Senegal, Mauritania on the cusp of LNG exports [Gas in Transition]

Phase 1 of BP and Kosmos Energy’s Greater Tortue Ahmeyim (GTA) LNG project offshore Mauritania and Senegal is due to come on stream in the second half of this year, with first gas shipped at the start of 2024. It is the first in what could be a string of LNG export schemes in the region, with the same two companies involved in several of them.

Yet cross-border projects are rarely straightforward, while the ultra-deepwater acreage involved brings technical difficulties of its own.

Cross-border cooperation

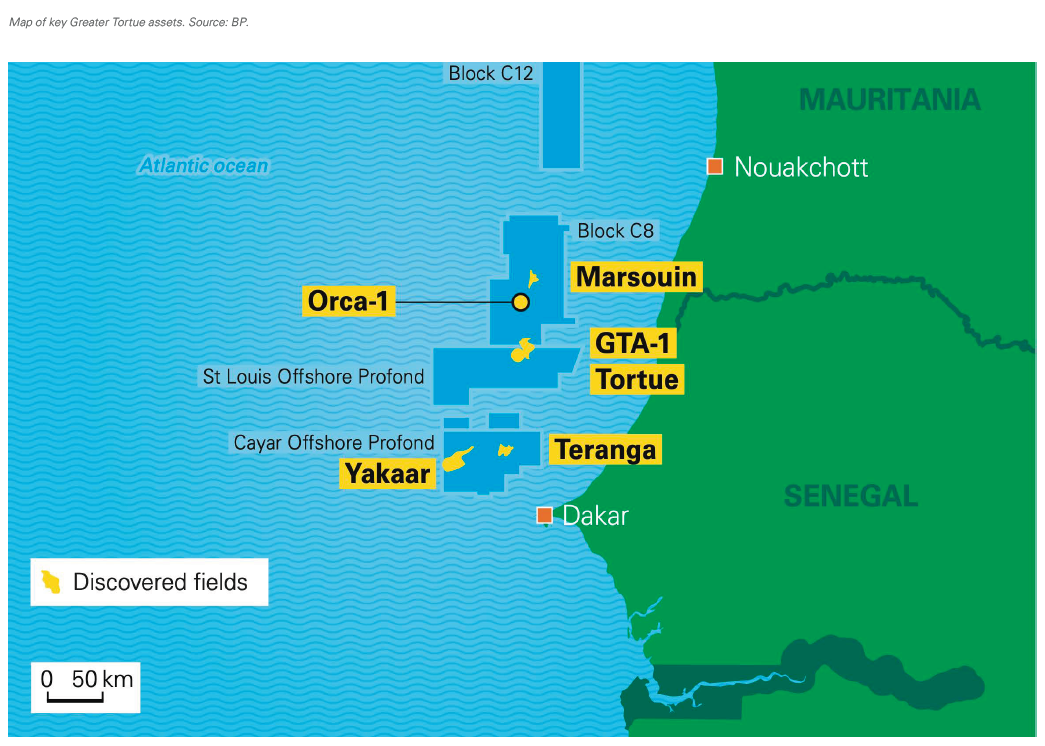

GTA is challenging because of the water depths involved and the fact that it spans two countries. The project’s 15 trillion ft3 in reserves lie on the Tortue Field offshore Mauritania and in the Ahmeyim Field offshore Senegal, both of which are about 120 km offshore in 2,850 m of water, making it Africa’s deepest oil and gas project..png)

Given the scale of the reserves, a larger onshore LNG plant might have been preferable, particularly given the range of other offshore gas discoveries and prospects in the area. However, the fact that the reserves straddle two countries complicated matters, with both governments keen to host an onshore plant. Modular development of FLNG vessels on the common maritime border provided a less politically-complicated and flexible alternative.

The final investment decision (FID) on the first GTA phase was taken by the development consortium in December 2018, with first gas originally due in 2022. However, as with so many projects, work was delayed by the COVID-19 pandemic. Nonetheless, Kosmos, which discovered the fields, announced that the $6.5bn project was 90% complete at the end of 2022.

