Yard capacity needs to rise to meet LNG carrier demand [Gas in Transition]

LNG carrier (LNGC) charter rates are climbing again as Europe continues to import large volumes of LNG ahead of winter, amidst major shortfalls in Russian pipeline gas imports. In June, Clarkson Research said rates to charter an LNGC were near their highest level in a decade at $120,000/day, up more than 50% on a year earlier.

At the same time, Asia is moving to increase stocks ahead of the cold season, a reminder that the vast majority of global LNG demand is subject to the northern hemisphere winter. More Asian journeys increases the number of long haul trips, meaning LNGCs stay longer on the water, reducing shipping availability.

The situation is unlikely to improve in the near term. New regasification capacity coming online in 2023, particularly in Europe, as countries rush to install floating storage and regasification units (FSRUs), will only increase demand for LNG cargoes, while the hoped-for return to full operation of Freeport LNG in the US and start-up of Eni’s Coral South project in Mozambique will increase supply.

LNGC charter rates are being carried along by sky high spot LNG prices and strong demand, but just as with new LNG supply, expanding the global fleet of LNGCs takes time, raising the question of whether a shipping shortage will be another factor slowing down the rebalancing of the LNG market.

LNGC orderbook

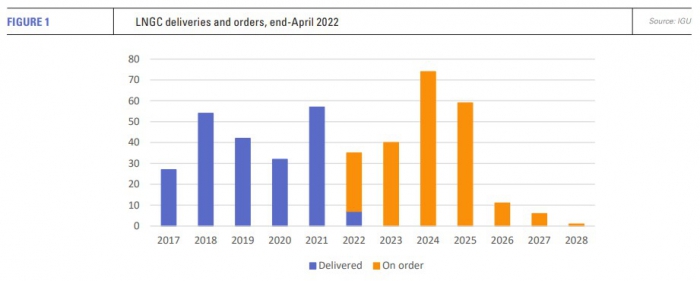

Orders for LNGCs follow the liquefaction investment cycle and this year the number of new LNGCs being delivered is relatively low.

According to IGU data, by the end of 2022, 35 new LNGCs will have been delivered, significantly fewer than last year’s 57. From 2017-2022, the average number of LNGCs delivered was just over 40, with the 57 recorded in 2021 marking a high point.

However, the order book for the coming years is expanding rapidly. At the end of April, some 213 new LNGCs were on order with the number reported to have risen to over 280 in early September, with deliveries now stretching through until 2028.

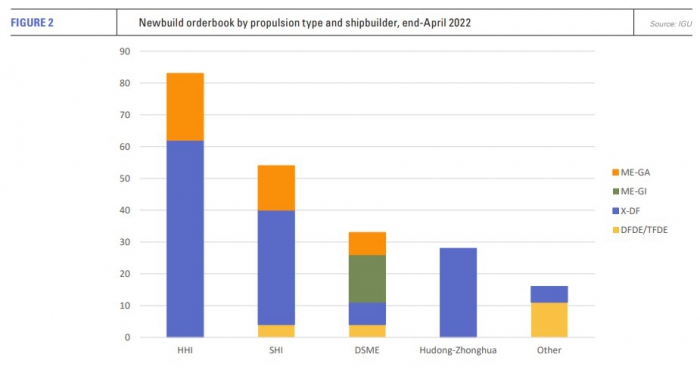

The number of shipyards capable of building LNGCs is limited. The market is dominated by four companies, South Korean shipbuilders Hyundai Heavy Industries (HHI), Samsung Heavy Industries (SHI) and Daewoo Shipbuilding and Marine Engineering (DSME), followed by China’s Hudong Zhonghua.

According to the IGU, 79 LNGCs were scheduled for delivery in 2024 substantially more than even the high of 2021. And it is not as if the shipbuilders are making money. The three major South Korean shipbuilders lost a combined $3.3bn last year, primarily owing to the rising cost of steel plate. However, the surge in LNGC orders is driving the price of newbuilds upward, a development likely to help restore shipbuilders’ profitability.

Prior bookings

Shipbuilding capacity for LNGCs is limited by demand for other types of ship, and new orders for container ships were very strong last year. Container ship lead times are now estimated at about two and a half to three years, double the delivery time two years ago.

The rush to build new container ships took off from the first quarter of 2021 and meant ship yards had a growing backlog of new projects before the LNGC orders started to pile in. In June, HHI said its order book was full for two and half years with about 30% accounted for by container ships and 30% by LNGC orders.

Yard capacity has also been eaten up by the shipping requirements of Qatar’s giant North Field expansion, which has prompted the largest LNG shipbuilding programme in history.

QatarEnergy placed construction reservations with both South Korean and Chinese shipyards well ahead of both the rise in LNG prices from the fourth-quarter of 2021 and Russia’s invasion of Ukraine in the first quarter of this year.

QatarEnergy ordered six LNGCs in November last year, four from DSME and two from SHI. This order followed one for four LNGCs made in October from Hudong-Zhonghua. Long-term time charter contracts for seven newbuild LNGCs have also been awarded by QatarEnergy to a consortium led by Malaysia’s MISC. These will be built by HHI.

In addition to fleet renewal and the North Field expansion project, QatarEnergy needs LNGCs for its share in the Golden Pass LNG export terminal, currently under construction in the US. The plant is expected to onstream from 2023-2024 with nameplate capacity from three trains of 15.6mn mt/yr.

The North Field expansion is expected to increase the country’s LNG capacity from 77mn mt/yr to 126mn mt/yr by 2027. All in, QatarEnergy is expected to require up to 100 LNGC newbuilds.

