[NGW Magazine] Energean focuses on Israel

CEO Mathios Rigas, petroleum engineer and former investment banker, talks to NGW about the regional E&P firm now poised for strong growth in Israel but eying potential exports too.

What and where is Energean's focus?

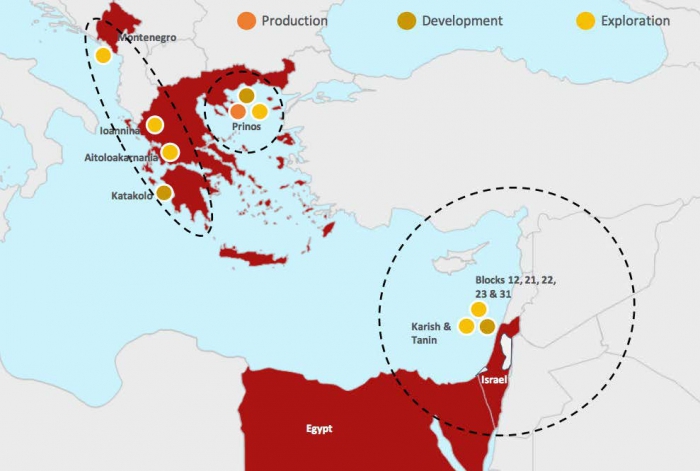

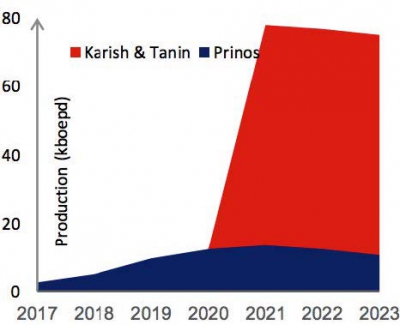

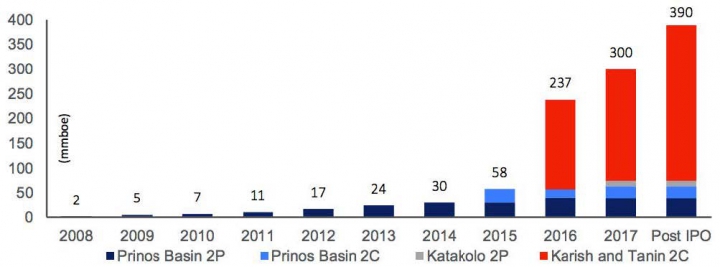

Energean group has live operations in three countries: Greece where we produce oil and develop gas through an ongoing 25-well programme and are aiming to increase Prinos oil output from 4,000 b/d to more than 10,000 b/d; Israel where Energean Israel has a $1.6bn-$1.7bn project to develop Karish/Tanin for first gas by 2021; with the third leg of our business being exploration; and Montenegro.

Energean Israel is a 70%-30% joint venture, with Kerogen Capital the 30% partner. There is no plan for Energean Israel to do anything outside that country.

Energean group’s exploration focus is clearly on Israel near to the infrastructure we are developing – this being the lowest-risk you can do: the Karish North well that we have committed to drill has a 78% probability of success. Onshore western Greece we work with Repsol as exploration operator. Offshore Montenegro, we have two blocks which we operate at 100%.

We are focused on the eastern Mediterranean and north Africa, including Italy. Our simple rule is: we will do business anywhere where we can fly 3 hours from Athens. This keeps us focused on this part of the world; it’s the area we understand both the rocks, and the people and politics. We’re not in Albania or Italy but are always looking at opportunities.

Has work on the Karish/Tanin FPSO and subsea work begun yet?

Yes. TechnipFMC covers the subsea, the pipeline and FPSO [floating production storage and offloader vessel]. There are two parallel streams – all moving toward first gas in 1Q 2021.

One is the FPSO: the design is being done at the moment. A subcontract was signed with SembCorp Marine which will build the FPSO; the hull is being built in China and will then be moved to Singapore and finished there; we are planning to cut first steel at the end of 2018 on schedule. The FPSO will be delivered to Singapore in 2020 whence it will be delivered and installed offshore Israel. The second stream of the Technip contract has to do with pipelines and subsea which is also ongoing. Installation will be in 2019-20. Procurement is being done at the moment.

The only part that falls outside the Technip contract is the drilling of the three production wells in 2019, which is contracted to Stena Drilling. It will drill those wells in 2019. Energean committed to one exploration well (Karish North) recently, and we have options for six more – either exploration or production – wells.

There is no risk of cost overruns. Technip has a turnkey engineering, procurement, construction, installation and commissioning contract at a fixed price. Unless there is a major variation in design, which we don’t intend to make, the price will stay fixed.

