[NGW Magazine] Qatar flexes its LNG muscle

Since lifting its North Field moratorium, Qatar has lost no time in launching a 23mn mt/yr LNG expansion – good news for buyers wary of a tightening market in the 2020s; not so good for competing project developers.

Qatar’s recent award of a contract to McDermott for the detailed design and construction of offshore jackets for its North Field expansion is the latest sign of its determination to re-assert its dominant position in global LNG.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Qatar Petroleum now plans to award the procurement, fabrication and installation contract by the end of this year, paving the way to begin a drilling campaign in 2019.

QP’s announcement made its intent abundantly clear in saying that the three more 7.8mn mt/yr mega-trains it is planning will “ensure Qatar’s continued global leadership in LNG production”.

A front-end engineering and design (Feed) contract for the related onshore liquefaction facilities was awarded to Japan’s Chiyoda Corporation in March, and a final investment decision (FID) is expected late in 2019 or early in 2020.

A further 23.4mn mt/yr of capacity will take overall capacity from 77.4mn mt/yr to 100.8mn mt/yr and the president and CEO of Qatar Petroleum, Saad Sherida Al-Kaabi, has said he expects first LNG to be delivered “by the end of 2023”. What is more, the Feed work includes “associated pre-investment to add a fourth LNG train in the future.”

About to be toppled

Qatar completed the last of its 14 LNG production trains in 2011 and has since held an overwhelmingly dominant position in global LNG trade. Those trains have been performing impressively well – so much so that in 2017 actual production was 77.5mn mt, or a 27% share of a global market of 290mn mt.

But Australian production has been rising rapidly, following a flurry of FIDs during 2011 and 2012.

A remarkable 18-month period saw the sanctioning of nine trains with a combined capacity 37.7mn mt/yr – enough to ensure that Australia would become a bigger producer than Qatar by the end of the decade, with more than 86mn mt/yr of capacity.

So, for a while, Qatar will lose its LNG leadership to Australia, because of a moratorium imposed on further development of the North Field back in 2005.

A long-awaited lifting

Covering an area of 6,000km², the North Field contains almost all of Qatar’s proved gas reserves. According to QP, it is “the largest single non-associated gas reservoir in the world”, with 900 trillion ft³ of recoverable gas”.

BP statistics put Qatar’s proved gas reserves at 858 Tcf at the end of 2016, with a reserves/production ratio of 134 years.

In the first half of the 2000s – following a review of the North Field that led to the QP reserves figure – Qatar got a little carried away with signing heads of agreement and letters of intent for projects utilising North Field gas.

