GoM edges closer to first FLNG deployments [Gas in Transition]

To date no offshore FLNG plants have been built in the Gulf of Mexico (GoM), but offshore interest has persisted for a number of reasons.

US LNG capacity is heavily concentrated on the Gulf Coast and the number of brownfield sites on land available for redevelopment with deepwater access has dwindled. Offshore, there are no land acquisition costs and fewer potential permitting problems. The primary permitting bodies, in addition to the US department of energy (DoE), are the Maritime Administration (MARAD) and the US Coast Guard’s Deepwater Ports Standards Division.

In addition, existing pipelines once used to bring gas ashore can be repurposed to bring gas offshore from the US pipeline system, which means no dedicated upstream development and relatively little new pipeline construction, again reducing costs. Nearshore FLNG accessing transportation pipeline gas also reduces the number of plant items and modules required offshore as the gas will already have received some processing, reducing the pre-treatment needed for liquefaction.

Moreover, given the large and long-standing oil and gas industry presence in the region, offshore skills and services are readily available. At the same time, upstream, the US’ abundant shale gas plays have proven their ability to expand production to fulfil domestic US demand, higher levels of LNG exports internationally and much increased pipeline gas exports to Mexico without a sustained uplift in base prices for feedstock gas.

GoM LNG can utilise the Panama Canal for access to Asian markets, as well as having ready access to the Atlantic basin via the Caribbean.

