[GGP] Lebanon's first offshore oil & gas exploration round: Challenges & Opportunities

Lebanon is advancing plans to develop its natural gas fields. After four years of delays the Lebanese Government awarded last month licenses to a consortium consist of Eni of Italy, Total of France and Novatec of Russia to explore for oil and natural gas in Blocs 4 and 9 of its exclusive economic zone (EEZ). That Consortium was the only one among 51 prequalified groups that submitted bids in the long due international exploration tender of the Lebanese Government. The following analysis attempts to assess the economic benefits gas discovery would bring upon Lebanon, as well as the destabilizing factors that threaten the success of this project. The author asserts that political and security stability are prerequisites for international investments in the gas sector and for successful exploration. In order for the State and the People of Lebanon to enjoy the fruits of its natural resources, it must reconsider its approach to outstanding disputes and take steps towards peaceful resolutions. Continued aggressive declarations and actions on behalf of Hezbollah may result in loss of billions of dollars in revenues to the people of Lebanon.

For more than four years, the oil and natural gas fields in Lebanon's EEZ have remained untouched. Internal political turmoil, the war in Syria, and tensions with Israel have created conditions of domestic and regional instability that have continuously delayed the bidding process. The recent exploration license award for ENI’s lead consortium is a positive sign that this may be about to change. Successful natural gas discoveries and resource development could bring Lebanon natural gas supply as early as 2025, a reality that has the potential to boost economic advancement, yield billions of dollars in government revenues and improve the quality of life to the average citizen. However, the factors contributing to geopolitical instability in Lebanon remain largely in place, threatening the exploration of an economic gold mine that could greatly improve the lives of the Lebanese people.

Although the Lebanese Petroleum Agency began the prequalification process for potential operators and partners in 2013, the advancement of further stages was made impossible by a political deadlock that continued for almost four years. Following the end of President Michel Sleiman's term in 2014, the divided parliament repeatedly failed to elect a replacement, leaving the country without a president until late 2016. Without a president, the parliament was unable to pass the necessary legislation for the natural gas development process to resume. In addition, regional instability caused by the civil war raging in neighboring Syria further hurt prospects for the continuation of the bidding process.

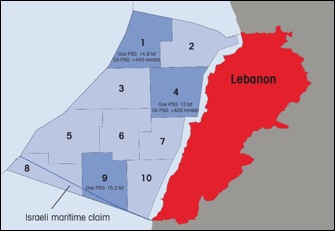

In January 2017 the government approved two decrees intended to advance the natural gas licensing procedure. According to these decrees, the Lebanese EEZ was divided into 10 blocks and the qualifications were set for determining which companies would be eligible to participate in the bidding round. Fifty-one international companies, including all of the companies that qualified in the 2013 prequalification process were approved to participate in the tender, 13 of them as operators. Among the qualified companies are leading American and European operators such as Exxon Mobile, Chevron, Shell, Eni, and Total. Nevertheless, only one group submitted proposal and got licenses and will be able to begin exploring for oil and gas fields, which are estimated to be of enormous worth.

According to a seismological-geophysical survey conducted in 2014 by reputable international companies for the Lebanese government, the Lebanese economic waters contain 25 trillion cubic feet (TCF) of "conditional" natural gas reserves as well as hundreds of millions of oil barrels. The recent natural gas discoveries in the EEZs of Cyprus, Egypt, and Israel reinforce the Lebanese government's hope that Lebanon’s EEZ could also be rich in oil and gas. The enormity of the economic surge that such discoveries would bring to Lebanon must not be understated.

In an optimistic scenario of gas exploration and discoveries, we estimate that the investments in exploration and development of the gas sector and the energy market following gas discoveries in Lebanon in the years 2018-2030 can accumulate to $9-14 billion. This includes investment in oil and gas exploration of $1-$2 billion, development of gas fields in the range of $2-6 billion, and investments in the development of infrastructure for transmission and distribution of gas in Lebanon and conversion of power stations to natural gas of $5 billion.

An investment of this size would considerably alter the state of the Lebanese economy, positively affecting both the state and the individual. Utilizing domestic energy resources could lead to significant improvement in Lebanon's balance of payments by saving foreign currency previously used for import of oil for electricity production totaling $1-2 billion a year (assuming oil prices of $50 and $ 100 per barrel, respectively).