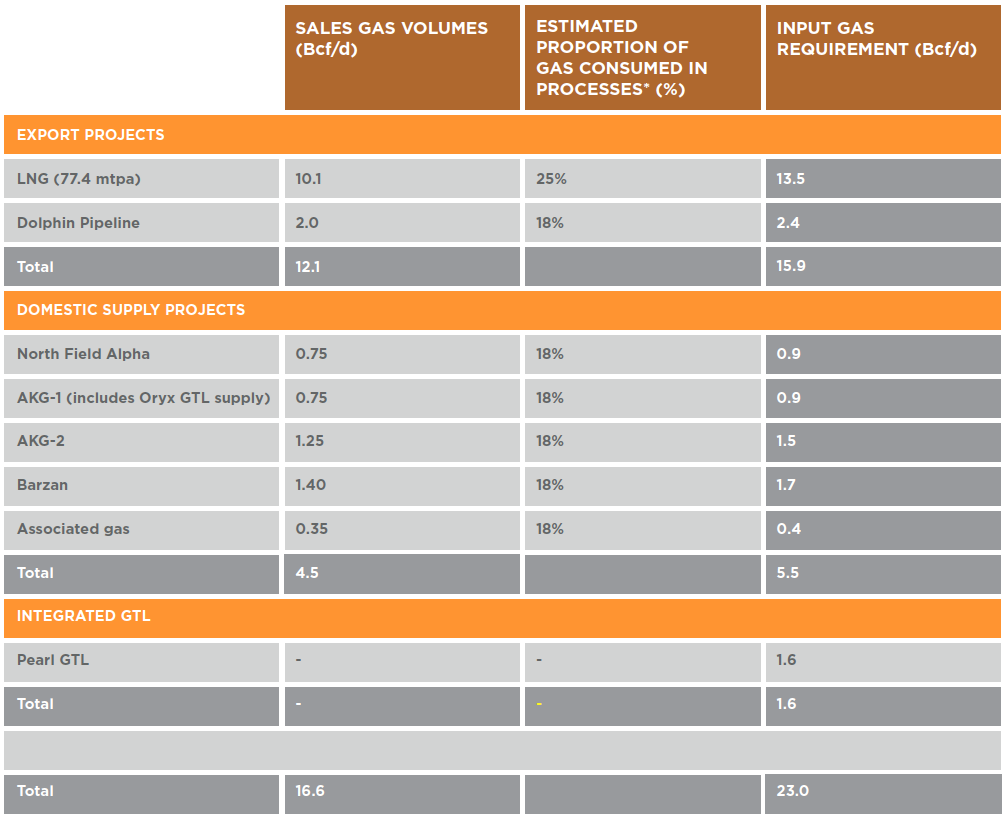

Qatar’s main gas projects

* Includes extraction of LPG and NGLs

So it did not come as much of a surprise when QP said in April 2005 that it had decided to impose a moratorium while studies were conducted to ensure the field was behaving as expected. It is common knowledge that Qatar is the world’s largest producer of LNG but the full scale of its gas development programme is not so widely appreciated.

As the table above shows, LNG accounts for just over half of total gross gas production. Qatar also has a number of domestic supply projects, it exports gas to the United Arab Emirates (UAE) and Oman via the subsea Dolphin pipeline, and it is home to the world’s two biggest gas-to-liquids (GTL) facilities. Pearl GTL alone uses 1.6bn ft³/d of feed gas, about the same volume as Poland consumed in 2016.

It is only relatively recently that the last of these projects, Barzan, was finally completed. It was in April last year that Al-Kaabi finally announced that the moratorium was to be lifted. “Since 2005,” he said, “QP has been conducting extensive studies and exerting exceptional efforts to assess the North Field, including drilling a number of appraisal wells to better estimate the field’s production potential – which has enabled us to reach this satisfactory result today.”

Trouble with the neighbours

The initial announcement was for a 2bn ft³/d expansion, prompting speculation that Qatar intended to debottleneck its six existing 7.8mn mt/yr trains in order to extract another 2mn mt/yr of capacity from each.

However, a couple of months later, in June, came the news that Saudi Arabia, the UAE, Bahrain, Egypt and the Maldives were imposing a blockade on Qatar. Soon afterwards, in July, Al-Kaabi announced the North Field expansion was being extended to 4bn ft³/d of additional production, a figure that has since risen to 4.6bn ft³/d.

It was only with the Feed award in March that the full scale of Qatar’s expansion ambitions became clear. While the moratorium was in place there was speculation as to what Qatar might do when it was lifted. As well as the debottlenecking option, there was the option of filling the 3.2bn ft³/d Dolphin pipeline, which carries only 2bn ft³/d of gas. Other possible options included more GTL and/or more domestic supply.

A variety of factors have combined to narrow down the choices to another three, perhaps four, mega-trains. The diplomatic spat militated against new pipeline exports to neighbouring countries and large-scale GTL looks less attractive than it once did.

Meanwhile, the ramp-up of production from Barzan means that Qatar is not short of domestic supply, despite its wide range of gas-based industries, which include petrochemicals, steel and aluminium production.

The signs are that the new mega-trains will form a whole new LNG-producing complex away from the existing concentration of natural-gas based industry at Ras Laffan Industrial City (RLIC) – a move that may have been inspired by growing political tensions in the region. RLIC is one of the largest concentrations of natural gas-based industry in the world and the security attractions of building a second LNG complex elsewhere are clear.

The obvious location, with easy access to the sea, would be the industrial city at Mesaieed, about a half hour’s drive south of Doha, the capital. Other factors may well have been the shipping congestion that three new trains at RLIC could create, and the fact that Mesaieed is closer to the southern part of the North Field that is to be developed, so pipelines from wells to onshore facilities would be shorter.

So why not opt for a combination of debottlenecking and new trains, given that there is a widespread view that debottlenecking would be relatively cheap? Qatar’s first three trains were successfully debottlenecked in the early 2000s, raising aggregate capacity from 6mn mt/yr to 10mn mt/yr.

According to sources in Qatar, this option was studied and the conclusion was that debottlenecking would have caused years of disruption to existing production capacity, just when Qatar is in the middle of a $200bn investment drive to realise its ambitious Vision 2030 economic and social development programme and is also gearing up to host the 2022 FIFA football World Cup.

GDP growth has already tumbled from an average of 13.5%/year during 2005-2013 to the low single figures today, partly because of the completion of much of the nation’s gas development programme by 2011 and partly because of the oil price collapse of 2014. So disruption to existing LNG revenues is not an appealing prospect.

Reasons to be fearful

What Qatar has not yet outlined is how it plans to market all this new LNG or who its foreign partners might be – if it even chooses to take on foreign partners at all.

What is clear is that Qatar has the determination, the financial muscle, and the engineering expertise to realise its ambitions, and as good a chance as anyone of meeting what is a challenging schedule. It has faced plenty of such challenges before and it has the advantages that its gas is relatively cheap to develop and liquids-rich, which helps project economics.

Developers of potential new supply projects elsewhere now have plenty to think about when they come up against this LNG behemoth while marketing their capacity.

Alex Forbes