Ample LNG and full storage offers Europe short-term relief [Gas in Transition]

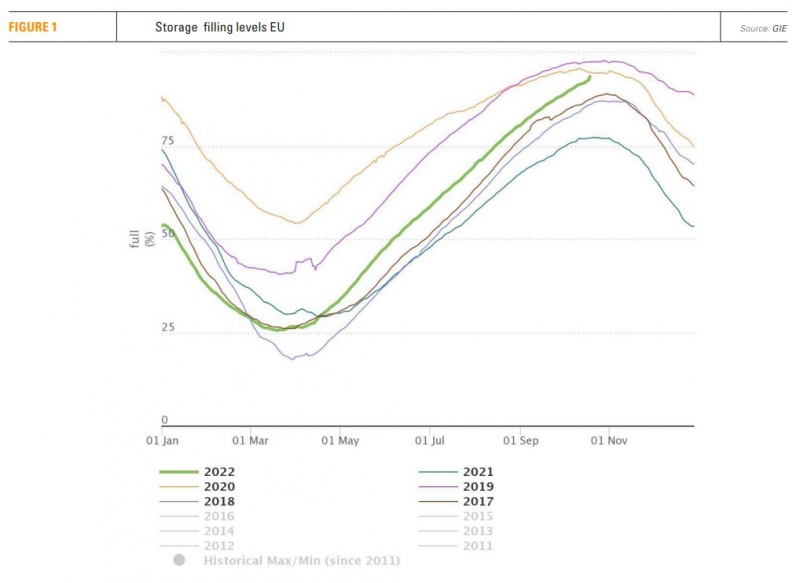

TTF gas prices have traded down sharply since August amid rising storage levels and ample LNG arrivals. Gas storage levels across the 27 EU nations are above 90% full on average and rising. As Gazprom gradually reduced supply to Europe, other suppliers have stepped in.

According to the European Commission’s most recent quarterly gas report, non-Russian LNG imports were up by 28bn m3 year/year in the first eight months of 2022 and pipeline imports other than from Russia rose by 17bn m3. In January-August the EU imported 39bn m3 of LNG from the US, compared to 22bn m3 in the whole of 2021. In the same period, Russian pipeline supply fell by 43bn m3 yr/yr and, at the time of writing, Russian supply via pipelines accounts for less than 10% of EU imports.

That is not to say Europe is out of the woods yet. A cold winter coupled with rising competition for LNG on world markets, for example, could lead to gas shortages particularly in countries with limited storage capacity. TTF prices are in contango, they are higher in the months further out, reflecting potential supply risks in December and the first quarter of 2023.

"Of course everybody's worried about the next six months. Prices in certain commodities are reflecting that very very clearly," Russell Hardy, CEO of Vitol told the Energy Intelligence conference in London in October.

Hardy pointed to unprecedented uncertainty in commodities markets.

"Markets [have been] coping with all sorts of shocks throughout the last nearly 12 months now [...] every month there is something new that is propelling the market," he said.

Some Russian gas is still flowing to Europe via the Ukrainian route, about 42mn m3/day, but many market observers doubt this will last long. Gazprom also supplies some gas to south east Europe via the TurkStream pipeline, estimated at around 1bn m3/month.

With little or potentially no pipeline Russian gas coming to Europe next spring it will be challenging to fill up depleted gas storage tanks.

"I think the Trafigura view is that we may well avoid disaster this winter but we are more concerned about the following winter because... you are not going to get significant amounts of new infrastructure built for Europe that will allow incremental regasification of LNG,” Ben Luckock, co-head of oil trading at Trafigura told the same conference. “And if the Russian situation continues the way it is, with the issues we have had on pipelines ... the balances of gas into next winter are far worse than this winter."

Others back this view. Winter 2023/24 is now looking like a real concern for Europeans.

"The problem is if there is no Russian gas to Ukraine ... you can't get [enough] storage next summer. Where are we now; over 90% storage full. But the most storage we can expect next summer is probably 45-50%. ... unless Europeans seriously do something about cutting demand next winter [we will have problems.]," Mike Fulwood, senior research fellow at the Oxford Institute for Energy Studies said at the conference.

With supplies in Europe currently ample, market players are being encouraged by the Gas TSO of Ukraine to send excess gas to storage tanks in Ukraine and this is to some extent already happening, according to market observers. Ukraine has about 30bn m3 of underground gas storage (UGS) capacity, but facilities are only around 15bn m3 full, according to a recent message on Gazprom’s Telegram channel. There are 11 gas storage facilities located in mainland Ukraine. There is also an UGS facility located in the occupied territory of Luhansk region.

Back in summer 2020, European traders put gas in storage in Ukraine because European facilities were full. But, following the Russian invasion, storing gas in Ukraine comes at a risk of sabotage and damage and companies may want to secure government guarantees or similar measures before they commit to injections.

EU solidarity may be tested

Meanwhile, Brussels has proposed a number of measures to strengthen security of supply and curb price volatility. This includes mandatory joint purchasing for 15% of storage filling, price controls on the TTF hub and an EU pricing benchmark for LNG imports. On October 20, EU leaders in the Council endorsed many of these proposals and more details are expected to emerge in the coming weeks.

The draft emergency regulation also contains a proposal for default solidarity rules to apply between member states that have not agreed bilateral arrangements as obliged under the EU Gas Security of Supply Regulation. Under the regulation, in case of gas shortages, EU member states are obliged to prioritise gas supply to protected customers such as households and social services in neighbouring countries over for example industrial consumers in their own country.

The regulation was adopted by the EU in 2017 but several member states have not yet settled bilateral agreements. Only six out of more than 40 required arrangements have been agreed so far, according to the EC. Compensation payments in case of emergency supplies are often a sticking point in bilateral negotiations.

The EC has therefore proposed that the solidarity compensation paid by the member state requesting ‘solidarity gas’ to the member state providing the gas will be based on the average market price of gas for the last 30 days preceding the request for assistance.

The solidarity rules may also be extended to cover LNG as the current framework only applies between member states that are directly connected via pipelines or via a third country. However, under the new proposal, the solidarity obligation will also apply to member states with LNG facilities “which even if not directly connected could provide solidarity to a Member State in an emergency if endowed with the infrastructure necessary to receive this LNG,” the draft regulation says.

While Russian pipeline supply has been reduced sharply, Europe is still importing a fair amount of Russian LNG. According to the EC’s quarterly report, the EU 27’s LNG imports from Russia rose by 4bn m3 yr/yr in the first eight months of 2022. The report did not give a total figure, however in the first nine months of 2021, LNG imports from Russia stood at around 11bn m3, according to the EC.

As long as there are no EU sanctions on Russian gas, LNG imports from that country may well continue. TotalEnergies, which holds a 20% stake in the Novatek-operated Yamal LNG project, has ostensibly no immediate plans to curtail LNG shipments from Russia.

"We will continue to ship LNG from Russia as long as there are no sanctions from Europe on the gas because we contribute to security of supply," Patrick Pouyanné, CEO of TotalEnergies, told the Energy Intelligence conference.