Best of 2016 | Europe and its Options

- European trends of gas demand

- US LNG

- Russia reaction/adaptation to market conditions

- North Africa’s gas supplies & Mediterranean gas hub

EU gas hub

The gas price has fallen by a quarter to $4.10/mn Btu in the last year, a downward price trend caused by several factors but mainly: the low oil price scenario and its effect on the oil-indexed pipeline contracts[1], weak internal demand and global (Asia in particular), coal’s cheapness, and a significant shift toward renewables (thanks to subsidies).

In 2015 the EU saw 1.6% growth according to IMF, a low level that affects particularly the power sector and so gas demand.

Too much of one thing is good for nothing. Energy security is still at the top of the agenda; the EU is struggling to diversify its dependence on pipeline suppliers, and reduce imports from Russia in particular. This is discussed in the following paragraphs.

The region can boast pipeline capacity of around 450bn m³/year (Entsog 2016) and investments in reverse flow have further reduced dependency (for example, in Poland and Austria). Regional LNG capacity is around 200bn m³/year (Entsog 2016) but in it has been less than 30% used in 2013 and 2014.

Looking at gascontracts we can divide them into four main categories, following the example of Timera Energy:

- Inflexible (pipeline or LNG - Norway, Russia or Algeria)

- Flexible from Norway

- Flexible LNG & Russian spot (gas flowing for arbitrage reasons)

- Flexible pipeline gas (mainly Russian in origin)

The last three create different price dynamics, as we will clarify later on.

Trends in demand

BP’s energy outlook this year foresees a compound annual growth rate of gas demand at 1.8% until 2035. In the OECD, this growth results from the coal-to-gas transition in power generation. The US major ExxonMobil supports this view, forecasting gas will account for 30% of the power sector and will equal coal by 2040.

Gas in Europe is mainly used for heating and power generation (half of it in combined heat and power plants), while industry accounts for about a quarter of demand.

The EU has set an aggressive target for renewables and reduction of CO2 emissions’ (see COP 21), these impact gas demand in the future. In this view, gas is the natural bridge for the transition process (from coal mainly) (Korany D. 2016).

Having said this, it is important to underline the better capabilities of gas turbines, more suitable to be combined with renewables to address peak loads and guarantee the proper flexibility to the system. For example, earlier in June, EDF launched the world’s most efficient gas-fired power generator which can power up fully in half an hour and produce 600 MW at 62.25% efficiency.

Timera Energy has estimated 50+bn m³/yr of power generation converted from coal in the actual price scenario.

