Statoil Makes Find, Gets PDO Approvals

Statoil said January 17 it has made an oil and gas discovery 5km northwest of the Norne field in the Norwegian Sea and received approval from the Norwegian authorities of its plans for development and operation (PDOs) for the North Sea Utgard and Byrding fields.

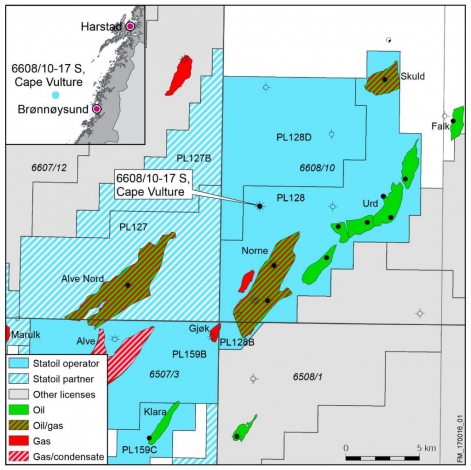

Recoverable reserves estimated at between 20mn and 80m barrels of recoverable oil equivalents (boe) were found at the Cape Vulture exploration well, spudded early last month, on PL128 on the Nordland Ridge.

Upstream regulator NPD gave broadly the same estimate for the discovery as Statoil. In contrast, Eni, a junior partner on PL128, said the find was roughly three times larger, giving a preliminary estimate of the discovery ranging between 70mn and 200mn barrels of oil in place. Neither it, nor Statoil and NPD, provided any indication of the oil to gas ratio of the find.

Operator Statoil said it plans to appraise the discovery further. A tie-back of the discovery to the floating production ship (FPSO) at the Norne field will be considered. Statoil operates licences 128 and 128D with 64% stake, while state Petoro holds a 24.5% and Eni 11.5%.

Cape Vulture prospect (Map credit: Statoil)

As operator, Statoil announced that PDOs for the North Sea Utgard and Byrding fields has been approved. Development costs are expected to be 3.5bn kroner ($410mn) for Utgard, a gas-condensate field, and about 1bn kroner ($117mn) for Byrding, an oil and gas field. Utgard has recoverable reserves estimated at 56mn boe, while Byrding’s are estimated at 11mn boe.

Due to start production in 4Q2019, Utgard straddles the UK-Norway median, with most reserves on the Norwegian side. Gas will be piped to Sleipner and, because Utgard gas has high CO2 content, will benefit from carbon cleaning and storage facilities there, before export to Karsto. Byrding’s oil and gas will be flow via Fram to Troll C, with gas onward to Kollsnes; the field is due onstream in 3Q2017.

Utgard licensees are Statoil 76.44%, Poland’s Lotos 17,36% and Kuwait’s Kufpec 6.2%, while Byrding's are Statoil 70%, Engie 15% and Idemitsu 15%.

Mark Smedley