The league of top gas producers for 2022 [Gas in Transition]

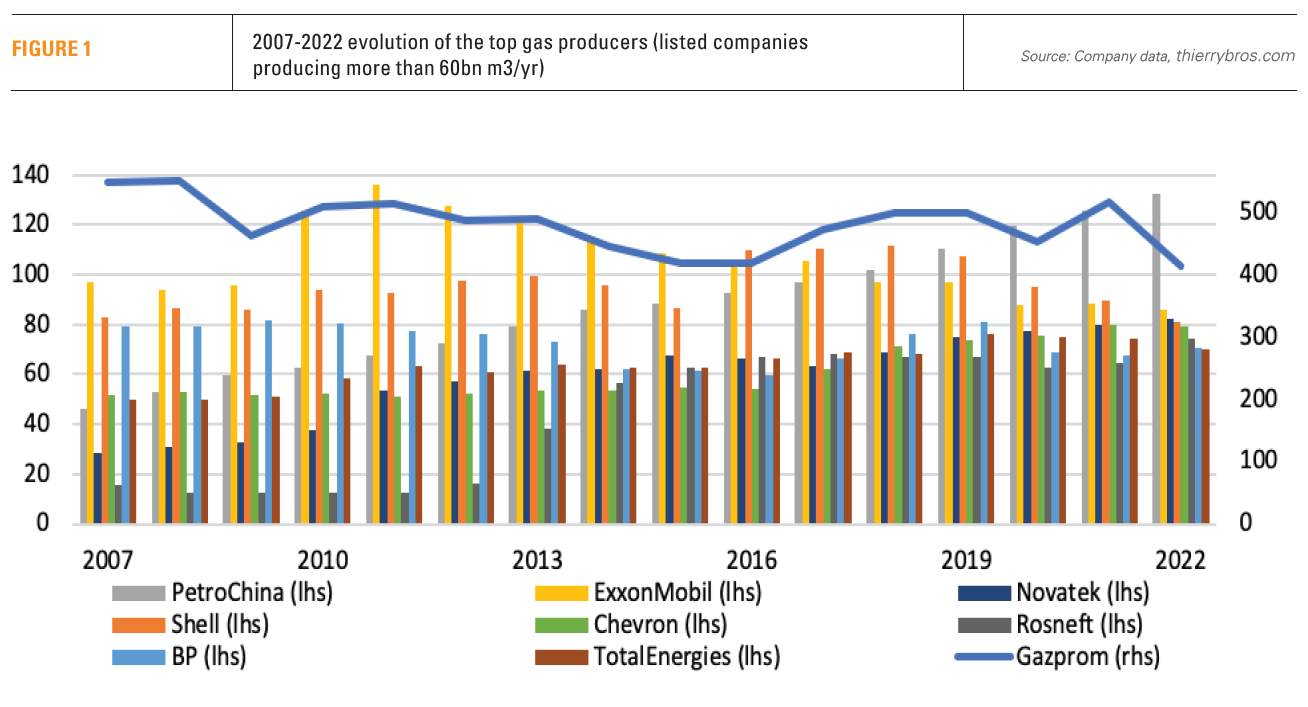

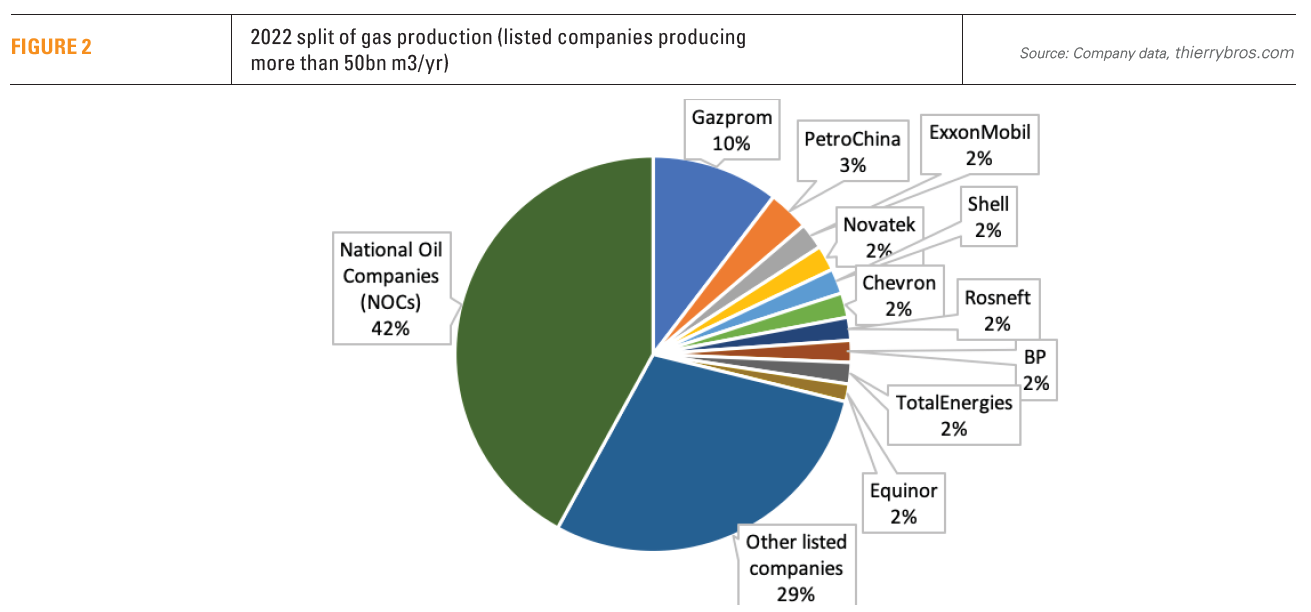

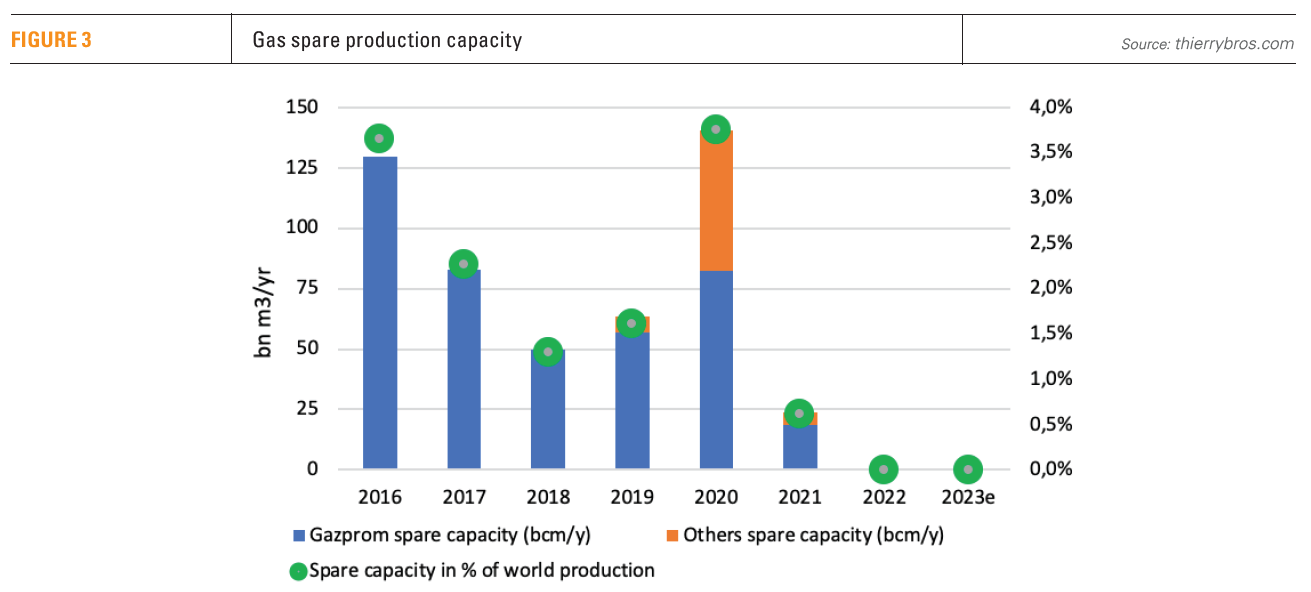

As major listed companies have published their FY2022 results it is now possible to compare their gas production levels. Even with a massive drop of 20% in 2022 versus 2021, Gazprom stays the undisputed leader with a 10% worldwide market share, followed again this year by PetroChina. As Gazprom was the major provider of worldwide spare gas capacity, the removal from Russia from Western trades also removed de facto all spare capacity. After being forced to reduce its dependence on Russian gas, Europe needs to understand and face the Chinese challenges.