US LNG

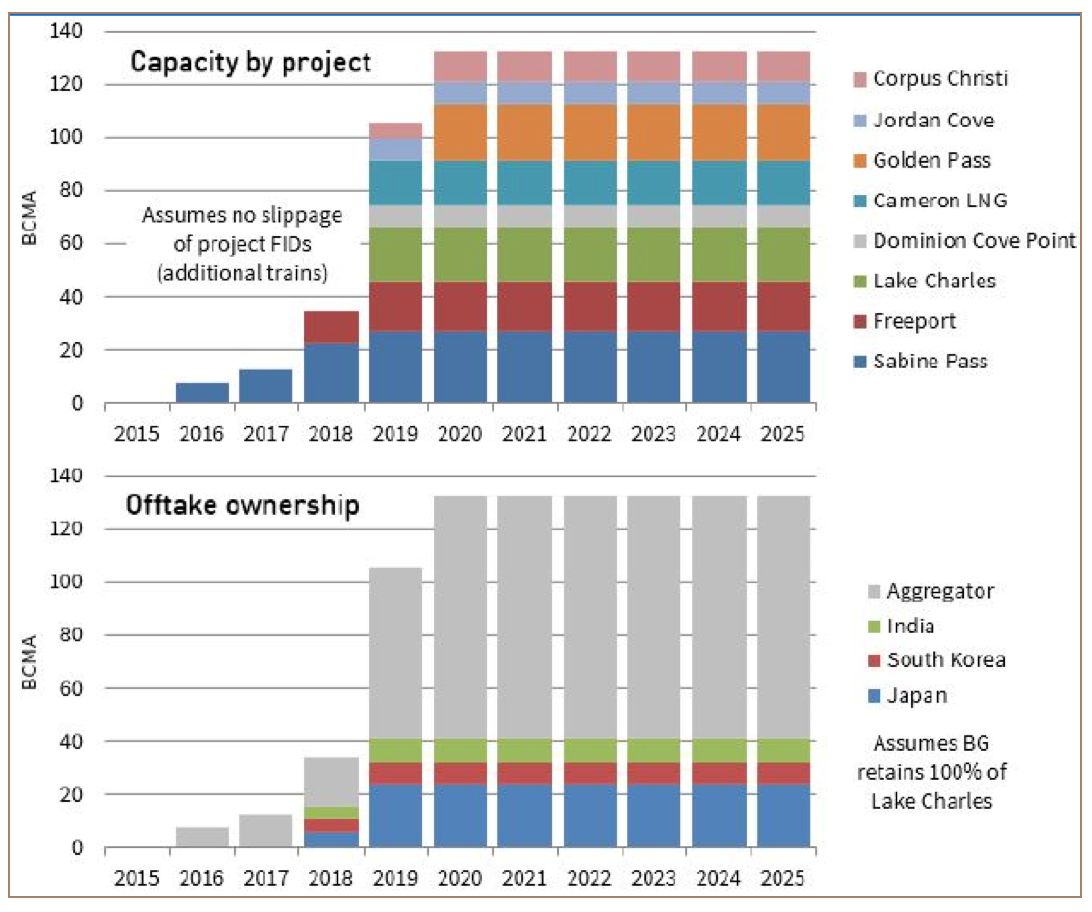

Well begun is half done: Europe received its first cargo of US LNG in April this year; 80bn m³/yr of US LNG capacity is actually contracted and under construction, expected to come in operation in 2020. This represents a tectonic shift for the gas trading globally and for EU in particular, even if for the next two years the volume of gas from US is be expected to be small.

Figure 1: US LNG capacity by project, source Timera Energy

However the flow from US to EU will be driven by the price differential between the western and eastern sides of the Atlantic.

This means that in future the flow of gas may be directed toward other destinations than the EU. In particular, it will depend also on the reaction of Russian’s gas. Which strategy Russia will decide to take in the EU, if starting a price war and keeping the market share or not, is not obvious.

The US LNG is putting downward pressure on EU regional prices, squeezing flexible contracts (Norway and LNG) and also Russian spot gas: here buyers are interested in bringing gas supplies at the minimum take-or-pay level.

Russia

The recent gas exports from Russia to Europe have ranged between 150 – 180bn m³/year, the overall pipeline capacity is 240bn m³/year of which 120bn m³.yr passes through Ukraine. Russia is facing a strategic issue if and eventually how to diversify Ukrainian routes to Europe. The contract in force between Gazprom and Naftogaz will end on New Year’s Eve, 2019.

The volume of exports from Gazprom has been affected by price trends in EU area, data from the Oxford Institute of Energy Studies show that sales peaked in 2007-2008 between 171 – 174bn m³/yr, then after the economic crisis 2008 – 2013 they fell to 151-162bn m³/yr.

Indeed during this last window, also the price difference between oil-linked contracts and European hubs went down. In 2013 Gazprom reduced the price of gas sold under oil-linked contracts, and sales picked up again to 2008 levels. The EU market is moving toward a greater proportion of spot contracts, with customers lowering the number of contracts that run for a decade or more.

If Gazprom does decide to stop any flow across Ukraine, we can estimate this flow of 54bn m³/yr. Will LNG replace it? From US, Qatar and Mediterranean Hub? Regarding the gas availability from Med Hub, it is quite difficult in a short term and it will be discussed later on in a dedicated point.

Saying is one thing, doing is another. The real question is if Russia will shut down completely the flow across Ukraine, as it has said it would several times, including at the St Petersburg International Economic Forum. Alexei Miller said there was no sense in maintaining the transit flows, and would start decommissioning the compressor stations to in order to keep just 15-20bn m³/yr of working capacity.

