[NGW Magazine] Iran's gas: where does it go?

Iran appears to have lost the European gas market: its own high gas demand and lowish European prices mean that it cannot profitably sell gas much beyond its borders.

As Azerbaijan prepares to supply 16bn m3/yr of its own gas as well as transiting gas from possibly Turkmenistan and Kazakhstan to Turkey and the European Union, Iran, with its 34 trillion m3 of reserves, is still no nearer cracking the European gas market.

Recently, a senior European Union (EU) official announced the continuation of negotiations with Turkmenistan over exports to the EU, while Kazakhstan and Azerbaijan established a joint working group to evaluate the possibility of exporting gas to the EU through the Southern Gas Corridor (SGC).

Turkmenistan has to diversify its gas markets as Russia and Iran stopped buying its gas in the last two years, leaving China the sole client. Kazakhstan, which sells gas to Russia and China, is also planning to produce 2.5 times more gas, or 110bn m3/yr, by 2030; demand is only due to increase by 38% to 18bn m3/yr by then. The country’s policy is to reinject its gas into oil fields to maintain oil output, but even so there will be a significant surplus of gas.

Recently, the foreign ministers of the five Caspian littoral nations announced after a meeting in Russia December 5 that they have resolved all the key disagreements over the legal status of the Caspian. Accordingly the draft text of the convention is practically ready to be signed by the heads of states at their meeting in Kazakhstan.

The convention on the Caspian Sea legal regime is set to pave the way for the construction of the Trans-Caspian pipeline from Turkmenistan to Azerbaijan, which Iran and Russia both oppose. Without this pipeline route, the only way to export Turkmen and Kazakh gas to the EU is by converting the gas to LNG or CNG for shipping to Baku for releasing into the Southern Gas Corridor, which when completed will be 31bn m3/yr.

Iran has said repeatedly that exporting gas by pipeline or LNG to EU is unprofitable owing to the 5,000 km separating its major gas field, South Pars, from European markets. But this distance is half the maritime route from Qatar to Japan, or from Nigeria to Turkey.

The real reason is the continuing gas shortage and the lack of investment in its projects. Oil minister Bijan Zanganeh told parliament December 13 that the total upstream and downstream oil and gas investment in March-November was roughly $1.5bn, compared with the planned $20bn/yr for 2016-2021. Foreign investment, which had been expected to account for four fifths of the costs of all the projects, is vital.

On the other hand, the gas shortage continues. Gas production rose by 25bn m³in 2016 to 285bn m3, but it has stagnated this year.

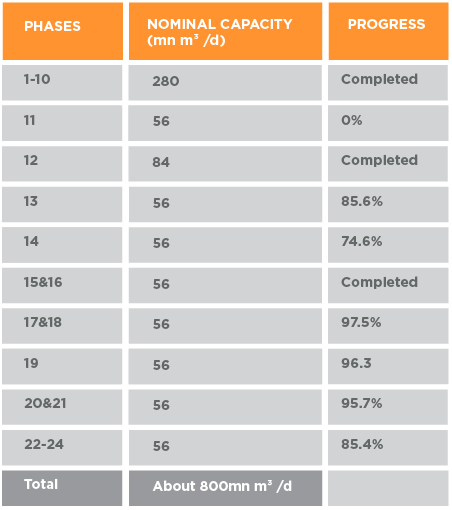

The gas production growth came from South Pars, but according to a document, prepared by oil ministry and seen by NGW, the new phases are taking a long time to complete.

Latest developments in South Pars as of 3Q2017

The country’s nine-month refined gas production increased by 7% to 156bn m3, of which 70% came from South Pars. The volume for the whole last fiscal year, ended March 20, was 204.5bn m3.

Power sector demand

Iran’s liquid fuel use in the power generation sector rose 15% to about 3.3bn litres during the first eight months of the year (March 21 to November 22), according to the energy ministry, owing to a gas shortage. Iran supplied up to 213mn m3/d of gas over that period, but when the temperature fell in late November this halved to 110mn m3/d as household demand tripled relative to summer, going above 460mn m3/d.

