Emerging Economies And The New Energy Security Agenda – Analysis

Theme:

The influence of the emerging economies on the energy markets is becoming as important as that of the developed economies. The new energy security agenda to be implemented in the coming years will have to deal with this scenario.

Summary:

This paper explores the implications of the rise in the importance of the emerging markets in regard to energy security. The emerging economies have become not only key players in the international political arena and in the global economy, but also in the energy markets. The new scenario implies that developed countries, coordinated by the International Energy Agency (IEA), must actively cooperate with new emerging powers such as China and India (and others). This is the only way for consumer countries to create an efficient energy security policy. From the supply side, this paper also suggests that Russia is the cornerstone of the world’s energy supply and that the Organisation of Petroleum Exporting Countries (OPEC) continues to play the most important role in the oil markets, as it has done over the past 40 years.

Analysis:

Daniel Yergin (2011) points out that the concept of security of supply, regarding energy, appeared on the eve of the First World War.[2] The then First Lord of the Admiralty, Winston Churchill, took the crucial decision to make the Royal Navy faster than its German opponents by switching from coal to oil. Coal was produced in Wales, while oil was produced in Persia. As a result, securing the oil supply became a key element of the UK’s global security strategy. Churchill’s solution to this new issue was to ‘diversify’ energy supplies and sources, and this remains the guiding principle of energy security policy.

In this respect, the concept of energy security has been described by the International Energy Agency (IEA) as ‘the uninterrupted physical availability at a price which is affordable, while respecting environment concerns’, a rather lax definition that arose during the first oil crisis.

In 1973 some of the Arab members of the OPEC decided to use energy as an economic weapon, decreeing an oil embargo on the US and other western countries to counter their support for Israel during the Yom Kippur war. As a result, oil prices soared from US$2.50/bbl to US$11.60/bbl, a 350% increase in only two years, with a grievous impact on the world economy: world GDP growth fell to only 2.5% in 1974 and 1.5% in 1975, compared with 5.1% in the previous decade.

The IEA was created as a result of this first oil crisis. The Agency’s main aim was, and continues to be, to provide the developed countries with a collective and coordinated response to a potential disruption of their energy supply that might be caused either intentionally or merely as the result of an accident. Furthermore, members of the IEA are required to hold a strategic petroleum reserve equivalent to 90 days of net imports. But, at present, energy security represents much more than just oil. This is why the IEA takes into account other types of energy, such as natural gas and electric power generation, and, lately, the energy mix.

Forty years after the first oil crisis, security of supply is still a key issue on the international agenda. In 2011 the civil war in Libya, along with its effect on the oil markets, forced the IEA to engage in collective action to soften its impact on the global economy. Thus, some of the Agency’s members released 60 million barrels of oil (or petroleum products) in the market, preventing a further rise in oil prices.[3] Moreover, in early 2012 the world watched uneasily as the tension rose in the Straits of Hormuz, the energy system’s main chokepoint. Western countries, specifically the EU, have declared an oil embargo on Iran, while the latter has increased its military presence in the Straits. According to the IEA, around 17 million barrels of oil and 2 million barrels of petroleum products cross the Straits daily, accounting for 20% of world oil production.

In the current context, it appears that energy security and security of supply are, to say the least, as important as they have been in the past. However, the economic and political environment that shapes the design of energy security has greatly changed since the first oil crisis. Furthermore, many experts point out that the new political and economic equilibriums make this concept much more relevant today than it was in the past.[4] This is precisely the main idea of this paper.

The New Energy Equilibrium: The Rise Of The Emerging Economies

The geopolitical chessboard has changed dramatically in the last decades and the world energy scenario is not an exception. The world and the new economic equilibriums of 2012 are quite different to those prevailing 30 years ago, when the oil crisis occurred.

The strong demographic growth in the emerging economies is a well-known phenomenon. The developed countries now have around 200 million more people than they did 30 years ago, while the population of the rest of the world has risen by 2,150 million. This new demographic balance has led to a change in the relative size of their respective economies. The developed countries accounted for two-thirds of the world’s GDP in 1980, while today they only represent around half.

