Sempra takes FID on Port Arthur LNG Phase 1

US LNG developer Sempra on March 20 announced that its 70%-owned subsidiary, Sempra Infrastructure Partners, had reached a positive final investment decision (FID) for the development of the Port Arthur LNG Phase 1 project in Jefferson County, Texas.

Sempra Infrastructure closed its joint venture with an affiliate of ConocoPhillips, as well as announced an agreement to sell an indirect, non-controlling interest in the project to an infrastructure fund managed by KKR. Additionally, Sempra Infrastructure announced the closing of the project's $6.8bn non-recourse debt financing and the issuance of the final notice to proceed under the project's engineering, procurement and construction agreement.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

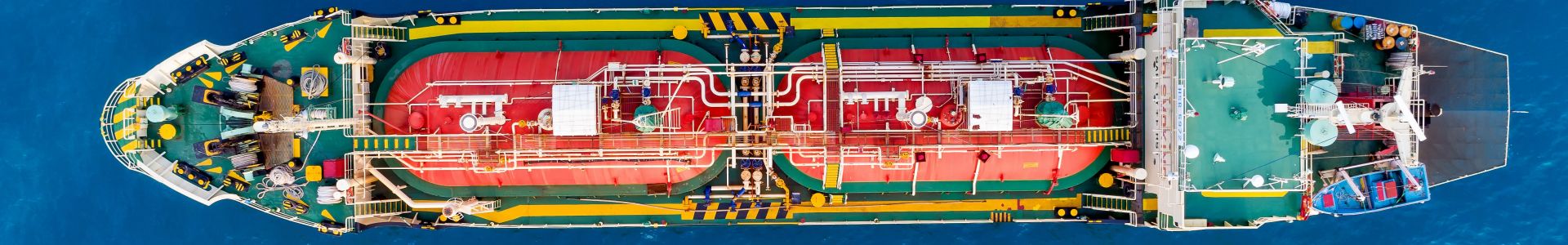

The Port Arthur LNG Phase 1 project is fully permitted and is designed to include two natural gas liquefaction trains, two LNG storage tanks and associated facilities with a nameplate capacity of approximately 13mn metric tons/year. Total capital expenditures for the Port Arthur Phase 1 project are estimated at $13bn, Sempra said.

The long-term contractable capacity of approximately 10.5mn mt/yr is fully subscribed under binding long-term agreements with counterparties —ConocoPhillips, RWE Supply and Trading, PKN ORLEN, INEOS and ENGIE, all of which became effective upon reaching FID.

Sempra Infrastructure is also actively marketing and developing the Port Arthur LNG Phase 2 project, which is expected to have similar offtake capacity to Phase 1.

Partnerships

Sempra and ConocoPhillips closed their joint venture whereby an affiliate of ConocoPhillips has acquired a 30% non-controlling interest in the project, is purchasing 5mn mt/yr of LNG offtake from the project under a 20-year sale and purchase agreement and is managing the project's overall natural gas supply requirements. ConocoPhillips will also have certain rights to participate in future expansion projects in both equity and offtake.

Sempra Infrastructure announced an agreement whereby KKR will acquire a 25% to 49% indirect, non-controlling interest in the Port Arthur LNG Phase 1 project. Pursuant to the agreement with KKR, Sempra Infrastructure will retain certain economic and other rights with respect to the interest being transferred while granting KKR certain minority interest protections. KKR is making the investment primarily through its Global Infrastructure Investors IV fund.

Sempra Infrastructure is targeting 20% to 30% of indirect ownership interest in the project, subject to the closing of the KKR sale.

Sempra Infrastructure has contracted with engineering, construction and project management firm Bechtel Energy and has issued a final notice to proceed for the project. The expected commercial operation dates for Train 1 and Train 2 are 2027 and 2028, respectively.