[NGW Magazine] Russian gas output prospects dim

Russian gas output has suffered a setback thanks to sanctions imposed on the oil and gas sector. According to domestic ratings agency Acra it will take some time to overcome despite the rapidity of Russian advances in technology.

There have been no official forecasts for Russian gas production until 2035 since 2013. That turned out to be a watershed year: early the next year Russia regained Crimea from Ukraine and helped the war effort in the east against Kiev, triggering sanctions from the US and the EU later that summer that ended a number of projects dependent for success on imported technology.

It was also a year before the catastrophic collapse in the oil price that focused minds on the easiest and the cheapest barrels. So in 2013, when the Russian energy ministry put the volume at 900bn m³/yr, that was reasonable. However, current international estimates, in the absence of official forecasts, are now far below that.

Looking at the country’s gas production and exports, Russia produced 690.5bn m³ in 2017, about 10.75% more than 2014. It also increased exports by 21.5% to 210.2bn m³. However, its export revenues declined 39.1% despite volume growth, owing to plunging gas export price from $287/’000 m³ in 2014 to $197/’000m³ in 2017. During the half of 2018, Gazprom exported 101.2bn m³ to Europe, worth $24bn.

Gazprom, the country’s pipe gas export monopoly, accounted for three quarters of the country’s total gas production last year.

During the last few years, a dozen Russian upstream projects were suspended, including nine by oil major Rosneft; while the gas giant Gazprom postponed several huge projects until “a better time”, including the Bazhenov shale, which it was to have developed with French Total until the ban on importing western technology took effect. Vladivostok LNG meanwhile sank without trace, despite the company having formally committed to it.

Gazprom also postponed Sakhalin III, including three deep-water gas fields with 26.5bn m³/yr output capacity, while one has been operational but with very low capacity since 2014.

Plans to expand LNG output from Sakhalin Energy's plant with shareholder Anglo-Dutch Shell also remain doubtful, although debottlenecking has added a small amount of capacity.

On the positive side, plans to turn Russia into a major LNG exporter mean a lot of investment upstream, although these plans will be heavily dependent on the strength of the Russian budget, as was the case with Yamal LNG.

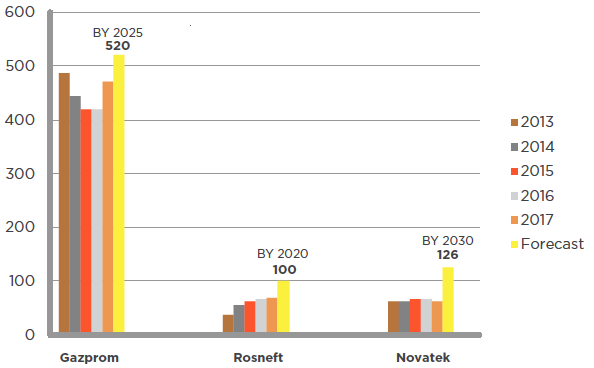

Production targets by major companies (bn m³/yr):

Companies’ official statistics and forecasts. Gazprom predicts 520-560bn m³ for 2025

In absence of whole official Russian gas production forecast, Gazprom, Rosneft and Novatek which shared about 87.5% of the country’s gas production last year, have their own output growth estimations for different date targets.

Earlier in July Russian ratings agency Acra predicted that sanctions on Russia could lead to less oil and gas output growth in the 2020s. The company, owned by 27 major Russian companies and financial institutions, says the Western sanctions have affected 20–21% of Russian GDP. “Restrictions were imposed mainly against large state-owned banks (54% of banking sector assets), oil and gas companies (accounting for 95% of the total revenues of the oil and gas industry) and almost the entire defence industry,” it said July 10.

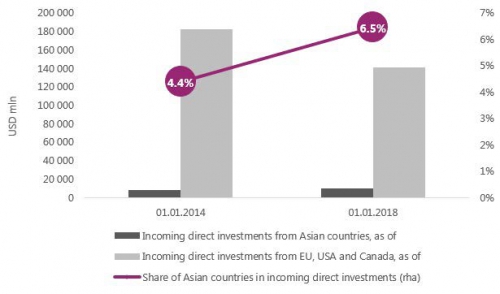

The sanctions also hit investments

Source: Acra

It says over 400 Russian companies and banks are under sanctions, most of which are subsidiaries of large holdings.

