy policy analyst Joel Stronberg, published on the website of Energy Central in August.

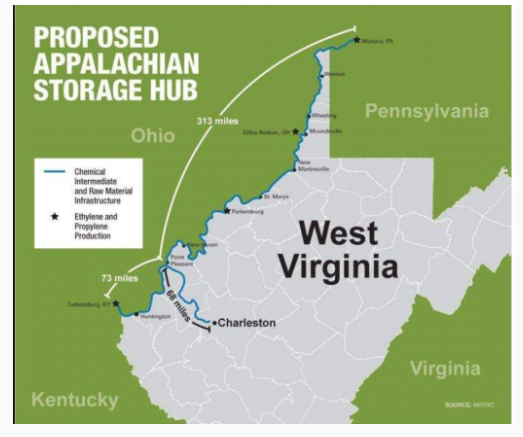

Stronberg vividly describes the stupendous “386-mile petrochemicals corridor” that is being developed along the Ohio River through Pennsylvania, Ohio, West Virginia and Kentucky.

Source: Joel Stronberg, Why the World Will be Slow to Abandon Natural Gas – One Word: Plastics”, 21 August 2019, Energy Central

“Feeding the industry are the proximate and plentiful gas supplies of the Marcellus and Utica fields,” writes Stronberg. “Anchoring the proposed Appalachian Storage Hub is Shell’s soon-to-be-completed cracker plant in Monaca, Pennsylvania… When finished the plant will take natural gas from the Marcellus and Utica shale deposits and turn it annually into more than a million pounds of plastic for use in the manufacture of everything from the red straws sold on the product page of Trump’s Make America Great Committee to solar panels, wind turbines, and consumer packaging.”

Interestingly, the project was begun in 2012 during the Obama administration, notes Stronberg, although Trump is now taking the credit for it and (rightly) boasting that it is one of the biggest construction projects taking place in the US.

On the downside: the Shell plant will also emit 2.2mn pounds of CO2 annually, adds Stronberg. “These emissions – permitted as part of Shell’s deal with Pennsylvania – equal the emissions from 480,000 automobiles.”

Three questions occurred to me after reading the article.

- Should we in Europe be jealous that the US is undertaking great fossil fuel projects like this, which seem pretty unthinkable nowadays on the Old Continent?

- Does it make sense for Europe to carry out a far-reaching energy transition, including ditching natural gas, when the US and other countries are happily continuing fossil fuel projects?

- What are we to make of the fact that Shell is involved in this gigantic fossil fuel project, while its executives in Europe are claiming Shell is “setting the course to become a future-proof energy company”and its actions are “completely consistent and compatible” with the Paris Agreement?

To start with this last question, the reality is that Shell presumably does not have much choice – not, that is, if it wants to continue being a leading energy company. It could shun opportunities like Monaca of course – but then a dozen rivals would be eager to take its place. How would that help the climate?

Shell’s dilemma points to the broader dilemma facing countries in Europe, some of which are making great efforts to reduce their greenhouse gas emissions but still see global emissions go up every year nonetheless. In this respect a country like Germany, bent on being a climate leader, is in the same position as a company like Shell, although Germany has made the opposite decision. It is gradually closing down its fossil fuel operations and spending billions, even trillions, on renewable energies, ignoring the fact that its efforts are thus far having a minimal impact on global emissions. How smart is that?

Some people argue that “rich” countries like Germany have a duty to “set the right example”, but that argument is not very convincing to many ordinary voters who may not be too “rich” in any case but who do have to pay the climate bills.

So where does this leave us as Europeans? Do we have no choice but to join the Trumps of this world – or be beaten by them?

For as long as we fail to reach a binding international agreement in which the whole world takes part, I can see only one way out of this climate conundrum. If it were possible for a low-emission economy to out-compete a high-emission economy, purely on economic terms, it would make it possible for countries – and companies – to follow a low-emission course. Indeed, it would even make it desirable to do so, as they would be gaining an advantage in the “energy economy of the future”.

