Accelerated decarbonisation demands ever more gas

While taking court action in order to accelerate decarbonisation, future generations – including Fridays for Future – run the risk of a severe financial burden and subsequent negative social impact thanks to ideologically misguided efforts at decarbonising.

The question is not only whether the tools we have now are adequate but whether what will be needed after 2030 will materialise.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

According to the International Energy Agency, half the technologies needed to achieve net-zero carbon beyond 2030 are only at the research and development stage. So what we have now will not be enough for net-zero carbon emissions.

What we do have is natural gas – the ‘low hanging fruit’ capable of substantially reducing CO2 now before it is replaced by non-fossil fuel gases over time: biomethane and hydrogen.

German politicians, with an eye on federal elections in September, are competing for the most ambitious net zero carbon headlines without defining the concrete and realistic measures needed to achieve the targets. More renewables expansion is promised – but again with no hard numbers on the quantity of CO2 these would cut.

The German minister of the economy boldly stated that Germany aspires to become the ‘global leader’ in hydrogen. A decade behind South-Korea and Japan, Germany’s real problem with the development of a substantial hydrogen market will be its ideological insistence on “green” hydrogen.

Meanwhile, cutting CO2 emissions using more gas faster will leave the ‘next generation’ with a manageable carbon budget. In this context, it is gratifying that Nord Stream 2 has made decisive steps towards completion. Shifting 55bn m³/yr of Russian gas away from the aged Ukrainian transit system yields an instant cut of 11mn metric tons/yr of CO2 emissions.

The facts and numbers presented below are meant to underscore the author’s approach of putting (realistic) pragmatism over (unrealistic) ideology [1].

The celebrated renewables proliferation in the power sector as well as CO2 reduction achievements claimed are misleading

The much celebrated ever-rising share of renewables in the power sector hides two facts. First the reported numbers are average annual output numbers and not the periods of available (or unavailable) load matching demand. Second, the power sector is only 20% of Germany’s primary energy demand while the transport sector is about 30% and the heat sector over 40%.

Oil products, predominantly serving the transport and the heat sector have, between 1990 and 2019, been stable at 35%. Hard coal shrunk from 15% and lignite from 21% to 9% each, while gas rose from 15% to 25%. The government's bureaucratic and excessively expensive coal-exit resolution did not achieve this: the market did. Low gas prices and high CO2 prices gave gas the edge over coal and lignite.

The renewables trajectory is impressive but sobering at the same time. While they rose from 1% in 1990 to 15% in 2019, wind power accounts for just 3.1% and solar is at 1.3% of primary energy.

Also the CO2 reductions claimed to have been achieved ‘since 1990’ (never mind the much celebrated Corona dip) are presented in misleading fashion. CO2 emissions indeed declined substantially in the early 1990s. However, this was mainly due to structural reforms in East Germany after re-unification. Since the enactment of the German renewables law (‘EEG’) in 2000, CO2 emission reductions were negligible outside the power sector.

Beneficial role of gas for climate, clean air and oscillating renewables

Gas-fired power generation achieves substantial CO2 emission reductions vs. coal and lignite. For example, power generation using the entire 55bn m³/yr of gas from Nord Stream 2, would reduce CO2 emissions by about 160mn mt/yr relative to coal. Put in perspective: 160mn mt/yr of CO2 nearly equals the emissions of the entire German transport sector (163mn mt/yr).

Gas also substantially improves air quality (no particulates and barely any NOx). A recent decision of the European Court of Justice, chiding the German government for violating the European clean air quality standards for several years, should give reason for politicians, regulators and others to think again. Just as the rise of gas in power generation delivered the bulk of improvement, so it can in transport.

Gas is not the adversary of renewables in power generation but their ‘friend and helper’ on three counts: (i) stable frequency in the power grids in the face of non-dispatchable, oscillating wind and solar power (ii) power supply especially during becalmed and short days of winter – the so-called Kalte Dunkelflaute, as we saw this year – and (iii) ramp-up to cover power peak demand which will grow with heat pumps and e-mobility.

The heat sector is, for good reason, called the ‘sleeping giant’: the replacement of aged oil boilers by modern gas condensing boilers would cut CO2 emissions hugely. The same goes for the deployment of LNG for trucks and marine transport.