In 2017, the aggregate, consolidated revenue of these companies and banks amounted to rubles 30 trillion ($482bn at current rate), and their GDP share is estimated at 20–21%.

The US Energy Information Administration says that sanctions and lower oil prices have reduced foreign investment in Russia’s upstream, especially in Arctic offshore and shale projects, and they have made financing projects more difficult.

Among other measures, the sanctions limited Russian firms’ access to US capital markets, specifically targeting four Russian energy companies: Novatek, Rosneft, Gazprom Neft, and Transneft. Sanctions also prohibited the export to Russia of goods, services, or technology in support of deepwater, Arctic offshore, or shale projects.

The European Union imposed similar sanctions, although they differ in some respects.

The report says that Arctic offshore and shale resources are unlikely to be developed without the help of western oil companies.

“However, these sanctions will have little effect on Russian production in the short term as these resources were not expected to begin producing for five to ten years at the earliest. The immediate effect of these sanctions has been to stop the large-scale investments that western firms had planned to make in these resources”.

Production, export perspectives

Last year, the International Energy Agency (IEA) predicted that Russia's annual gas production would rise by 11.5% to 718bn m³/yr by 2025 and continue to grow to 788bn m³/yr by 2040, but its oil output may decline by 7% in 2025 to 10.5mn b/d, then decrease to 8.6mn b/d by 2040. BP’s April forecast also eyes 29% growth for Russian gas by 2040, standing at 72bn f3/d (744bn m³/yr).

Speaking to NGW, Cedigaz and Wood Mackenzie were optimistic about the country’s gas production growth, but regarding lower demand growth, it should expand export infrastructures, especially LNG projects.

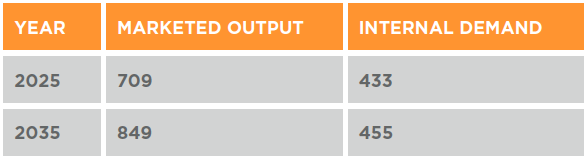

Wood Mackenzie’s Russian gas sector forecast (Bn mÑ/yr)

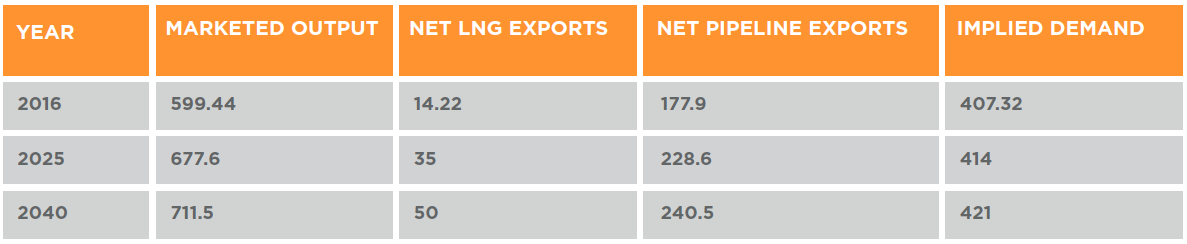

Cedigaz’s Russian gas sector Forecast (Bn mÑ/yr)

Gazprom is working on three major gas pipelines: TurkStream, NordStream and Power of Siberia. All of them are projected to become operational in two years. The first two are expected to replace most of the Ukraine route, which shared about a half of Gazprom’s exports to Europe last year. The Power of Siberia pipeline will be put into operation in December 2019 to supply 1 trillion m³ Russian gas to China in a 30-year contractual period: the contract is for 38bn m³/yr but it will take a few years to reach plateau. That is 'new' gas from the eastern Siberian fields but the other pipelines may simply reroute gas away from Ukraine. Gazprom Export though expects to sign additional long-term gas supply contracts for Nord Stream 2.

Dalga Khatinoglu