[GGP] Natural Gas Hubs in Asia Pacific Region: A Bi-Product of National Gas Developments

Natural gas consumption and its importance are growing as a result of economic development, increasing popularity and role of natural gas as a cleaner fuel in the Asia Pacific region. To facilitate the development of natural gas market, natural gas market reform is being conducted in line with or as a part of energy market reform. In accordance with energy market reforms and the rising liquefied natural gas (LNG) trading volume in the Asia Pacific region, three countries – Singapore, Japan and China – are working towards establishing LNG hubs. Countries in Asia are increasingly expressing intentions of having own LNG trading hubs rather than indexing natural gas price for international trades to oil products or hubs in other continents. While it does not guarantee lower price and natural gas exchanges in this region are only in the fledgling stage, various efforts and pilot projects are being conducted together with government policy supports. Having a regional or global gas/LNG hub can have not only symbolic meaning but also important economic influence on the development of natural gas market in the country and in the region. Multiple countries are aspiring to be regional natural gas hubs in Asia. However, the market situation in Singapore, Japan and China are most suitable for it and they have the clearest intention and government policies for the realization of functioning gas hubs.

INTRODUCTION

TThe price of natural gas is one of the most fundamental features of the market. The price is crucial for ensuring that natural gas resources are effectively developed and distributed; it provides a signal to producers about the need/opportunity to invest in upstream development, and it provides a signal to the consumer about the competitiveness of natural gas against other fuels. It is generally perceived that a market exchange provides the most consistent way of price discovery in the natural gas market. Importantly, all currently functioning natural gas trading hubs (spots where deals are attributed), such as Henry Hub in the US, TTF in the Netherlands, and NBP in the UK, all developed based on physical pipeline infrastructure. At present, there is no single platform that deals purely with liquefied natural gas (LNG) trading. This makes the future development of the Asia Pacific market a very interesting case, which potentially can bring about a fundamental change in natural gas trading on a global scale.

Natural gas trade in the Asia Pacific region is characterized by large volume of consumption and high dependency on imports. But what makes it essentially different from the North American or European market is the dominance of LNG trade flows compared to the volume of natural gas traded by pipeline. This has both geographical and historical reasons: while in some cases building pipelines is not viable because of the distance (for example, to bring gas from Algeria to Japan), in others this is due to political reasons (for example, between Russia and South Korea via the territory of DPRK). The basic instrument of natural gas trade in the region is bilateral long-term contracts, which were concluded by major Asian players such as Japan, South Korea and Taiwan for periods of up to 20-30 years, the prices of which are largely indexed to crude oil prices. This mechanism prevails in the regional natural gas trade today.

Market changes observed in Japan, China and South Korea demonstrate the increase of importance of competitive mechanisms on the national levels. This may well have spillover effect on the regional market and lead to the formation of a regional gas trading hub. In this article, we will look at four countries in the East Asian region (Japan, China, South Korea and Singapore), their roles and the possible benefits in the creation of a natural gas hub.

Natural gas hubs and exchanges in the Asia Pacific region

We see definitive interest toward finding a regional price index. The motivations behind this interest are two-fold. Firstly, all three importers are interested in a price index that would be independent of the oil price movement. In Asia, where natural gas supply is traditionally dominated by LNG (90% LNG and 10% pipeline) and natural gas price is indexed to oil, expensive LNG resulting from high oil price early this decade motivated discussions on transition to market based regional LNG pricing system. Secondly, it is important for LNG buyers to be able to purchase natural gas from the spot market to cover seasonal peaks and other unforeseeable peaks in demand. A liquid regional natural gas trading hub providing a price index as well as the opportunity to conclude spot deals and hedge risks would be a solution to both of these motivations.

However, despite the fact that prominent players are interested in the possibility to purchase gas from a hub within the region, the viability of setting up such a hub is rather limited. Below we will review the hub launching potential in three jurisdictions: Singapore, Japan, and China.