Fossil gas will turn non-fossil when it has served its purpose – and with a huge cost benefit

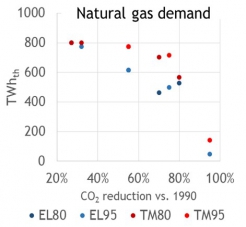

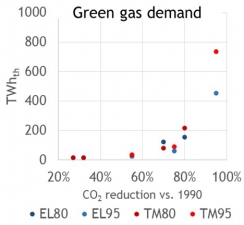

Fossil gas will over time converge towards non-fossil gas. There is a clear correlation between the degree of decarbonisation and the composition of gaseous molecules. By enabling as much as 65% decarbonisation relative to 1990, fossil gas makes a substantial contribution. Beyond that point non-fossil (‘green’) gas takes over.

Correlation degree of decarbonisation fossil/non-fossil gas

Source: Hecking/Peters, ‘The underrated long-term relevance of gas in the decarbonising German energy space’[2]

Non-fossil gas would, besides biogas and synthetic gas (in modest quantities) consist of hydrogen, another ‘gaseous molecule’, thus fit to be transported and distributed in (most of) the existing gas grid.

Politicians and others seem to have forgotten that gaseous molecules are much denser than electrons. The ‘dena-Leitstudie 2017’[3] compared the transport and distribution costs of an ‘all-out electrification’ scenario (‘EL’) with a ‘technical mix’ scenario (‘TM’) deploying gaseous molecules. Transport and distribution cost for gas (i.e. gaseous molecules) would modestly rise from €5.1bn in 2015 towards €5.4bn in 2050. In contrast, in the ‘all-out electrification scenario’, transport and distribution costs for electricity would exponentially rise from €21bn in 2015 to €42bn in 2050.

The recent furor in Berlin about the last-minute withdrawal of a proposed law on Spitzenlastglättung (‘smoothing of peaks’) – which would allow power supply to be cut off to domestic users when e-charging or turning up their heat pumps in planned-economy fashion to avoid reinforcing the distribution grids – provides a first taste of the above projected cost explosion.

Germany’s ‘green hydrogen’ ideology is a fallacy

In Germany, ideology is standing in the way of a substantial hydrogen economy. Ignoring CO2-neutral hydrogen derived from methane leaves just the limited output capabilities available from wind power.

An onshore wind turbine in northern Germany delivers on average some 1,900 full load hours and this is meant for the grid. Only when supply exceeds demand and (wind-) power is sold into neighbouring countries at negative prices in order to retain grid stability is it available for electrolysis.

Moreover, when Germany’s neighbours protect their own grid stability by turning down imports, these wind-turbines are ‘ordered’ to cease production and receive handsome compensation.

Let’s assume these amount to 400 full load hours/yr. An electrolyser fed by such German surplus onshore wind power would only be operating at about 4.5% capacity, no doubt vastly uneconomical.

Even if, contrary to the current goal of maximising renewable energy in the grid, one were to assume on-shore wind turbines were fully directed at electrolysers, the 1,900 full load hours/yr would still only run at 21% capacity. Also off-shore wind is not the ‘silver bullet’: its average 4,500 full load hours would still only give 51% of potential useful service, assuming full dedication. It would be much less if only ‘surplus-wind power’ were available. German wind-power then, with 3.1% share of primary energy, is unfit for a hydrogen economy of any size.

Without admitting this indigenous ‘shortfall’, the German government is seeking to forge partnerships with north African countries to generate and export green hydrogen. Electrolysis requires freshwater, which is scarce in north Africa. Imports from e.g. north Africa will therefore in all likelihood trigger controversies similar to the production of biomass where it competes with food production. Here, the controversy would be whether it is ethical to use a region's freshwater supplies for renewable energy production.

Both Norway and Russia are seriously engaged in developing hydrogen from methane. These efforts should, no matter what the ‘colour’, be appreciated fully. If such CO2-free hydrogen were accepted, it would, among other benefits, also open the door for a gradual decarbonisation of fossil gas through blending, in accordance with the trend shown on the charts above, but perhaps even more smoothly and quickly.

In this context, it is disappointing to see the – I dare say – obstructive position of the German networks regulator BNetzA. It refuses to extend the existing regulation for gas grids to gaseous molecules such as hydrogen. While a German law recently passed caters for the regulation of hydrogen grids – which is a step in the right direction – it is by no means clear – and highly controversial – whether it will be a joint gas/hydrogen regulation or separate.