Grand Isle LNG proposes 4.2mn mt/yr project

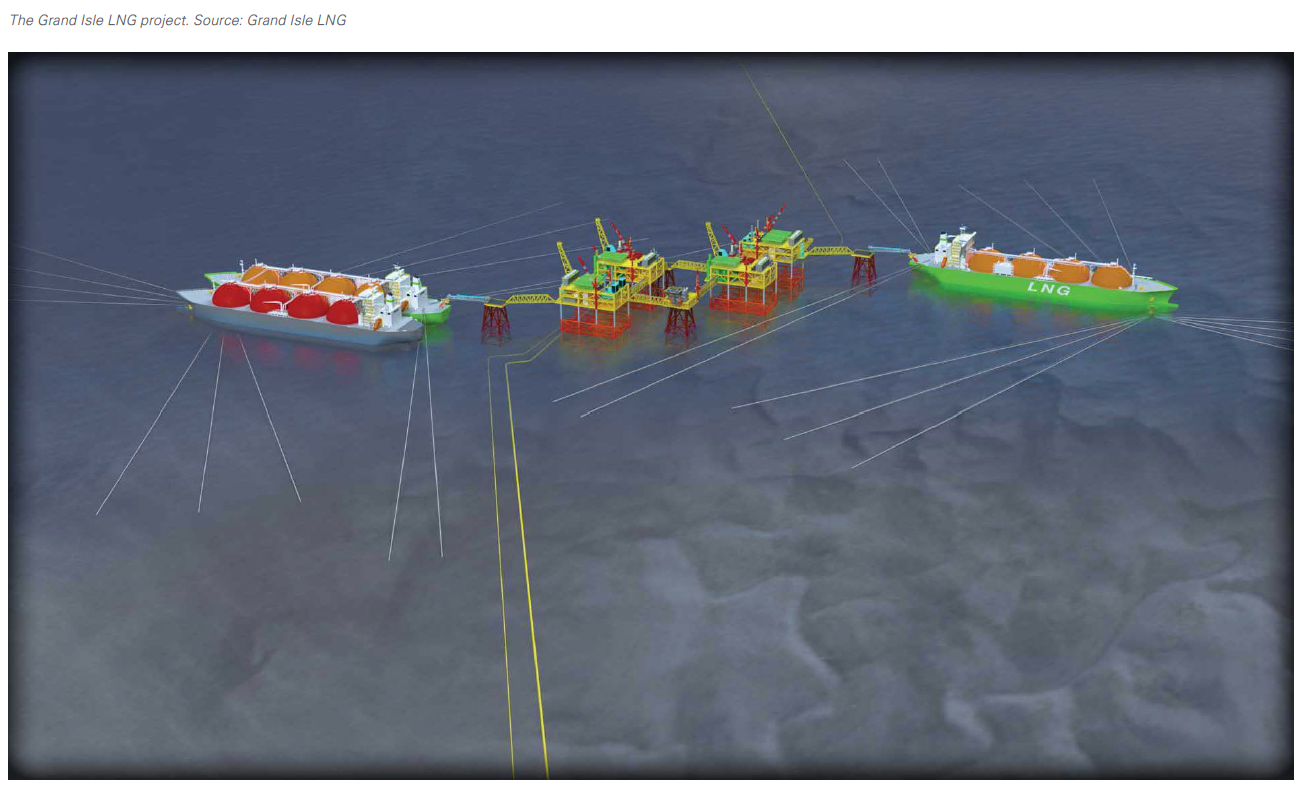

Grand Isle LNG, the latest project to propose an offshore deepwater port facility in the GoM, has identified a site 13 miles south of Grand Isle, off the Louisiana coastline, in water depths of 68-72 feet. The site is in federal waters in the West Delta Area, Block 35.

The deepwater port is to be built in two phases and on completion will consist of crew quarters, two gas treatment platforms, two 2.1mn mt/yr liquefaction platforms, two loading platforms, a thermal oxidizer platform and two floating storage and offloading vessels.

The facility will lie between two gas pipeline systems, Kinetica, which offshore comprises a 20-inch pipe and a 24-inch pipe and the High Point Pipeline. The company proposes construction of three pipeline laterals to connect each existing pipeline.

Grand Isle LNG’s president David Chung was the founder of Annova LNG, which aimed to build an LNG export facility in Brownsville, Texas. A large majority stake in Annova LNG was bought by US energy company Exelon. A 6.5mt/yr export facility was proposed in three phases of 2mn mt/yr, but despite gaining export approvals, the project struggled to land offtake agreements and was discontinued in March 2021, following the collapse of LNG spot prices in the first half of 2020.

However, much has changed in the world of LNG since then. European LNG has boomed as a result of the war in Ukraine and the loss of Russian pipeline gas. With this new project, Grand Isle LNG is targeting the start of deliveries in 2026, which would mean it joining a swathe of new LNG plant coming online worldwide designed to address both the increase in European demand and latent demand in Asia, which has been held in abeyance by the high prices cause by the Ukraine crisis.

Delfin LNG close to FID

However, nearshore GoM FLNG is not new and has not so far delivered the quick progress from concept to production that developers hoped to exploit.

Delfin LNG is developing what is arguably the most advanced US offshore FLNG project. Having been many years in development, the prospect of a final investment decision (FID) took a critical step forward in April, when the company announced a sales and purchase agreement (SPA) with Hartree Partners Power and Gas Company (UK).

Although the deal is relatively small – 0.6mn mt/yr LNG over 20 years – it brings the project’s total sales commitments to 3.1mn mt/yr, which Delfin says is sufficient for an FID. This the company hopes to take soon, saying mid-2023 at the time of the Hartree SPA announcement.

Although the deal is relatively small – 0.6mn mt/yr LNG over 20 years – it brings the project’s total sales commitments to 3.1mn mt/yr, which Delfin says is sufficient for an FID. This the company hopes to take soon, saying mid-2023 at the time of the Hartree SPA announcement.

Other SPAs include with trading house Vitol for 0.5mn mt/yr of LNG over 15 years with the price indexed to Henry Hub; a heads of agreement signed in August last year with UK company Centrica for 1mn mt/yr for 15 years; and, in September 2022, a deal with US oil and gas producer Devon Energy to provide 1mn mt/yr of liquefaction capacity from the first FLNG vessel.

The deal included an option to add an additional 1mn mt/yr in the future and for future equity investments in Delfin LNG by Devon Energy.

A further boost to the project came June 8 with the announcement that Japan’s Mitsui OSK will invest in Delfin Midstream. Delfin CEO Dudley Poston said, “proceeds from MOL’s investment will be used to accelerate making final investment decisions on our first two FLNG vessels this year.”

Firming up these various agreements is likely the final piece of the jigsaw before FID.

Delfin plans four FLNG vessels each with 3.325mn mt/yr capacity. Golar LNG is developing a Mark II FLNG vessel for the purpose. The offshore facility will be supplied by the UTOS pipeline, which the company bought in 2014 from Enbridge. UTOS was built in 1978 to take oil and gas onshore, but was abandoned in 2011.

