[GGP] What makes Putin’s vision of a Russian-US oil alliance a pipedream

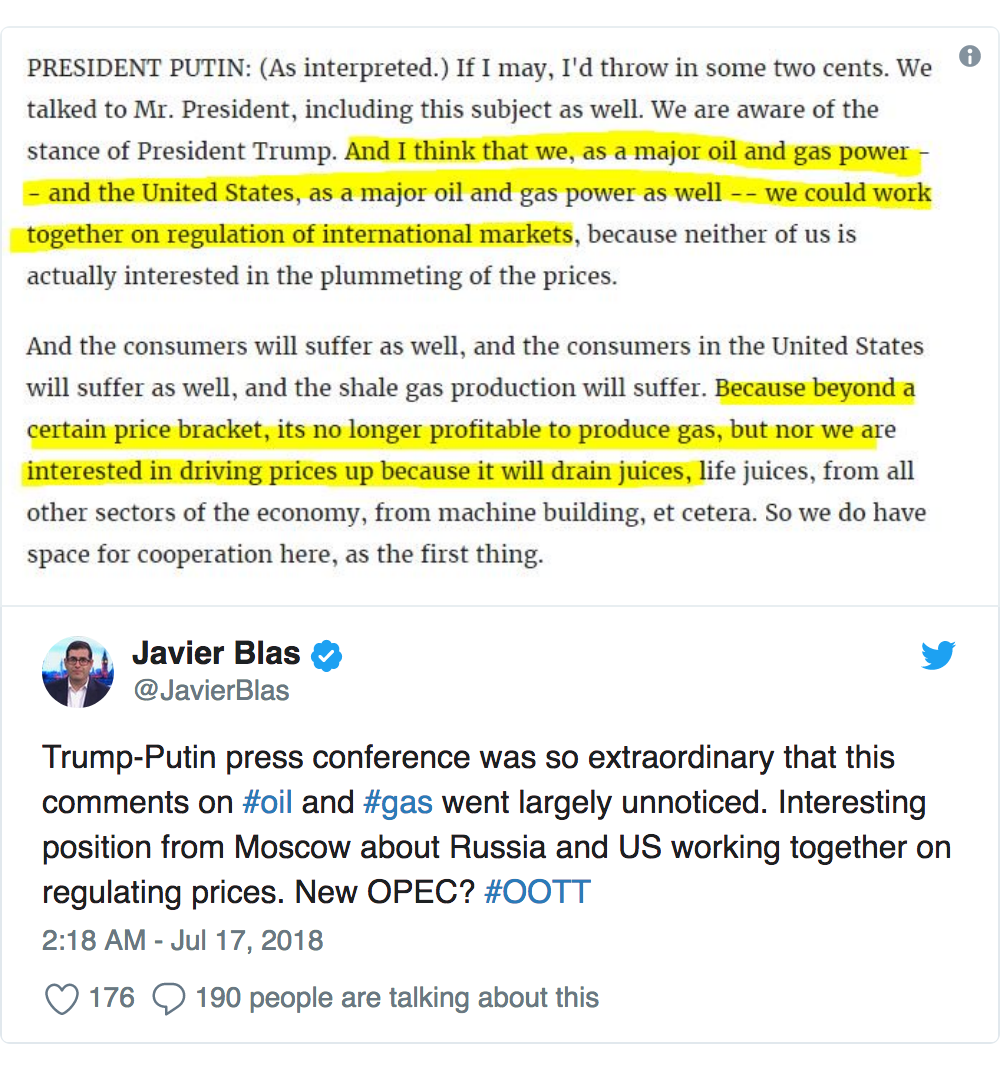

When Russian leader Vladimir Putin addressed the media in Helsinki alongside President Donald Trump, he proposed that their countries “work together” to make oil and gas markets calmer.

Trump didn’t say whether he supported the idea but he repeated his frequent assertion that Russia and the U.S. are competitors, adding, “I think the word competitor is a compliment.”

As a scholar of global energy geopolitics, I can see why Putin might want to forge an OPEC-like alliance between the U.S. and Russia – and how this idea might interest both countries if such alliance were possible. But that is not the case.

No price-fixing

There are two main reasons why Putin’s proposal is a non-starter.

First, there’s no national oil company or monopoly over the industry in the U.S. and the federal government exerts no direct control over crude production as is the case in Russia. Second, forming a cartel with Russia to collude on production levels or pricing would break American anti-trust laws that bar price-fixing.