While using the existing gas grid to blend hydrogen up to the prescribed technical limits is already happening in some places, the crunch will come when extra costs (e.g. for compressors) materialise. If the BNetzA continues to refuse ‘socialising’ the costs across all gas grid users, it would make the gradual blending of hydrogen next to impossible. This is an amazing attitude for an agency, which once forced the merger of German market areas and introduced an entry/exit system. While it has become common practice to offer motorists gasoline that includes greener fuels, the agency is blocking an analogous path for gas.

The final curtain – or further spanners in the works for Nord Stream 2?

After the ‘easing’ – but not the entire removal – of US sanctions, North Stream 2 is well on its way to completion. Commissioning and the start of commercial operations however are still outstanding. No doubt its opponents will continue to try to trip it up even at this final stage. It appears, therefore, appropriate to revisit – and dismiss – some of the misguided concerns about the project.

Dependency on Russia is ‘yesterday’s news’

Its opponents continue to lament Europe’s rising dependency on Russia. As we have explained earlier[4], this attitude is a hangover from 2009, the year of the so-called Ukrainian gas crisis. Given the state of the European and global gas markets today, the alleged dependency on Russia is 'yesterday’s news’.

This is because Europe has in the last 12 years developed a deep and liquid transnational wholesale traded gas market. In the event of a supply curtailment, the price would go through the roof and thus send out a ‘price signal’. The sellers of over 500bn m³/yr of destination-free or flexible LNG meanwhile continuously monitor the price spread between Europe and Asia and would direct – or even re-direct – LNG tankers to Europe with a response time of about three days. And Europe has about 220bn m³/yr of re-gas capacity and so could easily absorb it.

Second, Europe is not vulnerable to any price diktats from Moscow as Gazprom is, like any other supplier, merely a price taker. The ‘achievable price’ is the wholesale traded market price, nothing more and nothing less. Most of Gazprom’s long-term sales are hub-indexed and its sale of various traded products by auction match Dutch Title Transfer Facility hub price levels[5]. One of the few exceptions is Poland: it has, in violation of European law, locked up its market and so it does not benefit from Europe's traded markets.

Political fake arguments by Ukraine and Poland

Then there are the continued laments about the ‘Ukrainian losses’ – of both transit revenue and political leverage against Russia – and Poland's repeated assertions that its dependency on Russia will rise and the single European gas market will suffer.

While indeed less transit through Ukraine would mean about $2bn less in revenues, this is less than 2% of the national budget[6].

Ukraine would also not be exposed to increased Russian aggression just because of less or no gas transit. If energy transit constitutes political leverage, there is also the ‘Druzhba’ pipeline transiting Ukraine. It carries large quantities of Russian crude oil[7], which is much more valuable.

The Polish assertions of increased dependency on Russia are false. Poland has five sources of gas supply. The sum of the four non-Russian sources exceeds its domestic consumption[8].

Germany’s Ewi Institute calculated the welfare loss for European consumers in the ‘high LNG demand’ case at €24.4bn/yr without Nord Stream 2 supplies. Gas Value Chain assumes on average that European prices will need to be $3.3/mn Btu higher in order to attract global LNG in competition with Asia. This would in turn cause a welfare loss of some €50bn/yr. Europe would do better by fostering competition between pipeline gas and LNG.

US sanctions

In previous publications[9], I have characterised the US sanctions as an intolerable interference with European energy autonomy. Adding insult to injury was the undeniable fact that the motivation was not an honest concern about the security of an ally, but rather a camouflaged marketing campaign for US LNG.

I recommended, among other things, that the new US Secretary of State should speak directly with the US LNG exporters. He would learn that they neither want nor need political support as they only want to be free to choose the destination with the highest net-back. In 2019 and the better part of 2020, when the Asian/European price spread had collapsed, we saw substantial quantities of US LNG coming to Europe. Thereafter and to this day, exponentially rising Asian prices have (re-) directed trade flows predominantly towards Asia.

The easing of sanctions is in any event a decision, which does not hurt US LNG exporters at all and, at the same time, benefits European consumers.

It would therefore be highly desirable that the US removed all ‘residual’ sanctions as well. This should include providing certainty for contractors, which withdrew from the project out of concern for negative impact on their business elsewhere in the world, of which the certification company DNV GL is a prime example.

