The LNG industry is booming, but is it ready for climate change? [LNG Condensed]

The LNG industry is experiencing extraordinary growth. Global LNG consumption has more than tripled since 2000 to 431bn m3 (317mn metric tons a year) in 2018. Over 100bn m3 of new liquefaction capacity is expected to come online by the mid-2020s to meet growing demand for imported gas, primarily in Asia, boosting traded LNG volumes yet further.

Environmental and economic challenge

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

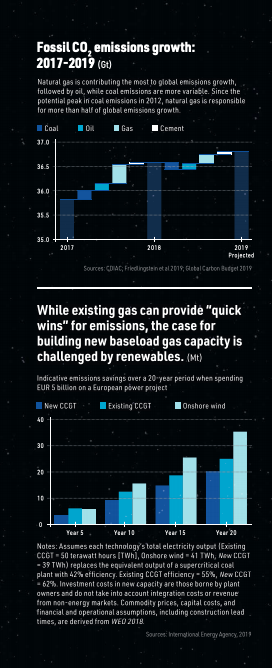

A key element and justification of the impetus behind LNG is the desire to stop the expansion of coal demand. However, at a global level, increasing gas consumption has more than made up for the greenhouse gas (GHG) emissions reductions achieved through reduced coal use.

Moreover, in Europe, less coal burn, combined with energy efficiency, new renewable energy capacity and regulation -- from plant emissions standards to carbon trading -- has led to an electricity grid with an emissions intensity of below 300 grams of CO2 per kWh.

Moreover, in Europe, less coal burn, combined with energy efficiency, new renewable energy capacity and regulation -- from plant emissions standards to carbon trading -- has led to an electricity grid with an emissions intensity of below 300 grams of CO2 per kWh.

This is lower than the emissions generated by modern, efficient Combined Cycle Gas Turbines, let alone an Open-Cycle Gas Plant used for peaking purposes. Higher emissions sources such as coal and lignite still need to be replaced, but a coal-to-gas switch is far from the only and often no longer the best option.

According to the International Energy Agency, the emissions benefits of a coal-to-gas switch pale after only five years to the gains made for the same investment in renewable energy capacity. A modest emissions benefit over five years is insufficient to justify investment in a power plant which will operate for decades.

The Role of Gas in Today's Energy Transitions

At the same time, the economic case for natural gas is become increasingly tenuous. Renewably-generated electricity from wind and solar is now cheaper than electricity generated from new fossil fuel plants, which cannot survive on a competitive basis in an increasingly zero fuel cost world.

Fossil fuel-fired generation is increasingly dependent on capacity market payments or other mechanisms which reward its potential rather than actual use. This is an extraordinary reversal – the fossil fuel plant is becoming a subsidy burden on a low carbon energy system.

Source: International Energy Agency, 2019

As such, the transition to a low carbon energy system has already begun moving beyond the natural gas industry as currently constituted. Public support for coal-to-gas switching is diminishing, and both climate change science and the policy ambitions adopted by the EU and national governments suggest the pace of change will only increase.

Net zero carbon ambitions

More and more countries are adopting net-zero emissions targets by or before 2050, the EU most recently becoming the largest regional bloc to do so. This creates a policy gap between the current trajectory of energy policy and the intended destination, to be filled by more ambitious policies.

As the policy targets become more far-reaching and the need to act more urgent, the natural gas industry finds itself repositioned as part of the problem rather than part of the solution. Its survival thus depends on its ability to adapt, but this in turn means the industry needs to quickly develop the necessary partnerships outside the sector which can enable change.

Rather than wait in hope of new technologies emerging, the natural gas industry needs to lead their development and deployment as part of the radical adaption required to current business models. If the business model choice is to decarbonise gas then that requires a suite of existing and new technologies, in addition to quick and comprehensive methane abatement.

These technologies, for example like Carbon Capture Storage (CCS), are needed on a large scale within the next decade but so far have failed to emerge in line with expectations. A rapidly decarbonising shipping sector is also essential for a better environmental footprint.

Methane target

Every year climate scientists warn that the opportunity to address climate change is narrowing and that the costs of inaction are increasing. This means decision makers will soon need to find quick ways to reduce emissions. Methane, which is 36 times more potent as a GHG than CO2 over a 100-year time horizon and 87 times more potent over a 20-year time horizon, is a clear and obvious target.

The primary source of methane emissions is the gas industry, owing to leaks along the supply chain from the gathering pipelines to compressors down to the incomplete combustion of LNG in truck and ship engines. Yet, so far, the industry has done little beyond some initial commitments to improve methane emissions monitoring and a pledge by some companies to reduce methane emissions by 30% by 2025.

These commitments are nowhere near sufficient, either in scope or timing. In the absence of serious action on its own initiative, the gas industry risks being seen by both the public and politicians as incapable of internal reform. The result will be regulation and potentially the imposition of the same phase out targets formerly reserved for coal.

Climate change vulnerability

Climate models and energy demand projections have one thing in common; they assume economic growth no matter which climate scenario we find ourselves in. This may skew dangerously assessments of the risks posed by climate change. If global temperatures do rise more than 2 degrees Celsius above pre-industrial levels, the economic consequences could be severe, including disruption to both fossil fuel supply and demand.