Suppose we found out, beyond a shadow of a doubt, that global warming was a complete hoax. Would that stop the transition to low-carbon economy dead in its tracks?

But how likely is it that low-emissions can be economically superior to high-emissions? On the face of it, not very. It is an inconvenient truth that, as energy economists such as Vaclav Smil have shown, fossil fuels are extremely hard to beat economically, because of their high energy density and unique storage properties. The German example indeed seems to prove that the low-emission route is prohibitively expensive – some even argue that it is downright suicidal.

Yet it might be a mistake to take the German case as typical. I know that policy-makers in the Netherlands were horrified at the way the Germans shaped their Energiewende, which combined hugely generous feed-in tariffs for renewables with the disastrous decision, from a climate perspective, to phase out nuclear power.

Many researchers – such as Mark Z Jacobson of Stanford University, Amory Lovins of the Rocky Mountain Institute and many others – are, in fact, convinced that a low-emission economy might well be able to compete with a high-emission economy purely on economic terms, especially in the longer term. They point in particular to the rapid cost reductions in wind and solar power and in battery technology as evidence. Could they have a point?

Let’s look at some recent reports and market developments and see how they may affect the competition between a renewables-based (or low-emission) economy with a fossil-based (or high-emission) one.

Powerwall and Powerpack

Cost of electric cars

First case: cost of EVs versus cost of cars with combustion engine.

In a remarkable research paper published in August, Mark Lewis, Global Head of Sustainability Research at BNP Paribas Asset Management, concludes that for light-duty vehicles, the economics of renewables are actually superior to those of oil. This is quite apart from any climate considerations.

In his calculations, Lewis uses the concept of Energy Return on Capital Invested (EROCI), “focusing on the energy return on a $100bn outlay on oil and renewables where the energy is being used to power cars and other light-duty vehicles (LDVs).”

He concludes that “for the same capital outlay today, new wind and solar-energy projects in tandem with battery electric vehicles will produce six to seven times more useful energy at the wheels than will oil at $60/barrel for gasoline powered LDVs, and three to four times more than will oil at $60/barrel for LDVs running on diesel.”

Accordingly, he calculates “that the long-term break-even oil price for gasoline to remain competitive as a source of mobility is $9-10/barrel, and for diesel $17-19/barrel,” ie far below the current oil price of around $60. And that is “before we factor in the other advantages of renewables and EVs over oil as a road-transportation fuel, namely the climate change and clean-air benefits, the public-health benefits that flow from this, the fact that electricity is much easier to transport than oil, and the fact that the price of electricity generated from wind and solar is low and stable over the long term whereas the price of oil is notoriously volatile.”

According to Lewis, “if we were building out the global energy system from scratch today, economics alone would dictate that at a minimum the road-transportation infrastructure would be built up around EVs powered by wind- and solar-generated electricity.”

He warns: “The oil industry has never before in its history faced the kind of threat that renewable electricity in tandem with electric vehicles poses to its business model: a competing energy source that: 1) has a short-run marginal cost of zero, 2) is much cleaner environmentally, 3) is much easier to transport, and 4) could readily replace up to 40% of global oil demand if it had the necessary scale.”

Cost of “green hydrogen”

Second case: hydrogen.

A key part of a renewables-based economy is likely to be played by “green” (renewables-based) hydrogen, made through electrolysis. Although this development is still at a very early stage, and by no means competitive yet with fossil fuels, new analysis by Bloomberg New Energy Finance is surprisingly upbeat about the cost reduction potential of renewable hydrogen.

Kobad Bhavnagri, BNEF’s head of special projects, said in the report that “once the industry scales up, renewable hydrogen could be produced from wind or solar power for the same price as natural gas in most of Europe and Asia. These production costs would make green gas affordable and put the prospects for a truly clean economy in sight.”

