What the new German climate plan means for natural gas [Gas Transitions]

Chancellor Angela Merkel’s so-called “climate cabinet” (a group of cabinet ministers) presented a new climate action plan on 20 September, designed to get Germany’s faltering climate efforts back on track. After the German government conceded last year that the country would miss its 2020 emission reduction targets, it decided to put together a new package that should ensure the targets for 2030 won’t be missed. The new plan should be viewed as an implementation of the Climate Action Plan 2050 agreed upon by coalition partners CDU and SDP in 2016, which still serves as the basic framework for Germany’s climate policy.

The 22-page plan can be found here on the website of the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety, but only in German. Fortunately, the website Clean Energy Wire, a project of the European Climate Foundation and the Stiftung Mercator which provides information on the German Energiewende (energy transition) has provided an English-language summary, which I will partially draw on here, in addition to the original document.

For gas market watchers, what is striking about the plan is that there is no reference whatsoever to natural gas (the word is mentioned only once, in passing) or to coal-to-gas switching. The only references to gas (but not natural gas) are in the sections on buildings and transport.

- In the building sector, the government offers a “swap premium” of 40% to replace heating systems running on oil or “other basic fossil fuels” with “renewable” heating systems, or, if these are not feasible, hybrid gas heaters.

- In the transport sector, the government promises to “support” the use of biogas and “synthetic” as well as “climate neutral gases”, although it does not say how.

The plan does, however, include short sections on hydrogen as well as carbon capture and storage (CCS).

- The government believes “green hydrogen” (produced through electrolysis from renewable energy) will play “a central role in the transformation of the economy.” In particular “towards mid-century the role of green hydrogen will become more important.” The government will present a “hydrogen strategy” before the end of the year.

- The plan says that carbon capture and storage (CCS) “can offer a solution for emissions from industrial processes that are difficult to avoid in order to facilitate climate-neutrality by 2050.” The government says it will “promote research and development” efforts in CCS and will initiate a “dialogue process” with “relevant stakeholders” to increase the acceptance of carbon storage.

What else does the climate plan contain? In the energy sector, the following actions are foreseen.

- The share of renewable energy in power generation will be raised from around 35% in 2018 to 65% in 2030.

- The government wants to increase public acceptance of onshore wind power, which has almost come to a standstill in 2019 as a result of public opposition. The plan says onshore wind turbines must maintain a minimum distance to residential areas of 1,000 metres - both for new turbines and in the case of replacing older models with newer ones (repowering). In addition, municipalities will from now on receive part of the profits generated with turbines built on their land.

- Coal-fired generation capacity will be reduced by 17 GW in 2030 and be completely phased out in 2038.

- The expansion target for offshore wind power will be increased from 15 to 20 GW by 2030.

- The support cap for solar PV, currently at 52 GW total capacity, will be removed.

- Measures are also promised to promote energy storage, combined heat and storage, “sector coupling”, and district heating networks, but no specifics are mentioned.

One of the most commented upon measures in the new plan is the proposal to introduce a national emission trading system in the transport and building sectors, which are not part of the existing European Emissions Trading System (ETS). The ETS only applies to power generation and the energy-intensive industry. The proposal is described by Clean Energy Wire as follows:

- The national carbon pricing will start with a fixed price in 2021 with an allowance price of 10 euros per tonne of CO2. Allowances prices are then going to rise to 20 euros in 2022, 25 euros in 2023, 30 euros in 2024 and finally to 35 euros in 2025. Retailers of heating and engine fuels will have to purchase these allowances, thereby creating a "trading platform" that later enables an auctioning of allowances.

- A fixed emissions budget will be set by 2026 and subsequently decrease each year in line with Germany's Climate Action Plan 2050 and EU emissions budgets in non-ETS sectors. Prices in auctions then will form based on market mechanisms but are confined by a corridor with a minimum price of 35 euros and a maximum price of 60 euros per tonne of CO2. The minimum and maximum prices for 2027 will be decided on in 2025.

- The German government says it will work towards establishing a Europe-wide emission trading system for all sectors in close cooperation with the European Commission. A first step in this regard should be a "moderate" floor price in existing ETS sectors, energy and industry, and all other sectors eventually should be included in the ETS. The government insists that all additional earnings generated with carbon pricing will either be invested in climate action measures or returned to citizens as a compensation.

The document further says that Germany's climate targets mean "a change of our way of living and running the economy" and stresses that supporting the transition to clean energy generation and low-emission technology brings "great opportunities for Germany as a country of business, innovation and jobs."