The US LNG is arriving in the EU, and Gazprom has two main options: lose market share, or cut selling prices and protect market share. The second option involves relaxing the Ukrainian case, and the predominance of a sense of pragmatism.

If Gazprom persists in its position (closing the Ukrainian transit) it has to consider another point: the EU’s decision to lift or not, the capacity constraint on the Opal pipeline, which transports gas from Nord Stream 1. If the EU removes this constraint, the market share lost for Gazprom is not so low.

If EU grants Gazprom the right to more than 50% of the capacity of Opal, that must guarantee between 70% and 85% of take-or-pay volumes. Gazprom can lose “only” between 6.6 – 33.6bn m³/yr (from Oxford Institute of Energy Studies). If the EU sets a limit of 50% in Opal, then the loss can range between 23.6 – 50.6bn m³/yr.

The prisoners’ exchange between Russia and Ukraine in May 2016 is an encouraging signal of dialogue.

North Africa and the Mediterranean Gas Hub

Algeria is important for its production, Egypt for its demand and both, along with Libya, represent important potential for gas discoveries.

In 2014 Algeria’s demand was about 1.5 trillion ft³/year, while production was 3 trillion ft³/year (EIA), overall its pipeline capacity to Europe has a spare of additional 2 trillion ft³/year, so Algeria can easily boost its gas to Europe (if gas is available).

Egypt in 2013 produced almost as much as it consumed, at a level of 2 trillion ft³/year (EIA). In a recent interview to Reuters (April 2016), the energy minister has stated that last level of gas production achieved, was 3.9bn ft³/day (1.4 trillion ft³/year). This means that in 3 years the country has “lost” 1.6bn ft³/day production.

The three largest gas projects (including the giant, Zohr), are expected to boost production from 2019, with additional 4.6bn ft³/day. So they can cover the lost 1.6bn ft³/day “lost” and having 3bn ft³/day (31bn m³/yr) to cover rising demand and restart exports: a fundamental source of cash flow for Egypt.

Egypt has spare LNG capacity of 17bn m³/yr. So there is a margin to send gas to Europe, and there is gas available.

Now we come to the last point: the Mediterranean Gas Hub. A lot of discussion is revolving around the Mediterranean Gas Hub: with new discoveries from Egypt, Israel and Cyprus, there is a real possibility of its inception and consequently how to link it with Europe. We have to say that the political obstacles are huge and probably it will take more time than we think.

Israel is expecting Leviathan to come on stream in 2019. Initially, Egypt, thirsty for gas was the natural market, but things can change fast and that, was before the Egyptian energy renaissance.

