Australian APA Plans A$1.5bn Investment

Australia’s biggest gas pipeline player APA Group has planned to invest A$1.5bn (US$1.14bn) across the asset classes that are already within its portfolio of transmission pipelines, renewable and generation assets and midstream complementary assets.

Over the next three years, it will invest about A$700mn on extending its pipelines, about A$500mn on renewables and generation, and another A$300mn on expansion of its midstream foot print, the company said on August 24 while presenting its results for fiscal year 2016 that ended on June 30. The company is also assessing opportunities in international markets, particularly in North America. In an interview given to Bloomberg, CEO Michael McCormack said the company is seeking to buy distressed pipelines in the US.

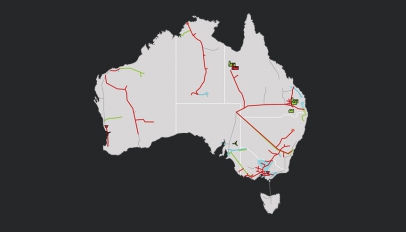

Map of APA's Australian operations (Credit: APA Group)

“The North America midstream market has crashed in the last 18 months. It’s been over capitalized with too much gas and too much infrastructure. The assets are fine but the market is in distress and that is suggesting to us there might be some opportunity,” he said.

APA reported a 68% drop in net profit for the fiscal year 2016. Its profit for the year was A$179.5mn. The drop is mainly because of higher depreciation, amortisation and interest costs related to its US$4.6bn purchase of Queensland Curtis Liquefied Natural Gas (QCLNG) pipeline. Revenue for FY 2016 rose 48% to A$1.66bn.

The company is the largest player in the sector and owns 15,000 km of natural gas pipelines which connect sources of supply and markets across mainland Australia. It operates and maintains networks connecting 1.3mn Australian homes and businesses.

Its dominance over the segment has been attracting the attention of Australian competition watchdog, Australian Competition and Consumer Commission (ACCC). In April, ACCC recommended greater regulation of gas transmission pipelines in order to alleviate gas supply shortage in the east coast markets of Australia. The recommendation was contained in a report on the competitiveness of wholesale gas prices in eastern and southern Australia.

On the occasion of the launch of the report, ACCC chairman Rod Sims said changes in the east coast gas market over the last four years with the development of LNG facilities in Queensland had created winners and losers. There is uncertainty about future supply outlook and some suppliers have taken advantage of this supply uncertainty and potential shortfalls to increase prices and implement more restrictive non-price terms and conditions, he said.

“While the pipeline sector is responding to the changing market dynamics and offering new services, pricing based on significant pipeline market power is prevalent. The regime regulating gas pipelines is not fit for purpose and pipeline pricing is largely unconstrained by either the threat of regulation or effective competition,” Sims said. “Pipeline pricing exacerbates the effect of supply tightness on wholesale gas prices. There are currently very few constraints on monopoly pricing by pipeline operators.”

Shardul Sharma