The International Panel on Climate Change (IPCC) says: “countries in the tropics and Southern Hemisphere are projected to experience the largest impacts on economic growth” even on the basis of 1.5 to 2 degrees warming, which on the world’s current trajectory is expected within about a decade.

Some of the largest projected growth markets for LNG are in the very same regions expected to suffer the most extreme and early impacts of climate change, for example South Asia, while LNG production centres, such as in Mozambique and Australia, would also be at risk.

There is a serious disconnect between climate and energy models. Going slow on climate mitigation is incompatible with the assumptions made about energy demand growth on which the LNG industry’s current expansion plans are based. It may not be climate policies that curb demand, but a lack of economic growth, owing to the impacts of climate change itself.

These impacts are already visible and will become more so. At first glance the LNG industry may see the disappearance of Arctic sea ice as an opportunity to accelerate global LNG trade. But at second glance this ignores at its peril that LNG liquefaction plants and regasification terminals have already been designated by the US Department for Energy as vulnerable infrastructure from just two feet of sea level rising. This increase in sea levels is a plausible outcome in the second half of the next decade under a business-as-usual scenario.

Sustaining investment

To keep the LNG flowing and to invest in climate proof business models, the industry needs investment. As both the environmental and economic case for LNG are challenged, investment flows will alter.

The LNG industry’s expansion has seen production race ahead of demand, resulting in a period of low prices and squeezed returns for many producers. This is being balanced by continued low interest rates and support from banks, investment houses and private investors. They, for now, see LNG as a relatively low emissions bulk energy commodity capable of taking market share from both coal in power generation and oil in transport.

However, neither low interest rates nor investor support can be taken for granted. Climate change is altering the risk profile of all fossil fuel investments, in particular their vulnerability to environmental regulation in pursuit of targets such as net zero carbon emissions.

The Dutch government has already adopted policies to end natural gas use in all residential buildings. The European Investment Bank has effectively ruled out funding for unabated fossil fuel projects, and a recently-adopted EU regulation now requires sustainable finance to substantially contribute to the stabilisation of greenhouse gases – a case which is increasingly difficult for natural gas to make. To comply with their disclosure duties, investors will be increasingly careful in evaluating the risks posed to natural gas by the energy transition.

As a result, gas companies also need to change to build resilient business models that are in tune with the energy transition in order to maintain investor confidence. Survival means adaption and just as with emissions mitigation, early action will minimise risk and maximise the rewards.

Lisa is a senior policy advisor at independent climate change think tank E3G.

Available Exclusively to NGW Subscribers:

Volume 1, Issue 12 - January 6, 2020

|

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets. Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World. LNG Condensed is your magazine for the fuel of the future. Sign up to NGW Basic FREE or to NGW Premium now to receive LNG Condensed monthly (you will find every issue of LNG Condensed in your subscriber dashboard)

|

In this Issue:Editorial: Climate Resilience There were many major achievements for the LNG industry over the course of 2019. Final investment decisions were taken on a swathe of next generation LNG projects in Russia, Mozambique, Qatar and the US. Even Nigeria LNG’s long overdue expansion got the go-ahead. There was clear evidence of the LNG market’s growing maturity in the form of the steep rise in liquidity in futures contracts linked to S&P Platts JKM price assessment, while BP’s publication of its LNG trading terms and conditions should aid much-needed contract standardisation. The growth of portfolio players, more diverse pricing mechanisms and the gradual disappearance of destination restrictions all bode well for increased international LNG trade. The LNG industry is booming, but is it ready for climate change? The LNG industry is set for continued, rapid expansion. As growing gas use now outweighs the emissions benefits of reduced coal consumption, and renewables are increasingly competitive, the environmental and economic case for LNG is eroding. Companies need to take a hard look at their business models and make radical changes – otherwise their image will quickly move from being part of the solution to being part of the climate change problem. Dili to go it alone in high stakes gamble The government of Timor-Leste has bought out foreign partners in the planned Greater Sunrise project to ensure the scheme’s LNG plant is built on domestic soil, but raising the fi nance for development is unlikely to be easy. Meanwhile, gas is running out on the Bayu Undan field, on which Dili is heavily dependent for state income. North Asian nuclear trends: implications for LNG North Asia accounts for a quarter of operational nuclear capacity worldwide, and about two-fifths of the capacity under construction or planned. But the prospects for nuclear power in the region vary widely, as do the implications for LNG requirements. Country Focus: Bangladesh’s LNG demand prospects Bangladesh is a newcomer to the world of LNG, but promises to become a substantial market with imports reaching 30mn mt/yr by 2041. Yet it would be foolhardy to say this demand is set in stone. Actual consumption depends on an ambitious industrialisation strategy and infrastructure delivery in all areas which could both benefit and detract from LNG demand. Project Focus: Rio Grande LNG US company Next Decade could hit the headlines early in 2020 if, as billed, it takes a final investment decision (FID) on its Rio Grande LNG project, the largest of four US LNG plants to receive final approval in November from the US Federal Energy Regulatory Commission (Ferc). Rio Grande LNG is located at the relatively uncongested Brownsville deepwater port on the US Gulf Coast. Technology Focus: FRSUs - The LNG industry’s flexible friend The growing popularity of floating storage and regasification units (FSRUs) is an integral part of the LNG market’s increasing flexibility. |

|---|