Order frenzy intensifies

If containerships were last year’s must-have, this year LNGCs have really taken over as the focus of new ship construction. In its annual report LNG Trade and Transport 2022, Clarkson Research said that by mid-July 104 new LNGC orders had been placed, more in seven months than the 84 ordered in the whole of 2021.

The report forecasts 5.3% growth in LNG trade volume this year to 400mn mt, but sees potential for the market to grow to 620mn mt by 2030, up around 40mn mt from previous estimates.

Strong charter rates are also pushing up prices for existing LNGCs. According to Clarkson, a five-year old vessel with dual-fuel diesel-electric propulsion cost $165mn in June, up from $145mn at the beginning of the year. Newbuild values are now around $240mn.

There has been no let-up since Clarkson’s report was published in July.

DSME announced a deal in September for seven LNGCs for delivery by February 2026. DSME has received orders for 36 ships this year -- 28 LNGCs, six container ships and one offshore plant. SHI announced four LNGC orders in early September for delivery sequentially by September 2025. Of 37 newbuild orders for SHI this year, 28 are LNGCs.

DSME announced a deal in September for seven LNGCs for delivery by February 2026. DSME has received orders for 36 ships this year -- 28 LNGCs, six container ships and one offshore plant. SHI announced four LNGC orders in early September for delivery sequentially by September 2025. Of 37 newbuild orders for SHI this year, 28 are LNGCs.

The order book increase is fuelling an expansion of shipbuilding capacity. HHI has started operations to reopen its Gunsan shipyard after mothballing the facility in 2017. The yard is expected to restart in January 2023.

Chinese shipyards will also provide competition for the South Korean majors. Jiangnan Shipyard landed a contract for four LNGCs from the Abu Dhabi National Oil Co. in May, the yard’s first LNGC orders. Likewise, Dalian Shipbuilding Industry reached an agreement in April to construct two LNGCs for China Merchants Group subsidiary CMES.

Possible vacancies

Total’s Mozambique LNG project, which has planned capacity of 12.88mn mt/yr, will need 16 newbuild LNGCs worth around $2.9bn. Orders for four ships each have been placed by Japan’s NYK Line, Mitsui OSK Lines, Kawasaki Kisen Maisha and Greece’s Maran Gas Maritime with SHI and HHI.

However, the project has run into problems, owing to an insurgency in the area of Mozambique, Cabo Delgado, where the project was under construction. Total declared force majeure on construction in April 2021, throwing the newbuild orders into doubt. To date the company has not said when the project will be restarted, although a junior equity partner in the project, India’s BPCL, has said a restart could be on the cards in the first half of next year.

Meanwhile, the non-fulfilment of Russian LNGC orders should free up some building slots. In July, Daewoo Shipbuilding and Marine Engineering (DSME) cancelled an LNGC order placed in 2020, its second such cancellation. Although the shipowner was not named beyond that it was European, the cancellations are thought to be for ships ordered by Russia’s Sovcomflot. An order for a third LNGC from Daewoo also appears to be at risk.

Sovcomflot had at least five LNGCs on order for delivery in 2023, one being built by HHI, three by SHI -- two of which are in partnership with NYK Line -- and two with DSME. The Russian company has a further four orders for delivery in 2024, two each with HHI and SHI, the latter two again in partnership with NYK.

Hyundai’s three newbuilds, Arc7 LNG carriers destined for Novatek’s Arctic LNG project, are reported to be up for sale and Sovcomflot is believed to have sold four LNGCs, which were already under term charters with Anglo-Dutch major Shell. In addition, NYK said in August that it would take over the contracts for the four ice-class LNGCs ordered as part of its joint venture with the Russian company.

Doubt surrounds the rest of the fleet expected to serve Arctic LNG 2, the majority of which are to be built by Russian shipbuilder Zvezda. The first four vessels are being made with the support of SHI, as Zvezda did not formerly build LNGCs, with the last ten to be built by Zvezda alone. Domestic LNGC construction is part of the Russian state’s desire to develop a complete indigenous LNG supply chain. All 14 ships have been ordered by Smart LNG, a subsidiary of Novatek and Sovcomflot.

Arctic LNG 2 already faces delays. Operator Novatek said in September that it would be unable to complete the first stage of the project before the end of 2023 at the earliest, representing a delay of one year. Since Russia’s invasion of Ukraine, Total, Linde, Siemens, Technip and Mitsui have all exited the project. In addition to the problems caused by the exodus of expertise, Arctic LNG 2 will now be highly dependent on Zvezda for its fleet of ice-class LNG carriers, but the yard’s capacity to deliver under sanctions looks highly uncertain.

Fleet renewal for all ship types will drive newbuild demand

According to Clarkson research, the need to reduce greenhouse gas emissions from shipping is also driving newbuild orders. Around 30% of the existing LNGC fleet of nearly 700 ships are relatively inefficient steam turbine vessels, whereas the majority of new orders will be powered by lower emissions X-DF engines.

New regulations impacting the maritime sector will increase the impetus towards more efficient shipping across all sectors. From January 2023, new and existing ships will have to comply with the International Maritime Organisation’s new Energy Efficiency Index and the Carbon Intensity Index.

In addition, the EU has plans to extend its Emissions Trading Scheme to shipping, and the FuelEU Directive is working its way through the European Parliament. This is expected to introduce increasingly stringent limits on the carbon intensity of the energy used by vessels from 2025. While this may not affect LNGC carriers directly, the need to invest in ships powered by alternative fuels should support both scrappage and newbuilding across all shipping segments.