The project is operated by BP, which now has a 56% stake, with the remaining equity held by Kosmos (27%) and two state-owned companies: Petrosen of Senegal (10%) and Société Mauritanienne des Hydrocarbures (7%). BP Gas Marketing has been chosen as the sole buyer for all output from Phase 1.

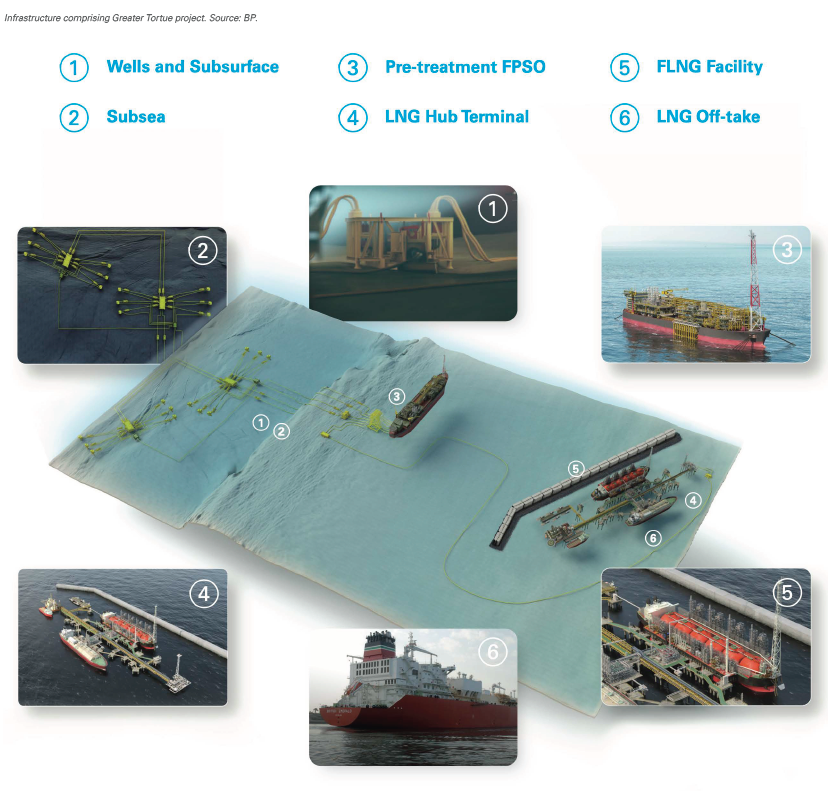

Gas and liquids produced on GTA Phase 1 will be separated by a floating production, storage and offloading (FPSO) vessel located about 40 km offshore. With eight processing and production modules, the FPSO will process around 500mn ft3/day of gas. Some will be piped onshore for power generation in the two host countries, but most will be transferred to a floating LNG (FLNG) vessel, Gimi, which will be located on the maritime border between Mauritania and Senegal, 10 km offshore in 120 m of water.

The FPSO was built by TechnipFMC under an engineering, procurement, construction, installation and commissioning contract at a Cosco Shipping shipyard in China and was due to arrive on the project site as Gas in Transition went to press. The Gimi, which is expected to have production capacity of 2.3mn mt/yr, is being converted for the project at the Keppel Shipyard in Singapore at a cost of $1.3bn and will be leased by Golar LNG to BP under a contract of up to 20 years.

Baker Hughes is providing subsea production infrastructure and turbomachinery equipment for the first phase.

Phase 2

International interest in the region’s LNG potential has risen. US treasury secretary Janet Yellen visited president Macky Sall of Senegal in January, while Sall held talks with German chancellor Olaf Scholz over shipping LNG to Europe last May in the immediate aftermath of Russia’s invasion of Ukraine. Given their Atlantic basin location, Senegal and Mauritania are particularly well placed to satisfy the rise in European LNG demand.

GTA has substantial potential beyond Phase 1 and will probably be developed in three phases, with a total capacity of 10mn mt/yr. Yet the FID on Phase 2 has not been taken. Some sources suggest it could be delayed until early next year because the Mauritanian and Senegalese governments want the consortium to prioritise domestic gas supply over LNG production.

