“Fit for Fifty” and Perhaps for More...?

Nowadays, the politicians and the mass media are passionately devouring, probably absent a strategic purpose, the amendments to the Fiscal Code. One can see yet again that 25 years later the government still sees and approaches taxation and tax policies not as economic tools but rather for fund raising, as social politics instrument.

However, what’s kept aside from the frantically debating, are the envisaged fiscal amendments aimed at the mining and petroleum sector by changes brought to the Petroleum and to the Mining Law. One of the potential reasons would be that this topic lacks crucial significance for the future of Romania in the eyes of the political decisions makers. Judging by a good deal of the population, for as long as the state collects money from what the collective mindset perceives as voracious companies plundering the country’s resources (“the property of the people”), there are no grounds for public debate. Also, it wouldn’t be a topic worthy of attention and, eventually, propaganda for the mass media unless petroleum companies would again report remarkable financial revenues or would embark on new ventures – the prospection or production of new deposits (that the propaganda would include in the potential shale gas category, thus inciting local communities).

Nobody can deny the sovereign right of states to charge taxes on any activity including petroleum activities. It is of utmost importance when, why and namely how such fiscal measures are established.

When a tax burden increase in the petroleum sector is sought

There couldn’t have been a more inappropriate timing.

The worldwide petroleum sector is confronted with the fiercest crisis of the past fifty years. These days, the oil barrel price reached historical low levels. Oil companies are reconsidering their investment strategy and business plans following the catastrophic financial revenues recorded lately. The drop in investment triggers a step back in the development of new technologies, portfolio strategies are going back to drawing board, along with mass layoffs and cascade effects at subcontractor and tax revenue level. Petroleum exporting countries are faced with the same dramatic effects, which might have an impact on global security. The shrinkage of large hydrocarbon consuming markets (China) and the outlook of a massive flooding of the market with abundant additional resources (Iran) can only aggravate the intricate state of affairs.

In their attempt to maintain a positive frame of mind, the employees in the petroleum industry dubbed the times we live in as that period when one needs to be "fit for fifty". In other words, tightening the belt to stay in the game at times when one barrel amounts to USD 50.

Also, one cannot rule out the local geological background. Romania is confronted with highly depleted hydrocarbon resources, a high degree of fragmentation and more or less the lowest well productivity in Europe. Any potential prospection of unconventional sources would be difficult to forecast for the coming years, considering the twisted perception of the Romanian population towards the environmental risks that such industry would involve. The political speech on the “energy independence” secured by the resources in the Black Sea is not based on the reality of identifying new commercially viable reserves and an appropriate infrastructure for the transmission of such hydrocarbons to marketplaces. As for the onshore sector, the Chevron case proved that a well organized propaganda can have effects on the entire industry, blocking the access of companies to prospection or production blocks, which involves significant increases in the deployment costs. Not until today has the Government managed to clarify the regulatory issue of petroleum companies accessing the exploration/production blocks (although the access right of petroleum companies is currently undeniable by law, even the single comma in the law text is speculatively used to deny such right).

A potential tightening of the taxation regime in the field might have serious consequences on the performance and competitiveness of the petroleum industry in Romania, namely because the emergence of several „elephants”[1] as reserves located in Iran, Australia, the Arctic area or Argentina undoubtedly determine the migration of petroleum companies from difficult areas (in terms of politics, law, tax, geology or trade) towards the abundant areas (sometimes despite an intricate political or legal background).

How will the tax “reform” in the petroleum sector be completed?

