China's hopes for Central Asian gas supply face hurdles [Gas in Transition]

While China's natural gas supply has stabilised in recent years, with the country having successfully avoided chronic seasonal shortfalls since winter 2021-22, long-term challenges to its energy aspirations persist.

Central planners may have increased the country's supply flexibility by investing in LNG import capacity, Russian piped gas deliveries and the domestic upstream. However, ongoing efforts to strengthen Central Asian imports have failed to gain much traction.

Central Asian gas flows are crucial to offset China's growing reliance on Russian supplies and maritime shipments through the Strait of Malacca choke point. Beijing's wariness over the strait's strategic weakness has inspired multi-billion dollar investments in gas pipelines from Central Asia, Russia and Myanmar. Diversity has been the watchword for mitigating China's import risks.

But the Central Asia-China Pipeline network is more than just a means of enhancing Beijing's energy security. The pipeline also extends the Asian giant's sphere of influence within its near abroad.

Hardly surprising, then, that — despite unused LNG capacity, expanded Russian piped gas supply and respectable growth in domestic production last year — Chinese President Xi Jinping renewed efforts last year to breathe new life into the Central Asia-China Pipeline's much-delayed expansion.

And yet, even if the Central Asia-China Pipeline's annual capacity is expanded from 55 to 85bn m3, it's still unclear whether supply will ever come close to matching capacity.

Short-term outlook

China's gas supply prospects for the next few years are bullish.

The country consumed an estimated 393.1bn m3 of gas in 2023, based on the 356.61bn m3 officially reported for January-November and a conservative 9% year/year projected increase in December's demand.

Domestic production, meanwhile, climbed 5.6% year on year to 230bn m3, according to the National Energy Administration (NEA).

LNG imports climbed 12.6% on the year to 71.3mn tonnes (94.3bn m3) in the January-December period, according to the General Administration of Customs (GAC). Import capacity is projected to expand by 30% from 139mn tonnes (183.8bn m3) to 182mn tonnes (240.6bn m3) by 2025.

Piped gas deliveries from Russia, Central Asia and Myanmar amounted to 48.65mn tonnes (64.3bn m3).

Russia's state-run Gazprom said in January that its piped gas exports to China hit 22.7bn m3 in 2023, up nearly 50% from the 15.4bn m3 delivered in 2022. Russia also aims to expand deliveries to 38bn m3 in 2025.

With an estimated 3.8bn m3 of gas imported from fields offshore Myanmar, China's Central Asia partners delivered roughly 37.8bn m3 in 2023, down considerably from the 43.2bn-m3 PipeChina said the Central Asia-China Pipeline delivered in 2022.

Across China's basket of gas imports, the only decline in 2023 came from Turkmenistan, Kazakhstan and Uzbekistan, which all cut supplies last year. While it’s still unclear why Turkmenistan reduced shipments, Kazakhstan and Uzbekistan have been vocal about their difficulty in meeting export commitments and domestic demand.

Rystad Energy's VP of Gas & LNG market research, Wei Xiong, tells NGW that Central Asia pipe flows were the only perceived risk in this year's supply. While Rystad Energy's base case scenario projects that Central Asian gas supply in 2024 will rebound to 2022 levels, Xiong says: "We still need to watch out for the risk in Central Asian gas, so a moderated growth is expected in the coming years."

Uzbekistan has committed to ending all exports next year, while Kazakhstan has warned that it might face gas shortages this year.

Wood Mackenzie is also taking a cautious position on supply growth, with Managing Consultant of APAC Gas & LNG Research Kai Dong telling NGW that gas flows through Lines ABC were forecast to hit 45bn m3 in 2027.

These numbers are a far cry from the network's capacity of 55bn m3 and raise serious questions over whether Central Asian suppliers can deliver 85bn m3 annually.

