[NGW Magazine] Uruguay takes a new approach upstream

With the prolific Brazil as one of its neighbours, Uruguay might be expected to be worth betting on, especially now that the lessons of previous rounds have been taken in.

It may be a late arrival to the oil and gas business but Uruguay has launched its third oil and gas-licensing round, and experts say the government’s long-term thinking is now improving prospects for the sector.

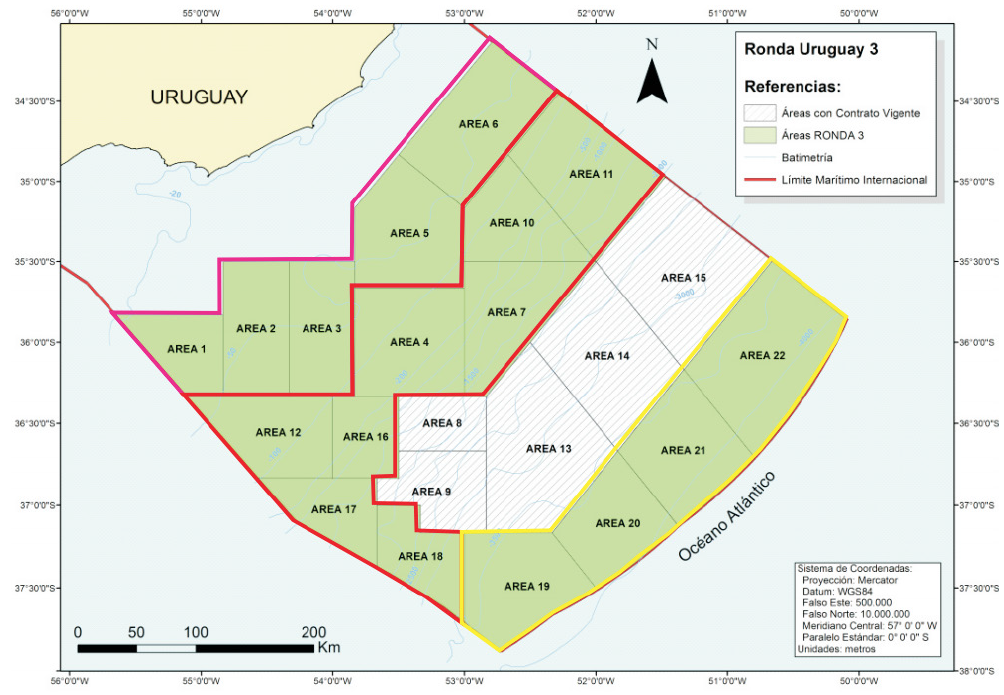

Known as Ronda 3, the tender was unveiled in September and October by the state oil company Ancap and the ministry of industry, energy and mining. It will offer blocks in 17 offshore areas in three basins.

Companies have until early April 2018 to submit qualifying bids for the tender and offers are expected to be opened later that month, the ministry said.

The blocks will have exploration terms of between eight and ten years, but contracts will last for 30 years with, an extension period of ten years. Water depths at the blocks range from 50 metres to 4,000 metres. There will be three categories of blocks based on the water depth. The exploratory period is eight years for the first two types, and 10 years for the third type.

Map credit: Ancap

Uruguay is estimated to have recoverable natural gas reserves of up to 588bn m³, which would give it the sixth largest potential gas assets in Latin America, according to the US Energy Information Administration (EIA). One basin alone, in the north of Uruguay next to some Brazilian fields, is estimated to have up to 368bn m³ of technically recoverable natural gas.

Uruguay launched its first oil and gas-licensing round less than a decade ago – in 2009 – but despite significant investment of around $1bn in exploration since then, there have been no significant oil or gas discoveries.

International companies including French major Total have drilled for oil and gas, spurred on by the belief that Uruguay’s geographical position between energy-rich Brazil and Argentina could mean it has significant undiscovered resources.

The main reason for lack of development of the sector so far is that the government previously “did not invest in the long-term” in the oil and gas sector, Juan Manuel Mercant, a Montevideo-based partner at law firm Guyer & Regules told NGW.

The latest licensing round shows that the country is accelerating efforts to expand its oil and gas sector but also more importantly it is confirmation that the government is “thinking in the long run,” he added.

Going forward, the most effective way that the government can incentivise exploration and production in the country is by maintaining regulatory stability, he said. “I believe that the important thing is keeping the rules and tax benefits without any changes.”

Indeed, Uruguayan energy officials have tried to highlight the stability of the sector as well as the country’s overall stable investment climate, in a region that is known for nationalisations and expropriations, such as the case of Repsol in Argentina – deterring many majors from investing heavily in Latin America in the past or causing them to pull out.

Governments in both neighbouring Argentina and Brazil have veered toward protectionism in the sector since 2000.

Uruguay’s president Tabare Vazquez and his ruling Frente Amplio party have also tried to give Ancap a makeover, by appointing senior staff members that have had significant industry experience. Last year he appointed Marta Jara Otero, who recently worked for the Anglo-Dutch Shell in Mexico, to run the company.

Contract flexibility is proving to be another major tenet of the government’s new approach to the industry. In 2015, the same business-friendly government agreed to offer an 18-month extension to all exploration licenses awarded at a 2012 tender.

Experts say that the latest round could attract more players to the market because it offers greater contractual flexibility than in previous rounds – as the government tries to inspire greater confidence in the market following the global crude oil price slump that began in 2014. Crucially, the new tender allows companies to participate in the exploration period only, meaning that smaller upstream specialists could take part and then farm out acreage later depending on their success.

In addition, qualification requirements in this round are also expected to be more flexible than in previous ones, though no further details have yet been disclosed. The government is keen to attract a greater pool of interested companies, since it knows that the oil price slump has resulted in firms having to cut their budgets, particularly in more frontier regions like Uruguay – where the investment required is high and the return on investment is risky.

British major BP is among the firms to scale back exploration in Uruguay in recent years, returning three oil blocks in 2015 to focus on lower risk projects in other parts of the world. However, Ancap said that a road show about the bid round, held in the US city of Houston in September, attracted companies that included Anadarko, ONGC Videsh, ConocoPhillips, Chevron, Noble Energy, Frontera Energy, Lukoil and Apache.

The government also argues that potential investors have easy access to the already well-established adjacent oil and gas industries in Argentina and Brazil, from where they could source both equipment and services, thereby cutting costs. For now, it remains to be seen how the industry will react to the latest tender, though initial investor interest appears promising.

Uruguay still has a long way to go in attracting investment to the sector at a time when there is limited appetite for risk among companies. However the government’s drive and long-term commitment to fiscal and contractual stability may be enough to get the industry moving.

Sophie Davies