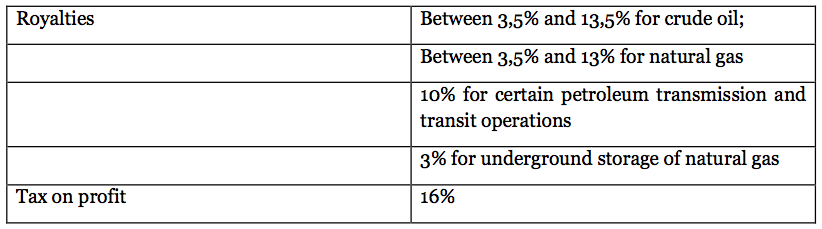

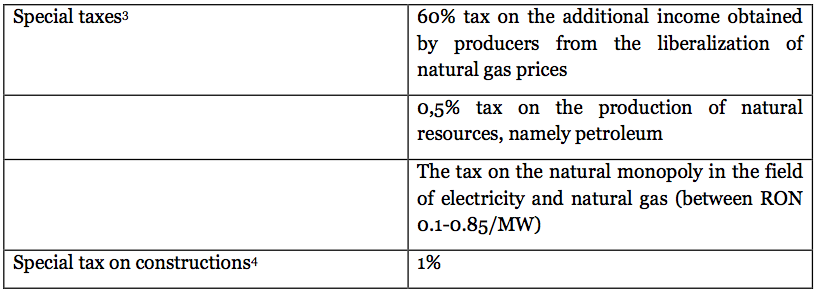

As regards the taxation of the petroleum sector, Romania currently implements an income based system [2] which involves the imposition of a differentiated royalty rate, the value of such being computed by reference to the hydrocarbon output per deposit, along with the tax on the profit of enterprises and several special taxes.

On top of this there are also the remainder taxes and fees (direct and indirect) borne by the taxpayers legal entities in Romania. One cannot fail noticing that “oilmen” currently bear one of the heaviest tax burdens in Romania.

Whereas a revision (increase) of the petroleum royalties levels would have drawn the forecasted state budget contributions only for the petroleum concessions concluded after enforcement of the new regulation (by virtue of the law principles tempus regit actum, non-retroactivity of the law and of the stability clause included in the petroleum concessions), according to the available information, it appears the Government intends to ensure an increase in the governmental revenues by enforcing an additional profit tax which being linked, as any other tax, to the moment the revenue was earned, would also include the profit made by petroleum companies based on concessioning operations prior to the enforcement of the additional tax.

We shall leave aside for now the in-depth analysis on the opportunities and impact of such measures as there are several cross-disciplinary analysis groups to tackle the issue (a well documented analysis can be accessed at: http://www.enpg.ro/headline-194-ELEMENTELE_UNUI_REGIM_FISCAL_OPTIM_AL_SECTORULUI_OFSHORE_DIN_ROMANIA.html), and further stay focused on the legal background.

Therefore, based on the envisaged legislative amendments, Romania would go on implementing the same taxation system described above. The difference consists in the additional profit tax replacing the tax on additional profit (“windfall tax”). Briefly, petroleum companies would have to pay the royalty, the profit tax and the additional profit tax, along with all other taxes and levies applicable to any business.

What does additional profit tax mean? It’s the name itself that tells it: in addition to the usual tax paid by all companies in Romania (16%), the petroleum companies will have to pay, for the same profit made, yet another tax (the amount is still unknown). Therefore, the result would be a double taxation of the same taxable income on the same line and timeframe, through the same fiscal tool.

The avoidance of double taxation is enshrined at international level through the double taxation conventions mechanism, as an expression of the principles of “fiscal neutrality” and “one time tax”.

The Romanian law regulates this principle at Art. 3 of the Fiscal Code. The full content of the article is worth citing below:

The taxes and levies governed by the present code are based on the following principles:

a) neutrality of the fiscal measures as regards the various categories of investors and capital, forms of ownership, by ensuring equal conditions for investors and for Romanian and foreign capital;

b) certitude of taxation, by developing clear legal norms, that do not lead to arbitrary interpretations, while the deadlines, manner and amounts payable are clear for each payer, respectively such payers may follow and understand their fiscal burden and may determine the impact of their financial management decisions on their fiscal burden;

c) fiscal equity at the level of natural persons, by different taxation of incomes based on the size of the incomes;

d) efficiency of taxation by providing long-term stability of the provisions of the Fiscal Code, so that such provisions do not to lead to unfavourable retroactive effects for natural and legal persons, in comparison with the taxation in force on the date when such adopted major investment decisions.

It goes without saying that such provisions that shall be treated as principles apply to any tax whether established by special law (such as an amendment to the Petroleum Law) or not.

It is also clear that a double taxation is reached in the harshest possible manner by imposing a profit tax in addition to the existing 16%, which would run counter to the principle of neutrality mentioned above.

Secondly, there is an obvious discrimination against the upstream sector in Romania as compared to other categories of taxpayers subject to profit taxation. A non-discriminatory treatment of all taxpayers implies two aspects: equality against the fiscal law and a fair determination of tax duties.

Equality against the fiscal law is based on the provisions of Art. 16 of Romania’s Constitution, and calls for an equal treatment applied in cases which, depending on their intended purpose, are not different[5].

A fair determination of tax duties implies a proportional, reasonable, equitable taxation without making distinctions between taxes based on groups or categories of taxpayers[6]. Applying a tax aimed strictly at hydrocarbon producers will lead to an inequitable application of tax duties, both as compared to other sectors, as well as within the mining industry.

