Reality versus wishful thinking: what to expect from Brussels' new leadership [Global Gas Perspectives]

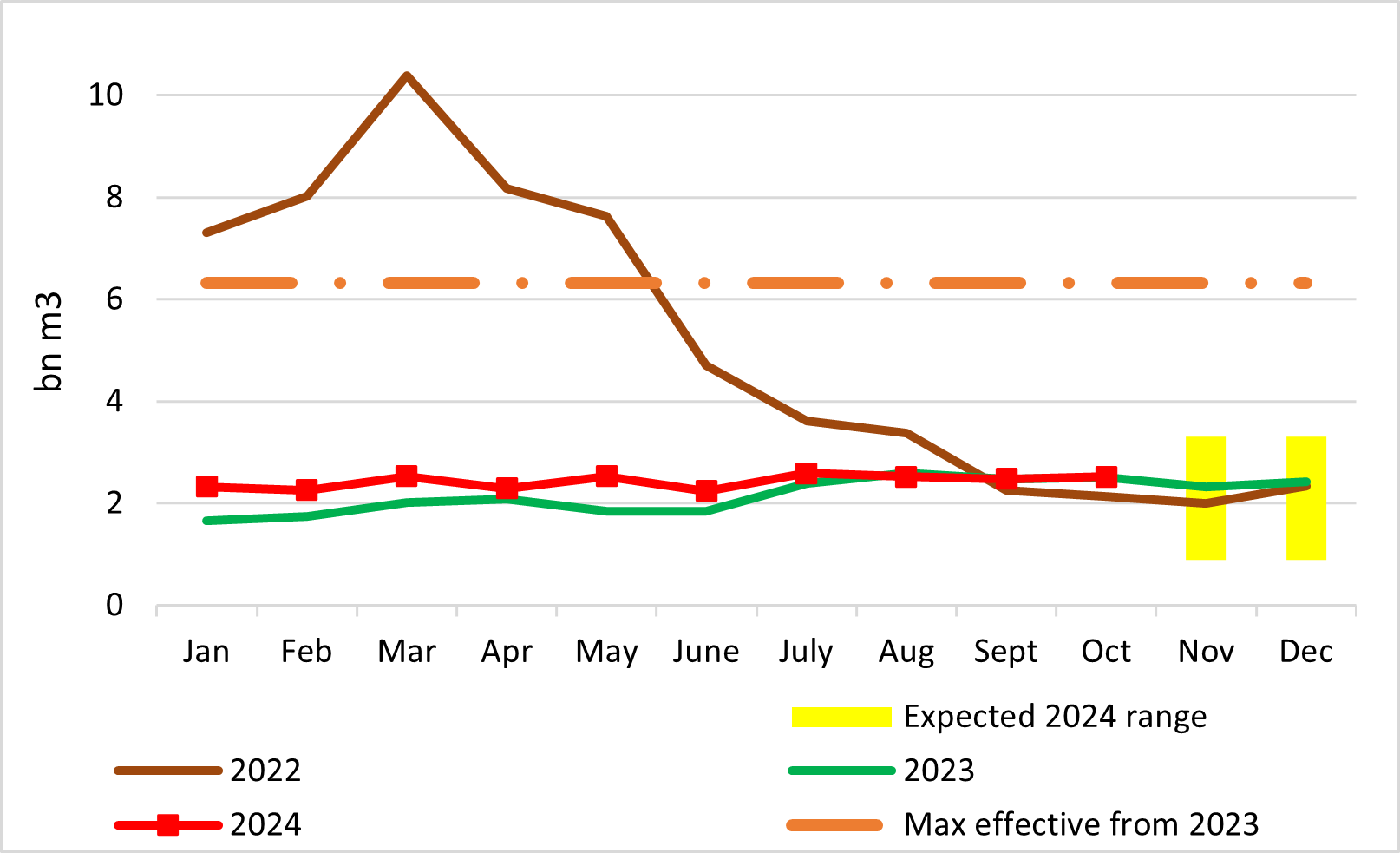

Gazprom piped 2.5bn m3 of natural gas to Europe last month, only 0.5% more than it delivered in October 2023. Year-to-date, volumes were 15% higher in the first 10 months of 2024, despite the EU’s ambition to eliminate Russian gas imports entirely within a few years. The auditions of the EU Commissioners-designate in charge of energy in public hearings at the European Parliament from November 4-12 could generate some interesting Q&As on this subject.