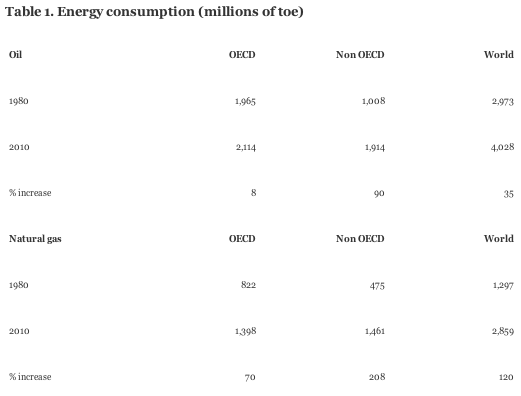

This change in the relative size of the emerging and advanced economies has been accompanied by a change in world energy consumption patterns. The emerging economies have fed their demographic and economic growth with energy. Oil consumption has grown by 90%, natural by over 200% and coal by around 150%. Meanwhile, energy consumption in the advanced economies has been moderate (see Table 1). The emerging countries not only have stronger demographic growth but also higher economic growth in per capita terms. Per capita GDP in the advanced economies grew by 3.2% over the past decade, compared with 9.5% in ‘developing Asia’, 4.1% in ‘Latin America’ and 4.5% in ‘the Middle East and North Africa’.[5] Obviously, the citizens of the emerging economies aspire to the same standards of living that the advanced countries already enjoy. From an energy perspective, it is quite important to internalise the impact of per capita economic growth on energy consumption: the higher the per capita GDP, the higher the per capita energy consumption.

Most analysts expect the emerging economies to continue gaining in political and economic influence over the coming years, with clear implications for energy security.

These economic and demographic trends have an evident impact on the energy markets. The US, China, Japan, India and Germany were the top five net oil importers in 2010.[6] It is evident that advanced countries cannot implement an effective policy regarding oil supply security without counting on the emerging economies. The picture is quite different from 1974, when the International Energy Agency was created. In that year, the US, Japan, Germany, France and the UK were the top five net importers and all of them were developed countries, while India and China ranked 13th and 48th respectively.

Thirty years ago the advanced economies were the leading oil importers and consumers. Energy security and security of supply were concepts associated with developed countries. However, the world has changed and now energy security is not only important for OECD countries but also for the emerging economies. The latter are devising their own strategies to deal with the security of energy supply.[7] For instance, China’s Prime Minister recently visited the Middle East to secure supplies for his country, given the tension between Iran and the West.[8]

In this respect, China is developing an aggressive ‘energy diplomacy’ to guarantee its access to energy resources. In particular, Chinese public oil companies are buying oil and gas reserves, securing energy supplies through direct upstream investment. There are substantial Chinese energy investments in countries such as Sudan, Algeria, Brazil, Peru, Ecuador, Venezuela, Iran, Iraq and Syria, among others.

The Supply Side: A Factor Of Geopolitical Risk

In the previous section we have shown that the present energy demand and consumption scenario is very different from that of 30 years ago, with the emerging countries playing a key role in the energy market. Contrary to this, the general outlook for oil producing countries has not changed that much over the same period. Concerning oil, comparing the top producers in 1980 and in 2010, there are only minor differences. Russia (then the Soviet Union), Saudi Arabia and the US are the world’s main oil producers, the same as 30 years ago.

The degree of geographical concentration of oil production is quite significant and the market is controlled by a small group of countries. It is unnecessary to emphasise the importance of this degree of concentration from the point of view of energy security. Oil remains the main source of primary energy today, accounting for one-third of the world’s total energy consumption.

The OPEC is the leading player in the oil market, as it was 40 years ago during the first oil crisis. In 1973 the OPEC produced 30 million barrels/day (51% of world output), while the developed economies produced 15 million (25%); in 2010 the OPEC supplied 34 million barrels per day (42% of total output), while the OECD countries produced 18 million (23%). Despite the fact that the OPEC’s output share has dropped, its capacity to influence the market is as significant as it has been for the past 40 years. The OPEC’s political and economic predominance in the oil scenario remains intact.

The second most important source in terms of energy demand is coal, which is undergoing a recovery thanks to the emerging economies, that have increased their coal consumption threefold since 1980. The great difference between oil and coal is the latter’s geographical diversification. Coal is spread all over the world, giving it a clear advantage from the point of view supply safety, thus improving global energy security.