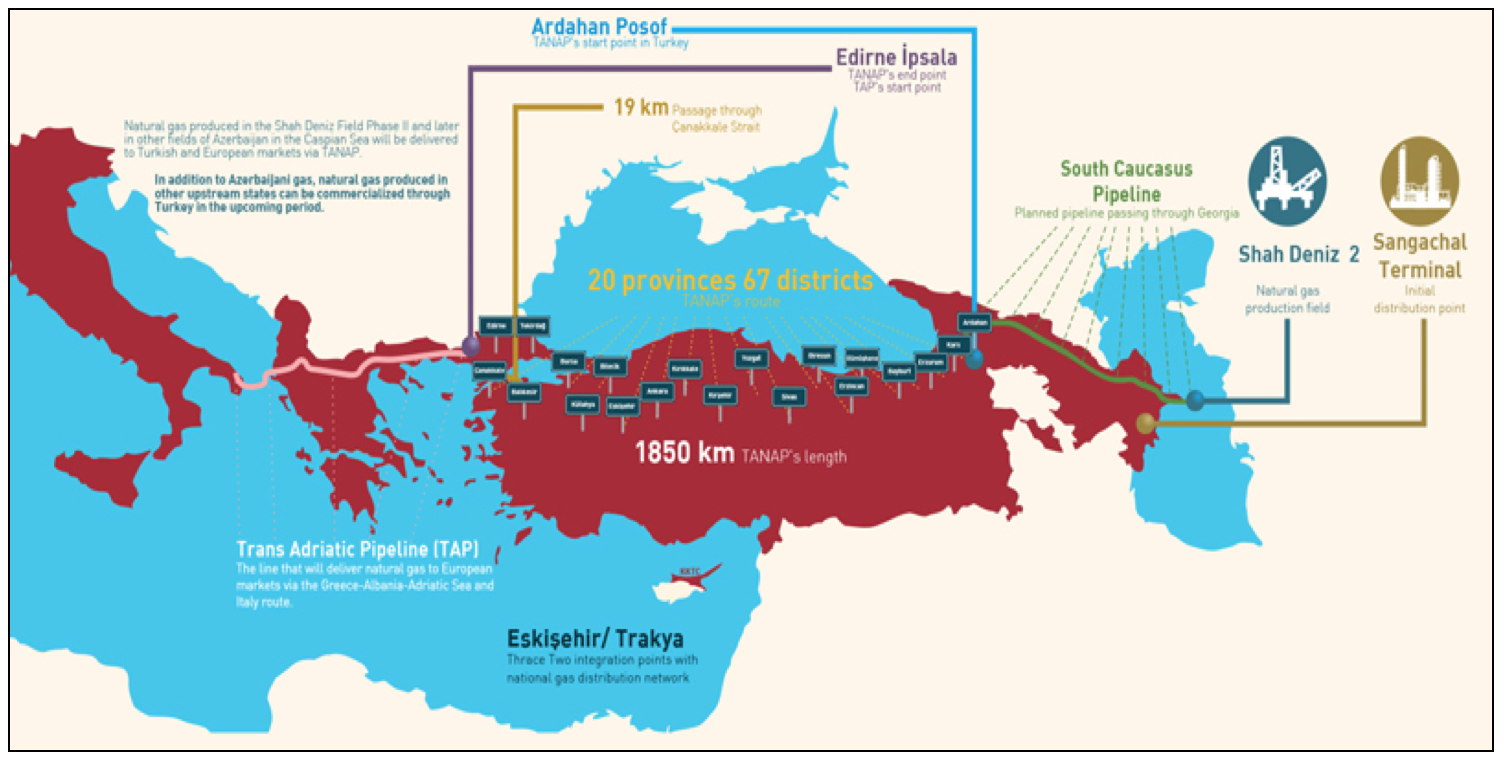

Israel, by connecting with Cyprus, can send its gas to Turkey and connect to the 31bn m³/yr TransAnatolian Pipeline and the 20bn m³/yr TransAdriatic Pipeline, expected to be ready in 2020. Or, as alternative it can send gas to Egypt (there is already a pipe available, the Arab Gas Pipeline) and from Egypt to Europe, as LNG.

Figure 3: Tanap (from official website)

Conclusions

The paper has not considered the potential supplies from Iran, Turkmenistan, Iraq that can be connected to the Southern Gas Corridor (SGC), or Libya's gas potential. All these aspects will introduce others players in the game but expected in the mid-long term.

The gas market in Europe is undergoing to a great transition in the near future. we have analysed what are the main forces playing at today.

The first steps are always the hardest. EU needs to strengthen its policy on ‘one voice’ in three areas: energy security, environmental targets and energy prices. It can be difficult if Poland (and Germany) need to preserve coal-fired power stations, or France bans US-LNG or national interests still prevail.

The North-South Corridor as supported by Atlantic Council and the development of a Mediterranean Gas Hub are strategic targets to increase security of supplies, unlock the potentiality of central Europe and increase trade and hence economic growth in Africa and Europe. It is not excluded that Russia will come also with its stake in the Mediterranean Gas Hub, it can bring in security. It will take time to find a perfect equilibrium for all stakeholders but it is feasible and, profitable.

“On no one quality, on no one process, no one country, on no one route, and no one field must we be dependent.” (Winston Churchill, 1913)

Raffaele Perfetto has been working for nine years for an international oil company, covering different positions in Italy and abroad in the upstream sector. The views expressed in this paper are his own.@Raff_Perf

LinkedIn Raffaele Perfetto