Renewable hydrogen costs may fall to as low as $1.40/kg by 2030 from the current range of $2.50-$6.80, BNEF said in the report. That could decrease further to 80 cents by 2050, equivalent to a natural gas price of $6/mn Btu. According to BNEF, “about 3 GW of electrolysis projects are currently underway to test new applications of hydrogen according to data from the International Energy Agency. Over the following decades, the amount of total capacity of electrolysers could sky-rocket 1,000 times that amount if a significant demand builds for renewable hydrogen.”

That’s the most positive assessment I have seen anywhere on green hydrogen. An important reason for BNEF’s optimism is: China. The report observes that “Chinese manufacturers lead the way in low-cost manufacturing of hydrogen production equipment…. While companies [in Europe and North America] that experiment with hydrogen haven’t bought equipment from China, the country could show the way to a drastic decrease in production costs through a combination of increased scale, automation and moving production to countries with cheaper workers.”

Potential of green hydrogen in the steel sector

BNEF is also remarkably bullish about the potential of green hydrogen in the steel sector. In a report that came out September 2, it notes that “steel could shed its reputation as a climate threat by using hydrogen instead of fossil fuels for as much as half of global output by 2050.”

This report concludes that “the steel industry could adopt hydrogen for between 10% and 50% of output by mid-century given the right carbon pricing. The sector accounts for as much as 9% of global carbon emissions, according to the World Steel Association.”

“Hydrogen technologies offer a viable pathway to slash the emissions from making steel,” said Kobad Bhavnagri. “No big R&D breakthroughs are necessary. If policy was in place, the world could start producing green steel within a decade.”

“Hydrogen can do everything coal does in the steel-making process, and the technology to make fossil-free steel is already currently operating with natural gas in many parts of the world,” Bhavnagri said. “Hydrogen technology will be competitive with high-cost, coal-based plants when the cost of renewable hydrogen falls below $2.20/kg, assuming coking coal prices at $310/ton. That’s possible by 2030, BNEF said.”

In Australia, meanwhile, Tesla is taking aim at gas plants

Steel is made from mined iron using a process largely unchanged for more than 150 years, notes BNEF. “Iron ore is first smelted with carbon-rich coke in huge blast furnaces that emit carbon gases and churn out liquid metal. Gases can be used instead of coke as reduction agents in an alternative process called direct reduced iron, or DRI. This does away with the blast furnace and is already employed in some locations using natural gas.”

Cost of batteries

Finally: batteries.

A new report released on 31 July, again from BNEF, projects that battery costs will halve in the next decade and “energy storage installations around the world will multiply exponentially”, from 9 GW/17 GWh deployed as of 2018 to 1,095 GW-2,850 GWh by 2040.”

According to BNEF, “this 122-fold boom of stationary energy storage over the next two decades will… be made possible by further sharp declines in the cost of lithium-ion batteries, on top of an 85% reduction in the 2010-18 period.”

What is a particularly important take-away from the analysis is that batteries are rapidly becoming cost competitive. “Cheaper batteries can be used in more and more applications”, notes BNEF. “These include energy shifting (moving in time the dispatch of electricity to the grid, often from times of excess solar and wind generation), peaking in the bulk power system (to deal with demand spikes), as well as for customers looking to save on their energy bills by buying electricity at cheap hours and using it later.”

Logan Goldie-Scot, head of energy storage at BNEF, said we are entering “a new era of dispatchable renewables, based on new contract structures between developer and grid.” According to BNEF, “energy storage will become a practical alternative to new-build electricity generation or network reinforcement. Behind-the-meter storage will also increasingly be used to provide system services on top of customer applications.”

