Shell Won't Be Drawn over Iraq 'Divestment'

Shell has responded to a November 28 Reuters report that it plans to divest its upstream oil assets in Iraq but wants to retain its gas interests there. The report cited industry sources. The super-major announced a $30bn asset disposal programme for 2016-18, after its acquisition of BG in February.

"There have been a number of recent speculative press reports regarding Shell's portfolio of assets in Iraq,” said Shell November 29: “Whilst we will not comment directly on the coverage, we will say that we remain committed to working with our partners in Iraq to redevelop the country's energy infrastructure. Our focus is on continuing to add value to the country by delivering against our 2017 growth strategy at Majnoon, the Basrah Gas Company [BGC] and through the progression of the Nebras [petrochemicals] project."

Iraq accounted for 4.4% of Shell’s 2015 production, said Reuters quoting Shell’s annual report.

Shell upstream chief Andy Brown said last month that it had put 16 assets worldwide on the market, each worth over $500mn; later that month it announced the sale of Western Canada shale interests for $1bn.

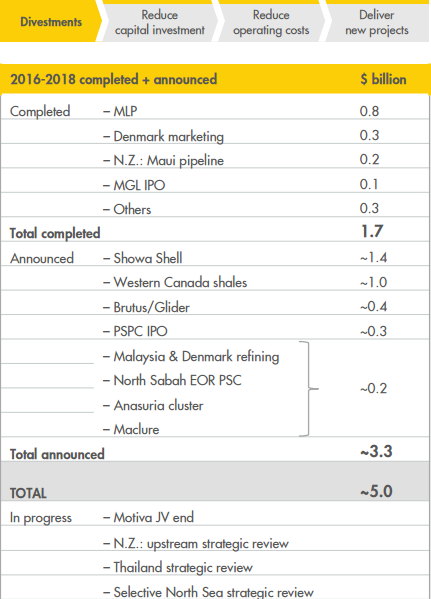

At a November 1 briefing, Shell said it had completed $1.7bn of acquisitions and announced a further $3.3bn of such divestments, for a total of $5bn – putting it one-sixth of the way towards its $30bn target by end-2018.

Recent Shell divestments from its Nov.1 presentation (Credit: Shell)

NGW Magazine issue 4 included an overview of Shell’s interests and roles in Iraq, notably in BGC and Majnoon, with remarks by the group’s vice president for conventional oil and gas projects Graham Henley.

Mark Smedley