Gazprom’s monthly gas exports to Europe

Sources: Entsog, thierrybros.com

Gazprom CEO Alexei Miller on October 10 described the situation on the European gas market as “bad,” noting the significantly higher prices for gas and electricity compared with competitors and, as a result, the deindustrialization of Europe. "Volatility on the gas market will increase even more, and what is most unpleasant is that such a policy on the European market could lead to a new price shock for gas and supply disruptions," Miller said. This is in line with last month’s analysis cautioning against Gazprom’s willingness to grow supply to Europe this winter. Nevertheless, pipeline flow should remain within the expected narrow range of between 0.9-3.5bn m3/month.

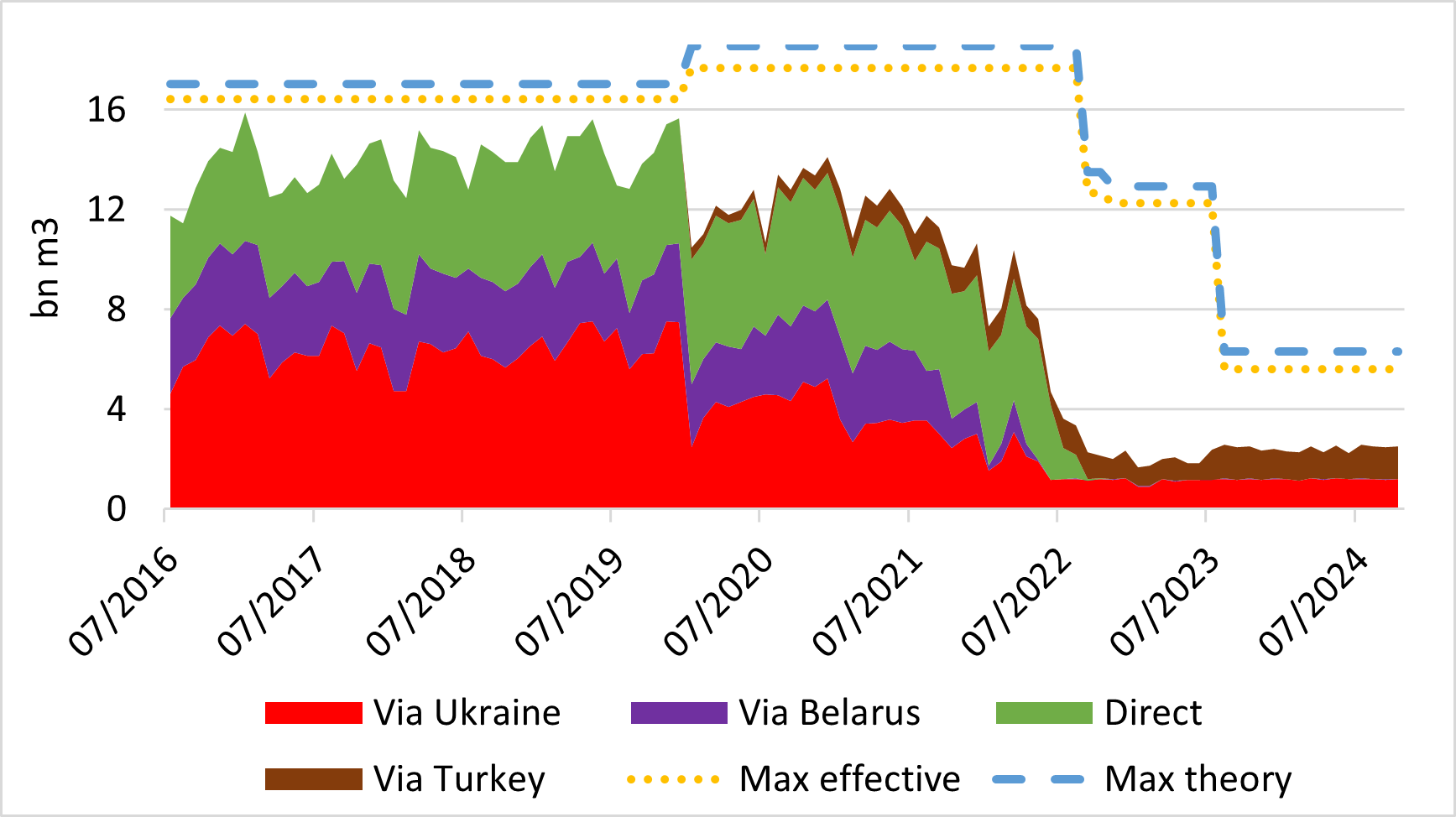

Gazprom’s monthly gas exports to Europe via route

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

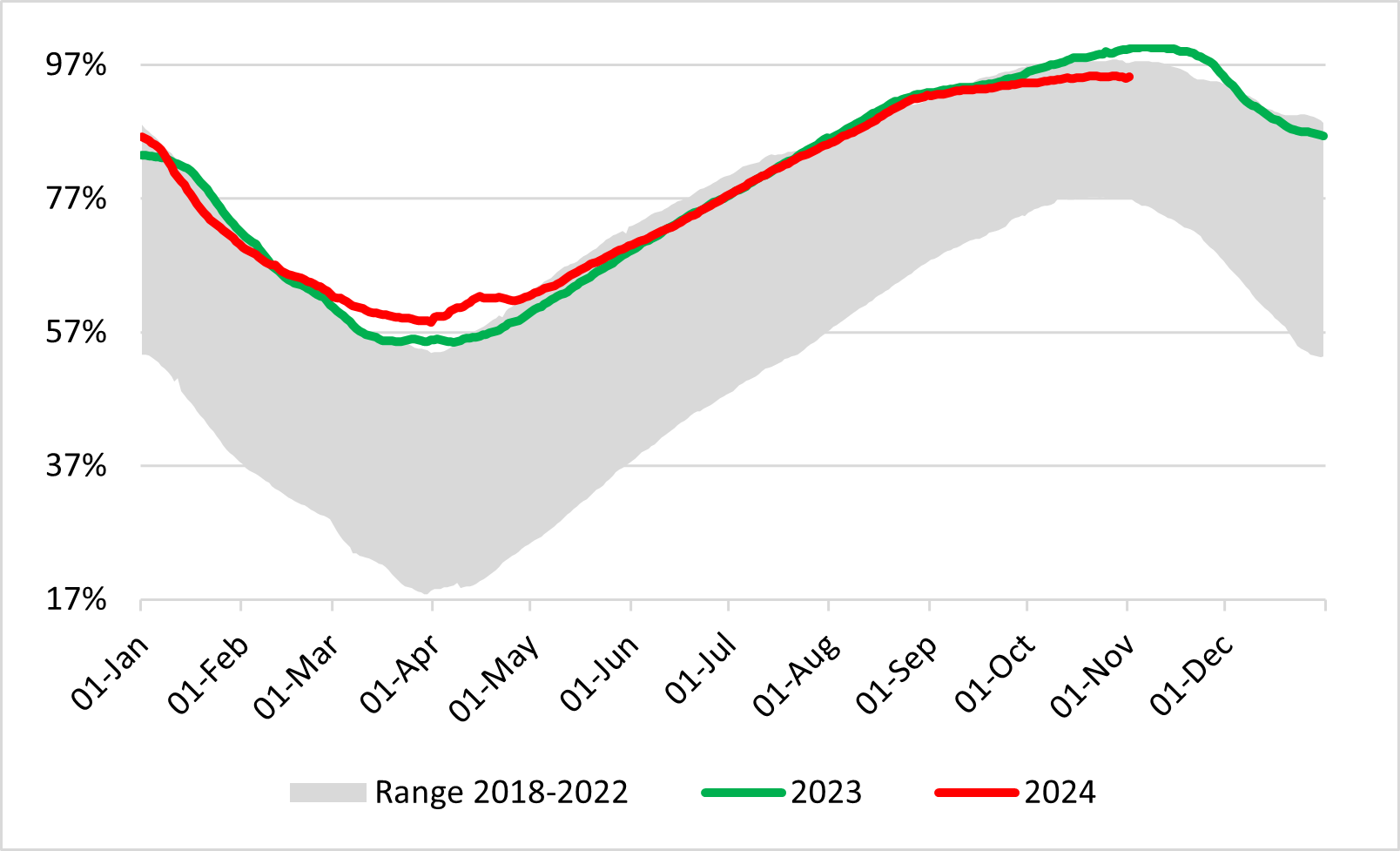

EU storage utilisation reached the 90% target on August 19, more than two months ahead of schedule. Storage facilities were filled to 95% of capacity by the end of October, towards the higher end of the historical range but slightly less than at the same point last year as withdrawal started on October 21, versus November 9 last year.

