US Tellurian to Take FID Early Next Year: Souki (Correction)

Original report published on September 18, 2018 at 8h30 am GMT.

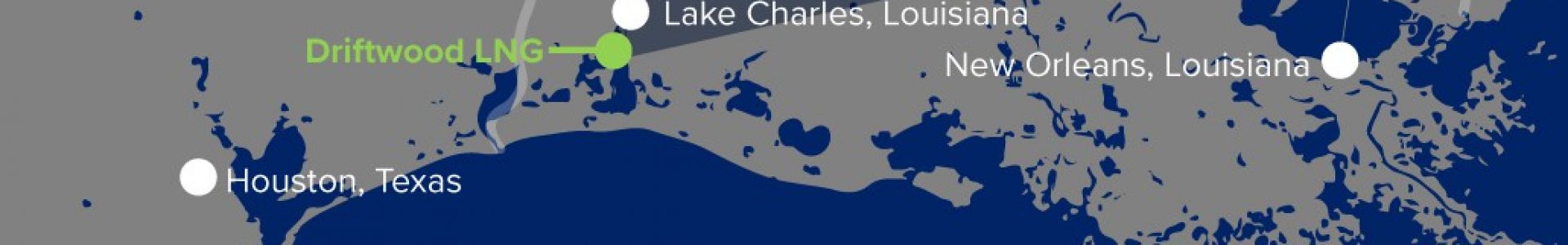

US LNG project developer Tellurian is expecting to announce its final investment decision for Driftwood LNG early next year, chairman Charif Souki told NGW late September 17, on the sidelines of Gastech, a major gas conference happening in Barcelona this week.

NGW mistakenly reported Souki saying the decision would be taken this year; but the company does however expect this year to reach agreements to sell out enough of the capacity in at least three and possibly all five trains, which will be a key condition before it takes FID.

Souki co-founded Tellurian in early 2016 with Martin Houston, the former BG executive credited with devising the merchant LNG model and now vice-chair at Tellurian. Souki had been deposed from the board of Cheniere Energy, which he also founded, just before Cheniere's first LNG consignment left the Sabine Pass terminal on the Gulf Coast.

The two executives set up Driftwood LNG. Among its selling points is the cheap feedstock: gas from the Permian Basin is a by-product of oil and so having a negative cost: not producing gas means that oil is not being produced.

Driftwood LNG will be either three or five trains, he said, each having the capacity to liquefy 5.5mn metric tons/year. Unlike many other US projects, the offtakers have been offered the rights to buy equity in the project for LNG at $3.50/mn Btu on the water, or between a third and a quarter of today's assessment for LNG in northeast Asia, delivered this winter.

Participants will have the choice of raising equity themselves or letting Tellurian do so. The banks would probably shoulder about 70% of the cost. Souki said that the equity that represents a bigger risk will have a higher return, and that Tellurian has reserved some of the capacity for itself. He said that the engineering company Bechtel was lined up to do the work, as it had done earlier for the existing Cheniere Energy trains.

Houston told NGW that the world had changed very swiftly since the World Gas Conference, held three months ago. The idea of an LNG glut is dead, he said. This glut has been mopped up by a radical change of policy in China, boosting demand by 30mn mt in the last year as it cut coal use, according to some analysts. "There is going to be room for everyone. It's great to have a sellers' market again," he said.

Banner map credit: Tellurian