Greenpeace Shows the Way for German Gas [Gas Transitions]

On September 26, Greenpeace Energy published a set of reports authored by researchers from the respected think tank Wuppertal Institut and the well-known Berlin-based consultancy Energy Brainpool, aimed at finding out what the need for gas would be in a fully climate-neutral energy system in Germany by 2040. The reports are available only in German, but you can find a short news item in English here on the website Clean Energy Wire with links to the originals. The Wuppertal Institut looked in particular at the transport sector, Energy Brainpool at the possibilities of “power-to-gas”, i.e. “green hydrogen” based on electrolysis of renewable energy.

I should explain that Greenpeace Energy is a renewable energy supplier (utility) founded in 1999 by the NGO Greenpeace to stimulate the expansion of solar and wind power in Germany. In other words, Greenpeace Energy is not the same as the NGO Greenpeace. Nevertheless, spokesman Michael Friedrich of Greenpeace Energy told me, “since we carry the name Greenpeace, we make sure that what we do is broadly supported by Greenpeace.”

The major takeaway from the reports is that Germany is not going to be able to run on renewable electricity alone. Indeed, the researchers conclude that a future zero-carbon energy system will use more gas (in the form of hydrogen) than electricity.

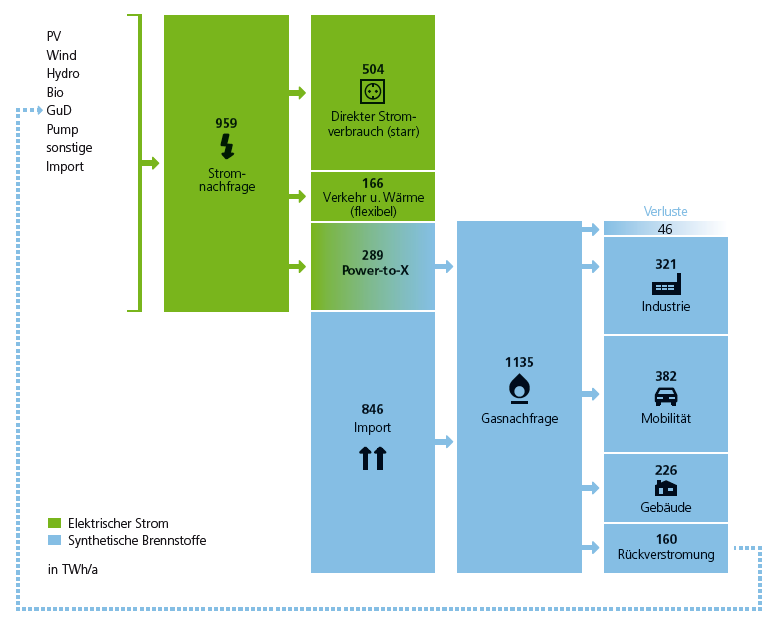

Clean Energy Wire summarises the findings thus: “In a future fully renewable energy system, the demand for renewable hydrogen and fuels produced from it will be higher at 1,089 terawatt hours (TWh) per year than the demand for green electricity at 959 TWh." (Greenpeace notes that current total German power demand is 596 TWh, although other sources put it at around 646 TWh.)

In other words, in the vision of Greenpeace, hydrogen will become bigger than renewable electricity in Germany.

Hydrogen does not just refer to “power-to-gas” (hydrogen made from renewable electricity) but also “power-to-liquids”, whereby renewable electricity is first converted into hydrogen and then combined with CO2 and turned into liquids through the Fischer-Tropsch process. The idea is that the CO2 needed for the production of these hydrogen-based liquid fuels, which are to be used in the transport sector, will be supplied by industry, although there are even experiments going on to capture CO2 directly from the air.

The researchers came to this conclusion because they found that in the energy-intensive industry, the buildings sector and in transport, electrification alone would not be feasible, for various technical and economic reasons. For example, in the transport sector they assume that whereas in 2040 passenger cars will be electrified for 70%, international aviation and shipping will still be based 100% on liquid fuels. “Even when the transport sector will be electrified to the maximum extent, we found that for aviation, maritime transport and parts of heavy road transport battery-electric drivetrains are not an option for a good many years”, said Karin Arnold of the Wuppertal Institut.

In addition, in “important parts of the industrial sector and heating, gases such as hydrogen or synthetic methane will be needed in large quantities”, said Greenpeace Energy, “when fossil energy sources cannot be replaced directly by green electricity. For reliability reasons green gases are also indispensable to cover longer periods when there is little wind or solar power available.”

This is a very important admission coming from a source like Greenpeace, which has been a major supporter and driver of the massive expansion of solar and wind power in Germany. It means that even Greenpeace has come around to the conclusion that Germany can’t run on green electricity alone and that there are clear limits to the possibilities of electrification.

It is not a new insight of course: it confirms the most up-to-date findings of many other researchers. Earlier this year, international consultancy Navigant for example found that an “optimised” low-carbon European energy system would need substantial amounts of “green gases”, although it should be noted that this study was financed by European gas network operators collaborating in the “Gas for Climate” initiative.