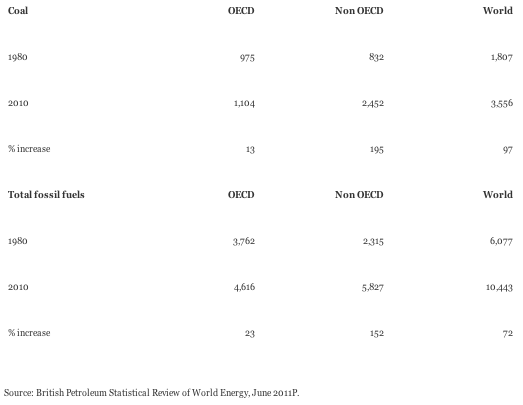

China is the world’s leading consumer of coal and, at the same time, its leading producer. Chinese power generation rests heavily on coal and its consumption is equal to the aggregate demand of the US, India, Japan, Russia, South Africa, Germany, South Korea, Poland, Australia, Indonesia, Ukraine, Kazakhstan, Turkey, the UK, Canada, Thailand, Italy, Vietnam, Brazil, Greece, Mexico, Spain and the Netherlands. However, despite its enormous demand, China does not need to import from abroad. Table 2 shows that five countries consume 80% of global production and that all of them, except Japan, are practically self-sufficient.

World consumption of coal has practically doubled since 1980, pushed by the demand from the emerging countries. China and India account for almost 60% of total demand and both countries have doubled their coal demand over the past decade. In this respect, it is important to discard the idea that coal is an energy of the past. According to IEA estimates, the additional demand for coal in the last 10 years is equal to the sum of all the additional demands for oil, nuclear energy, renewables and natural gas for the same period.

As for renewable energies, they are not only a way of combating greenhouse emissions but also a good mechanism for strengthening energy security. We tend to think of these new technologies as way of being greener but, alternatively, they also provide an additional national source of energy. Although renewables are more expensive than traditional hydrocarbon fuels, a fair economic analysis must include all their externalities. The impact of oil, coal and natural gas on greenhouse gases and on climate change is clearly a negative externality, and renewable energy additionally reinforces a country’s energy security.

Natural gas, although traded regionally (not globally) in the past, is quickly becoming global, similarly to the oil market. Natural gas accounts for a quarter of the world’s total energy consumption and is the fastest-growing source of energy. From an energy security perspective, natural gas is in between coal and oil. Gas production is geographically more diversified than oil, but less so than coal. The US, Russia, Iran, China and Japan are the main consumers, while Russia is the largest exporter and Iran only a small one. Both China and the US are almost self-sufficient and Japan relies entirely on imports.

The largest importers of natural gas are, in general terms, the European countries. Germany, Italy and France, together with the US and Japan, were the main net importers of natural gas in 2010. Since most European Western countries do not have access to conventional gas and given their high consumption levels, natural gas plays a key role for Europe’s energy security. Europe and the US share the same view on security in terms of oil but do not see eye-to-eye in the case of natural gas.

However, the natural gas scenario could change dramatically over the next few years and leader to less risk as regards security of supply. The energy world is immersed in a technological revolution focused on unconventional gas, with hydraulic fracturing or fracking being the best-known process. Gas-mining is becoming much more efficient and, according to some studies, the new technologies could double natural gas reserves from 60 to 120 years of current consumption. If environmental doubts and associated problems are fully resolved the technology could spread world-wide. In any case, if the shale-gas revolution takes hold, the energy security scenario will change substantially. According to some projections, shale gas is an energy resource that is well distributed across the world and if it is massively produced, access to energy will be easier and have a positive impact on global energy security.

Nuclear energy is another way of securing a country’s energy supply. However, it is highly controversial, especially after the recent Fukushima incident. Nevertheless, some countries are opting for nuclear energy in order to rely less on fossil fuels. According to the World Nuclear Association, around 60 power plants are currently being constructed, notably in emerging countries such as China (26 plants), Russia (10), South Korea (five) and India (four).

Key Countries For Energy Security

Today’s emerging economies are significant players from the point of view of energy demand and, thus, from an energy security standpoint. The international community cannot develop an energy agenda without the active participation of the emerging economies. On the contrary, from a supply perspective, particularly of oil, the situation is similar to what it was in the past. In this section, we select the world’s key players in energy security, analysing both the demand and the supply side. The first important point is that the quantities traded internationally in the oil markets are much greater than those traded in the natural gas markets. For instance, Japanese and German imports of oil are double, in energy terms, those of natural gas. In the case of France, oil imports treble natural gas imports. None of these countries has a significant volume of production of oil or gas. Similarly, the net petroleum imports of the sixth largest importing countries amounted to 1,275 million tons in 2010. [10]

In the case of natural gas, the leading importers bought the equivalent of 335 million tons of oil. These figures show that the international market for petroleum is four times larger than that of natural gas. Oil is, by far, the world’s main source of energy but also its most vulnerable one. There are three reasons supporting this idea: (1) oil is the energy that is most intensely traded in the international markets; (2) oil reserves are concentrated geographically in only a few countries; and (3) the oil trade has to deal with physical choke points such as the Straits of Hormuz and Malacca. Hence, petroleum should be the main element to take into account from the point of view of energy security.