What's the significance of the Israeli gas market?

Energean Israel has contracted to sell 4.2bn m³/yr from Karish/Tanin for 16 years to main power producers and industrial consumers in Israel. That leaves us with some 4bn m³/yr spare capacity, as the FPSO has 8bn m³/yr capacity overall.

The Israeli gas market has grown by 15%/yr over the past ten years. It’s the fastest growing gas market in the world and today demand has reached 10bn m³/yr. It is projected by the Israeli government to grow to over 20bn m³/yr over the next 10-15 years, driven primarily by the fact that the government has decided to shut down all coal-fired generation capacity and switch it to gas. By 2022, it is shutting down the first four coal plants with combined capacity of 1.44 GW. It will then shut the remaining coal-fired plants.

The economy in Israel is booming and demanding more electricity. Our immediate plan is to fill that 8bn m³/yr capacity, sell into the more distant customer base, or to new customers in Israel. That will effectively double the projected cashflow of Energean Israel – maybe more so, as infrastructure costs will have been paid in the first phase of the development. We are also targeting export markets.

How will exports work?

The Israeli gas framework provides that Karish and Tanin, the two fields that we operate, are targeting exclusively the local market. [So Energean Israel’s 4.2bn m³/yr contracted, and almost as much again yet to be contracted, will stay in Israel.] But the five new blocks that we have been awarded offshore Israel are free to be exported. That was the decision of the Tsemach committee.

The Tsemach II committee is updating the Israeli regulations; its general idea is that small gas fields can be exported but, as fields get bigger, there’s a percentage of the gas that needs to stay in the local market and a percentage that is allowed to be exported. That will come out as an Israeli government decision in the next few weeks, I believe.

In our case, though, the five new blocks that we have are free to be exported.

Energean Israel shall have the only floating gas production system in the whole of the eastern Mediterranean for the time being, so we are looking to use this as a gas export hub for other markets – such as initially to Cyprus which is only 200 km away. A pipeline could be laid to Cyprus. Last week [late June] we submitted a proposal to the Cypriot government for that. It’s a very feasible project and we would fund it. It would service the Cypriot market if they elected to buy gas from us. [Rigas separately told Reuters that its proposal is to supply 0.5bn to 1bn m³/yr to Cyprus]

Leading Oil & Gas Development in the Eastern Mediterranean

Credit: Energean OIl & Gas

But Cyprus has its own gas - why should it take your Israeli gas?

The Aphrodite discovery offshore Cyprus – from what we read in the market – is targeting the Egyptian LNG [export] terminals through a co-development with [Israeli field] Leviathan. As far as we know, there is no other plan to bring gas to Cyprus, other than a floating storage and regas unit [LNG import project].

Every government looks to have long-term stable gas supply, with access to LNG as a back-up plan. That’s what the Israeli market is doing: they have piped gas, they have an FSRU as a back-up. And it’s exactly what the Greek government is doing: they have Russian gas supplied via pipeline – including via Turkey – and they have the LNG regas unit on Revythoussa.

Why did Energean stay out of offshore Cyprus?

Cyprus took a decision a long time ago to focus on major oil companies. It was its strategic decision. The second reason why we stayed out of Cyprus is because we are not going to go into deepwater frontier exploration. That’s not our strength or strategy. We like production, we like development projects and we’ve done that in Greece and Israel. We’ll let others take deepwater exploration risk. If there is a project that adds value for our shareholders, we then go in and take over.

The eastern Mediterranean Pipe project would go from offshore Israel via Cyprus to Crete and thence to mainland Greece. But it isn’t going to start up any earlier than 2025?

Correct.

And it may never get built.

It could be never. But it is fully supported by the governments of Greece, Cyprus, Israel and Italy and has the backing of the EU to connect gas in the eastern Mediterranean with the rest of Europe. It’s a very challenging project technically and geopolitically, because it crosses many countries and goes through deep waters. It would give us another option to tap the European export market.

Nonetheless the eastern Mediterranean pipeline is a very important project for the region. We support its development. But we are not part of the development consortium. We are not part of what is being discussed. We hear and read what is discussed. Even yesterday [July 4] there was a meeting in Athens of host governments. Whether the project happens or not, I don’t know – we hope it will.

Why is Energean so interested in the East Med pipe?

Any pipeline needs gas, and a market to sell into. The market is Europe, which has an increasing demand for natural gas, and it also needs to diversify from its traditional suppliers. So, there is a market. Access to gas that will justify investment, like this project, is one of the issues. A lot more gas is going to be discovered in this region. We already have Calypso offshore Cyprus. There are rumours about the potential in a block offshore Egypt’s Nile Delta called Noor, that might be licensed to Eni. At Energean Israel, we see 7 trillion ft³ of extra gas in our blocks. Leviathan has additional gas too.

