Playing the long game: North American shale operators that prioritize ESG win in the long run

Oil and gas companies in the US are striving to find a balance between ongoing environmental, social and governance (ESG) initiatives and a desire to ramp up production as the world battles a sweeping energy crisis. All the while a larger conversation concerning so-called “greenwashing” – the practice of misleading investors into thinking environmentally unfriendly practices are, in fact, good for the environment – grips the US financial market.

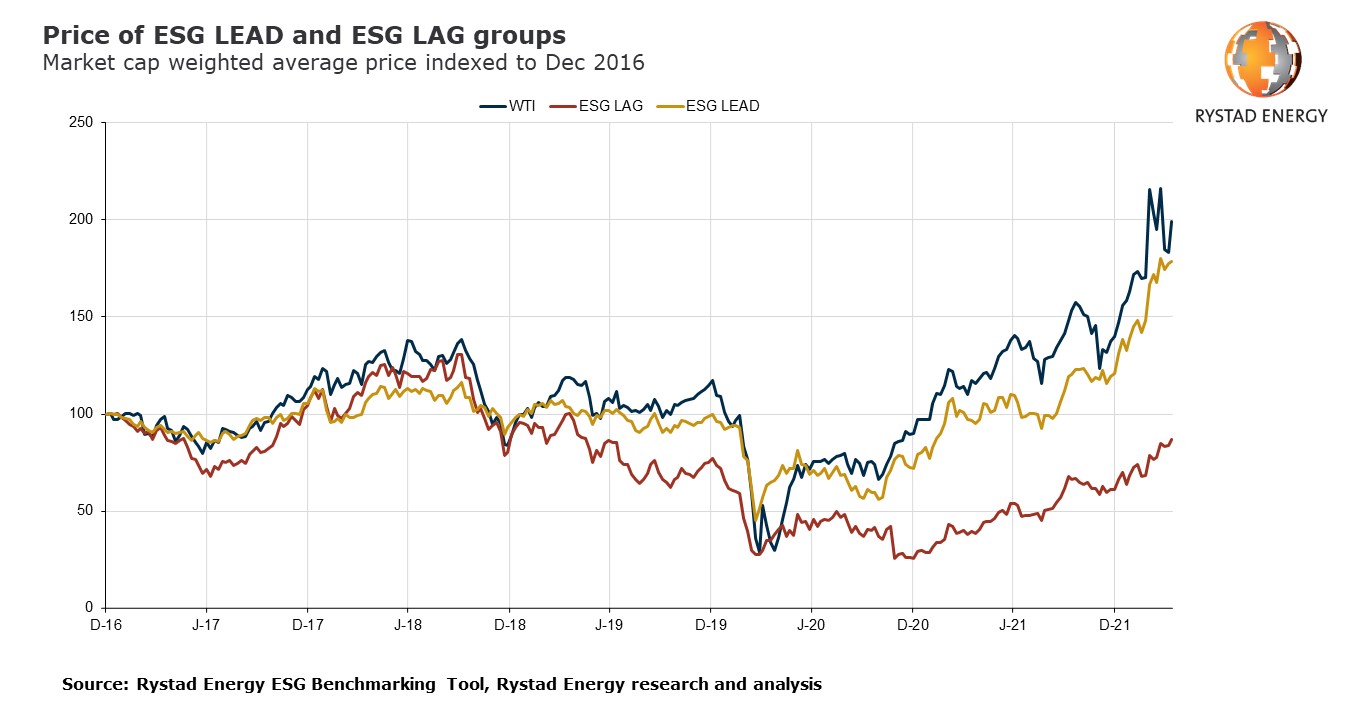

Rystad Energy has evaluated the ESG performance of a peer group of 43 public oil and gas producers in the US and Canada, including supermajors ExxonMobil, Chevron and BP, and compared it against their stock price to understand how focusing on these issues impacts their share performance. The analysis shows that while companies ranked the lowest on ESG outperformed the market since the recent rally, companies with a higher ESG score performed better over the long term.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

