Aker BP Boosted by Prices, Discoveries

Norwegian producer Aker BP reported record revenues for the third quarter, thanks to higher oil and gas prices. Operating profit was $548mn, up from $219mn in the same quarter of 2017; net profit was $125mn, up from $112mn.

Average realised prices were $78/barrel and $300/'000 m³ of gas. The company expects full-year production to be within the previously communicated range of 155,000-160,0000 barrels of oil equivalent (boe)/day.

Investments in fixed assets in the quarter amounted to $340mn, up from last year's $226mn, driven by field development projects across the company’s portfolio. The Aker BP-operated field developments of Aerfugl, Valhall Flank West and Skogul as well as the Johan Sverdrup development are all progressing according to plan. The company’s capex estimate for 2018 has been reduced from around $1.3bn to around $1.25bn, it said.

Production costs amounted to $11.9/boe in the quarter, down from $11.8/boe in the first nine months, and "remain in line with the company’s estimate of around $12/boe for the full year".

Exploration expenses amounted to $94mn, driven by three dry exploration wells, as well as seismic acquisitions and field evaluation expenses. The appraisal wells at Gekko and Hanz were successful, it said.

According to a statement from the offshore regulator Norwegian Petroleum Directorate the Gekko oil and gas find, about 5 km east of the Volund field and 200 km northwest of Stavanger, could hold up to 6.3bn m³.

Well 25/4-13 S south on the structure encountered a 43-metre oil and gas column in the Heimdal formation, of which 6.5 metres was oil. Nearly the entire interval consists of reservoir sandstones with very good-to-excellent reservoir quality. The gas/oil contact and the oil/water contact were encountered at 2100 metres and 2106.5 metres total respective vertical depths below sea level.

Well 25/4-13 A north on the structure encountered an approximate 30-metre oil and gas column in the Heimdal formation, of which 6 metres was oil. About 15 metres is net reservoir sandstone with very good to excellent reservoir quality. The thickness of the oil zone is somewhat uncertain due to reservoir quality variations.

Preliminary estimates place the size of the discovery between 0.9 and 2.3mn m³ of recoverable oil and 3.8-6.3bn m³ of recoverable gas. The licensees are considering tie-back of the discovery to the Alvheim FPSO, said the NPD. The wells were not formation-tested, but extensive data acquisition and sampling have been carried out. At time of press there was no statement on Aker BP's site.

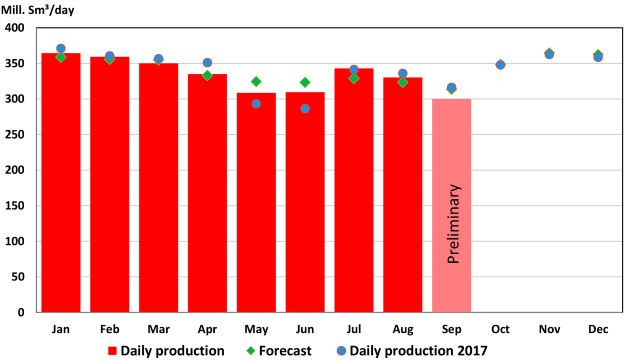

Norwegian gas output down

Norwegian gas output slipped against the forecast by about 4.4% to average 399mn m³/d, the NPD said in a statement October 19, without giving an explanation. It was also down, by 5.2%, on the September 2017 output. Oil and liquids output was also down against the forecast, by about 12% in each case.

Norwegian September 2018 gas output