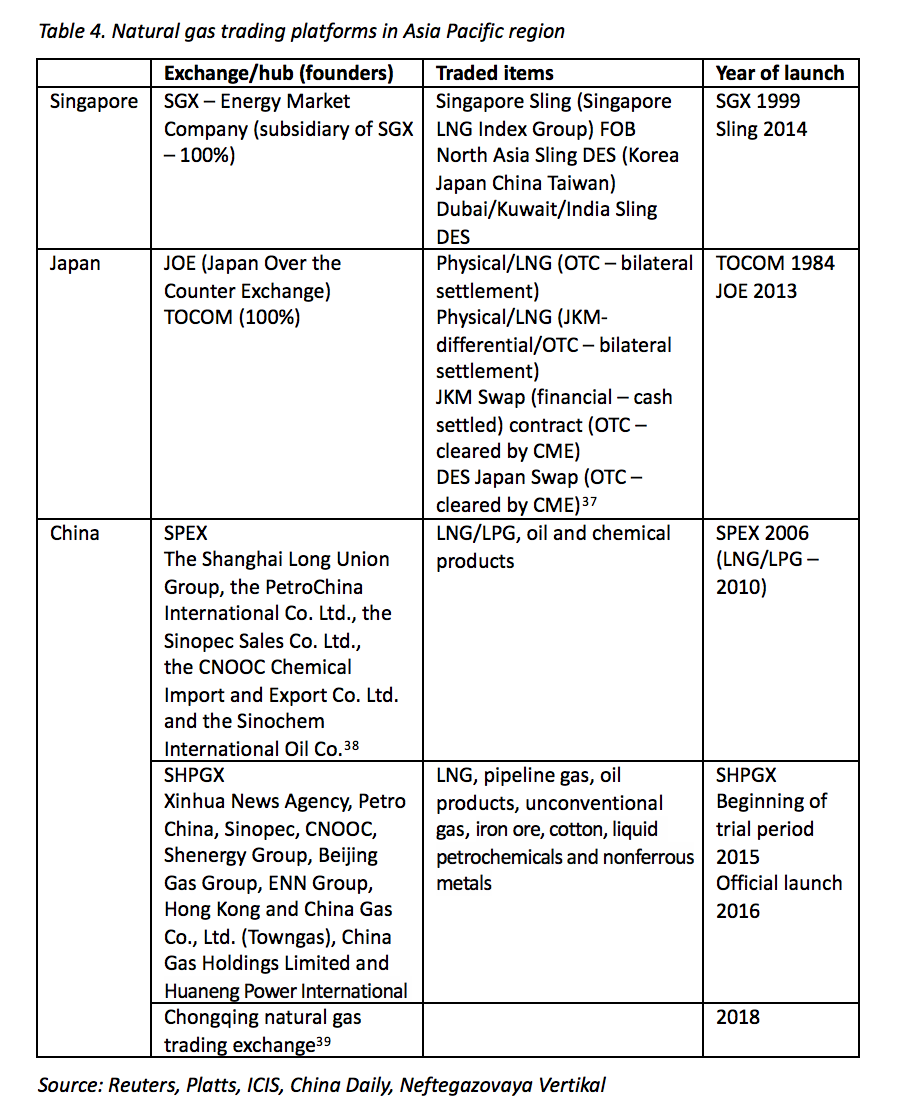

Singapore

Singapore is already one of major oil trading and financial hubs in the world. It is also located on route of a significant part of the LNG deliveries to the Asia Pacific region (those that originate in the Middle East have to pass through the Malacca strait). It is quite logical that if LNG importers want to find a spot convenient to attribute their deals to, Singapore serves as very handy choice due to its geographical location and trading infrastructure. Moreover, existing energy trading companies and financial institutes in Singapore provide a favorable business environment for the development of a natural gas hub. The Singapore Exchange (SGX), which has been serving as a trading platform for a number of commodities since 1999, started trading LNG under the ‘Sling’ category (abbreviation of SGX LNG Index Group) in 2014. The Sling spot LNG price index has three categories: Singapore Sling FOB, Northeast Asia Sling DES and Dubai/Kuwait/India Sling DES. At the SGX, bilateral over-the-counter trades are conducted and cleared. LNG futures and swap deals at the SGX are tied to Sling spot price index. However, the volume of trades on the SGX is relatively small, while Japan and China are working on launching their own exchanges instead of trading in Singapore.