There has already been a precedent in Italy in this regard, where a recent decision of the Constitutional Court[7] stated that the so-called "Robin Hood" tax imposed since 2008 and gradually increased over the ensuing years to take advantage of the rising prices of crude oil and increasing thus budget revenues from the energy sector, is discriminatory against companies operating in the petroleum sector as compared to other levels of activity. Grounding its decision, the Court argued that such levy was applied as an independent and structural tax, which proves a discriminatory nature, although it was imposed as an additional profit tax on the energy companies in the context of the unusual economic environment.

Last but not least, the amendment of the taxation terms applicable to petroleum concession holders can be regarded as a breach of the stability provisions of the Petroleum Law or, under contract, of stability the clauses provided by the petroleum concession agreements. In such context, any advocacy that the offshore petroleum operators working at depths exceeding 100 meters would be exempted from the application of the new tax under the provisions of Emergency Ordinance No. 160/1999 (which was implicitly repealed by the Petroleum Law), providing for the enforcement of the existing tax regulations at the time of execution of the petroleum agreement throughout its performance term, would actually place the dispute concerning the legality of the new tax and concerning concession stability, once production is started, at the level of the relationships between petroleum operators and ANAF, i.e. the courts of law, at that given time when, perhaps, the Government’s target will have already been achieved.

Besides the legality issue attached to an additional tax applied exclusively to the petroleum sector, arguments can be invoked arising from the obligations undertaken by Romania under the bilateral investment treaties concluded with 92 states to date. Such arguments could be justified on the basis of the principles enshrined by the Treaties and also widely recognized by the international arbitration case law.

International law undeniably recognizes the necessary, legitimate and sovereign right of the states to establish and apply taxes, but does not consider that such right should be used to discriminate, confiscate/expropriate property/income, in breach of contractual or international obligations, especially in the field of foreign investments where investors are subject to the sovereignty of another foreign country under situations de facto and de jure, promises or reasonable and legitimate expectations that their investment will not be affected in an arbitrary way.

There is a widespread international case law which firmly denounces failure of the states to comply with the principles of equal and fair treatment of investors and protection against expropriation (direct or indirect) enshrined by:

Equal and fair treatment of investors, considered an expression of good faith – the most often invoked principle in international investment litigation. Such principle requires transparency and stability of the legal framework of the host State governing the operations promoted by investors, and protection of the legitimate expectations of the latter as concerns the economic and legal environment in which they are making investments.

Creeping expropriation, occurring when investments are subject to measures that have the effect equivalent of an expropriation by affecting the ownership right of an investor, meaning that such investor is deprived of its ability to achieve economic benefits, according to the expectations arising from the existing legal and tax framework at the time of such investment.

For such purpose, we will quote only a few of the multitude of arbitration cases, focusing on the court resolutions and without approaching other legal nuances and particularities.

In Revere Copper v. OPIC-Jamaica case (August 24th, 1978, 17 I.L.M. 1321) the arbitral court held that "a tax measure is not necessary to be of a confiscatory nature to represent a breach of the State’s obligation against an investor; to deprive the investor of the economic value of its investment by implementing excessive tax measures is per se an event of default as concerns the Government’s contractual obligations".

Likewise, in Link-Trading v. Moldova case (UNCITRAL, 2002), the arbitration court held that "in principle, tax measures are likely to become of an expropriatory nature when considered abusive. A tax measure is unfair when it can be demonstrated that the State acted in an unfair manner as concerns the investment, when it adopted measures which are arbitrary or discriminatory by their nature or implementation, or if the action taken represents a breach of the obligations undertaken by the State in respect of that investment”.

In Occidental v. Ecuador case (ICSID Case File ARB/06/11, 2012), the arbitral court held that the Ecuador State is liable for breach of the Bilateral Investment Treaty ("BIT"), more specifically of the principle of equal treatment, holding that the stability of the legal and business framework in terms of taxation (Ecuador amending in this case its tax law and declining the VAT return to the company Occidental) is a fundamental aspect of the principle of equal treatment.

As regards double taxation, at European level, the European Court of Human Rights, in the case Building Society v. UK, held that domestic double taxation can be considered as a breach of Art. 1 of Protocol 1 to the European Convention on Human Rights. Similarly, France's Constitutional Court upheld (Award 2010-70 QPC) the same under its domestic law (Art. 13 of the Declaration of the Rights of Man and Citizen) considering double taxation incompatible with the French Constitution. Also the European Commission concluded constantly that double taxation is incompatible with the single market (SEC(96)1996 DOC(05)2306/2005, COM(2005)532/2005, COM(2006)823/2006.