More recently, researchers from the Centre for European Policy Studies (CEPS) in Brussels reviewed 23 studies looking at the future of gas in Europe. They similarly concluded that “while increasing levels of electrification represents a necessary decarbonisation strategy for several sectors, electricity will not be able to cover all EU energy needs in the future, especially in some sectors that are difficult to decarbonise. Renewable methane and hydrogen will likely play an important role, especially for industrial energy demand where it is used as feedstock, for the power sector by providing flexibility and storage, for heating in the building sector, and as fuels in the transport sector.”

This debate, then, seems to be pretty much settled. As Ulco Vermeulen, executive board member of Dutch gas transmission system operator Gasunie, succintly put it in an interview with Natural Gas World earlier this year: “Energy needs molecules”.

Real consequences

The million-dollar question is: what kind of molecules?

For Greenpeace the answer is clear: there can only be one acceptable molecule, namely green hydrogen. Greenpeace rejects the idea that there could be a role for so-called “blue hydrogen” in the future energy system, i.e. hydrogen made from natural gas through steam methane reforming, combined with carbon capture and storage (CCS), to prevent the release of CO2 into the atmosphere.

For the natural gas industry this is important because blue hydrogen (also called “decarbonised gas”) could provide an important lifeline into a decarbonised future. But Greenpeace does not believe in CCS. Michael Friedrich of Greenpeace Energy rejects the possibility of CCS out of hand: “We don’t regard CCS as a safe or efficient solution”, he says. “We see it as a way in which the gas industry tries to avoid the real consequences of the energy transition.”

Here is where it gets really interesting. The question then becomes: if Germany, as Greenpeace admits, needs gas, but rejects blue hydrogen, can it meet its energy demand with green hydrogen alone? Because if not, then there is a big opportunity for the natural gas industry to continue to play an important role in the German economy. (And what goes for Germany, largely goes for Europe in general.)

The reports from Wuppertal Institut and Energy Brainpool are very useful in this respect because they are based on the assumption that all needs will be met by green electricity and green hydrogen. They don’t consider any role for natural gas. By looking at how realistic these reports are, we can infer a lot about the future of natural gas in Germany (including natural gas in the form of blue hydrogen).

To give away my conclusion: the reports seem to me very unrealistic.

Let’s see what they have to say. Greenpeace’s renewable energy future is based on four broad assumptions.

Assumption #1 is that electrolysis capacity will be expanded massively. By 2040, Germany will need 115 GW of electrolysis capacity, in the Greenpeace scenario. According to the researchers of Brainpool, it will be cost-efficient to run these electrolysers when power prices are low (i.e. when the supply of renewable power is high), which on average will be some 3,000 hours per year. In that case the system will require only limited and temporary government support, according to Greenpeace. Power generation costs will be between 6.1 and 8.1 cts/kWh (excluding transmission and distribution costs).

I don’t want to discuss the costs here, which are difficult to verify in any case. But I do want to point out that 115 GW is an extremely high number. Currently there are some three dozen power-to-gas projects being carried out in Germany, but they are all pilot projects, measured in single-digit or double-digit megawatts, not gigawatts. Just recently, on 6 September, the city of Hamburg announced that it wants to “become home to the world's largest hydrogen electrolysis plant with a capacity of 100 MW”. An FID on this project has yet to be taken. To get from this to 115 GW will be a Herculean effort indeed.

When it comes to power-to-liquids, these are in an even more experimental phase. They are not produced at scale anywhere yet. Some experts don’t believe that power-to-liquids could ever be an economically feasible option.

When it comes to power-to-liquids, these are in an even more experimental phase. They are not produced at scale anywhere yet. Some experts don’t believe that power-to-liquids could ever be an economically feasible option.

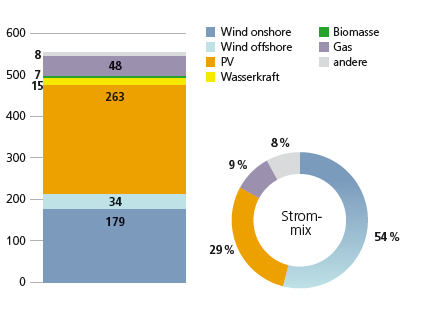

Assumption #2 behind the Greenpeace scenario is an equally massive expansion of solar and wind power. That is inevitable, because these renewable energies will not only have to deliver the green electricity needed, but will also be the feedstock for the green hydrogen production. According to the Greenpeace scenario, Germany will need 498 GW of renewable energy capacity, of which 179 GW will be wind onshore, 34 GW wind offshore and 263 GW solar PV.

How much is this? A lot! In 2018, Germany had 52.7 GW of wind onshore, 5.9 GW wind offshore and 45.3 GW solar power, according to figures from research institute Fraunhofer ISE as reported by Clean Energy Wire:

.png)

Source: Clean Energy Wire

This means then that renewable energy capacity would have to more than quadruple in twenty years.