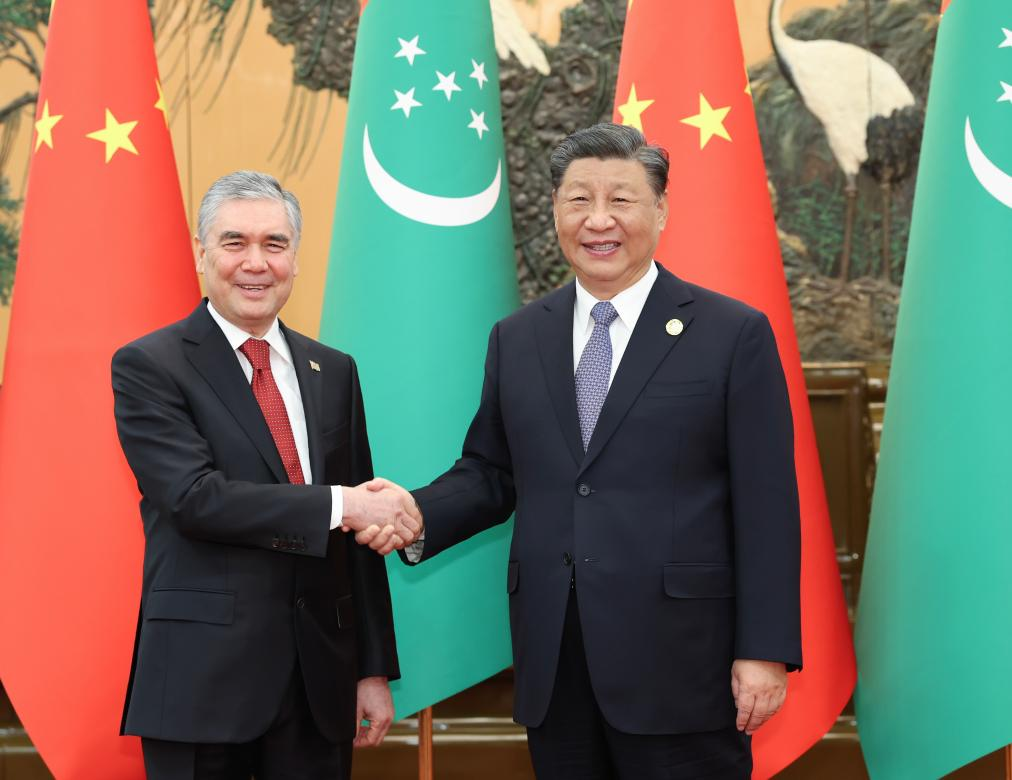

Chinese President Xi Jinping meeting with Gurbanguly Berdimuhamedov, chairman of the People's Council of Turkmenistan, in Beijing in October 2023. Source: Chinese government.

Long-term questions

China's plans for a fourth spur of the Central Asia Gas Pipeline date back over a decade, with the Asian giant signing agreements with Uzbekistan, Tajikistan and Kyrgyzstan in 2013 to build the branch line.

Although Line D is supposed to pump 30bn m3/yr of Turkmen gas, Beijing and Ashgabat still need to finalise a gas sales agreement (GSA), which is why construction work was indefinitely suspended in 2017.

China has begun applying pressure on Turkmenistan to sign a deal so work on the branch line — which would run from Turkmenistan through Uzbekistan, Tajikistan and Kyrgyzstan — can resume.

During an October 2023 meeting between Chinese President Xi Jinping and Head of the Turkmen People's Council Gurbanguly Berdimuhamedov, the two sides agreed to implement the outcomes of the China-Central Asia Summit held five months earlier. It was during this summit that Xi called for a renewed focus on Line D.

Interfax quoted anonymous PetroChina sources late last year saying that work would resume once a GSA was in place. Until then, however, prospects of a startup before the end of the decade are dwindling.

Rystad Energy's Xiong says: "Line D could postpone its startup to 2028-2030 from its previous timeline around 2026, as the construction has yet to kick off. There will be more flows from Central Asia with the startup of Line D, but the 85bn m3 capacity is less likely to be fully utilised."

Wood Mackenzie's Dong agrees that Line D will likely be delayed, estimating that "Line D will probably commission around 2031". He adds: "With Line D, the total pipeline capacity will reach 85bn m3. However, it's very challenging for the actual flow to reach this level in the foreseeable future from both the current gas sales agreement and the Galkynysh field development perspectives."

While Galkynysh's first development phase supplies Lines ABC, the Turkmen government is still looking for investors for the second and third development phases, which will feed Line D and the Turkmenistan, Afghanistan, Pakistan and India (TAPI) pipeline respectively.

What's the hold-up?

China still needs to close a gas supply deal with Turkmenistan, which accounts for the lion's share of existing supply and will be responsible for all of Line D's supply, owing to pricing issues.

Reports from May 2023 suggest that Ashgabat and Beijing were struggling to find a middle ground on pricing for the new supplies. At present, Turkmenistan’s gas reportedly costs around 30% more than that coming through Russia's Power of Siberia.

Ben Godwin, head of analysis at PRISM Political Risk Management, tells NGW that Turkmenistan was caught between a rock and a hard place. He says: “While Turkmenistan needs to find new capacity for its exports to give an outlet for the expansion of Galkynysh and boost the economy, Ashgabat is deeply worried about increasing its already heavy dependence on the Chinese market.”

The launch of Lines ABC was originally celebrated as a means of reducing Turkmenistan’s dependence on Russia. Years later, however, and Turkmenistan finds itself once again beholden to a major power with precious little leverage of its own.

Godwin says: “Central Asian gas producers have been left with few tangible export options, constrained by their geography and a legacy of infrastructure that has largely served Russian needs.”

China’s impasse with Turkmenistan is similar to its stalemate with Russia over the first Power of Siberia pipeline. China eventually secured steep discounts on supplies, with Russian government documents revealing last year that Chinese gas sales would average $271.6 in 2024 compared with the $481.7 that Turkey and Europe would pay.

Indeed, Beijing is also dragging its feet over pricing for the Power of Siberia 2 to secure similarly steep discounts.

Chinese negotiators will look to play Turkmenistan and Russia against each other as they seek the best possible deal while the domestic gas supply market is relatively robust. Ultimately, Ashgabat's ability to attract investors to Galkynysh's second development phase will hinge on its ability to secure concessions from China.

When all's said and done, however, Central Asian supplies will likely never reach an expanded design capacity of 85bn m3.