Tortue Strides Ahead

NGW interviewed operator BP about the marketing arrangements for the Tortue FLNG project, for which a final investment decision is expected later this year. The UK major has just made some key decisions on its contracts.

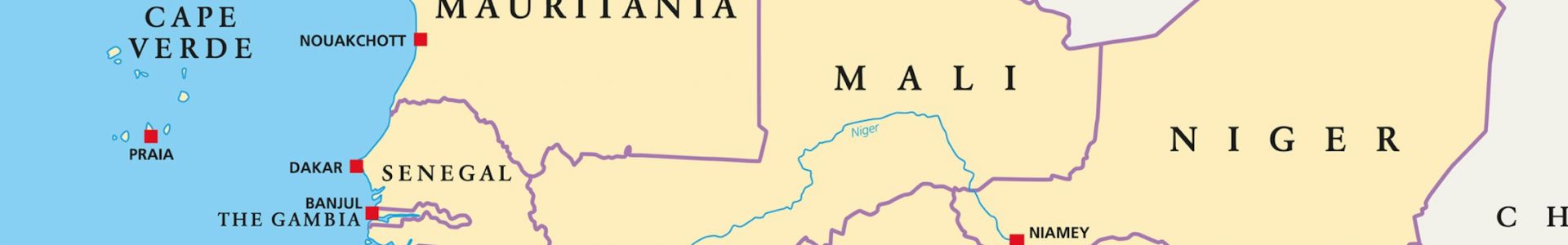

The Tortue floating LNG project, which will monetise gas from some 130 km offshore Mauritania and Senegal by tying it back to process and liquefaction units on the two nations’ nearshore maritime border, is edging closer to its planned final investment decision later this year.

As Tortue FLNG operator, BP has simplified its structure and used standardised and proven technology, by choosing to have a production ship (FPSO) to process the gas, tied to a separate floating liquefaction (FLNG) vessel, BP’s upstream gas business development director Andres Guevara told a panel at the AIPN International Petroleum Summit on April 24.

In just six weeks, BP has taken three key decisions on behalf of Tortue FLNG partnership of BP, Kosmos Energy, and the host national oil companies PetroSen and SMHPM:

Technip said April 16 it had won the front-end engineering and design (Feed) contract for the Tortue FPSO unit to process the gas; the contract can be upgraded into a full construction and installation (EPCI) order later on;

McDermott and Baker Hughes-GE jointly won a similar Feed, also leading to EPCI, in mid-March for the subsea infrastructure to tie the first four gas production wells to the FPSO;

Golar LNG said April 19 it had been chosen as charterer of the floating liquefaction vessel itself, expected to have capacity to liquefy 2.3-2.5mn metric tons/yr. It said its preliminary agreement obliges it to progress Feed work and to be ready from July 2018 onwards to begin converting one of its vessels at the Keppel shipyard, Singapore.

It is not only in upstream procurement that Tortue FLNG will opt for a simplified structure.

In choosing an LNG offtaker, Guevara told NGW that BP will select a single offtaker for the first phase of Tortue, which is eyeing a final investment decision later in 2018 in the expectation that first LNG may be produced late 2021.

Its partners have said in the past that a second same-sized development phase might follow with a lag of two years. NGW spoke to Andres Guevara.

It's early days with the BP-led Tortue floating LNG project, but has marketing of the volume begun?

We have gone to the market. We have a number of shortlisted buyers. We have decided to have one offtaker for phase 1, the logic being that – operationally – it really is the best way to do it, given the FLNG storage limitations. So, it will be a competitive process, and there will be one offtaker.

The other important element to consider is that the two host nations are very keen for the partners to jointly market the LNG. It has to do with keeping things balanced between the two countries, and also for them to develop their capabilities. That’s actually something that, we believe, was signed in the inter-state cooperation agreement between the two nations in February 2018 – which is the framework for the units. The development straddles the border.

So, BP and Kosmos will jointly arrange the offtaker, but won’t be the offtaker themselves?

We are selling. We as the upstream partners, with BP as operator, are jointly selling the Tortue LNG from phase 1. So, there’s going to be a single buyer. I’m the seller. There will be one buyer.

Will it be similar to Cameroon FLNG's arrangement with Gazprom, and Coral FLNG's with BP?

Absolutely.

Is that because the host nations want visibility, and arms-length arrangements?

It has to do with operational logistics. Let me give you an example. Imagine you have an average LNG cargo of 175,000 m³. The Golar technology – the one in Cameroon, and the ones planned both in Equatorial Guinea and at Tortue – has storage for 125,000 m³ LNG.

So, in a world where you have limited storage, your logistics will need to be run in a very efficient, seamless way. The best way to optimise your logistics is by having one party to deal with. The moment you have more than one party, then you get sub-optimal logistics because you get into partial loads, and partial loads mean higher shipping costs per unit of energy. So that’s not the rational way. That’s why you see the pattern of one buyer per FLNG development.

Portfolio buyers tend to say: "The world is our market". But is there a particular market envisaged for Tortue FLNG?

I am the seller. My team and I are selling on behalf of [Tortue FLNG] partners in that process. But I would presume that the [would-be] buyers are going to think about Europe for a very simple reason: proximity. But Tortue’s location also gives options into a growing South American market where we’re seeing particularly Brazil becoming an even more relevant LNG importer.

Never on the scale of Europe. But one that is very well-placed. Also the location of Tortue allows us to be competitive into Asia, subject to shipping.

Mark Smedley