Only Rosneft, PetroChina and BP managed to grow their gas production substantially (by respectively 14.9%, 5.8%, and 5%) in 2022. After the 2021 IEA net-zero scenario, most European IOCs have been pursuing, in 2022, greener less profitable options while producing less gas.

- As Russia did cut exports to unfriendly Western countries, Gazprom had to reduce its production by 20%. The drop in production (-103bn m3) is even higher than the drop in its EU market (-82bn m3), showing that even the Chinese exports are still not enough to meaningfully impact production data. Gazprom’s drop in production is also higher than global gas consumption decline (-65 bcm), giving de facto a boost to all its competitors. In a year when EU gas prices achieved record levels, Gazprom provided both volume and price opportunities to its competitors. Even if this drop is material, Gazprom still accounts for 10% of global production and is more than three times bigger than the second worldwide listed gas producer but 2023 looks bleak.

- PetroChina, with its gas production focus, has overtaken respectively ExxonMobil in 2018 and Shell in 2019, to now sit firmly in second position. Gas output was again up by 5.8% compared with last year. Gas production reached the highest level in history, and the proportion of gas in oil and gas equivalent output continued to increase. With a 5.9% 2015-2022 organic CAGR PetroChina is the company that has the best performance. PetroChina is increasing the intensity of its gas exploration and development to promote nationally rapid growth of gas consumption.

- ExxonMobil’s gas production growth in 2010 was the consequence of buying the American shale gas producer XTO. But since this acquisition, production is trending down, leaving ExxonMobil in third position. This year its gas production dropped by 2.8% versus an increase of 2.8% for its oil.

- With another 2.8% growth in gas production, Novatek managed to overtake Shell.

- Shell witnessed again the worst drop (-9.4%), due to supply issues and divestments. Oil production was even more impacted with a drop of 13.2% in 2022 versus 2021. As expected, Shell lost in 2022 its third position and is now ranked fifth. The financial bonanza is in fact hiding the naked truth: most European IOCs are divesting away from oil and gas.

- Chevron’s gas production was flat in 2022 versus 2021 (-0.4%) with a growth in the US (+4.1%) mitigated by a drop at the international level (-1.7%). Chevron hydrocarbon production in the US Permian witnessed another strong growth in 2022 (+16.3%).

- Rosneft’s output hit a new all-time record of 74.4bn m3, up 14.9% versus 2021. Rosneft is now in seventh position, after overtaking both BP and TotalEnergies. During the last 10 years, Rosneft gas production was multiplied by 4.5. The 19.75% stake in the company held by BP must now change hands: if “given” back to the Russian government it could allow Russia to recover a majority stake.

- BP grew its total gas production by 5% while its oil production declined by 2%. Bpx energy recorded a massive 10% growth in gas in 2022. BP expects its hydrocarbon production to be broadly flat until 2025 with the growth concentrated in Bpx energy (up 30-40%). BP expects the delayed start-up of Mad Dog Phase 2 in the second quarter of 2023 and first gas from the Tangguh expansion and GTA Phase 1 Tortue projects in the fourth quarter of 2023. As it’s the only IOC growing its gas production, BP has overtaken TotalEnergies. BP seems to be the first European IOCs to realise that, even if not fashionable, oil and gas production growth is needed for the foreseeable future both for customers that need more energy and shareholders that need high dividends!

- TotalEnergies gas production dropped again by 6.2% in 2022 versus 2021 due to exiting from Myanmar and some fields in Russia, natural fields decline and security-related production cuts. TotalEnergies is going down the ranking to ninth (-2).

- Equinor’s gas production has increased by 2.7% in response to the energy security crisis in Europe. Equinor gas production in Norway increased by 8.5% at the expense of liquid production (-5.9% compared to 2021).

With Russia a pariah state since 2022 the global gas system is scrambling as there is no spare production capacity available. And this could last for a few more years until enough new LNG projects come online.

But in the meantime, if China, the third worldwide gas consumer (and the fourth producer), is becoming not only the top LNG buyer but also an astute player it could make sure Europe pays its LNG with a premium.