Putin’s idea is therefore impossible to execute regarding the oil industry, absent a government mandate, which would require an act of Congress and a host of new regulations.

As for natural gas, I believe that this concept is even more far-fetched. Natural gas does not trade in the same way oil does in the global markets, making OPEC-like arrangements extremely unlikely between any countries. Besides, as I have explained before, the U.S. and Russia are beginning to compete in that industry.

A Goldilocks industry

Even so, this proposal shines a light on the complex interplay among oil prices, global economics and national energy policies.

Because they depend heavily on the money they make from oil exports, the governments of OPEC members like Nigeria and Qatar and Russia have tried to keep prices stable and at the kinds of levels that can keep demand robust while generating enough revenue to cover their budgets. OPEC stands for the Organization of the Petroleum Exporting Countries, after all.

The calculus is not easy but simply put: when oil prices rise, they make other things cost more. In general, when prices rise too much, demand decreases. That slows the economy, eventually lowering crude demand and prices.

When prices do fall, importing countries may welcome cheaper oil. But drastic reductions hurt oil-exporting nations, sometimes triggering global economic troubles that hurt everyone.

In short, all governments benefit when oil prices are relatively stable, regardless of whether their policies toward that goal are determined by market forces or steered by the state.

Not only price levels but also their stability matters

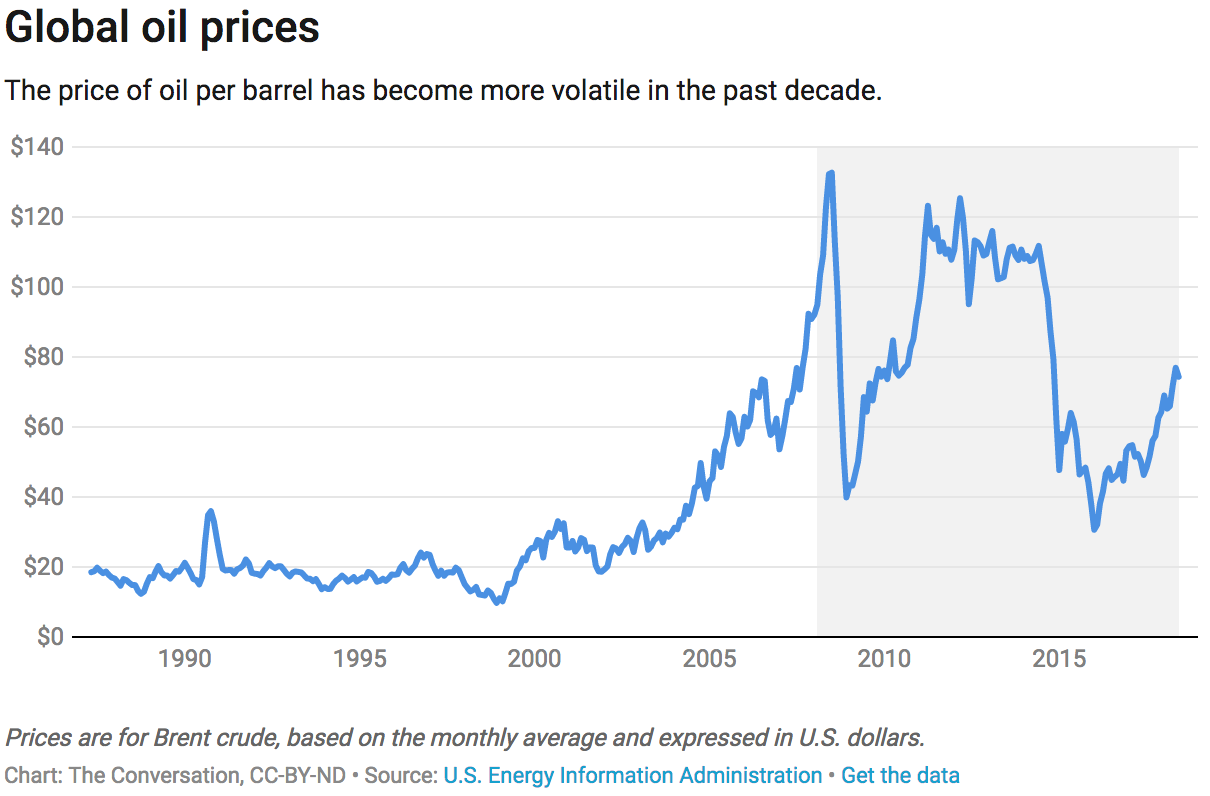

To be sure, the roller coaster that crude prices have been on for the past decade has been hard on oil exporters and oil importers alike.

