OPEC Members Leave Their Troubles at Home

The latest OPEC meeting in Vienna reached an uneventful conclusion on Thursday. Compared with the December 2015 meeting, which ran well overtime, and an unproductive April meeting, Thursday's event was different — not in result (OPEC producers reached no consensus on a policy change) but in tone. By all accounts, the discussion was positive, and the group agreed that the oil market was recovering. And it is, albeit slowly. The U.S. Energy Information Administration released data on Wednesday showing that U.S. production had fallen to an estimated 8,735,000 barrels per day, down 200,000 bpd since April's meeting and 430,000 bpd since December's. Meanwhile, the price of Brent crude oil closed above $50 on Thursday for the first time since November.

Despite the meeting's cordial atmosphere, most OPEC producers — beyond the power players in the Gulf Cooperation Council (GCC) — remain in dire political, economic and financial straits. Oil prices may be improving, but for countries such as Iraq, Nigeria and Venezuela, things are going to get worse before they get better. Lacking the financial stability that has enabled GCC members to take a long-term approach to the oil crisis, these OPEC members have had to implement stopgap policies, however unsustainable or futile.

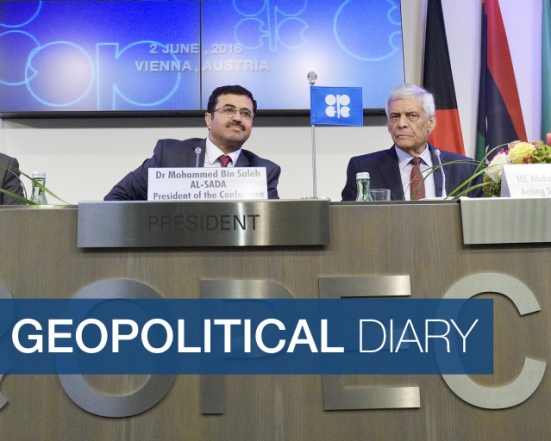

At the June OPEC meeting in Vienna, the organization's members failed to reach a consensus on policy -- but they did so diplomatically. (HANS PUNZ/AFP/Getty Images)

Unlike in GCC countries, where leaders face neither the realistic chance of a coup nor the constant worry of re-election, in Venezuela low oil prices threaten the country's president and ruling party. In response to the price drop, Caracas slashed imports and refused to remove currency restrictions or price controls, all while blaming the United States and other foreign actors for its troubles. As a result, Venezuela is experiencing ever-escalating inflation, which steadily drives public unrest and erodes support for the ruling party.

Iraqi Prime Minister Haider al-Abadi took office in September 2014. Since then, he has had to cope with dwindling oil revenues and try to counter the Islamic State, which took Mosul just three months before he assumed office. At the same time, disagreements over political and economic reforms have gridlocked his government. And twice in the past two months, protesters heeding Shiite cleric Muqtada al-Sadr's calls for demonstrations against government corruption have overwhelmed Baghdad's Green Zone.

Militants in Nigeria's Niger Delta region have wreaked havoc on the country's oil industry for the past month. President Muhammadu Buhari won last year's election with a dearth of support — less than 5 percent of the popular vote — in the Niger Delta. Under Buhari's predecessor, Goodluck Jonathan, the region grew accustomed to consistent patronage; with a new leader in office and less oil revenue to go around among Nigeria's 180 million citizens, that patronage has diminished. In protest, three militant groups have emerged. The most violent of these, the Niger Delta Avengers, has carried out numerous attacks on oil infrastructure since January. These attacks have contributed to the steep decline in Nigeria's oil production, from 2.2 million bpd to just 1.4 million bpd since the beginning of the year. Lower production, in turn, has exacerbated the country's budgetary constraints.

Many of Nigeria's problems, like Iraq's, are structural and systemic in nature. As a result, Buhari's attempts to placate diverse and diverging interest groups despite falling oil revenues have been mostly unsuccessful. Although he has made some progress, for example by abolishing fuel subsidies, the gains have spurred political backlash and turmoil. Buhari does not face imminent elections, but unrest is a cause for concern nonetheless: He was ousted as Nigeria's head of state once before, in 1985.

In Venezuela, Iraq and Nigeria, low oil prices have aggravated existing political crises, putting the countries' leaders in jeopardy. To them, self-preservation is the principal objective. But OPEC's long-term strategy for dealing with lackluster oil prices — suitable though it may be for wealthy member countries such as Saudi Arabia — gives them little assurance of retaining their power in the years to come. So why do these countries stay in OPEC? The group's divided opinions have left it paralyzed throughout the current crisis, unable to freeze or even cut production. But OPEC is not entirely dead yet. In the likely event of another crisis in the next few years, OPEC will almost certainly rethink its actions to stabilize the market. Moreover, OPEC gives countries a forum to share their views and a chance, however small, to influence policy.

Thursday's OPEC meeting did not produce any shift in policy, but it did give Saudi Arabia an opportunity to mend fences between the organization's haves and have-nots in the wake of the divisive April and December talks. For now, this will be enough to keep OPEC intact and relevant, even if it does not try to directly control prices. Ultimately, though, one common theme drives OPEC's struggling members: self-preservation.

Natural Gas Europe is pleased to provide this article in cooperation with Stratfor, a Natural Gas Europe Knowledge Partner. For more visit www.stratfor.com Follow Stratfor: @stratfor on Twitter | Stratfor on Facebook