Time to get honest on full value chain emissions and sustainability in all sectors

The gas industry has made serious efforts to make its full value chain emissions transparent, also due to the expected European carbon levy on energy imports. But politicians – as well as car manufacturers with their avalanche of ‘life-style’ commercials – never tire of singing the praises of e-mobility in traffic.

The full value chain emissions and negative social and ethical impacts of e.g. battery production and the mining of minerals are neglected. The harrowing pictures on cobalt mining by child labour in Congo under the most precarious circumstances [10], published by the Financial Times and Die Welt, are only the tip of the iceberg: the entire CO2 ‘back-pack’ of e-mobility is much larger.

Germany is trumpeting its so-called value chain law (Lieferketten-Gesetz), which imposes ecological and ethical conditions for the upstream supply chain of German enterprises. One can only hope that the impact of this law will not stop with T-shirts from Bangladesh.

It is high time to get honest on full value chain emissions as well as social and ethical impacts in all sectors. I am convinced that this will put the (temporary) deployment of fossil gas in a totally different light.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

Wolfgang Peters has been working in the oil and gas industry for some 37 years, including senior roles at the US companies Mobil and Duke and latterly at German RWE, whose Czech operations he ran from 2008-16. He negotiated and litigated successfully with Gazprom to decouple oil and gas pricing.

The Gas Value Chain Company GmbH (GVC) offers services as ‘partnering commercial operator’ and acts as commercial expert in arbitrations and due diligence procedures. Peters' gas advocacy engagement has produced many publications (https://gasvaluechain.com/publications-interviews/) and presentations (https://gasvaluechain.com/news-events/). He served as Eurogas board member for eight years.

[1] This paper summarises key points from the author’s recent podcast at the German-Russian Chamber of Commerce (https://russland.ahk.de/infothek/news/detail/deutscher-gasexperte-nord-stream-2-muss-gebaut-werden) and picks up on recent developments on U.S. sanctions and court decisions dealing with decarbonization.

[2] https://gasvaluechain.com/cms/wp-content/uploads/2017/02/ewi_ERS_GVC_Gas_in_the_decarbonizing_German_energy_space_Paper.pdf

[3] dena-Leitstudie Integrierte Energiewende. Impulse für die Gestaltung des Energiesystems bis 2050. Ergebnisbericht und Handlungsempfehlungen. Deutsche Energie-Agentur GmbH. Berlin, 2017.

[4] E.g. in the GVC paper ‘Nord Stream 2 caught between politicization, hypocrisy and ignorance: a few inconvenient truths: Both U.S. sanctions and EU regulations obstruct climate efforts and pose risks to security of supply’ (https://gasvaluechain.com/cms/wp-content/uploads/2020/04/2020-04-28-GVC-Paper-Nord-Stream-2-Hypocrisy.pdf), page 25 ff.

[5] Ibid, page 32 ff.

[6] For more detail see GVC paper ‘Klimaschutz geht nur mit Gas – der Nutzen von Nord Stream 2‘ (https://gasvaluechain.com/cms/wp-content/uploads/2021/06/28-04-21-Klimaschutz-Gas-geht-nur-mit-Gas-der-Nutzen-von-Nordstream-2_PT-Magazin.pdf), page 28.

[7] Ibid, page 28.

[8] For more detail see GVC paper ‘UOKiK NS2 Decision: ‘Alternative Facts’ & ‘Sanctimonious Hypocrisy’- UOKiK should clean up the foreclosed Polish market in front of its own doorsteps instead of acting ‘Headmaster’ for the EU’ (https://gasvaluechain.com/cms/wp-content/uploads/2020/12/2020-12-14-GVC_Paper_UOKiK_Alternative_Facts__Sanctimonious_Hypocrisy.pdf), page 26 ff.

[9] ‘Nord Stream 2 caught between politicization, hypocrisy and ignorance: a few inconvenient truths: Both U.S. sanctions and EU regulations obstruct climate efforts and pose risks to security of supply’ (https://gasvaluechain.com/cms/wp-content/uploads/2020/04/2020-04-28-GVC-Paper-Nord-Stream-2-Hypocrisy.pdf), page 10 ff.

[10] According to the FT, some 15 to 17 to of cobalt in Congo is produced by so-called ‘informal mining’, with child labor and frequent deadly accidents (https://www.ft.com/content/c6909812-9ce4-11e9-9c06-a4640c9feebb). Ssee here for Die Welt images: https://www.dw.com/en/is-child-labor-the-price-for-e-cars/a-40195923