The End of an Era – or Boom and Bust as Usual?

The US Permian has been the success story of the last two years, with both massive merger and acquisition (M&A) activity among the upstream players, and production growth. The biggest deal was Occidental's purchase of Anadarko last year, but there were also smaller acquisitions, such as Callon taking over Carrizo.

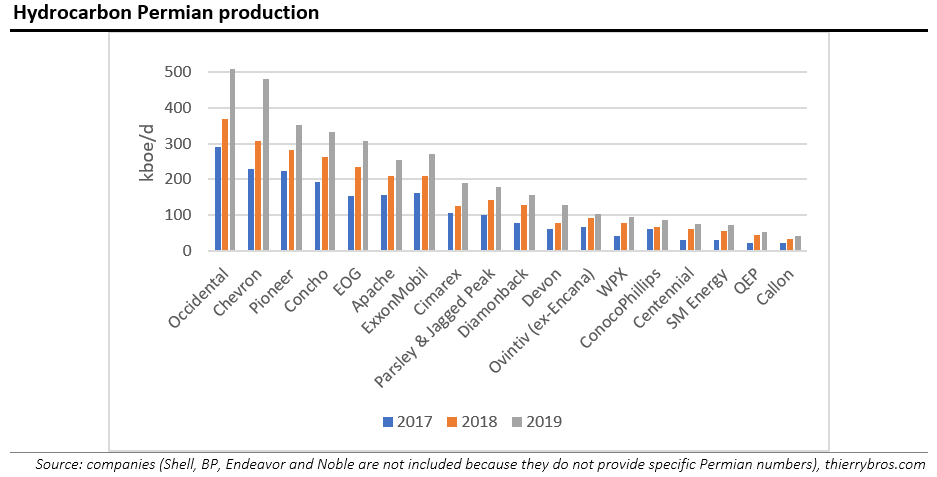

And this was still on-going with Parsley and WPX, which completed their previously announced acquisition of respectively Jagged Peak and Felix, in early 2020. Looking at the listed companies that supply a Permian oil and gas output figure, 2019 saw hydrocarbon growth again above 30% compared with 2018.

But with oil prices nose-diving, the forecasts for both the Permian M&A prices and the unconventional production growth need to be reassessed as US upstream companies are particularly vulnerable to low oil prices. For example, Diamondback and Parsley were the first to inform the market about their reduced activity going forward to adapt. Occidental will also reduce its 2020 capital spending by more than 30%… And the capex cuts are global!

The oil price war that started March 6 will undoubtedly change the guidance for 2020 and beyond. With lower oil prices and reduced capex, the growth in Permian output is going to stop later this year. This means that the oil price war initiated by Russia and Saudi Arabia – and now followed by United Arab Emirates – will not only halt US unconventional oil growth by the end of the year, but also stop associated gas production growth, as more than a quarter of the Permian hydrocarbon production is associated gas.

Russia learned that keeping European gas prices artificially high post-Fukushima (in 2011-2014) was only a medium-term gain as the outcome was more LNG supply and much lower prices from 2018. To avoid repeating this in oil, the only sensible solution is to engage in a price war to deter expensive new oil projects being sanctioned.

But low energy prices today are going to deter all new expensive projects: not only shale (oil & gas) in the Permian but also renewable anywhere. On top of that, the pressure to fast-track a clean energy transition is going to be put on the backburner[1] by EU policy-makers. They will need to direct time, effort and public money[2] at fighting the Coronavirus and to avoid a severe economic recession.

We have therefore the recipe for another decade-long bust and boom cycle. Not only should gas prices recover before oil prices, but once energy demand bounces back, the extra supply will not be readily available. It is always counter intuitive to write about potential blackouts ten years in the future when we are facing a bust situation but so far, a boom always follows a bust and with the plan to continue cutting nuclear output in Europe this decade, I wouldn’t bet against severe blackouts down the road…

Thierry Bros

12 March 2020

Advisory Board Member of Natural Gas World

[1] In particular, it would be nearly impossible to achieve energy efficiency gains in old buildings as people will not invest in expensive refurbishments during an economic recession.

[2] In a world where public money is limited, more going to health and medical research means less going into energy R&D like Carbon Capture and Storage.