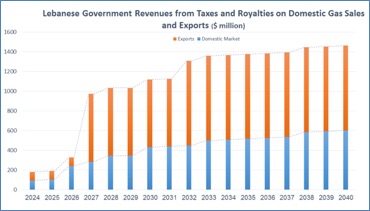

Furthermore, the government will gain revenues from taxes and royalties from gas sales to the Lebanese market, amounting to some $85 million per billion cubic meter (BCM). Tax revenues in 2025 will total about $90 million and will increase to about $600 million per year by 2040. The cumulative revenues from gas sales to the domestic market in the years 2025-2040 could be about $7 billion. In addition, the state would gain from reciprocal procurement of international companies in Lebanon. Accordingly, the international companies chosen to operate and develop the gas fields will be required to make reciprocal purchases and investments in Lebanon at a rate of 10% to 20% of their investment, which will yield additional hundreds of millions of dollars in revenues to the Lebanese economy;

According to our assessment, domestic demand for natural gas is expected to grow from 1.1 BCM in 2025 to 7 BCM in 2040, mainly for electricity generation, as well as for industry, transportation and other uses. In light of this, Lebanon can enjoy strategic and energy security benefits from switching to use of locally produced energy, which will reduce dependence on oil imports. Conversion of the country’s power plants from the use of heavy fueloil and diesel to natural gas will result in savings of $400-600 million per annum in electricity production costs, assuming that the price of a barrel of oil is $50 on average. If the price of oil rises to $100 a barrel, the savings in converting power stations to gas will rise to about $1.5 billion a year. The savings will enable the government to drastically reduce the large subsidies it provides to electricity consumers.

Yet another source of economic gain for Lebanon could come from potential revenues from gas exports. By becoming a gas exporter, Lebanon can both multiply its profits and improve its geopolitical status, enabling it to cooperate with the countries of the region and take part in international projects. Should significant natural gas reserves of more than 5 TCF be discovered, Lebanon may be able to export natural gas to countries in the region and possibly to Europe as well. Assuming exports of 1 BCM per year in 2025-2026, 8 BCM per year in 2027-2031, and 10 BCM per year in 2032-2040, revenues to the Lebanese government from direct taxes and royalties could reach $850 million per year and a cumulative $11 billion in the 2025-2040 period. Exports can be made to the following markets: (1) Export to Syria, Jordan and Egypt can be made by diverting the flow of the "Arab pipeline" that already reaches Tripoli; (2) Export to Turkey (the region of Ceyhan in southeast Turkey) and through it to Europe can be accomplished through the construction of a pipeline through Syria's economic waters; (3) Export to Europe can also be done via the East MED Pipeline planned from the eastern Mediterranean (Israel, Cyprus) to Greece and Italy. We estimate that this pipeline will be built within 15 years by international companies that will purchase gas from various suppliers in the region. Another potential option for gas export to countries in South Asia and Europe is the export gas in liquefied form (LNG). In this manner, exports can be done via construction of floating LNG (FLNG) facilities in Lebanese waters – a new innovative technology, or through the establishment of landfill facilities in Lebanon or Cyprus, in cooperation with the countries in the region. It should be noted that the cost of offshore or land-based facilities is estimated at $5-10 billion, and it is not expected that this will be economically feasible in the coming decade given the expected supply surplus of LNG in international markets and low LNG prices.

As for the citizens of Lebanon, they could benefit greatly from successful gas discoveries. The development of the gas infrastructure will lead to an increase in employment and demand for thousands of local workers in order to construct pipelines, convert power stations and factories to gas, and perform marine and logistical services for the drilling companies. The gas sector also has a high economic multiplier of 1.5-2, so that every dollar in income from employment contributes to demand of an additional $1.5-2 in the economy. Natural gas would also grant a competitive advantage to local industry over imports, by reducing the cost of domestic production due to the decrease in fuel prices. Lastly, considerable environmental and health benefits will be felt in the reduction of air pollution currently caused by the use of fueloil and polluting diesel in electricity generation and industry, as well as in the reduction of carbon dioxide emissions.

Natural gas discoveries could alter the economic future of Lebanon, but it is not without obstacles. Security stability and regulatory stability are necessary conditions for attracting international companies to invest in oil and gas exploration in Lebanon. These conditions are also crucial for the development of the country's gas infrastructure and export projects and for gaining the economic, strategic and geopolitical benefits mentioned above. It should also be noted that the investments required for deep oil and gas exploration are very high ($70-150 million per drilling) and international companies will refrain from investing in countries where they fear high security risk or regulatory risks. Thus, the Lebanese government should have a supreme interest in ensuring stability and resolving outstanding conflicts with its Southern neighbor Israel.

Another important issue that is rarely discussed is the division of future profits from gas sales. Given Lebanon's political structure and dynamics, it is highly likely that there is already talks or possible nontransparent agreement between political parties in Lebanon regarding the distribution of revenues in a manner that optimize their interests. The big fear is that the Lebanese citizens will not reap the benefits.

