Canadian Regulator Sees Gas, Renewables Growth [NGW Magazine]

Canada may see increased reliance on renewable electricity to meet primary energy demand over the next 20 years, the National Energy Board suggests in its latest market assessment. But natural gas and crude oil will continue as key fuels for most of the forecast period.

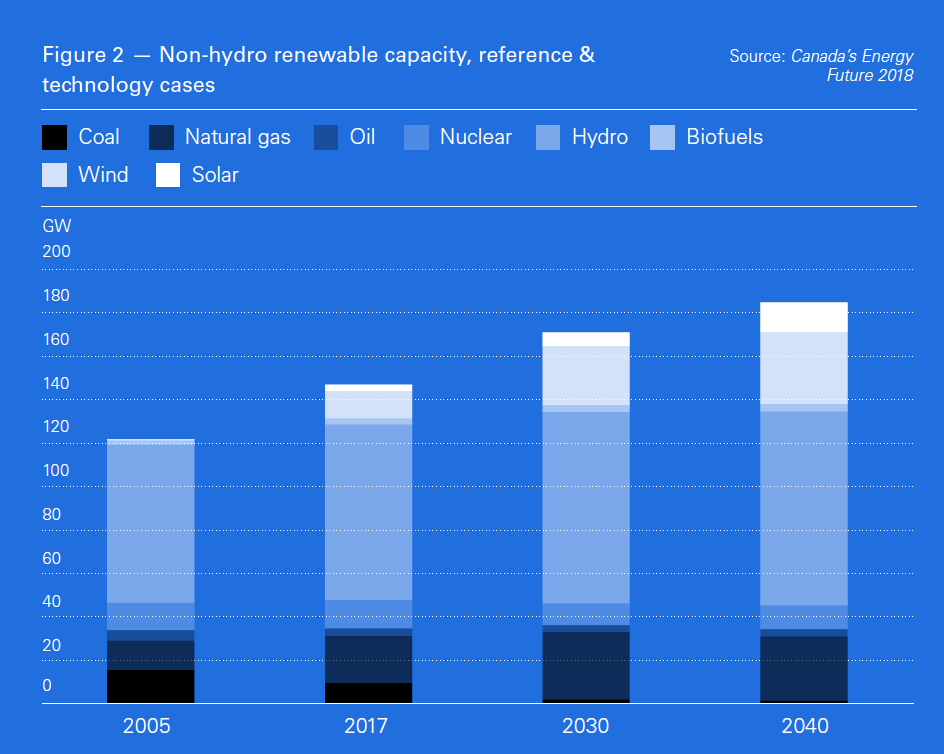

The report, Canada’s Energy Future 2018: An Energy Market Assessment, shows that hydro, renewables and natural gas will lead the growth in total electricity generation, while coal and nuclear generation will decline. Wind capacity is expected to double over the forecast period, while solar generation will nearly triple.

All those suggest a reduced national carbon footprint over the forecast period, the board says, and support the assessment report’s five key findings:

- Canada’s energy demand growth is slowing, while sources to meet these demands are becoming less carbon intensive.

- In a scenario with greater adoption of new energy technologies, Canadians use over 15% less total energy and 30% less fossil fuels by 2040.

- Energy use and economic growth continue to decouple.

- Canada’s energy mix continues to diversify, and its already low-emitting electricity mix adds more renewables.

- Canadian oil and natural gas production increases in the reference case. Price and technology trends will be key factors influencing Canadian production in the future.

In his foreword to the report, NEB chair and CEO Peter Watson says three engines are seen driving Canada’s energy mix over the forecast period, which extends out to 2040.

“First, continuous improvement in energy efficiency causes energy use and economic growth to further decouple,” Watson writes. “Second, falling costs of renewables such as wind and solar, leading to a more diverse energy mix. Third, the oil and gas sector has the ability to respond and remain competitive under challenging market conditions.”

The market assessment presents four cases or scenarios for the next 20 years:

- The reference case, which is based on the current economic outlook, moderate commodity prices and technological improvements, and existing climate and energy policies;

- High and low prices cases, which incorporate and consider the impact of uncertain commodity prices on the Canadian energy system, and;

- The technology case, which pushes past the policy and technology assumptions of the reference case to include greater global climate policy action and low carbon technology adoption. It provides a possible view of what a faster transition, enabled by stronger long-term carbon policy, faster uptake of technologies such as electric vehicles, and lower cost of renewables would mean for Canada’s energy future.

Demand growth slowing

In its baseline reference case, the NEB says natural gas production will increase by 23% over the next 20 years, while crude oil output will grow by 58%. Improved technology to reduce emissions will help oil and gas production remain competitive in this changing environment.

Energy use, however, grows slowly in the reference case – by about 5% from current levels, or about 0.3%/yr, compared with 1.2%/yr between 1990 and 2016 – with more renewables and natural gas in the mix, but less coal and refined petroleum products.

Slower demand growth, the report says, reflects reduced economic activity, and in the reference case and the high and low price cases, real GDP grows at less than 2% on a compound annual basis, well below the 2.28% rate seen between 1990 and 2016.

