What next for Asia’s LNG trailblazer? [Gas in Transition]

Brunei LNG, the first LNG export project to launch in Asia when it began production in 1972, celebrated half a century of operations last year. The world’s longest-running LNG plant helped to pioneer large-scale liquefaction and transportation of gas and establish LNG as a global energy source, but its long-term future is unclear as it faces a looming production decline from dwindling feed gas supply.

Brunei LNG is the only LNG export project of its namesake nation on the island of Borneo, surrounded by Malaysia and the South China Sea. It ships more than 5mn metric tons/year to long-term customers in Japan and the rest of Asia, and has delivered more than 7,500 cargoes to date – equivalent to more than 273mn mt of LNG.

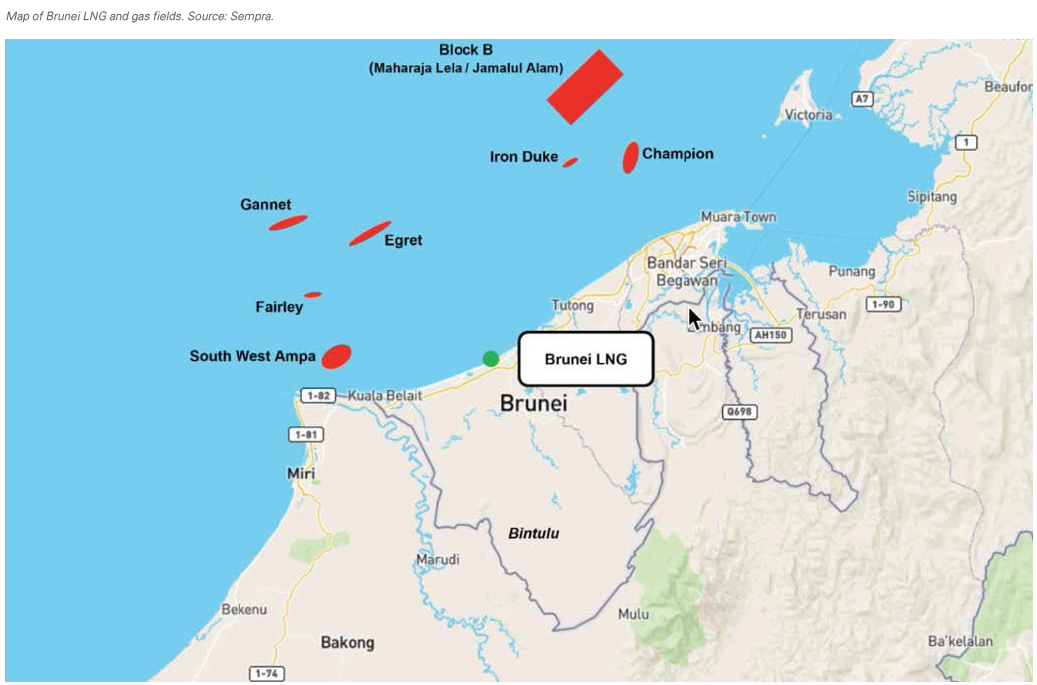

It is operated by the Brunei government with a 50% stake, while UK supermajor Shell and Japanese conglomerate Mitsubishi each own 25% interests. Shell first discovered the promising South West Ampa gas field offshore Brunei in 1963 and then decided to partner with Mitsubishi in 1969 to produce LNG from the gas and export it to Japan. This made Brunei LNG the first large-scale LNG project to receive participation from a Japanese company.

Brunei LNG has an operational production capacity of 7.2mn mt/yr and supply contracts mainly with Japan. Brunei holds an estimated 7.9 trillion ft³ of proven gas reserves as of 2020, according to the BP Statistical Review of World Energy. Brunei Shell Petroleum (BSP), the country’s largest oil and gas company, is a 50-50 joint venture between the Brunei government and Shell, and operator of the primary feedgas sources for Brunei LNG.

The outlook for LNG production is uncertain for Brunei LNG as it faces declining feed gas supply. The government needs to develop more gas fields to maintain production beyond

2023. Gas from the disputed Block CA1 and CA2 acreage with Malaysia is crucial for the plant’s outlook. Kelidang, a cluster gas field in the ultra-deep waters of Block CA2, is of particular interest and shows promise to provide long-term supply for Brunei LNG with 450mn ft³/day.

Contracts supporting Brunei LNG are predominantly with Japanese utilities. After this year all the plant’s existing long-term contracts will expire. The uncertainty in acquiring feed gas for LNG production has led to difficulty in securing long-term contracts.

Industry stalwart

Brunei LNG presently comprises five 1.44mn mt/yr liquefaction trains over an area of 130 hectares. Train 1 completed construction in August 1972, with the first-ever shipment arriving at Osaka Gas’s Senboku 1 terminal in Japan at the end of the same year. By 1974 the fifth train had finished completion.

Brunei LNG was initially envisioned as a four-train project, each with an annual capacity of 1.05mn mt/yr. It was later expanded during construction to a five-train project with an updated design of the main cryogenic heat exchanger (MCHE) for the fifth train. In 1987 a cogeneration plant was constructed to provide reliable and cost-effective power to the region using waste heat from the LNG plant.

As early as 2012 Brunei LNG had suggested there was potential for a sixth train with a capacity of 4mn mt/yr to monetise its gas reserves, but it abandoned the project in 2015.