Unfortunately, a number of factors currently at play threatening the required stability for successful exploration process, and with it, Lebanon's prospects for prosperity.

The most direct threat to international investment in gas exploration is an outstanding conflict on the maritime border between Lebanon and Israel. Three out of Lebanon's ten natural gas blocks are located in this disputed area (Blocks 8, 9 and 10, altogether totaling 854 square kilometers). Negotiations to resolve the dispute were conducted by the US State Department earlier this decade. Those negotiations were resumed lately, but the deal that was proposed by the U.S. envoy was reportedly rejected by Lebanon. Instead, Lebanon chose to offer the three disputed blocks for tender, sparking an outcry from Israel. The Lebanese government justified its choice of which blocks to offer by claiming that these simply had high potential for discovery. However, expert assessments claim that through this act, the government was rejecting negotiations as a means of resolving the dispute and unilaterally claiming these blocks as part of its EEZ. Regardless of its motivations, it is likely that international companies will refrain from exploration in the disputed areas. It follows that most of the area Block 9, which have high probability of discovery, will not be explored as long as the maritime border between Lebanon and Israel is not agreed upon. Additionally, Lebanon's decision to offer these disputed blocks intensified an already volatile conflict with Israel, further threatening the stability it needs to get international investments.

Another factor that poses a severe threat to stability on the Lebanon-Israel border is the presence and influence of Hezbollah in Lebanon and its government. Regular statements by Hezbollah's leaders intentionally provoke Israel and threaten it with an imminent war. Of particular concern is Hezbollah Secretary General Hassan Nasrallah's statement in February 2016 that "A few missiles on a few ammonium plants equals the same amount of death as an atomic bomb." In early 2018 Hezbollah also threatened to attack Israeli gas facilities as “punishment means” against Israel in case it will threatened Lebanon’s gas exploration. This indicates the heightened vulnerability of civilian infrastructure, and the potential that such targets will be hit in a future war. It also serves as a large deterrent for international companies looking to invest in such infrastructure in the region.

Hezbollah further threatens stability with its consistent violations of UN Security Council resolutions 1559 and 1701, which prohibit armed militias in Lebanon, and specifically Hezbollah's accumulation of weapons and presence south of the Litani River. Over the past few months, Israel has revealed intelligence information proving Hezbollah's presence along the border, even under the civilian cover of nonprofit organizations such as Green without Borders.

A serious debate about the effectiveness of these resolutions has persisted through recent months and called into question the ability and will of the Lebanese government to subdue Hezbollah and prevent it from carrying out reconnaissance missions along the border. On the contrary, it is clear that factions in the current government, including Lebanese President Michel Aoun, support and defend Hezbollah. Aoun, who is a member of the Hezbollah aligned coalition, stated in February 2017 that "The resistance's [Hezbollah] arms are not contrary to the state project; otherwise we could have not tolerated it. It is an essential part of Lebanon's defense." Even Lebanese Prime Minister Said Hariri, a member of the Hezbollah-opposed March 14 coalition, stated as recently as September that "Hezbollah is present. It's in the government and it has support in the country." With the tacit approval of the Lebanese government, Hezbollah has a free hand to continue inciting against Israel and building its arsenal for a war against Israel.

In our assessment, Western oil companies will find it difficult to make investment decisions in exploration and development of reservoirs under conditions of high security tension between Lebanon and Israel, especially if there is a growing fear of fighting between the two countries. Therefore, a calm political atmosphere, a reduction in rhetoric against Israel and indirect understandings between the Israeli and Lebanese governments, as well as Hezbollah, regarding mutual non-aggression are an important factor that will assist in the momentum of gas exploration and development of reservoirs in Lebanon.

In sum, Lebanon has a high economic-strategic incentive to reach an agreement with Israel regarding border demarcation and cooperation through international companies for the collaborative development of joint reservoirs. Israel, a country that also has a vested interest in regional stability, should express willingness to continue negotiations with Lebanon on this matter, and on the decreased influence of Hezbollah in Lebanon. The US government, for its part, must serve as an unbiased mediator in order to bring Lebanon and Israel to a fair agreement on this issue. All countries involved would benefit from such a resolution, which would bring Lebanon one step closer to developing its natural gas resources and becoming a major player in the industry.

Dr. Amit Mor is the CEO of the Tel Aviv based Eco Energy Financial & Strategic Consulting firm. He also serves as a Senior Lecturer for Energy Economics and Geopolitics at the Herzliya Interdisciplinary Center and at the Technion

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.