Venture Global takes FID on Plaquemines LNG Phase 2

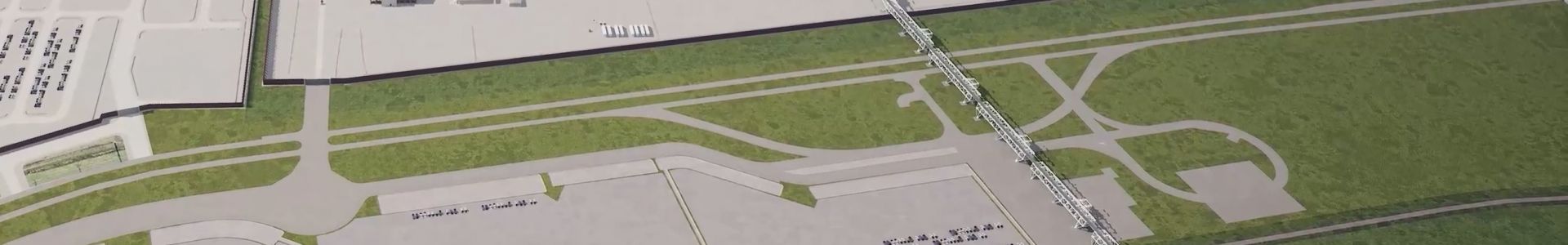

US LNG developer Venture Global LNG said March 13 it had reached financial close and taken a final investment decision (FID) on the $7.8bn second phase of its 20mn metric tons/year Plaquemines LNG terminal in Louisiana.

With financial close, Venture Global has committed $21bn to both phases at Plaquemines LNG, which it said was the largest project financing ever done. Full notice to proceed was also issued to its prime contractor, a joint venture of Zachry and KBR (KZJV).

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

“Our company’s continued ability to commercialise, obtain financing and build our projects in an extremely competitive market is a testament to our team’s proven track record of discipline and execution,” Venture Global CEO Mike Sabel said.

Plaquemines Phase 2 customers include ExxonMobil, Chevron, EnBW, New Fortress Energy, China Gas, PETRONAS and Excelerate Energy.

The first 10mn mt/yr phase at Plaquemines was sanctioned in May 2022.