The falling costs of battery and other energy storage technologies is already impacting the demand for gas peaking plants. In a report published in June 2019, The Potential for Battery Energy Storage to Provide Peaking Capacity in the United States, the National Renewable Energy Laboratory (NREL) in the US notes that “4-hour storage provided by batteries whose costs continue to fall while their performance improves, can substitute for peaking units currently used to meet peak demand. The results show significant potential for energy storage to replace peaking capacity, and that this potential grows as a function of [solar] deployment."

NREL's analysis “concludes that roughly 28 GW of peaking capacity in the US offers the practical potential to be converted to 4-hour energy storage, given current grid conditions and demand patterns. An increase in solar deployment would push the practical potential for 4-hour storage to 50 GW or beyond assuming that solar meets 10% of the US electricity demand. Total installed generation capacity in the US is about 1,187 GW with fossil-fuelled peaking capacity accounting for roughly 261 GW, mostly natural gas fired plants.”

In Australia, meanwhile, Tesla is “taking aim at gas plants” with its 3 MWh “megapack” battery unit, according to a recent article on the website Reneweconomy.com. Tesla chair Robyn Denholm said the new megapack “would allow the company to take grid scale storage to a ‘massive scale’, and would take higher cost and emissions intensive plants – such as gas peakers – off line.”

The megapack, inspired by the success of South Australia’s Hornsdale Power Reserve battery, would allow the installation of gigawatt-scale “power plants” four times faster than a fossil fuel plant, said the company.

The 100-MW/129-MWh Tesla big battery in Hornsdale, the largest in the world, “was built using the company’s commercial-scale Powerpack batteries in a period of just 4.5 months, and at a cost of A$91mn”, writes Reneweconomy. “The Neoen-owned facility – situated next to the Hornsdale Wind Farm – has been a huge success, both as a source of revenue, and for its critical role in maintaining grid security, and preventing blackouts, as highlighted by its response to the dramatic interconnector failure in August.”

In the past year alone, Tesla has installed more than 1 GWh of global storage capacity with the Powerwall and Powerpack, bringing “our total global footprint to more than 2 GWh of cumulative storage,” according to the company. “With Megapack, this number will continue to accelerate exponentially in the coming years.”

A complete hoax

These examples go to show that the outcome of a competition between a renewables-based and fossil-fuel based economy, even in the absence of strong climate policies, is not a foregone conclusion.

True, to make a renewables-system work, some government support will be needed. BNEF for example acknowledges that “without political support, a hydrogen economy wouldn’t likely develop.… Lawmakers will need to support renewable hydrogen in order to spur advances and growth of electrolysers in the years ahead.”

Still, for governments to interfere in the market to some extent – for example to give temporary subsidies to overcome the barrier of high upfront costs – is hardly unreasonable. After all, fossil fuel and nuclear activities also get plenty of direct and indirect government support. Just think of the public money that has gone into the construction of motorways. Some boon to oil companies!

In addition, there are external costs to consider, for example the costs of air and water pollution as a result of the use of fossil fuels. For private companies like Shell external costs can’t enter into their calculations as long as they don’t have to pay for them, but for national policymakers they are relevant– or should be. Eventually, all costs have to be paid by someone after all.

What if Europe reduced its plastics use, making a plant like the one in Pennsylvania simply unnecessary?

US citizens, for example, may have relatively low energy costs, thanks to the abundance of fossil fuels, but if these fossil fuels at the same time cause relatively high environmental and public health costs, their economic advantage will be that much reduced. (How to compare external costs is another matter. Renewable energy technologies, including batteries and EVs, also come with external costs, although according to some researchers these are much lower than those of fossil fuels.)

Perhaps the question to ask ourselves is this: suppose we found out, beyond a shadow of a doubt, that global warming was a complete hoax, as some people believe. Would that stop the transition to low-carbon economy dead in its tracks? I wonder.