Japan

In 2016, the Japanese government officially announced a policy of de-linking the LNG price from crude oil prices in favor of an LNG pricing mechanism, based on the Japan Over-the-Counter-Exchange (JOE), which was established in Tokyo in 2013. JOE aims to be an international platform for LNG trade by the early 2020s. Originally, it was a joint company of the Tokyo Commodity Exchange (TOCOM, 60%) and the Singaporean group GINGA (40%) but since April 2017, JOE has become a 100% subsidiary of TOCOM. At the time of creation, JOE did not have a lot of support from Japanese companies, since these had enough long-term contracts to supply their customers and therefore, trading activity has thus far been low. Indeed, the first deal was concluded in July 2015, which was almost a year after the introduction of the LNG trading in 2014. In April 2017, JOE launched physical and cash-settled swap contracts based on the JKM DES (Japan Korea Marker, a price assessment published by Platts; DES stands for ‘delivery-ex-ship’).

Japan faces the problem of a high degree of contracted demand on its way to introducing a gas trading hub. An active entrance to the spot LNG market was caused by the Fukushima accident. Currently however, in the context of nuclear power plants re-start, the only way to change prevailing pricing mechanisms for natural gas is to negotiate a shift from JCC indexation to alternative formulas within the already existing long-term contracts. Overall, Japan so far does not use spot indexation itself as a result of the share of long-term contracts in overall demand as well as the absence of adequate local indices. Therefore, the chances of Japan providing a regional benchmark in the short and mid-term future are rather low.

China

Many consider China to be the most prospective candidate for the role of Asian LNG hub thanks to its considerable volume of indigenous natural gas production and its diverse import sources such as LNG and pipeline imports.

China houses the very first platform in the Asia-Pacific region that started trading LNG: the Shanghai Petroleum Exchange (SPEX). It was established in 2006 by several Chinese state oil companies (CNPC, Sinopec, CNOOC) and originally facilitated the trading of crude oil and petroleum products. SPEX started to trade LNG and LPG in 2010, but these trades have continuously lacked liquidity.

Despite being the first, SPEX is not the only exchange in China dealing with energy products. Pipeline gas, LNG and oil products are also traded at the Shanghai Petroleum and Natural Gas Exchange (SHPGX). SHPGX was formed within the framework of a strategic alliance between Xinhua News Agency and the NDRC, thus its status among Chinese exchanges is rather special because of the state support. The SHPGX was officially launched in November 2016, after 16 months of trial operations. During the first 10 months of operation, the volume of pipeline gas trading reached 15,4 bcm, whilst LNG trades reached 1,32 bcm. The trading volume of natural gas (including both physical and cash-settled contracts) reached 50 bcm in 2017. These figures indicate that the SHPGX has the potential to become the most liquid natural gas exchange in Asia and this trading platform does indeed seek to position itself as China's main natural gas trading hub, similar to Henry Hub in the US or the NBP in the UK. There is also a potential of becoming the single most important natural gas trading platform in the Asia-Pacific region. However, it now it has a potential competitor in Chongqing.

The Chongqing natural gas trading exchange is the newest among the Chinese exchanges dealing with natural gas. The city of Chongqing is located in the province of Sichuan, where the largest shale gas production site in China is located. Also, the province is connected by a pipeline with Myanmar and potentially with LNG routes bypassing the Malacca strait, through a regasification plant under construction in Myanmar and an already functioning pipeline. Trunk pipelines from Central Asia also reach this province. The Chongqing natural gas exchange was created in 2017, and its functioning is targeted at the creation of a Chinese natural gas price index that would have regional prominence and help to create a proper price benchmark.

At the same time, China also faces many challenges to provide competitive and free trade of gas at wholesale market. Overall, China’s potential of hosting a natural gas trading hub is stronger than that of Japan. Given the higher volumes and strong continuous increase in gas demand in China, there is every reason to assume that at least one of the hubs developing there now has the potential to become the most liquid hub in Asia.

Republic of Korea

South Korea does not aspire to be a global or regional LNG hub or exchange. Even if it had such ambitions, at the moment, it does not look likely that they could be realized. A low level of liberalization of the domestic natural gas market and a lack of competition in the wholesale market hinder the establishment of a natural gas hub. KOGAS is the sole seller in the wholesale market. The existence of a monopolist does not allow competition to create a hub or exchange in the country.

The best candidate?