The E Med pipe is not an easy project. If or when it happens, it will benefit everyone including us, as we would get access to a great market. Our immediate focus is to fill up the FPSO and targeting the Israeli market: the low-hanging fruit. But there are other options to transport gas apart from apipeline, such as liquefaction, or compressed natural gas. Because we have a shipping presence, we understand offshore transportation operations. We shall continue to optimise the export route. There are alternatives.

How far has Energean investigated the option of liquefying Israeli gas in Egypt?

We haven’t because, at the moment, all our gas is contracted to the local Israeli market – which is growing. It makes more sense to sell into Israel where we will have infrastructure. So, we don’t need to get involved in complex geopolitical issues. Our strategy is: focus on Israel; but also when others open the road for Egypt or Europe, we will tag along and sell gas to any market that is out there.

Were you satisfied with the London listing? Might Energean raise more after that $460m IPO?

We have fully funded our projects: Prinos in Greece, and Karish/Tanin in Israel, are fully funded. We would look to raise more when we see a need for further growth, but we’d like to de-risk first. Any raising of funds would be driven by growth opportunities.

If we see a market grow, and we need more infrastructure, we may borrow more. The market we are watching most intently is Israel. The government there is privatising a number of state-owned gas-fired power plants [or CCGTs] – which would be our potential clients. There is a significant switch from coal-fired power generation to gas underway in Israel. Energean Israel owns infrastructure and is creating a gas hub.

Are you thinking of investing in the Israeli power sector?

No, we are not considering investing in Israeli CCGTs. But in that sector, a number of modern H-Class turbines are being installed because the country will need new capacity when it replaces coal.

The Israeli government has clearly stated that it wants two things from the gas market: competition, which is what we are bringing; and security of supply. From 2021, when we come onstream, there should be three independent gas fields: the Tamar gas field is already producing; Leviathan will start operating in late 2019/early 2020 according to the operator; and our Karish/Tarin field will start in early 2021. So, by then, there will be enough redundancy in the system.

Will Israel eventually halt LNG imports?

Whether the Israeli government will want to return the FSRU [the LNG floating terminal chartered from US firm Excelerate] is not for us to comment on. That will be for the Israeli government to decide. But by then, Israel’s primary gas supplies will come from the three fields that I have named.

What is Energean's presence in North Africa?

In Egypt we had two blocks: East Magawish block offshore in the Gulf of Suez (drilled from onshore), and the West Kom Omobo block 200 km from Luxor in onshore southern Egypt. We drilled five exploration wells in total, operating in Egypt for ten years without success; but that’s the nature of exploration. We still maintain an office and our operator status and we continue to seek opportunities.

Production

Credit: Energean OIl & Gas

Energean has not been involved in recent M&A deals in Tunisia. Because you judge it too risky?

No, we don’t. We don’t have a project in Tunisia at the moment. But we have done business in Egypt, Israel, Montenegro and Greece. We don’t think any country in this region is too risky, we just see different risks that can be managed in a proper way.

[As if to illustrate that very point, Rigas told Reuters that Energean is ready to buy and operate a 45% stake in the Gaza Marine offshore gas field if both Israeli and Palestinian authorities approve. Shell sold its 90% stake in the field offshore Gaza to the Palestinian sovereign wealth fund PIF in April; PIF said then that it hoped to farm out half of that stake, so 45%, to an international operator.]

In Greece, we were there when it had capital controls and closed banks, at a time when the oil price fell from $120 to $27/barrel. In the summer of 2015 we had what I’d describe as a perfect storm.

We managed not only to stay alive but also grow. Today [July 5] is the third anniversary of the referendum that we had in Greece [on whether to retain the euro, and thus pay down Greek debt].

Is it early days with Repsol as a partner onshore Greece?

Repsol has a team of 140 people in Greece and it is the operator in western Greece with 60%. They are shooting challenging ‘fault thrust’ seismic in the mountains; they are one of the best at this, having built up expertise in Latin America. Our plan is to shoot 400 km of 2-D seismic, which will take another year. It will be 2020 at the earliest before the first well in western Greece.

What's been happening in Montenegro?

We have submitted the applications for environmental permits for seismic operations. We plan to shoot 3-D seismic towards end-2018 on two blocks, then evaluate data in 2019, and decide where to drill the first well in early 2020. We will look to bring a partner in there for the drilling phase.

Mark Smedley