Oil prices plummeted to only US$33 per barrel in December 2008, after hitting record highs of $147 the prior summer. Then, they soared again, generally remaining above $100 a barrel between 2011 and mid-2014, only to tumble down all the way to about $30 in January of 2016.

Oil prices have gradually rebounded by now thanks to more vigorous global economic growth and supply constraints stemming from production outages due to political and social upheaval in countries like Venezuela, Libya and Iran

In addition, deliberate production cuts orchestrated by a set of collaborative agreements between OPEC and Russia have been increasing prices and reducing volatility.

Russia and OPEC members’ heavy reliance on oil export earnings, together with their ability to control their oil production, makes them natural partners for a cartel-like arrangement.

Decisions that disrupt oil markets sometimes serve geopolitical considerations. For example, the 1973 OPEC embargo occurred when oil-rich OPEC nations suspended their crude sales to the U.S. to punish it for backing Israel.

As my colleague Gabriel Collins has found, Russia has often disrupted its supplies of natural gas and oil, most recently in Ukraine, Poland and Slovakia, to influence other countries’ policies.

When prices drive production, not government fiats

The situation is dramatically different in the U.S. Here, since the early 2000s, hydraulic fracturing technology together with advances in horizontal drilling have brought about a U.S. oil and gas production boom.

As a result, the U.S. has ratcheted down its crude imports, ended its ban on crude exports and began to export some of the oil it drills.

According to International Energy Agency chief Fatih Birol, the U.S. will account for 80 percent of world’s oil supply growth through 2025. That being said, the U.S. still imports crude, which in 2017 accounted for 19 percent of total petroleum consumption.

I believe these oil imports will continue as long as U.S. refineries remain equipped to process the heavy and sour crude that comes from other countries, rather than domestic varieties. Moreover, its huge national market makes it virtually impossible for the U.S. to become a net exporter like OPEC members and Russia.

Also, all American oil companies – from oil majors like Chevron and ExxonMobil to mom-and-pop fracking operations – are privately owned. They decide how much fuel to produce, free from direct government influence. Their main concern is profits, not boosting the government’s budget or furthering geopolitical goals.

U.S. businesses are also explicitly forbidden by an antitrust law known as the Sherman Act from colluding on production targets as this is equivalent to price fixing.

The federal structure of the U.S. government additionally complicates the picture. Individual American states play a big role in oil and gas regulation.

Furthermore, if any cartel-like actions by the U.S. were to hike oil prices, American consumers would suffer since the country remains a net oil importer.

What the U.S. can do

That said, the federal government does have some tools at its disposal that can indirectly have an impact on oil and gas production and prices.

For example, the U.S. could tap into emergency oil stockpiles stored in salt caverns along its Gulf Coast, also known as the Strategic Petroleum Reserves. The government created this stashing system following the 1970s oil shortages to provide temporary relief when the need arises.

The Trump administration has been considering this move to counter a recent uptick in gasoline prices. But any oil sold this way would probably have short-lived effects as the supply is limited.

Second, Trump can, as he recently did, ask Saudi Arabia to increase its crude production. This reflects the special relationship between the two countries that dates back to the Carter administration.

Lastly, Congress can play a role too. For example, it can impose restrictions on production or even restore the ban on oil exports that the U.S. lifted in 2015. However, I believe that the prospect of imposing higher prices via a government program is a non-starter since the number of states that consume more oil than they produce far exceeds the number of states that produce more than they use.

Perhaps the clearest sign that any openness on Trump’s part to joining forces with Russia in some kind of new OPEC-like alliance would go nowhere is some pending legislation in Congress.

The House Judiciary Committee has approved a bipartisan proposal to expand U.S. antitrust law. The No Oil Producing and Exporting Cartels Act, or NOPEC, would subject foreign oil cartels to U.S. antitrust laws. And a bipartisan group of senators recently introduced their own NOPEC bill within days of the Trump-Putin summit.

Anna Mikulska

Anna Mikulska is a Nonresident Fellow in Energy Studies, Baker Institute for Public Policy, Rice University

Originally published at The Conversation

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.