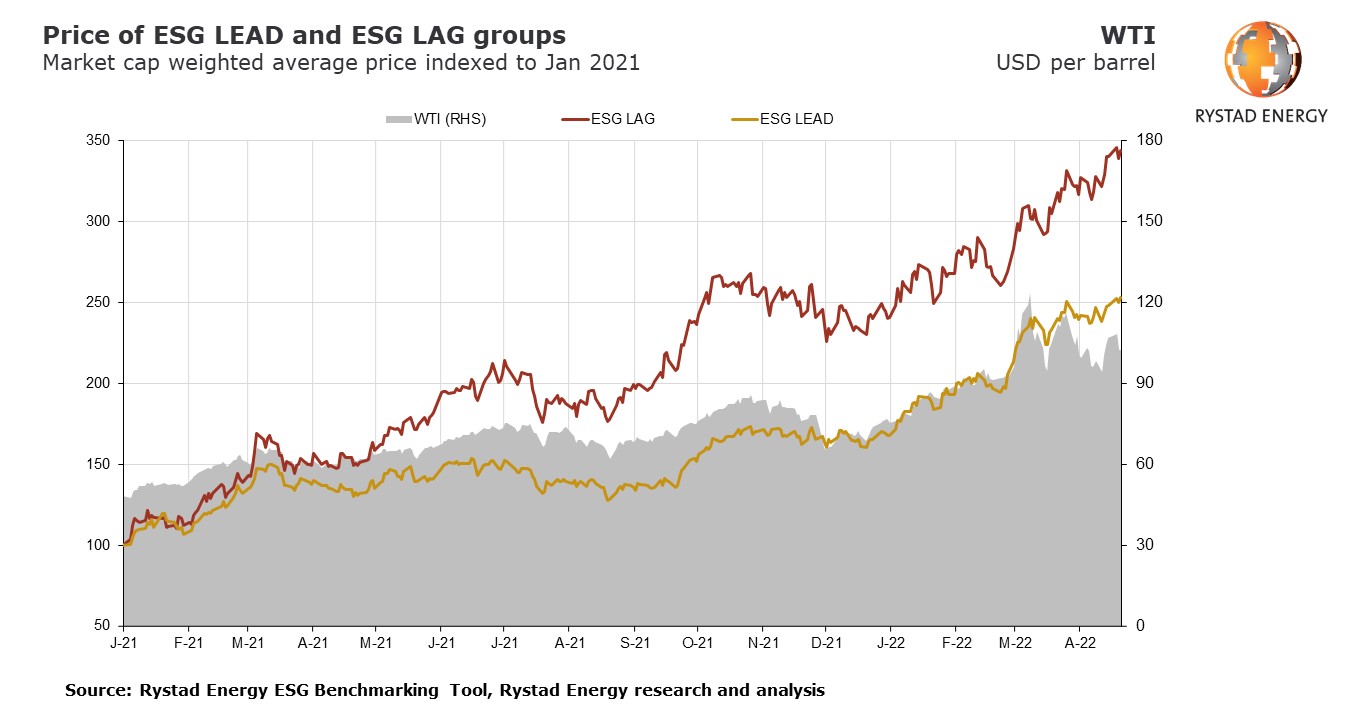

Indexed to January 2021, producers with the worst ESG ratings (named ESG LAG) gained almost 250 points, whereas those with the highest scores (ESG LEAD) gained only around 150 points. However, if you expand the timeline and compare prices to those in December 2016, the companies with the strongest ESG ratings gained 78 points, while the lowest performers dropped 12 points on average. This is a clear illustration that ESG ratings impact long-term financial performance.

The short-term trend is easily explained, as operators in the ESG LEAD group are mostly larger producers, with an established sustainability strategy and stronger finances. Companies with the lowest scores are the more volatile smaller operators that have yet to build financial endurance and sustainability improvement plans. In an upcycle like the one witnessed since the start of 2021, higher leveraged and undervalued companies are the ones that recover the fastest.

“It is clear that ESG performance impacts investor appetite, even though ESG scores have not been the lead indicator of stock growth during the latest market recovery in 2021. As such, ESG performance affects the ownership profile of the energy sector with sustainability-focused investors diversifying into the other sectors,” says Alisa Lukash, Rystad Energy’s vice president of shale research.

The energy industry is under greater scrutiny as grassroots activists and leaders press for more prompt climate action. Drawing the spotlight as a key contributor to the worsening environmental crisis, big and small companies have stepped up their efforts to implement best practices regarding emissions, spills and accidents. They are working even more closely with society to ensure minimal disruption and are stepping up spending on communities near their operations by building hospitals, schools and parks.

But the sector is facing growing calls to boost output to help plug the growing global supply-demand gap because of the prolonged Russia-Ukraine war that has in part resulted in oil and gas prices surging to multi-year highs. Amid the firmly elevated market, the list of US states where the average cost of gasoline is over $5 per gallon has grown steadily. Given the twin pressure, the industry has to strike a balance between stepping up activity and ensuring that the ramp-up does not result in losing sight of its environmental, social and governance goals.

In our analysis of the peer groups’ ESG performance, the environmental score evaluates hydrocarbon spills, greenhouse gas and methane emissions, emissions reduction targets, water management and alternative energy benchmarks. The social score includes gender and ethnic diversity, employee total recoverable incident rate (TRIR), contractor TRIR and total TRIR benchmarks. Finally, the governance score consists of the percentage of independent board members, board gender diversity, climate-related responsibilities for boards, ESG incentives for employees and management and ESG-related compensation. Together, the companies in the peer group are expected to account for about 60% of the US and Canada shale and oil sands output in 2022.

The ESG ranking shows that supermajors and diversified shale operators scored the highest on the environmental dimension, while supermajors scored the highest on the social parameter. Diversified and Permian-focused operators scored the best on governance. The highest ESG score overall goes to Chevron, followed by SM Energy in second, while Ovintiv and ConocoPhillips shared third place.

Antero Resources came out on top in the environmental rankings, closely followed by several private operators. British supermajor BP landed the top spot in the social charts, alongside an anonymous private operator, but Marathon, SM Energy and Occidental were not far behind. Chevron scored a perfect 100 points in the governance category, with SM Energy and several others not far back.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.