Onshore UTOS has connections to interstate pipeline systems such as Transcontinental Pipeline, Natural Gas Pipeline Company of America and ANR Pipeline Company. Delfin will need to reinstate these connections, build a compressor station at UTOS’s landing point and carry out other work to reverse the direction of flow.

With offtake agreements nominally for 3.1mn mt/yr, Delfin is in a position to take an FID, but Grand Isle LNG may want to take note of the length of time it has taken to get the project this far. Like Grand Isle LNG, Delfin is also targeting 2026 as a start-up date for first deliveries.

Fast LNG should be first past the post

New Fortress Energy (NFE) is on a faster track. The company applied to the DoE for export approval for a similar project to Grand Isle LNG offshore Louisiana in March last year. This envisages two 1.4mn mt/yr liquefaction trains in West Delta Block 38 in water depths of about 98ft.

Each liquefaction unit will have three platforms consisting of gas processing facilities, utilities and accommodation in addition to the liquefaction train.

NFE wants to use a converted jack-up rig for the first train and fixed platform structures for the second. A second converted jack-up is expected to house feed gas compressors. By using mobile units, pre-prepared in anticipation of permitting approvals, NFE aims to shorten drastically the time taken to produce its first shipments.

Like Grand Isle, NFE’s application to the DoE points to gas supply from the existing Kinetica gas pipelines via the construction of two new pipeline laterals. Both of NFE’s FLNG units will be connected to a single floating storage unit via a flexible, partially-submerged, 220-m cryogenic hose transfer system.

At the time of its application, NFE said it had not entered into any offtake agreements and that it anticipates distributing the LNG either to its downstream terminals or third-party customers. If the company is not dependent on third-party off-take agreements for finance, then it can indeed move quickly, and at least up until 2026, the spot LNG market looks strong as a result of Europe’s gas predicament.

Mexican FLNG unit close to deployment

NFE is developing five ‘Fast LNG’ units, two of which are expected to be deployed offshore Altamira in Mexico, two offshore Louisiana and one on the offshore deepwater Lakach gas field in Mexico.

Although the project timeline has slipped this year, it remains quick by conventional standards and in fact appears ahead of time based on the agreement reached with Sembcorp Marine for the conversion of the two cylindrical Sevan drillships in October 2022. This agreement envisaged delivery of the first unit in the first half of 2024.

NFE said earlier this year, the first unit would be ready in May to move to Altamira in June, which would make it the first operating FLNG project in the GoM, albeit not in US waters. On June 2, NFE announced that it had received an export permit from the Mexican Ministry of Energy for its Altamira Fast LNG unit to export up to 7.8mn mt of LNG through April 2028, sufficient to support production from the 1.4mn mt/yr capacity Sevan Driller.

NFE said earlier this year, the first unit would be ready in May to move to Altamira in June, which would make it the first operating FLNG project in the GoM, albeit not in US waters. On June 2, NFE announced that it had received an export permit from the Mexican Ministry of Energy for its Altamira Fast LNG unit to export up to 7.8mn mt of LNG through April 2028, sufficient to support production from the 1.4mn mt/yr capacity Sevan Driller.

The former drilling rig is based on Sevan SSP’s 650 circular hull design and was originally delivered in 2009 from Cosco Nantong shipyard in China. Conversion of the unit is over 90% complete, according to NFE, which said LNG production off Altamira is expected to begin in the third quarter of this year.

Feed gas will be supplied via TC Energy Corp’s Sur de Texas-Tuxpan pipeline. Mexico’s Comisión Federal de Electricidad will take a share in the production and marketing of LNG. Modular expansion is expected depending on market conditions. The Fast LNG hub will supply gas to multiple CFE power plants in Baja, California Sur, a Mexican state on the Baja California peninsula which lacks pipeline connections to the main Mexican gas grid and US export pipelines.

As a result, it looks like the first operational GoM FLNG project will be in Mexican waters. NFE had hoped to be producing LNG offshore Louisiana in March of this year. However, MARAD stopped the clock on its approval process for the project twice last year and final approval is not now expected until September, providing there are no further delays.