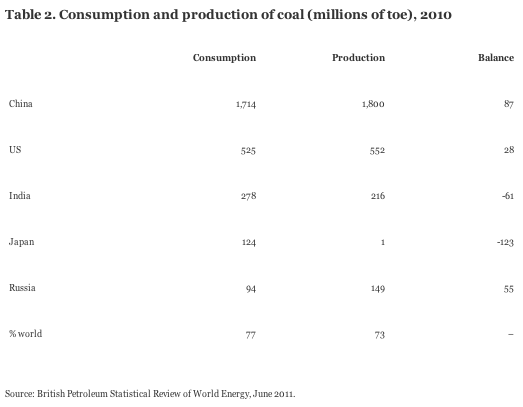

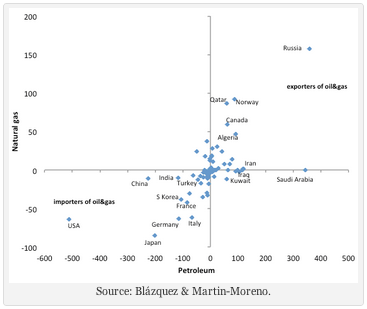

Graph 1 shows the situation of all countries –whether importers or exporters– in respect to oil and gas. The graph shows that Russia, Saudi Arabia and the US are quite atypical. From the point of view of the importers, the US was by far the largest oil importing country and a large importer of natural gas in 2010. Nonetheless, the US is reducing its imports of gas very quickly and will soon be self-sufficient. From the exporters’ perspective, Russia can be considered to have the greatest strategic value, as it is vital for both the oil and natural gas markets. Saudi Arabia is as important as Russia on the petroleum side and, furthermore, is considered the ‘central bank’ of oil because it has a significant spare capacity.[11] The IEA has recently defined Russia as the cornerstone of the world’s energy system.[12]

A simple way to determine the key countries for world energy security is to calculate the standard deviation of the net exports (domestic production minus consumption) of petroleum and natural gas for all countries in 2010 and then select those whose net exports are greater, in absolute terms, than the standard deviation.

From the point of view of demand, there are six key countries (importers), of which two are emerging economies: China and India. The rest are IEA members (the US, Japan, Germany and South Korea). It is clear that if the OECD –ie, the IEA– wants to implement an efficient energy security policy, it needs to coordinate its agenda with India and China. On the other hand, Russia leads the group of key exporting countries, but the other five key countries are OPEC members (Saudi Arabia, Iraq, Iran, Nigeria, Kuwait and the UEA).

Regarding natural gas, Turkey is another emerging economy that has become a significant importer, the other six being IEA members (Japan, the US, Germany, Italy, France and South Korea). As for gas exports, Russia is again the most important player. Norway and Canada are OECD members, while Qatar, Algeria and Indonesia complete the overall picture. The natural gas market is different to oil. Gas exporters are much more diversified geographically and there is no oligopolistic association like the OPEC cartel.

Conclusions:

One of the main risks for the world economy in 2012 is the extreme volatility of energy prices.[13] The Arab Spring, the civil war in Libya, the political and military tensions between Iran, Israel and the US, and the Fukushima nuclear crisis in Japan strongly affected energy prices in 2011 and the first quarter of 2012. As a result, energy security has re-emerged as a key issue on the international agenda.

The strong growth of the emerging economies is probably the most important characteristic of the world economy over the past 10 to 15 years. These economies are currently key players in energy security too. Now, non-OECD economies consume more energy than developed (OECD) countries. Some estimates project that the energy demand from non-OECD economies will double the OECD’s by 2030. Energy security and security of supply are concepts associated with rich and developed countries. However, the world has changed and energy security is not only important for OECD countries but also for the emerging economies. Furthermore, these countries are developing their own strategies to deal with the problem of energy supply.

From the energy demand perspective, China and India –but also other emerging countries such as Turkey and certain Latin American nations– are playing a front-line role. Their demand is as important as that from developed countries and, hence, their contribution to designing a global energy security agenda is critical.