Worth considering are also the recent arbitral awards in cases Micula and Yukos, the latter being more interesting as, for the first time, it was considered that the exception to the applicability of the European Energy Charter to the "tax measures" (Art. 21) is excluded when such measures lead to an expropriation (either direct or indirect), discrimination or unfair treatment.

International legal doctrine states in this regard that domestic tax measures can breach international law, respectively, can be assimilated to an expropriation, when:

- taxes are of a confiscatory nature, when alone or combined with other taxes, they are of an excessive or destructive nature;

- taxes are able to force investment abandonment or sale at a price subject to pressure;

- taxes are in breach or repudiate an explicit obligation of the Government towards investors (such as concession stability clauses);

- taxes are of a discriminatory nature;

- taxes are arbitrary, when it is obvious that there is no new income tax generator factor which require taxation under the tax law or where its imposition is ungrounded;

- taxes that are in breach of the law of the State under which the investor decided to make the investment and to which the investor was entitled under international law.

In our opinion, without denying the State’s right to impose taxes, the proposed application of an additional profit tax on the upstream sector represents the very core of a breach by Romania of the principles of international and European law for the protection of investments.

Why would such tax be applied?

Difficult to answer this question, but its answer most likely lies in a combination of factors, such as negotiations with international financial institutions, the need for financial compensation of the effect of proposed amendments to the tax code, political populism, personal frustrations of some politicians against some players in the upstream sector tailored in the most heroic outfit of economic nationalism or totally unjustified comparisons with situations in countries with "elephant" deposits, such as Norway, the State’s administrative inability to effectively direct revenues already derived from levies on the petroleum industry (State revenues from petroleum operations seem to have been almost equalled by ANRP – the National Authority for Property Restitution – compensation in the case files of fraudulent real estate restitutions), but in any case no long-term strategy (a fact that petroleum operations, which are extremely expensive in terms of cost and time, have always criticized) . In any case, such a tax initiative betrays large ignorance of the nature of petroleum operations which typically have a long cycle (20-30 years) of investment recovery. This greatly increases the likelihood that no matter how big a revenue the State might obtain on short-term that would still be far below the long-term loss generated by the decline in investments made in the relevant sector.

Effective management of the natural resources of a State implies their production to be treated as a development instrument by acting as an incentive for major industry players to invest in the economy of that country, thus creating cascade added value to all the involved players, and over-taxation in the sector such as the intended one runs counter to that objective undertaken and repeatedly stated by the representatives of Romanian public authorities. Moreover, the implementation of such mechanism while maintaining the current system of royalties is an option that petroleum companies will not easily accept.

The question is how “fit” the petroleum operators are when faced with the tax increase on the petroleum operations and which is the Government’s "plan B" if confronted with international litigation or a substantial decline in petroleum operations.

Laurenţiu Pachiu and Irina Zamfir

The Energy Policy Group (EPG), a Natural Gas Europe Knowledge Partner, is a Romanian nonprofit, independent and non-partisan think-tank specializing in energy policy, market analytics and energy strategy. EPG’s regional focus is Eastern Europe and the Black Sea Basin, yet its analyses are informed by wider trends and processes at global and EU levels.

[1] “Elephant”- term used by petroleum companies for giant hydrocarbon deposits.

2 The income based system ensures clear revenues to the state budget ever since the commencement of business production; it features transparency, flexibility and predictability both for investors and for the state. On the other hand, the only advantage of the profit based system is that the risks attached to projects are shared by the investors and the state. The drawback of the profit based system, especially today when the oil prices are diving, lies in the possibility of such to entail a drop in the taxable income, or even an integration of the tax in the price to consumers.

3 Enforceable by December 31st, 2015

4 Starting January 2015.

5 Constitutional Court Decision No. 3 of January 6th, 1994, published in Official Gazette of Romania, Part I, No. 145 of June 8th, 1994

[6] Constitutional Court Decisions No. 176 dated May 6th 2003, published with the Official Gazette of Romania, Part I, No. 400 of June 9th 2003 and No. 325 of June 25th, 2013, published with the Official Gazette of Romania, Part I, No. 431 dated July 16th 2013.

7 Decision No. 10 of February 9th, 2015