EU gas storage utilisation

Source: GIE, thierrybros.com

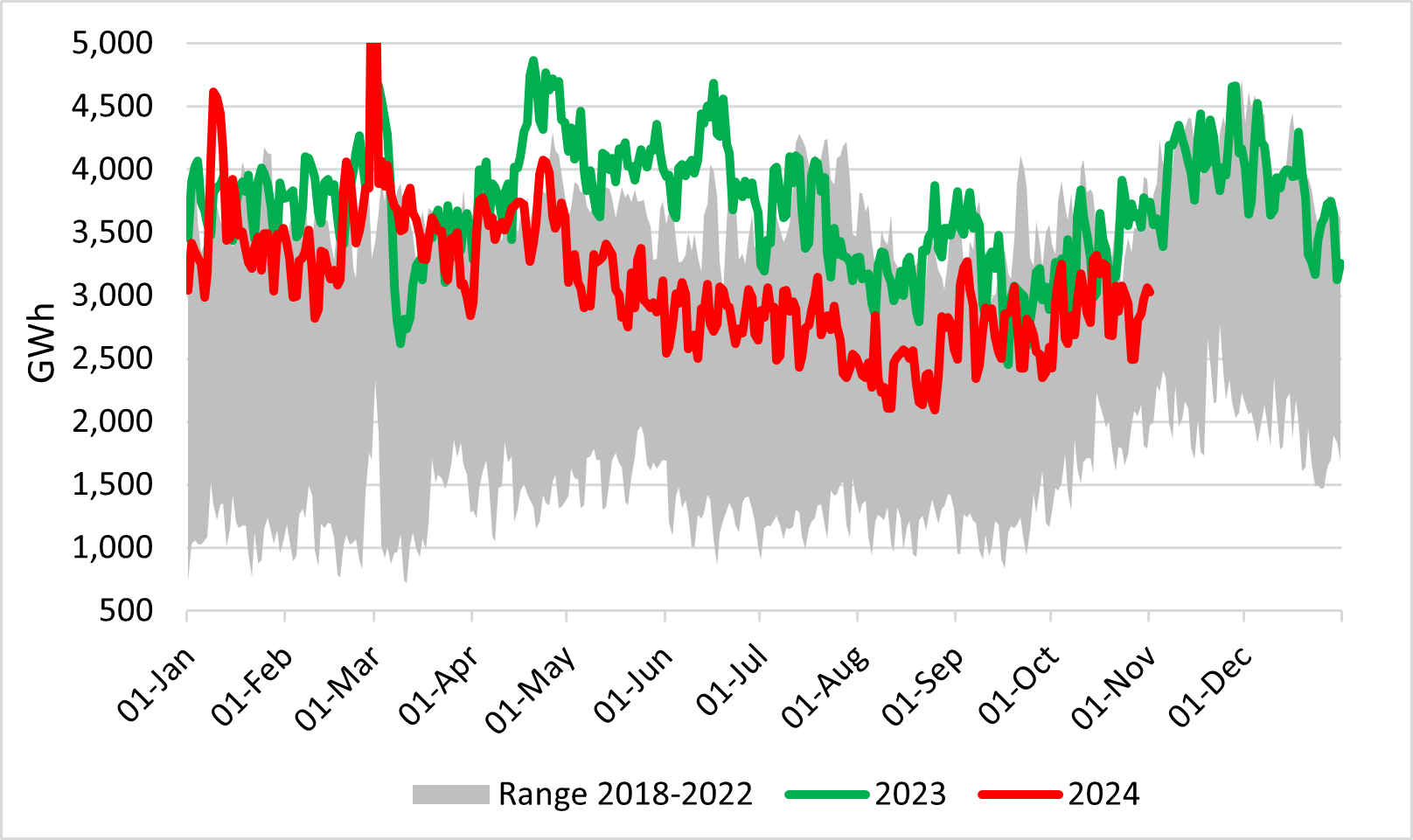

Spot LNG provides the equilibrium between Asia and Europe with Asia more willing to attract LNG since the start of this year as the EU is in no need of extra LNG, thanks to Russian supply and further demand destruction. Year-to-date, send-out is 16% lower than for the same period last year. But even with European storage levels at a near record high, Europe is paying over $12/mn Btu for gas, as the global gas market is tighter than the consensus predicted, because of delays in LNG plants start-ups.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

Looming two months from now is the expected end of Russian gas transit via Ukraine. Moscow and Kyiv’s long–term transit contract expires at the end of December and is unlikely to be renewed. But with European wholesale gas prices at above $12/mn Btu, replacing the 14bn m3/yr of gas that is delivered through Ukraine’s pipelines is going to be a challenge. Replacing a further 5% of EU gas demand could be very expensive and could contravene the next European Commission’s focus on re-industrialisation. Interestingly Hungary’s foreign affairs minister Peter Szijjarto met Gazprom’s CEO on October 10 at St. Petersburg International Gas Forum 2024. “It was noted that Russian gas supplies are highly important for ensuring the energy security of Hungary [and] a memorandum of understanding with regard to the possibility of increasing Russian gas supplies to Hungary was signed.”

Dr. Thierry Bros

Energy Expert & Professor

November 8, 2024