Consider what Stronberg writes in his article about the Appalachian Storage Hub: “Beyond potential economic rewards, the communities in the corridor are being exposed to the inevitable environmental risks associated with fracking, e.g., water pollution, the transport of oil and gas through pipelines, eg, methane leaks, and chemicals by truck and rail, e.g., derailed and split-apart tank cars. Those risks rise accordingly with the two to threefold increase in fracking activities needed to feed Shell’s cracker plant. The administration’s efforts to rollback Obama era methane emission rules only adds risk to the proposition.”

Add to this the environmental effects of the huge amounts of plastics that will be produced by the Shell plant, and the petrochemicals plant becomes a lot less to be jealous about. What if Europe reduced its plastics use, making a plant like the one in Pennsylvania simply unnecessary? This is the course the EU is taking, which might make much more economic sense, if we take a slightly longer-term view.

Shell in any case seems to be hedging its bets. On 22 August, the company announced that it has made a $419mn takeover offer for ERM Power, “Australia’s no.2 electricity retailer to businesses and industry”, according to Reuters. Shell, which has no presence yet in the Australian power market, said Australia “is one of the core markets for its new ‘Emerging Power’ theme, focused on strong growth in renewables to complement traditional fuels.”

The Australian takeover, if it succeeds, ties in with Shell’s ambition to become “the biggest electricity company in the world”. The company has made a string of acquisitions in what it calls the “New Energies” field in recent years. Some of these activities, incidentally, are also complementary to Shell’s gas business. ERM Power, for example, owns two gas-fired power plants. Clearly for Shell the energy transition is not a black-and-white issue. They may well be right at that.

The potential of wind and solar power for Europe

Wind and solar power may also be attractive from a purely economic point of view, especially for countries that have no fossil fuel reserves of their own. How attractive exactly compared to fossil fuels depends on a lot of factors.

According to new analysis from the University of Sussex in the UK with Aarhus University in Denmark, published in August, “Europe has the capacity to produce more than 100 times the amount of energy it currently produces through onshore windfarms.”

The study estimates that more than 11 million additional wind turbines could be theoretically installed over almost 5 million square kilometres of suitable terrain generating 497 EJ of power which would adequately meet the expected global energy demand in 2050 of 430 EJ. The authors “identified Turkey, Russia, and Norway as having the greatest potential for future wind power density although large parts of Western Europe were also considered ripe for further onshore farms because of favourable wind speeds and flat areas.”

“Europe has the potential to supply enough energy for the whole world until 2050”, according to the researchers. “If all of Europe’s capacity for onshore wind farms was realised, the installed nameplate capacity would 52.5 TW - equivalent to 1 MW for every 16 European citizens.”

Co-author Benjamin Sovacool, Professor of Energy Policy at the University of Sussex, said the study suggests “that the horizon is bright for the onshore wind sector and that European aspirations for a 100% renewable energy grid are within our collective grasp technologically.”

Peter Enevoldsen, assistant professor in the Center for Energy Technologies at Aarhus University, said that “even without accounting for developments in wind turbine technology in the upcoming decades, onshore wind power is the cheapest mature source of renewable energy, and utilizing the different wind regions in Europe is the key to meet the demand for a 100% renewable and fully decarbonized energy system.”

All of this may sound impressive, but this kind of build-up of wind power is purely theoretical of course, , since it would require covering most of Europe with windmills. Sovacool acknowledged that “Obviously, we are not saying that we should install turbines in all the identified sites but the study does show the huge wind power potential right across Europe which needs to be harnessed if we’re to avert a climate catastrophe.”

Another new paper - entitled A high-resolution geospatial assessment of the rooftop solar photovoltaic potential in the European Union – carried out by the European Commission’s Joint Research Centre and the European Institute of Innovation & Technology, looked at the potential of rooftop solar systems in Europe. This study comes to the more plausible (if somewhat disappointing) conclusion that “the EU rooftops could potentially produce 680 TWh of solar electricity annually, representing 24.4% of current electricity consumption, two thirds of which at a cost lower than the current residential tariffs.”

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For Natural Gas World he will be reporting on the Dutch and wider International gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com