In order to guarantee a significant impact of OECD policies on the markets it is necessary to count on the active cooperation of at least China and India. The International Energy Agency already hosts international technical meetings of experts from producing and consuming countries to improve communication and understanding. Even more, the Agency has created the Standing Group for Global Energy Dialogue to discus with non-OECD members issues such as security of supply, regulatory policy and energy efficiency. Currently, the IEA is focused on China, India and Russia and has signed memoranda of policy understanding to strengthen co-operation with them. Within this context, the Chinese policy to create a large strategic petroleum reserve is good news.

From the supply perspective, this paper suggests that Russia is the cornerstone of the world’s energy supply. Additionally, the OPEC remains the most important player in the oil markets, as it has been for the past 40 years.

Finally, this paper points out that oil is the most vulnerable energy source, for three reasons: (1) it is the energy source that is most intensely traded internationally; (2) oil reserves are geographically concentrated in only a few countries; and (3) the oil trade has to deal with physical choke points such as the Straits of Hormuz and Malacca. Thanks to its ample reserves all around the world, coal and, to a lesser extent, natural gas (in the midst of a technical revolution), are overtaking oil. Without a doubt, there are reasons why coal and gas are subject to increasing demanded, but energy security is probably one of the most important.

Authors:

Jorge Blázquez, PhD in Economics, and José María Martín-Moreno, University of Vigo and REDE (Research in Economics, Energy and the Environment)

Source:

This article was published by Elcano Royal Institute, and may be accessed here (PDF).

Notes:

[1] José María Martín-Moreno is grateful to the Ministerio de Economía y Competitividad ECO2011-23959 and the Xunta de Galicia 10PXIB300177PR for their financial support for this paper.

[2] Daniel Yergin (2011), The Quest: Energy, Security and the Remaking of the Modern World, Penguin Press, New York.

[3] A Reuters report (June 2011) explains in detail the context in which the decision was taken by the IEA. At that moment the oil market expected the price to reach US$150/barrel.

[4] Ed Morse (2011), ‘Expect More Oil Price Rises in the World of New Geopolitics’, Financial Times, 6/IV/2011.

[5] Based on the categories and database of the International Monetary Fund.

[6] We define net oil imports as the difference between production and consumption of oil.

[7] Trevor House (2011), ‘Oil-Hungry China Needs an Energy Security Rethink’, Financial Times, 17/III/2011.

[8] ‘Chinese Prime Minister Seeks to Deepen Gulf Energy Ties’, Financial Times, 11/I/2012.

[9] In accordance with the British Petroleum 2010 database.

[10] Here we define net imports as the difference between consumption and domestic production. A positive figure means that the country is a net exporter; a negative number means it is a net importer.

[11] According to an oil market report by the IEA (18/I/2012), Saudi Arabia could increase its production by 2.15 million barrels per day.

[12] IEA (2011), World Energy Outlook.

[13] World Economic Forum, Global Risks 2012.

The Elcano Royal Institute (Real Instituto Elcano) is a private entity, independent of both the Public Administration and the companies that provide most of its funding. It was established, under the honorary presidency of HRH the Prince of Asturias, on 2 December 2001 as a forum for analysis and debate on international affairs and particularly on Spain’s international relations. Its output aims to be of use to Spain’s decision-makers, both public and private, active on the international scene. Its work should similarly promote the knowledge of Spain in the strategic scenarios in which the country’s interests are at stake.

Jose María Martin-Moreno is currently an Associate Professor of Economics in the University of Vigo, Spain. Professor Martín-Moreno is also a member of Spanish Association of Energy Economics and of Rede, an association to promote the research in economics, energy and environment. Within the Academia, he also has worked as the Dean of the Faculty of Economic and Business Studies (2003-2008) and as the Secretary for academic issues of the same Faculty (2000-2003). In the public sector, Professor Martin-Moreno has been the General Director of the Galician Foundation to promote knowledge-based society (2008-2010). In the private sector, Professor Martin-Moreno is currently a member of the Board of Directors of the Granite Industry Association and a member of the Advisory Committee of the Foundation to Promote New Technologies in the Granite Rock Sector. Finally, he has written numerous academic and non-academic articles

Jorge Blázquez is currently a lecturer on emerging markets at International Centre of Financial Studies. Dr. Blázquez was worked both in the private and in the public sector. Most recently he served as Chairman of Corporación de Reservas Estratégicas de Productos Petrolíferos. He is a member of the Group of Experts on Energy of the Real Instituto Elcano, a Spanish think tank on foreign policies. Additionally, numerous writings of Dr. Blázquez have appeared in both academic and non-academic reviews and publications. Jorge Blázquez holds a doctorate degree in Economics from the Universidad Complutense de Madrid.