Another way of looking at this: solar PV would have to expand by 10.9 GW per year, whereas it has grown by only 1.7 GW annually over the last five years, i.e. it would need to grow ten times as quickly as it has been doing so far. Not even the most sympathetic market watchers expect anywhere near 263 GW to be reached within the next few decades. The most optimistic projections speak of 5 GW per year.

Wind onshore would have to grow by 6.3 GW/yr against annual growth of 4 GW/yr over the last five years. Again, this is very ambitious, especially in view of the fact that the expansion of onshore wind in Germany is currently stagnating.

Interestingly, the power mix envisioned by Greenpeace in 2035 (see chart below) also includes 48 GW of gas-fired power capacity, based on biogas. This is much higher than the current 29.6 GW of gas power stations Germany has.

Power mix in 2035. Source: Greenpreace-Energy.de Numbers are in GW. “Wasserkraft” is hydropower.

Hydrogen imports

If assumption #1 and #2 seem optimistic, to say the least, then brace yourself for assumption #3. If Germany succeeds in building 115 GW of electrolysis capacity and 498 GW of renewable power capacity in less than twenty years, and it will produce green hydrogen and hydrogen-based liquid fuels approximately 3,000 hours a year, then it will still only produce a quarter of the hydrogen the country will need!

Yes, you read that right. The 115 GW of electrolysis capacity will produce only between 182 and 243 TWh/yr of green hydrogen, while Germany will need 1,089 TWh. This means that at least 846 TWh will need to be imported.

Greenpeace’s envisioned renewable energy system is illustrated in this chart:

Source: Greenpreace-Energy.de The green parts show renewable power, the blue parts “synthetic fuels” (power-to-gas and power-to-liquids). “Strom” = electricity, “Direkter Stromverbrauch” = direct power use, “Verkehr u. Wärme”= transport and heat, “Gasnachfrage” = gas demand, “Gebäude”= buildings, “Rückverstromung” = reconversion.

Greenpeace puts a positive spin on the hydrogen import requirement. Germany is already a very large gas and oil importer and the new system would actually reduce Germany’s import dependency from 70% today to 50%, says Greenpeace.

That is no doubt true, but not very relevant. The real question is: who will supply those 846 TWh of green hydrogen? There is no international market for green hydrogen at the moment. It will have to be built from scratch. The Germans apparently expect the likes of Saudi Arabia and Australia to build a supply chain for green hydrogen to help Germany meet its self-imposed climate targets. How realistic is that?

If all of this seems pretty fanciful, then assumption #4 is the nail in the coffin of Greenpeace’s green energy scenario – at least in my opinion. The scenario is also based on the achievement of maximum energy efficiency and energy savings to be realised in the coming years.

To illustrate what “maximum” means in practice: the researchers of the Wuppertal Institut assume that Germans will start driving smaller cars and fewer miles. They assume that “the share of large passenger cars will shrink from 20% to 9%”. In addition, they project that the total number of cars will be reduced from 47 million in 2018 to 21 million in 2035! Further, all domestic air transport will be replaced by trains and heavy road transport on the motorways will run on roads with overhead wires!

I have no desire to bash Greenpeace or to soft-soap the natural gas industry but I can’t help feeling that these are, well, fairy-tales. (Incidentally, I have the impression from talking to other German energy stakeholders that they are fairy-tales that are widely believed in in Germany. The German government has promised to come up with a national hydrogen strategy before the end of the year and that will likely also be full of equally optimistic assumptions.)

And I am not the only to think so. Christian Egenhofer, one of the authors of the CEPS report mentioned earlier, which reviewed 23 studies into the future of the European gas market, comes to the same conclusion. He told me that if Germany wants to go the gas route, there is no way around blue hydrogen. “One thing is evident from these studies,” he said. “None of them saw a transition to a hydrogen economy, unless you use blue hydrogen. But this reality is ignored in Germany.”

Conclusions?

If Germany goes the green hydrogen route, as seems likely now, it means that that there will be plenty of opportunity for natural gas suppliers to continue to sell gas to Germany for quite a long time to come. As we have seen, by any realistic standard green hydrogen is going to take much longer to build out than Greenpeace and others expect.

However, the gas industry should not forget that at some point “unabated” natural gas is going to be phased out. If the gas suppliers really want to stay in the picture permanently, they should invest in blue hydrogen production capacity (as professor Jonathan Stern of Oxford Institute for Energy Studies concluded earlier this year). Even if the Germans themselves may not want to have CO2 stored underground in their country, other nearby countries, such as Norway, the Netherlands and the UK, are much more positive about accepting CO2 storage on their soil, especially offshore.

But for the time being, as I have observed before in this space, the future for natural gas in Germany looks bright. We have heard it now from the horse’s mouth – even if the horse himself does not want to admit it.

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For Natural Gas World he will be reporting on the Dutch and wider International gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com