The government argues that investments under the programme will ultimately spare Germany high costs resulting from climate mitigation and adaptation as well as from buying emissions allowances from abroad. "The 2020s will be the decade of resolute implementation of the energy and mobility transition."

Great opportunities

What are we to make of this? Predictably, environmentalist groups and the Greens were hugely critical of the plan. Patrick Graichen, Director of think tank Agora Energiewende, speaking for many, said the climate package “is shockingly feeble and faint-hearted.”

The strongest criticism was aimed at the price levels for CO2 emissions proposed by the government, which are described by many as a “joke”. This is probably true. What I personally question is the wisdom of introducing an emission trading system in the transport and building sectors. As energy economist Claudia Kemfert put it, such a scheme is “not transparent, costs valuable time and is expensive and legally sensitive.” In fact, just days after the plan was announced, legal experts were already questioning whether there is a sufficient legal basis in Germany for the emission trading plan.

One problem with the proposed emission trading scheme, in my view, is that it is supposed to function as a “market instrument”, but is in fact subject to permanent political intervention, complete with government-determined minimum and even maximum prices. That does not bode well for its effectiveness. A simple tax scheme seems more preferable.

I am also struck by the complete lack of a comprehensive energy plan that takes into account not just carbon emissions, but also such issues as affordability, security of supply and financing. Amazingly, the German government announces emission reduction targets and coal power phaseout dates, in addition to targets for charging points for electric cars, but presents no credible scheme to show how the energy system should be organised to make this all happen.

What does it mean for natural gas? It means: great opportunities. If the sector can seize them. To see where they lie, let’s take a look at some facts and figures on the German gas and energy markets and then consider how the markets would be affected by the proposed measures.

