Northern Acquires Minor Italian Gas Assets

Northern Petroleum said June 8 it is acquiring minor assets onshore central Italy from another UK-listed independent Rockhopper Exploration, including the small producing Civita gas field, and will be paid by Rockhopper to do so.

Civita, which averaged gas production of 130 barrels of oil equivalent/day in 2016, holds an estimated 1 bn ft³ of recoverable gas and is linked to the Italian gas grid. It is part of the Aglavizza production concession. Northern will also these outright, along with stakes of 50%-100% in four other exploration concessions. Among the latter, Northern will review potential for redeveloping the Cupoloni field in the Scanzano concession and subsurface potential of the Vigna Nocelli field in the Torrente Celone concession.

Northern CEO Keith Bush said: “This acquisition is the company's first step into the valuable gas production market in Italy.” It will assume abandonment liabilities of the production concessions which, excluding Aglavizza and the two fields with redevelopment potential, are estimated at €3mn ($3.4mn). Rockhopper will pay Northern $1.6mn on completion of the acquisition. The acquisition is expected to occur later in the year but be retroactive to 1 January 2017.

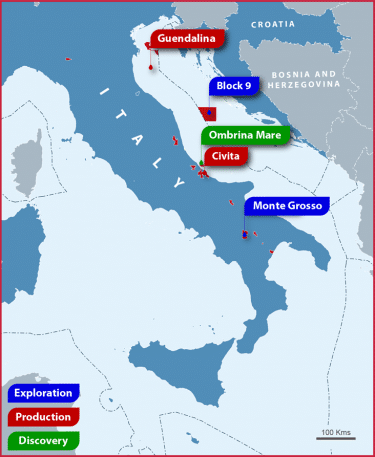

Rockhopper interests in Italy/Croatia, including those onshore to be divested (Map credit: the company)

Rockhopper called the Italian interests “non-core”, given its assets in the Falklands and elsewhere in Italy/Croatia and Egypt. It will retain stakes in Eni-operated interests in Italy, focusing on its 20% stake in the producing Guendalina gas field and 22.89% stake in the Serra San Bernardo exploration permit – including the Monte Grosso exploration prospect.

Its arbitration case begun March 2017 against the Italian government over the Ombrina Mare project (100% Rockhopper), in the Adriatic offshore Pescara, is unaffected by the transaction. Rockhopper is trying to recoup drilling costs after Rome refused it a production concession in February 2016.

Mark Smedley