In all of the potential hubs discussed above (and summarized in Table 5), there is a problem in terms of a lack of liquidity. Essentially, this means that it is not easy to conclude the sales-and-purchase agreements. But it has to be stressed that this is not unique for the Asia Pacific region: LNG trade is also less liquid than pipeline network–based deals in other regions. Asian Pacific players are conducting a unique experiment, and its outcome in the form of shaping a hub will have global implications. In this regard, China has a relative advantage over Japan and Singapore because of the following factors:

1. All of the potential hubs in China have both LNG and pipeline supplies;

2. The trade volume of the Chinese market is the largest out of all the countries in the Asia Pacific region;

3. The government makes consistent steps to liberalize the market and introduce competitive pricing;

4. The pipeline network in this country is integrated and connects different regions not only inside China, but also across Asia (including Central and Southeast Asia).

Table 1. Natural gas trading platforms in Asia Pacific region

CONCLUSIONS

Three Northeast Asian countries, Japan, China and the Republic of Korea, are the world’s leading importers of LNG. All three countries have transformed their domestic natural gas markets in order to have more competition. Their national efforts may well have a spillover effect on the regional market, since LNG buyers are increasingly expressing intention to move away from oil indexation toward a pricing principle that would reflect market conditions in the natural gas market (instead of the oil market). This naturally creates the demand for the launch of a regional natural gas trading hub. In this context, gas exchanges have been launched in Singapore, Japan and China. When looking at these exchanges, we can conclude the following:

• Japanese companies have large volumes contracted and because of that they have not been able to engage in trading at the newly created hub in Japan. LNG buyers plan to get rid of oil price indexation in long-term contracts, so a functioning hub that provides a price benchmark (whether in Japan or in another location in the Asia Pacific region) is definitely within their interest.

• Singapore meanwhile seeks to become the center of physical trades of LNG at the regional and global level. Its position as an established oil trading hub and the existence of a high number of energy companies and financial institutions in the country can help to strengthen its position as an LNG trading center.

• China has several potential hubs. One of them is the Shanghai Petroleum Gas Exchange (SHPGX), which aims to position itself as the main natural gas hub in China, and later to become an international platform for the pricing of hydrocarbon resources in the Asia Pacific Region. Initial results show that the SHPGX is producing more positive results than other exchanges in the region. Another potential hub is the Chongqing Natural Gas Trading Exchange, which is a newly created entity with large ambitions and potential as well. Many consider that China is the most prospective candidate for the role of becoming an Asian gas hub thanks to its considerable volume of indigenous natural gas production and its diverse import sources such as LNG and pipeline imports.

Lack of liquidity is a characteristic of all the potential hubs discussed in this paper. It should be noted, however, that there is no other place in the world where LNG trading is more active than in the Asia Pacific region but that there is not enough trading activity to support LNG hubs in the global market overall. This is due to the difficulties of transportation and storage related to this fuel; the large capital investments required in LNG infrastructure restricts the number of market participants. Therefore, it can take more time for the LNG market to develop compared to the oil market, for example, and the path to a liquid and reliable LNG trading hub is complicated and unpredictable. However, thanks to a number of advantages of natural gas (such as being the cleaner fossil fuel and its price-competitiveness as a transportation fuel), LNG trading activities will continue to grow, and the role of LNG hubs will strengthen over time.

Read the Related Article by Jinsok Sung and Irina Mironova: Natural Gas Market Reforms in East Asia: Motivation, Development and Consequences

Jinsok Sung, PhD candidate at Gubkin Russian State University of Oil and Gas and researcher at Working Group “Small Scale LNG” at the Energy Center of Moscow School of Management SKOLKOVO. Jinsok’s doctoral dissertation is titled “Development of LNG market and comparative analysis of two natural gas pricing mechanisms in the North East Asia”. His research focuses on energy markets, especially natural gas and LNG markets. Address for correspondence: jinsok.sung@gmail.com, jinsok.sung@gubkin.ru

Irina Mironova, Editor-in-Chief of the ENERPO Journal and other publications of the ENERPO Research Center. She is pursuing her PhD in Energy Economics. Irina has previously worked in research at the Energy Research Institute of the Russian Academy of Sciences, the Russian Center for Policy Studies, Energy Charter Secretariat, Clingendael International Energy Programme. Teaching experience includes ENERPO (Energy Politics in Eurasia MA Programme at the European University at Saint Petersburg), Venice International University, OSCE Academy in Bishkek, Saint Petersburg State University of Economics. Address for correspondence: imironova@eu.spb.ru

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.