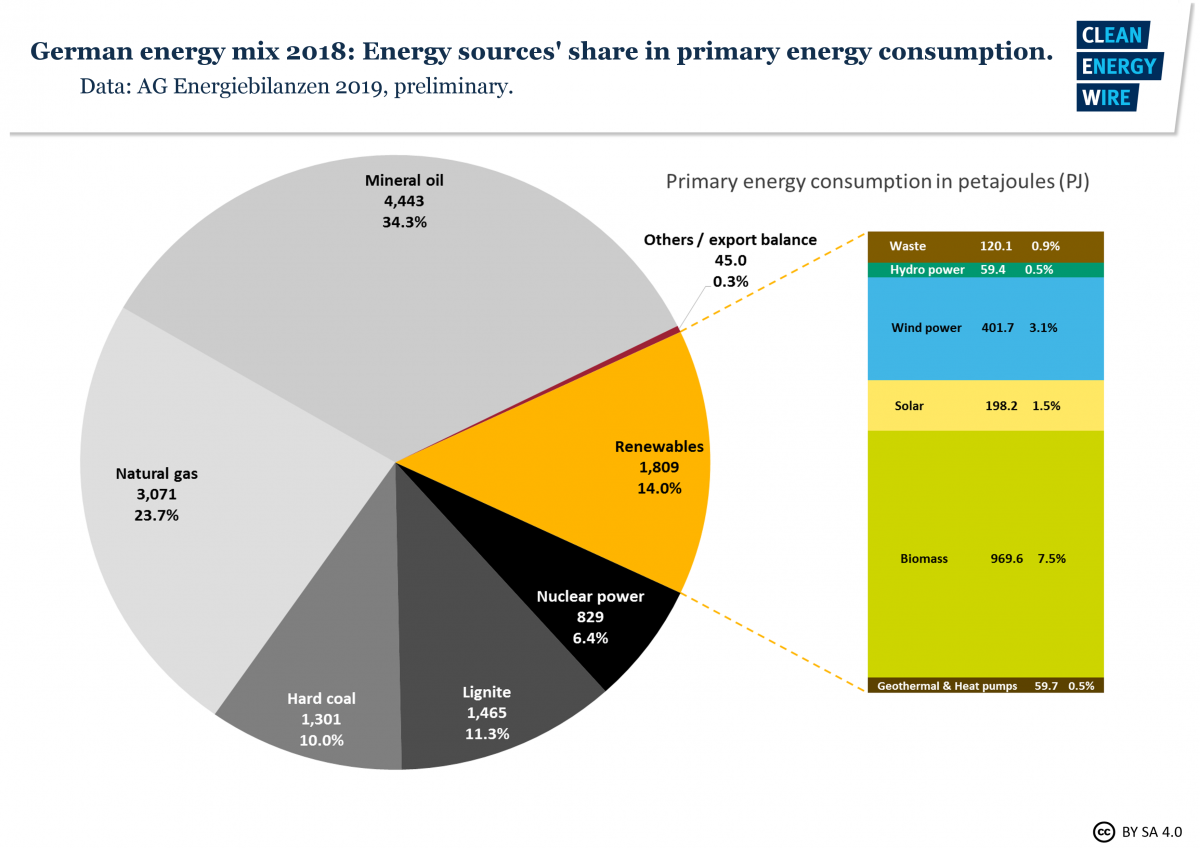

In 2018, total gas use in Germany was 3071 PJ (97bn m3), according to figures from AG Energiebilanzen, an official statistics agency. Gas supplied 23.7% of primary energy demand, as can be seen in this chart:

Source: Clean Energy Wire/AG Energiebalanzen

This gas was used as follows by sector:

Industry 845.6 PJ or 26.7bn m3 (29%)

Households (heating) 958.3 PJ or 30.3bn m3 (33%)

Businesses (heating) 461 PJ or 14.6bn m3 (16%)

Power generation 637 P or 20.1bn m3 (21%)

Transport 5.2 PJ or 0.16bn m3 (0.17%)

These figures were kindly provided to me by Dr Norbert Azuma-Dicke of the Berlin-based association Zukunft Erdgas. Note that the number for power generation is an estimate based on power production figures from 2017. The real figure for 2018 is probably a bit higher.

What is significant about these figures is that more gas is used in Germany in heating and industry than in power generation. This means that the most growth potential probably exists in the power sector, particularly since we may expect substantial electrification of the transport, heating and industry sectors.

If we look at the German power sector, we see the following mix of sources:

.png)

Source: Clean Energy Wire/AG Energiebalanzen

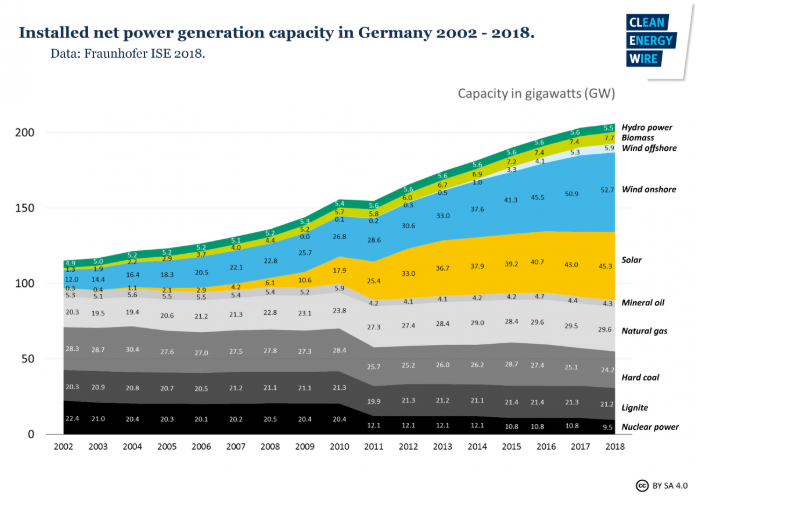

These generation figures are based on the following power capacity mix:

Source: Clean Energy Wire/AG Energiebalanzen

So what will happen if nuclear is phased out, and coal and lignite capacity is reduced by 17 GW in 2030 and completely phased out by 2038?

As can be seen in the charts, coal and lignite contributed 228.4 TWh with 45.4 GW of capacity (1 GW produced 5.03 TWh). Nuclear produced 76 TWh with 9.5 GW (1 GW produced 8 TWh). If by 2030, 17 GW of coal/lignite capacity will be removed, this means some 85 TWh of power will be lost. Together with the 76 TWh of nuclear power, in total 161 TWh will be lost and must be replaced. For 2038, the number is considerably higher: total nuclear and coal phaseout will reduce power generation with 304 TWh.

How much of this would be supplied by renewable energy? In 2018 renewables contributed 225.7 TWh with 117 GW capacity (1 GW generated 1.9 TWh). The government wants to increase the share of renewables in the power mix to 65%. If we assume power consumption will stay equal, this would mean renewables would generate 420 TWh in 2030, which would require 221 GW of capacity, if we assume output remains equal.