GTA has substantial potential beyond Phase 1 and will probably be developed in three phases, with a total capacity of 10mn mt/yr. Yet the FID on Phase 2 has not been taken. Some sources suggest it could be delayed until early next year because the Mauritanian and Senegalese governments want the consortium to prioritise domestic gas supply over LNG production.

Last July, Kosmos CEO Andy Inglis said: “In light of the changed global market conditions following the invasion of Ukraine and the continuing volatility, our aim is to agree on the best concept in the coming months, which will enable us to advance the pace with the right expansion. This is taking longer than initially envisaged as we look to obtain the full agreement of both governments who are rightly considering the importance of their gas resource and the opportunity to build new government-to-government partnerships.”

However, at the end of February, BP announced that the development plan for Phase 2 had been completed and that it was working with contractors to move towards the pre-front end engineering and design (FEED) stage. New wells and subsea infrastructure will be added to the project’s existing structure, adding 2.5-3.0mn mt/yr of liquefaction capacity, presumably requiring the addition of a second FLNG vessel.

The consortium is considering liquefying the gas using electricity to reduce the project’s greenhouse gas emissions in line with their wider environmental pledges.

Gas hub expansion

GTA is just one element in wider gas industry activity in the two countries. According to BP, GTA Phase 1 is the first step in unlocking wider gas reserves in the region, which the firm estimates may contain more than 50 trillion ft3 of natural gas.

Kosmos has said that two other gas hubs could be developed near GTA based on the BirAllah find offshore Mauritania and the Yakaar-Teranga discoveries offshore Senegal.

Yakaar-Teranga, which is estimated to contain 20 trillion ft3 of natural gas in 3,000 m of water, was discovered in 2017. Kosmos and BP were due to take the FID on developing the find last year, but this has been pushed back until later this year, with first production also likely to be extended beyond 2024. Phase 1 would supply 150mn ft3/d to the Senegalese power sector and other domestic customers. Phase 2 will involve increased domestic supply, particularly for petrochemical production, plus an LNG plant of unspecified capacity.

In addition, BP renewed its production sharing contract on the BirAllah and Orca fields offshore Mauritania early last year, enabling it to continue with plans for additional LNG production. The Mauritanian fields were discovered in 2019 and contain an estimated 13 trillion ft3 in water depths of about 2,500 m.

However, on both BirAllah and Yakaar-Teranga it is not clear whether standalone LNG projects will be developed, or if either of them could be integrated with one of the region’s other planned gas projects. It appears that talks between the developers and the two governments are ongoing.

As with GTA, it might be simpler to connect the various gas fields to a single, large onshore LNG plant, but, again, it is likely that both Senegal and Mauritania would want to host the project. Twin onshore projects either side of the border could be feasible, as is planned in southern Tanzania and northern Mozambique on the other side of the African continent. However, this may not be warranted by the gas volumes and implies a long lead time before first LNG would be produced.

Aside from LNG and onshore gas supply, BP also plans to develop a hydrogen project in Mauritania, probably to supply European markets.

Meanwhile, Senegal will also begin producing oil for the first time later this year when Australian firm Woodside Energy brings the Sangomar Field on stream, with production capacity of up to 100,000 b/d. The FPSO for the project has been completed, again by Cosco, but no plans for the commercial development of the field’s associated gas reserves have yet been announced.

In 2021, US firm New Fortress Energy signed a memorandum of understanding with the government of Mauritania to develop the 1.4mn mt/yr Banda LNG project using its Fast LNG technology, while also supplying gas to the existing 180-MW Somolec power plant and another planned 120-MW power plant.

Interest has also heightened about further prospects in the wider region. GTA is now considered the northern edge of an oil and gas region running down as far south as Guinea, where gas finds have already been made. Termed by some as the ‘MSGBC Basin’ to represent the countries included – Mauritania, Senegal, Guinea-Bissau and Guinea-Conakry – it is actually a succession of basins which may hold the potential for a series of LNG developments.