“The historical trend of Canada becoming a less energy-intensive economy, as measured by energy consumed per unit of GDP, persists over the projection period,” the report says. “Energy efficiency continues to play a role in reducing energy demand growth because less energy is required for new buildings, devices, and equipment.”

In the technology case, the decoupling of energy use from economic activity continues at an even more pronounced pace, the report says. As the world shifts to a lower carbon future and other countries act on climate change, economic growth in Canada under the technology case remains similar to that in the reference case.

But because energy use in the technology case decreases, energy intensity trends decline even further, and by 2040, GDP energy intensity – 30% lower in the reference case – is down by nearly 50%, while energy use per capita – down nearly 15% in the reference case – is more than 30% lower.

“The technology case explores what a global shift in the implementation of innovative technologies and related policy assumptions might mean for Canada,” the report says. “Non-emitting sources and energy technologies get cheaper, improvements to equipment and buildings reduce energy requirements, and markets and infrastructure adapt to these changing trends.”

Growth of renewables

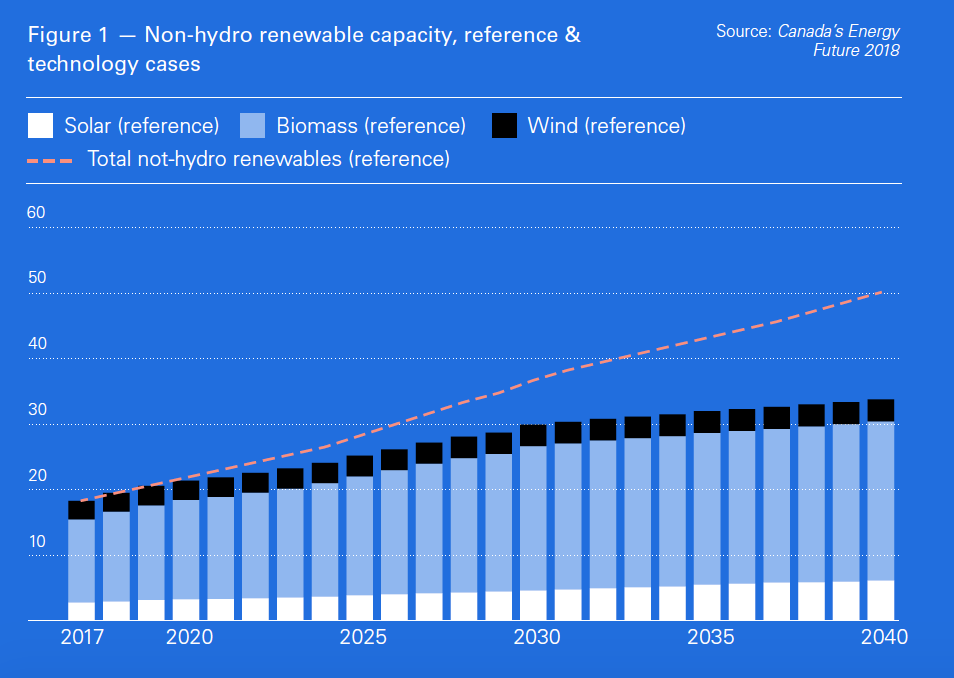

As non-emitting sources of energy – primarily wind and solar – gain traction, traditional forms of energy, mostly fossil fuels, show limited growth or actually decline, the report shows. The reference case shows wind doubling and solar tripling, but the technology case sees even greater penetration by renewable energy.

“In the technology case, installed capacity of non-hydro renewables reaches over 50 gigawatts (GW) by 2040, 48% higher than the reference case. By 2040, the share of non-emitting electricity generation increases to nearly 84% in the reference case and 90% in the technology case, compared to approximately 80% currently.”

Where does gas fit?

In the reference case, natural gas production grows by 23% by 2040, to 21bn ft3/day from 16bn ft3/day, as primary demand increases to 6,000 petajoules (PJ) in 2040 from 4,500 PJ this year.

This growth, however, depends on two key assumptions, the report says: that elevated price discounts continue in the short to medium term, as production growth outpaces infrastructure capacity additions; and that export markets will be found to absorb gas production that is surplus to domestic needs.

In the reference case, the North American benchmark gas price at Henry Hub remains flat and stays under $3.00/mn Btu until 2025 as the market continues to be over-supplied. It increases gradually after that, as US industrial demand and LNG exports outpace supply growth, reaching $4.16/mn Btu in 2040.

In the technology case, however, Henry Hub prices reflect projections that global gas demand will slow: it is $0.30/mn Btu less than in the reference case in 2030 and $0.50/mn Btu lower by 2040.

All of the report’s scenarios assume some level of LNG exports from Canada will begin in 2025 at about 750mn ft³/day, double to 1.5bn ft³/day the following year and double again by 2031, to 3.0bn ft3/day. But even with LNG Canada’s October 2 final investment decision launching the country into the global LNG market, uncertainty remains the watchword, the report says.

“Many dynamics will influence potential Canadian LNG exports, including economics, individual company investment decisions, and the role of natural gas globally in switching away from more carbon-intensive fuels like coal,” it says. “LNG export assumptions are a key uncertainty in all cases, and could be higher or lower than assumed both compared to the assumptions, and relative to each other.”