In other words, with a 65% share, by 2030, renewables would produce an additional 194 TWh of power, more than compensating for the 161 TWh of cancelled coal and nuclear power generation. That would not leave any room for gas to grow in the power sector.

However, that’s not the whole story. A few points should be noted which make the case for gas look a lot better.

First of all, it is not clear at all whether Germany will be able to expand the share of renewables in power generation to 65% in the next ten years. It would require a massive effort. The 20 GW of new offshore wind that is being planned, if that target is reached, will not be enough to do the trick. If we assume that offshore wind has double the output of onshore wind, this would still only supply 40% of the required growth. Given the current problems in the onshore wind sector, it is not unreasonable to doubt that 65% is realistic.

Secondly, a 65% share of renewables, in combination with a phaseout of 26.5 GW of thermal capacity, would lead to a much more volatile power system, requiring more back-up capacity, which would have to be supplied by gas turbines. Already, the German power system is highly strained. The cost of stabilising the power grid amounts to some €1.5 billion a year. One technical consultant in the electricity industry told me recently: “We used to have 30 critical days in a year in the German power grid, when we had to take action to prevent blackouts. Now every day is a critical day.”

Thirdly, if we look at the period 2030-2038 we see that the gap suddenly becomes much bigger, as another 143.4 TWh in coal power generation are taken off the grid. The share of renewables would have to jump from 65% to 82% to make up for all this lost power, in just 8 years. Virtually the entire electricity supply of Germany would be based on solar and wind power. Is this realistic?

Those are three big ifs, but perhaps the most important point is that all this does not yet allow for any additional electrification. Energy analyst Christian Egenhofer of the Brussels-based think tank Centre for European Policy Studies (CEPS) pointed out to me in personal conversation recently that electricity supplies only 23% of total energy demand in Germany. And this number has not changed for the last ten years. If we consider that Germany is aiming for a massive switch to electric cars and wants to change its home heating systems in part to electric heat pumps, it seems reasonable to assume that electricity demand will grow substantially in the coming decades, even if we assume improvements in energy efficiency. It wouldn’t seem possible to achieve all this without expanding gas-fired power capacity.

Green hydrogen

And then there is hydrogen. If Germany were to succeed in making “green hydrogen” the backbone of its future energy system, as the government seems to want, that would present a real threat to the use of natural gas, especially in the industrial and heating sectors. But this would require even more – much more – renewable power production. As “green hydrogen” is made from renewable energy, it would require practically the entire energy supply of Germany (not just its electricity use) to be provided by solar and wind power. There is no way this could happen anywhere before mid-century, if ever.

The Germans could also choose to start importing green hydrogen, an option that is being taken quite seriously in Berlin, as Clean Energy Wire reported recently. It takes some imagination, though, to see this happen in reality on the scale needed.

There is another hydrogen route, though. It’s called blue hydrogen, and it’s based on natural gas, produced through steam methane reforming, i.e. in the normal way it is done all over the world today, but combined with the capture and storage of CO2. If Germany wants to develop its hydrogen capabilities, there seems to be no other way than through blue hydrogen – i.e. through natural gas. This was confirmed to me by several energy experts I spoke with recently.

Egenhofer, who with two of his colleagues at CEPS recently reviewed 23 studies on the future of the European gas market, told me that “none of them saw a transition to a hydrogen economy, unless you use blue hydrogen.”

Ralf Dickel, Senior Visiting Research Fellow at the Oxford Institute for Energy Studies (OIES), and an expert on the German energy market, came to the same conclusion last year. In a paper he wrote for OIES, published in April 2018, he observed that practically the only rational option is for Germany to invest heavily in blue hydrogen over the next several decades. And this means, as Dickel pointed out, that natural gas would stay in the energy mix rather than just being a “bridge fuel”.

A choice for blue hydrogen does come with one drawback. It would mean that Germany would have to embrace CCS. No simple matter. So far, there has been far too much public opposition to CCS to make this a serious option. Yet the inclusion of CCS in the new climate plan seems to indicate that the government is preparing the ground for a new campaign to convince the German public to support CCS. Egenhofer believes this might just work. “The CCS discussion in Germany was very negative,” he told me. “But it is changing rapidly. In informal settings everybody acknowledges we need it.”

The takeaway? Although natural gas is not mentioned in Germany’s new climate plan, a lot of the roads out of the plan seem to be leading to it.

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For NGW he will be reporting on the Dutch and wider international gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com