Over the years the five trains have undergone debottlenecking works to extend their operational life. Major refurbishment work took place from 1989 to 1994 to extend the plant’s life, while another round of revitalisation efforts in 2004 involved the replacement of four of the five MCHEs, to improve the power plant and cooling water system. This upgrade took six years and was completed in 2010.

As the oldest LNG plant in the Pacific basin, Brunei LNG’s first train completed 50 years of operation in 2022. LNG production has declined from its peak in 2016 as gas production falls and the facility ages, and so the likelihood is that trains will be decommissioned gradually in the next decade.

Brunei LNG ranks in the middle of the pack for LNG supply assets when it comes to readiness for the energy transition. Looking to future-proof itself, the plant has proposed using renewable energy supply for its gas supply facilities and producing hydrogen at its site.

Brunei LNG aims to shift 10% of its power generation from fuel gas to renewable energy by 2025. In June 2020 a pilot project was launched between Brunei and Japan to supply Japan with hydrogen produced from processed gas from Brunei LNG. In July 2021 Shell sold a carbon-neutral LNG cargo from Brunei LNG to Osaka Gas’s Senboku terminal – marking the first such shipment from the project.

The hunt for new feed gas

Brunei’s LNG output peaked in 2016 and then declined at an average rate of 3% from 2017 to 2020, but the plant maintained a steady 88% utilisation rate during the same period. The facility has historically conducted maintenance before the winter and summer periods in March-April and September.

The plant is mainly fed by the South West Ampa, Fairley and Gannet fields that are operated by BSP and have been in production since 1972, although other sources include the Champion and Iron Duke fields. The Jamalul Alam and Maharaja Lela fields from the Block B Joint Venture operated by France’s TotalEnergies have also contributed to Brunei LNG’s feed gas since they started production in 1999, while the BSP-operated Egret field has been supplying since 2003.

Brunei’s oldest field, South West Ampa, makes up 60% of domestic gas production. The country’s output has been stagnating at an average of 1.25bn ft³/day from 2015 to 2020. Additional gas production from the Dart Gas Project, also operated by BSP, came online in late 2018 and contributes as much as 2mn m³/day or approximately 70mn ft³/day – equivalent to 5% of Brunei LNG’s feedstock supply.

Brunei has prioritised finding new sources of gas with increased exploration activity. Different types of gas are being explored, including tight gas, shale and coalbed methane, which all could potentially bolster the country’s reserves.

While utilisation rates at the Brunei LNG plant remain steady, the government needs to develop more gas fields to maintain production beyond 2023. Feedstock availability is the primary concern for Brunei LNG despite recent deepwater discoveries.

Gas from the disputed CA1 and CA2 acreage with Malaysia is crucial for extending the project’s longevity. Hopes have been pinned on Kelidang – comprising the Keratau and Kelidang North-East fields in Petronas-operated Block CA2 – as having major potential to provide long-term supply of 450mn ft³/day for the plant. Petronas counts Shell, Houston-headquartered Murphy Oil and Brunei National Petroleum Co. as its partners in Block CA2, which will be considered the complex and expensive development needed to bring Kelidang onstream.

Work on Kelidang has been stop-start as maritime territorial disputes between Brunei and Malaysia have complicated new offshore developments. Petronas carried out pre-front end engineering and design work at Kelidang but withdrew from the deal in March 2020 due to a disagreement over the revenue split. Development was then delayed by the pandemic.

The proposed floating production, storage and offloading (FPSO) unit for Block CA2 was expected to handle about 470mn ft³/day of gas. Original targets were for first production in early 2022, but the sense among analysts is that the field will have a 20-year life span and first production may not begin until 2025.

In late 2022 Petronas initiated a tender process for the selection of contractors for the Kelidang onshore gas gathering and processing facility – a strong indication it was in the mood to revive development of the project after the pandemic pause. Petronas also reached out to owners of FPSO units regarding lease availability.

Petronas maintained the momentum when it awarded a “sizeable” contract to Dutch geotechnical player Fugro in January to perform site characterisation surveys to support the front-end engineering and design of the offshore production facilities and the pipelines to prospective buyers onshore. Fugro will carry out most of the work this year in different phases.

Brunei’s production outlook now depends on the success of its exploration campaigns. The renewed momentum over Kelidang’s development in recent months has increased analysts’ expectations that the field will be developed and extend Brunei LNG’s production.

Contracts coming to an end

Brunei LNG’s primary sales contracts are with Japan’s Jera, Osaka Gas and Tokyo Gas, but its existing 5.1mn mt/yr of contracted volume will expire this year. Brunei LNG has endeavoured to retain its foundational buyers, having extended its Japanese contracts but for only about half the original volume over 10 years when they first expired in 2013.

In 2013 Korea Gas Corporation (Kogas) – the world’s largest LNG importer at the time – extended its original 15-year contract for 700,000 mt/yr for an additional five years, bumped up to 1mn mt/yr, but this expired in 2018 and was not renewed.

Also concluding in 2023 are portfolio contracts with Petronas and Shell spanning 10 years. It is unclear how renegotiations with its Japanese customers are going, due to the ongoing uncertainties about future feed gas supply to the plant. In January 2023 Brunei LNG signed a long-term contract to supply Japan Petroleum Exploration Co. (Japex) starting in April, but details were not disclosed.

While the majority of Brunei LNG’s volumes are delivered to Japan to support its contractual obligations, more recently the plant has stepped up its spot marketing efforts through cargo tenders for North Asia delivery on delivered ex-ship basis.