Iran also started selling 7mn m3/d to Iraq June 22, which rose gradually to the current 12-14mn m3/d. Exporting gas to Iraq has a unique advantage for Iran, because Iraq uses gas in its power sector, whose demand is very high in spring and summer, when Iran’s household demand is very low. Further, Iraq is not far from the South Pars field, so transport costs are low.

Iran has two agreements with Iraq to export gas to Baghdad and Basra; each at 25mn m3/d. But the country is obliged to send 70% of the volume in hot seasons and the rest in autumn and winter. Iran also exports 27mn m3/d gas to Turkey, split 60/40 in favour of summer.

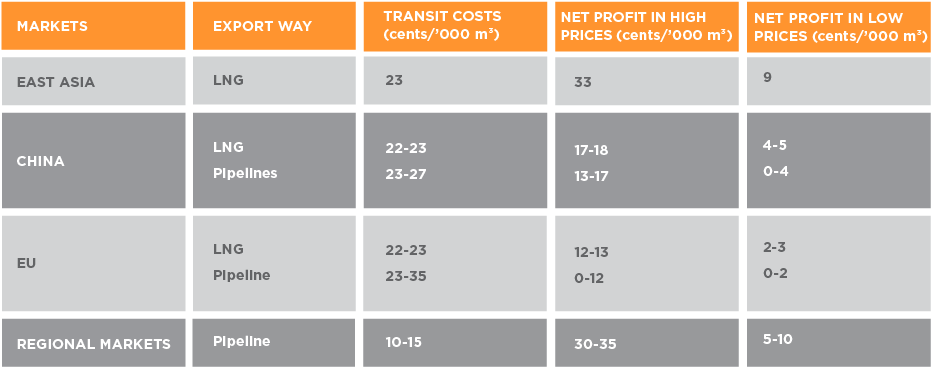

Iran’s parliament published a report in July, saying that re-injecting gas was more profitable than exporting it, especially to distant markets such as east Asia and the EU.

Below are the transit costs and net benefits of Iran’s gas export, estimated by parliament in low ($50/barrel) and high ($100/barrel) oil price scenarios, with LNG beating pipelines over 7,000 km:

Source: parliament

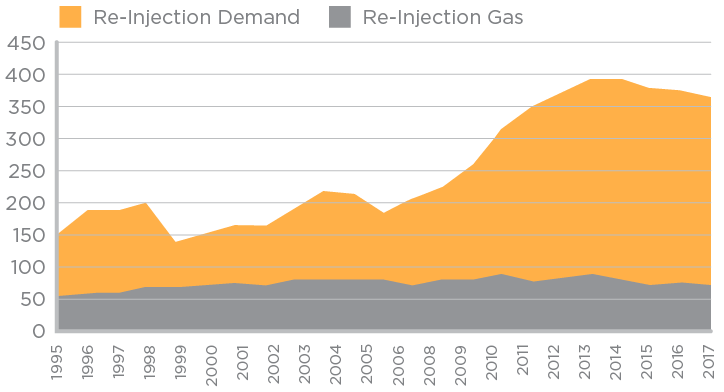

Gas re-injection to oil fields

The parliament’s report says that gas re-injection into oil fields is more profitable than exports. About 85% of Iran’s active oil fields are in their second half-life and lose 8-12% productivity each year. Iran should have re-injected more than 1,000bn m³ into old oil fields since 1995, but has re-injected only 340bn m3. On the other hand, the recovery rate of Iran’s oil fields is about 20% on average, with the potential to rise to 25-26%.

Iran's actual re-injected gas versus the required re-injection (mn m3/d)

Source: Oil ministry

Parliament’s report says that the net profit of gas export in the best conditions is about 35% of gas price in markets, but the ratio for oil is 80%. Iran should re-inject at least 90bn m3/yr to old fields, but the figure roughly reaches 25bn m3/yr during this year.

Compared with 40 years ago, the average productivity of each oil well in Iran’s active fields was 12,500 b/d, but now it is 1,600 b/d.

Dalga Khatinoglu

_f1920x300q80.jpeg)